The Benefits Of Having A Good Credit Score

Having a credit score higher than 629 can make it easier to qualify for lower interest rates on different types of loans, a mortgage, and credit cards. Plus, youll have an easier time getting approved for an apartment down the line.

Exploring various ways to build your credit can make it easier to not only improve a low credit score, but get as much value as possible from all of your monthly bills. In the past, only homeowners were able to build credit through their monthly mortgage payments, but the same is now possible for renters to prove their credit worthiness.

Having a good credit score affects many areas of life, from necessities like housing and transportation to opportunities for leisure and travel. The quicker you begin reporting your on-time rent payments to a credit bureau like TransUnion, the easier itll be to have a stellar credit history.

Does Paying Rent Late Affect Your Credit Score

Federal law dictates that a late payment can only be reported to credit reporting bureaus after 30 days. So, it wont hurt your credit if you pay before the thirtieth day. However, you might have to pay a late fee.

Unfortunately, paying rent late will be reflected in your credit report If you miss the 30-day deadline. This can have significant consequences for your credit score.

A late rent payment can affect your credit score so much that it can prevent you from getting loans, credit cards, and future housing. If you have any option to avoid a late payment, you should try.

Rent: Does It Impact Your Credit Score

In 2016, about 35 percent of the millennials were renting. Its not so much because they wanted to. Usually, they didnt have a choice. Many would like to own a house, but they couldnt because they may not have enough credit history and, therefore, have low credit scores.

But cant their rent contribute to improving their credit information? Find out here.

Also Check: How To Remove A Repossession From My Credit Report

What Is A Credit Score

A is a number between 300-850 that essentially describes your creditworthiness. The higher your credit score, the better you look to a potential lender. On the other hand, if you have a low credit score, it could be a red flag to lenders. Additionally, it can be much harder to borrow money with a low score.

Heres a basic idea of where you stand according to your credit score.

- Excellent: 800 850

- Fair: 580 669

- Poor: 300 579

Your credit score is based on several factors, including the number of accounts you have open, your payment history, total levels of debt, and more. As such, lenders look at credit scores to determine the probability of a borrower paying loans back promptly. There are several ways to improve your credit score. But first, lets go over how your score is calculated.

How Else Can You Build Your Score

While this new initiative gives Canadians one more way to build their credit score, its important to use multiple methods. The credit bureaus give the best scores to people with a long history of responsible borrowing with different types of credit.

Here are few other options:

Above all, remember that keeping a close eye on your credit score is crucial, as it can have a substantial impact on your ability to get a decent interest rate on a car loan or even get a job.

You may want to sign up for a free credit monitoring service Borrowell is a popular option that works with Equifax that will inform you when your score changes and provide personalized advice on how to improve it.

This article was created by Wise Publishing, Inc., which provides clear, trustworthy information people can use to take control of their finances. Millions of readers throughout North America have come to count on the Toronto-based company to help them save money, find the best bank accounts, get the best mortgage rates and navigate many other financial matters.

You May Like: How To Get Inquiries Off Your Credit Report

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Do Tenant Screening Landlord Credit Checks And Recordkeeping

Landlords using the FrontLobby platform to report rent can also conduct Tenant screening, including pulling Credit Reports, with data from Equifax and Landlord Credit Bureau.

Landlords can also keep organized records of Tenants rent payment habits. FrontLobbys Recordkeeping tool saves Landlords and Property Managers time, enabling them to focus on activities that are more productive than managing rent payments.

Read Also: How To Find Out Why Credit Score Dropped

How To Use Rent Payments To Increase Your Credit Score

8 min read

Are you one of the over 40 million people currently renting? Here’s a little secret: it can help improve your credit score.

Like it or not, your credit affects just about every aspect of your financial life. Whether youre trying to buy a house, a car or even a fancy new phone, your credit score is the first thing lenders will look at to determine your ability to pay. And a good score always translates to lower rates and more favorable terms.

But building credit can be difficult, especially if you find yourself in the catch-22 of needing credit to establish credit. The good news is, if youre a renter, there are several ways to report your monthly payments which could help improve your score and build your credit history.

