Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.;

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.;

Ready to help your credit go the distance? Log in or create an account to get started.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

What Can Identity Thieves Do With My Information

With your name and social security number, imposters can open credit cards, rent an apartment, take out a car loan and even open new bank accounts. Most victims don’t realize they’ve been compromised until they review their credit report or credit card statements, and it may be too late. Using a credit monitoring service can help alleviate the headaches that come with trying to restore your identity after it’s been stolen. Credit monitoring helps you to act immediately whenever anything suspicious occurs.

Also Check: Why Is My Credit Score Not Going Up

Submit Your Request And Review Your Report

The site will produce your credit report within a few seconds. If you request your report over the phone, it will be sent by mail and could take up to 15 days to arrive.

The report is separated into five sections:

- Personal information: Your name, past and current addresses, year of birth, and phone numbers.

- Accounts: This is where you’ll find the entire history of every line of credit you have or have had in the past the current balance, date opened, status of the account, highest balance, minimum payment, credit limit, etc.

- Public records: If you have been involved in legal matters, filed for bankruptcy, or experienced a tax lien, it will be listed here.

- Hard inquiries: If you have applied for a new credit card or loan in the last two years, the name of the lender will appear here with the date of the inquiry and the date it is set to expire.

- Soft inquiries:;If an employer, landlord, insurance company, or credit-card lender has ever made a soft inquiry into your credit, it will appear here. Soft inquiries don’t affect your credit score and thus aren’t disputable.

Review Your Report & Dispute Any Errors

Reading your credit report is one of the most vital steps when it comes to building credit and maintaining it. While reviewing your report, make sure your personal and account information is accurate.

Common credit reporting errors to look for include the following:

- Incorrect name or address

- Paid accounts that are listed as open

- Account balance or credit limit errors

- Accounts that dont belong to you

If you spot an error, dispute it with each credit bureau that lists it on your report or the creditor that reported it. The investigation will typically take 30 days to complete. Once its over, the credit bureau will remove the information if it finds that it is in fact an error.

Also Check: How To Remove A Delinquency From Your Credit Report

What Is The Fair Credit Reporting Act Or Fcra

The Fair Credit Reporting Act is an important law that gives you the right to know the information that the credit bureaus keep on you and how that information informs your credit scores.

This law includes a number of consumer rights and protections. For example, under the FCRA you have the right to dispute incomplete or inaccurate information on your credit reports. In most cases, the credit bureau must investigate your case and correct or remove any inaccuracies within 30 days.

How To Get A Free Copy Of Your Credit Report

Posted in Finance on 2015-06-16by Joan ::

When was the last time you checked your credit report? Many consumers dont know they have the ability to request a free copy of their credit report. In todays blog post, were going to show you how to do this!