Rod Griffin, senior director of Public Education and Advocacy at Experian, says that reporting this information is not only a very powerful tool for those who are looking to establish credit for the first time, but also for those whove faced credit challenges in the past.

It’s one of those rare things where we see improvements almost immediately and across the board, Griffin says. In fact, Experians latest study on the subject found that roughly 75% of the participants who opted to include their rental payments as part of their report saw their credit scores improve between 11 and 29 points.

So, if youve been paying your rent like clockwork, heres how you can make it count toward your credit.

How Do I Get Rent Payments To Show Up On My Credit Report

Rental Exchange is an organisation that has introduced a way of adding your rent payments to your credit report. This is done through partner organisations that are able to handle this process. When youâre set up with a Rental Exchange partner, all you need to do is update your credit records when payment is confirmed. These services are often free for tenants, and you can still use them if youâre privately renting or in social housing.

Once set up, all you really need to do is keep paying your rent on time and recording it with your credit reference agency. Through the Rental Exchange company, your regular rent payments are recorded and verified. This verified information allows you to update your credit report, which provides proof of your timely rental payments.

Recommended Reading: What If My Credit Score Goes Up Before Closing

Using A Credit Card To Pay Your Rent

You can use a credit card to pay your rent and boost your credit score in an indirect way. Open a credit card, and use it to pay your rent , then pay your credit card balance in full each month. The timely credit card payments will help boost your credit score.

Some landlords may charge a processing fee if you use a credit card to pay your rent.

How Applying For Rentals Affects Your Credit Score

Many landlords pull your credit report when you’re approving your rental application. The hard inquiry that comes from a credit check can affect your credit score.

Inquiries are 10% of your credit score, but fortunately, apartment hunting may be treated the same as mortgage or auto loan rate shopping. A FICO executive confirmed to The Balance that multiple identifiable tenant screening-related inquiries are included in the special FICO Score inquiry treatment logic. In other words, multiple apartment-hunting inquiries are treated as just a single inquiry as long as they’re completed in the same time frame.

Not all landlords or leasing agents pull your credit information to qualify you for a rental. Applying for an an apartment won’t hurt your credit if there’s no credit check in the process. The application also won’t hurt your credit score if the landlord uses a service that does a soft credit check. You can ask the landlord for their process to find out whether there’s a credit review involved.

Also Check: Can Closed Accounts Be Removed From Credit Report

Maybe: If Enrolled With A Rent

If you and your landlord have enrolled with a rent-reporting service, your monthly rental payments will be reported to credit bureaus and appear on your credit report.

But just because your rental payments are reported to credit bureaus and exist on your credit report doesn’t mean that your credit score will immediately increase. To understand why, let’s talk about how on-time payments are used to generate credit scores.

Does Rent Reporting Work

As a concept, the building of credit through rental payments is not new. In the United States, ones rent payments can be logged with any number of rent-reporting companies such as Rental Kharma, Rent Reporters or Cozy.

Its also not a perfect solution. Remember that:

-

Rent payments cannot be relied upon exclusively as a means to build credit. A history with different types of payments, including , is still an essential component.

-

Rent payments wont impact all of your credit scores. Each Canadian has multiple credit scores that are accessible by different lenders for different purposes, and the LCB hasnt made an arrangement with Canadas other big credit bureau, TransUnion.

Before signing up, landlords and tenants should understand how the agency will protect their personal information, what theyll be paying for and what the cancellation policy looks like.

Don’t Miss: Does Getting Pre Approved For A Mortgage Affect Credit Score

Will Missed Rent Payments Hurt My Credit

Its more likely that reporting your rent payments will have a positive rather than a negative effect on your credit score, if it has any significant effect. Late rent payments may not show up on your credit report at all if you are using a rent payment and reporting service. For example, Cozy notes that your report will simply show no activity for the month if you skip a payment, instead of showing it as late.