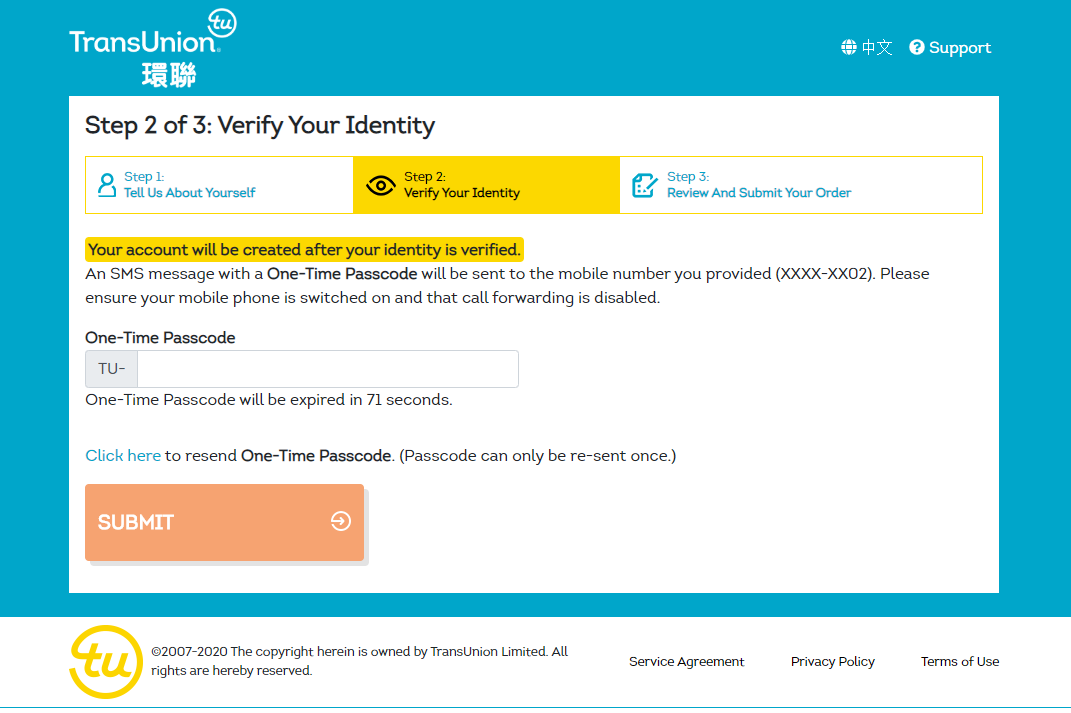

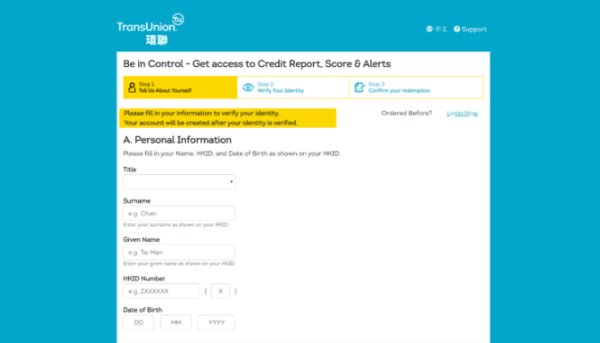

In Canada, there are two credit reporting agencies: TransUnion and Equifax. Below are the step-by-step instructions on how to request a free copy of your credit report. It is important to know that there may be a cost for requesting an electronic copy of your credit report or to get access to your credit score.;In order to verify your identity, you will need to provide copies of two pieces of I.D. with your request.

Also Check: How To Get A Bankruptcy Off Your Credit Report

Go To Annualcreditreportcom Or Call 1

You can only request your credit report through;AnnualCreditReport.com or by calling the verified phone number 1-877-322-8228. If another source claims to have your credit report in exchange for personal information, it’s probably a fraud.

Requesting your credit report won’t negatively affect your credit, but again, you’re limited to three reports per 12 months under federal law.

How Do You Unfreeze Your Transunion Credit Report By Phone

Send a letter to TransUnion requesting to unfreeze your credit report.

Your request must include the following information:

- Full name with middle initial

- Birthdate

- Addresses for the past 2 years

- A copy of government-issued ID

- A copy of your bank statement or utility bill

TransUnion Mailing Address:Chester, PA 19016

Read Also: Can Student Loans Be Removed From Credit Report

How To Get Your Free Credit Report: The Ultimate Guide

- , , Personal

If you want to learn how to get your free credit report you will need to create accounts and provide your personal information on certain websites in order to access your accurate credit report. Make sure you have all your personal information ready and we will walk you through how to get a free copy of your credit report.

How To Get A Free Credit Report From Transunion

Keeping your credit report in good shape is essential if you want to apply for credit cards, loans and mortgages. Some credit score apps will try to lure you in with free trials for what eventually will be a paid subscription service. But in fact, everyone is entitled to one free report from each of the three major credit bureaus each year. TransUnion offers additional free reports to people who meet certain criteria.

Read Also: Which Credit Score Matters The Most

Some Faqs: Rbc Credit Score

What do I do if the RBC credit report is incorrect?

If you find an incorrect information on your TransUnion credit report provided by RBC, you should contact TransUnion immediately to correct it. An incorrect information or a credit you did not apply for could be a sign of identity theft.

Check here to learn how to check and correct errors on your credit report.

How accurate is RBC credit score?

The credit score you see is based on one of TransUnions proprietary credit models so it is accurate. However, the score may not be the same as the ones lenders will see when they pull your credit to make lending decisions.

In addition, lenders consider several other factors in evaluating your creditworthiness such as your employment history. So your credit score is just one variable and would not necessarily disqualify or qualify you for credit.

Can I check my credit score on RBC mobile app?

No, the free credit score tool provided by RBC is only available through the online banking interface. It is currently unavailable on the mobile app.

Which credit bureau does RBC use for the free credit score and credit report?

The credit score through RBCs online banking is provided by TransUnion. If you need to check your Equifax credit score or credit report, you can use Mogo or Borrowell.

Get Free Credit Report Transunion Canada

Fewer than 5 of south african consumers make use of the legislation which entitles them to obtain their credit report free of charge from every credit bureau every year. Place a security freeze place or manage a freeze to restrict access to your equifax credit report with certain exceptions.

What Is Cibil Score How To Know Your Cibil Score Credit Repair

Don’t Miss: How To Read A Transunion Credit Report

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Read Also: Does Closing A Credit Card Hurt Your Score

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

Don’t Miss: Which Credit Score Is Correct

Can I Buy A Copy Of My Report

Yes, if you dont qualify for a free report a credit bureau may charge you a reasonable amount for a copy of your report. To buy a copy of your report, contact:

- TransUnion: 1-800-916-8800; transunion.com

But before you buy, always check to see if you can get a copy for free from AnnualCreditReport.com.

Federal law says who can get your credit report. If youre applying for a loan, credit card, insurance, car lease, or an apartment, those businesses can order a copy of your report, which helps in making credit decisions. A current or prospective employer can get a copy of your credit report but only if you agree to it in writing.