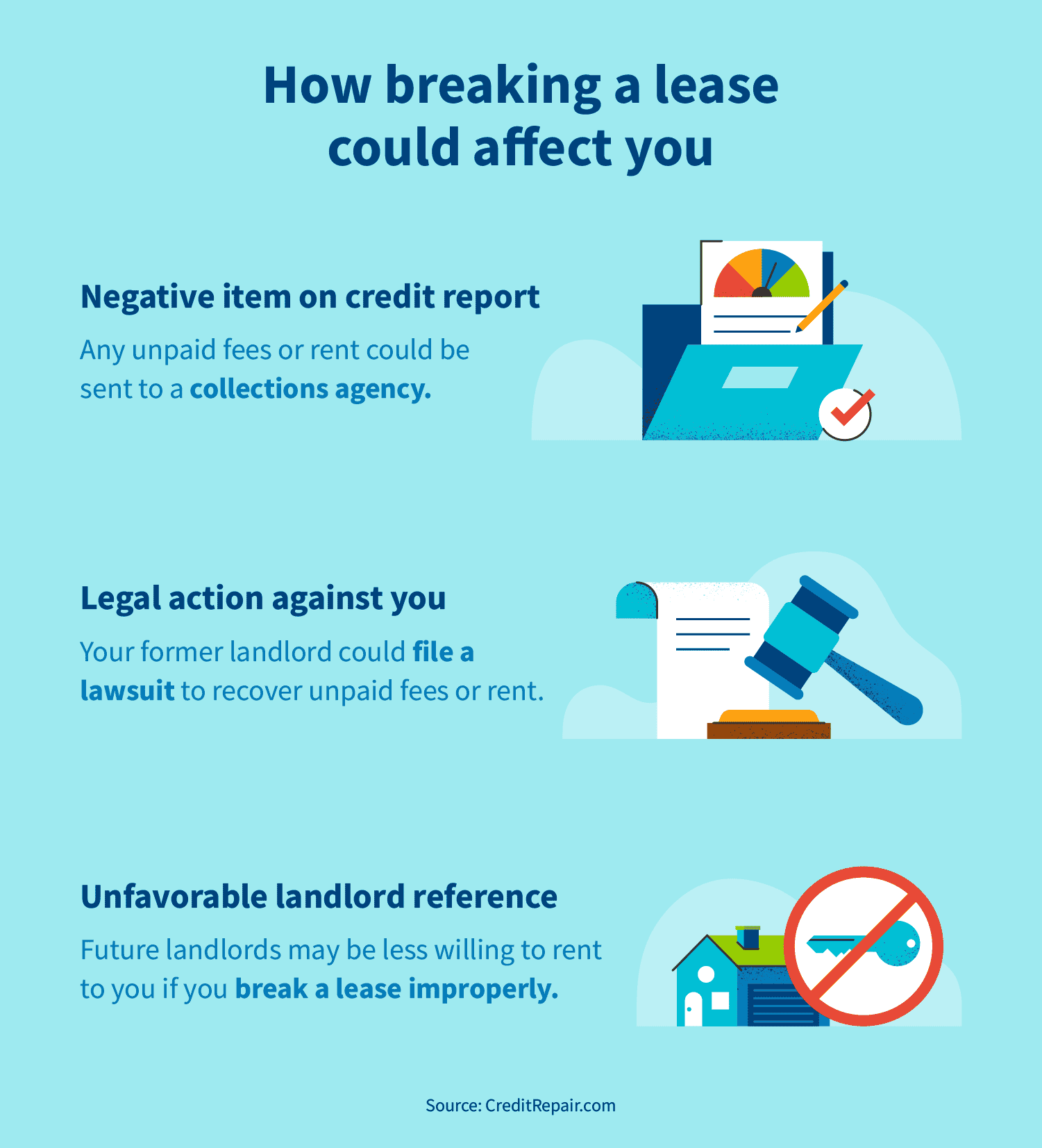

That said, your credit can still be dinged by a failure to pay your rent. Thats because your landlord may send your unpaid rent debts to a collections agency, which may then report this to the credit bureaus. Your credit can suffer for up to seven years from having an account in collections.

So whether you use a rent reporting service or not, you should always:

Also know that simply looking for an apartment or home to rent doesnt hurt your credit, but landlords will often do a hard credit inquiry once you apply to rent a place. This can slightly ding your credit, although one inquiry shouldnt have too much of a negative effect.

Do Rent Payments Affect Credit

All three major credit bureaus Equifax, Experian and TransUnion will include rent payment information in credit reports if they receive it.

-

The most commonly used versions of the FICO score dont use rental payment information in calculating scores.

-

Newer versions of FICO, such as the FICO 9 and FICO 10, do consider rental information if it is in your credit report.

-

VantageScore, FICOs competitor, also considers rent payment information.

Also Check: Is 783 A Good Credit Score

Does Paying For Rent Build Credit

There is no definitive answer to this question as it depends on a number of factors, including the landlords policies and the credit reporting agencys guidelines. However, in general, paying rent on time can help build credit, as it is typically reported to credit agencies. Therefore, if youre looking to build credit, paying your rent in full and on time is a good place to start.

Rent payments do not typically build credit, but they can be reported to the credit bureaus on a regular basis to help build credit. Credit score calculations are based on the information contained in your credit reports. Rent payments are typically not reported to Experian, Equifax, or TransUnion. If you pay your rent on time, your rental payment information may be included in your credit report, which may help you establish or strengthen your credit. In general, utility bills are only reported to the bureaus if they are late or in collections. In order to avoid harming your credit score, you must ensure that utility bills are paid on time. If the owner reports the information, it will assist.

If you are late on your payments or are evicted from your home, they may still affect your credit score if they do not. You should not rely on information provided on WalletHub Answers for financial, legal, or investment advice. This site may display ads from third parties, in addition to those of paid advertisers.

Calculating Your Credit Score

Each credit bureau uses a unique calculation to determine your credit score however, they generally use a combination of these five factors:

1. Payment history

This information will include any payments you make as agreed , as well as any missed or late payments.

Late payments will work against you however, making payments on time can improve your score.

2. Credit utilization ratio

Your is the amount of credit you use against the total amount of revolving credit you can access .

The key word here is revolving credit. Revolving credit is money you borrow, pay back and can borrow again, up to a limit. For example, a line of credit or a credit card would fall into this category, but not rent.

Staying below 30% of your credit utilization ratio can have positive impacts on your credit score.

3. Credit history

This factor includes details on past and present credit accounts and how long they have been open.

Typically, its the accounts with a long history that can benefit you the most.

4. Credit mix

This section will show lenders how you manage different credit products.

5. Inquiries

When you seek credit, your lender will typically request your credit report, resulting in a hard inquiry and can temporarily impact your score. Many inquiries in a short period can signal an urgent need for creditindicating risky lending behaviour.

Requesting your credit report will not result in a hard inquiry but a soft inquiry and wont affect your score.

Don’t Miss: Which Credit Score Is Used To Buy A Car

How Does Your Rent Impact Credit Score

Because the credit score informs the lender of your trustworthiness and reliability in paying loans on time, it is a critical requirement when you apply for a mortgage. Even non-conventional home loans like VA, FHA, and USDA will still check the score, although the minimum score may be lower than when you try a conventional loan.

Many items can contribute to your credit score, but when it comes to renting, youll find yourself in a rather interesting position.

The credit score mainly depends on the data from the credit report. Many renters dont know that landlords are not obliged to report these rental payments to credit bureaus. However, you can still see records of these if the landlord becomes diligent enough to report or if you missed repayments, and the landlord passes the responsibility of getting these payments to collection agencies.

But even if they may appear on the credit report, historically, they hardly impact the credit score. This could be because reporting these payments isnt standard, and some renters pay using checks or money orders. Some versions of FICO can factor in rental payments, but not all lenders may be using them. The most popular doesnt account for rent.

Fannie Mae doesnt grant loans but instead backs them, but considering that this is supported by the government, it will still have a significant influence on the mortgage industry.