What Are The Three Credit Bureaus

The three major companies that provide these reports are TransUnion, Experian, and Equifax. Each credit bureau is different and separate from the others so not all three credit bureaus will be reporting the same information.

The credit bureaus report financial information gathered from lenders such as banks and credit card companies to evaluate your creditworthiness. Each lender reports to different credit bureaus so that is why you might have three completely different credit scores from each credit bureau.

Read Also: What Is The Highest Credit Score You Can Get

What Is A Credit Report

A credit report is a thorough history of your finances. The information inside will include how much money you have borrowed in the past and any late payments or defaults from those loans. With this information, future lenders can judge whether or not they want to give you more credit. The credit information is evaluated by the three main credit bureaus. The items you can see on your credit report include:

- Payment history

- Any derogatory items you might have

- Summary of account totals

- Total debt that is owed

- Personal information

Credit reports are one of the most important aspects to our financial lives. They are used by employers, landlords, mortgage lenders and credit card companies when theyre deciding whether or not you deserve a good interest rate on loans or credit cards. Knowing your credit report is crucial in todays society where jobs can be hard to come by and rent has sky rocketed. But did you know that it is possible to get your credit report for free? Ill tell you how!

Related: How Can I Report My Rent Payments To The Credit Bureaus

How To Correct Errors In Your Credit Report

If you see anything you believe is incorrect, contact the credit bureau immediately. You can call the telephone number on the report to speak with someone at the credit bureau. If you find evidence of identity theft, the next steps to take include contacting any creditors involved to close fraudulent accounts and filing a police report. See Identity Theft Victim Checklist, on our web page for more information on what to do.

Read Also: How To Get My Own Credit Report

What Is A Credit Report Freeze And Why Do You Need It

Also known as a security freeze, a credit report freeze prevents entities from accessing your credit report. Many consumers use this service to protect them against the threat of credit fraud due to possible identity theft, such as when their sensitive information has been compromised.;

After you request a credit report freeze online or offline, the credit bureau must set it in place within one business day. If you submitted a request by mail, the freeze will take effect within 3 business days after its receipt. If creditors and lenders cant check your credit report then thieves will also have a hard time opening accounts under your name without your knowledge or authorization.

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.;

You May Like: Does Requesting A Credit Report Hurt Score

Get Your Credit Report By Mail Or Phone

Free annual credit report

Phone: 877-322-8228

Youll need to verify your identity through our automated phone system. Once verified, your reports will be mailed to you.

Mail:

Request your credit report by filling out the Annual Credit Report Request form and mailing it to:

Annual Credit Report Request Service P.O. Box 105281

Send us a request stating youd like your credit report, and include the following:

- First, middle and last name

- Current address

- Previous addresses in the past two years

- Social Security number

Please note: We accept either standard or certified mail.

Why Its Important To Check Your Credit Report

Checking your credit report should be done periodically to screen for reporting errors and unrecognized activity. The first signs of identity theft usually appear on your credit report, and the earlier you spot them, the easier it is to stop the theft. Even if all the information you find is accurate, seeing your credit activity at a glance can give insight into how to manage debt more efficiently and raise your credit score.

Requesting a free credit report should also be an early step in any upcoming plans involving applying for a loan, such as buying a home or car. Pull a copy at least six months before a major purchase because if you do need to work on your credit, dispute errors, etc., it can take several months or longer to address these issues, says Bringle.

As long as youre entitled to a free report, theres no harm in requesting one. A common myth is that getting your own report will hurt your credit scores, says Rod Griffin, senior director of public education and advocacy at Experian. It wont. This is because there are two types of credit checks: hard inquiries and soft inquiries. While the former can temporarily ding your score, the latter which includes requesting your personal credit report will not. Soft inquiries do not affect credit scores or lending decisions, says Griffin.

Don’t Miss: How Are Account Numbers Displayed In A Credit Report

How Many Free Credit Reports Can You Get Per Year

The number of credit reports you can get for free depends on where you get them from and whether youve placed a fraud alert on your credit reports.

For example, the Fair Credit Reporting Act entitles you to receive one free credit report from each major credit bureau a year. In most cases, this means you can view all your credit reports for free once per year through AnnualCreditReport.com. However, due to Covid, you can receive free weekly credit reports from all three credit bureaus through AnnualCreditReport.com until April 20, 2022.

In addition, some credit reporting companies and personal finance websites allow you to check one or more of your reports for free. For example, if you sign up for myEquifax, you can get six free Equifax credit reports per year through 2026. Experian also allows you to view your Experian credit report for free 12 times a year.

You can also get an additional free copy of your report from each credit bureau if you suspect fraud and place a fraud alert on your credit reports. To do this, you must contact one of the credit bureaus.

If youve been a victim of identity theft and filed a report, you can get an additional six free credit reports per year, two from each credit bureau.