The Bottom Line On The Paypal Cards

The PayPal credit and debit cards can certainly be useful, and the reward rates for the credit cards are competitive. But with more payment methods on the market than ever, you may find some other options that give you more value than the PayPal cards .

You can often get introductory interest rates with credit cards. Or you may want to score a sweet signup bonus after being approved, but the PayPal cards dont come with anything like that. Depending on what youre looking for, perhaps youd just rather go with a different .

So take the time to survey your choices, and dont apply until you find a card that fits neatly into your spending habits and lifestyle.

Can Paypal Serve As Your Bank Account

PayPal offers several financial services and products that may serve the banking needs of some people. You can use PayPal to pay your bills, online or from the PayPal app. If youre looking for a convenient way to get more benefits from your PayPal account, some of the PayPal credit cards, debit cards or financing options could be helpful.

Especially if you cant qualify to open a traditional bank account because of a bad ChexSystems score, PayPal may offer an effective way to manage your money.

PayPal itself is not a bank, so, if you are leaving money in your PayPal account, that money is not FDIC insured in the same way it would be in a bank account. If you want FDIC insurance for your PayPal balance, your best option is to request a PayPal Cash Card.

Once you have a PayPal Cash Card, PayPal will begin to deposit your funds into a pooled account held by PayPal at an FDIC-insured bank. PayPals intent is to provide these funds with the benefit of pass-through FDIC insurance up to the applicable limits. With that being said, if you are keeping a significant amount of funds in your account, wed recommend using an account that offers direct FDIC insurance.

How Pay In 4 Works

Pay in 4 is for purchases between $30 and $600. Each purchase qualifies for the same buyer protection benefits as other PayPal purchases do. The payment frequency is 4 interest-free payments with a payment every 15 days. You pay the full balance in 6 weeks.

The first payment is a down payment due when you make a purchase.

There isnt a prepayment penalty if you pay back the balance early.

Read Also: What Does Filing For Bankruptcy Do To Your Credit Score

Does Ashley Furniture Accept Bad Credit

We offer credit for bad credit! Ashley Furniture The No. 1 manufacturer of furniture worldwide, deploys in-house designers and engineers to keep a tab on changing consumer tastes. Buy now pay later no credit check and zero interest furniture options allow you to buy now and pay later even with bad credit.

When It Comes To Getting A Mortgage There Are Enough Numbers Flying Around To Make Any Mathematician Happy Lenders Will Look At A Number Of Items Which Can Include Your Credit History Your Income And How Much Debt You Have Among Other Things

But one number is perhaps one of the most important numbers of all. Your FICO® scores can impact whether you get a loan or not, and if so, at what interest rate. Thats why its important to understand the nuances of your FICO® scores. Luckily, its not rocket science. Heres the scoop on how your FICO® scores can affect your mortgage.

You May Like: Which Credit Score Is Correct

Does Paypal Bill Me Later Affect Credit Score

Like any credit card, PayPal Credit will charge you for late payments. Currently, a customer service rep explained on the phone, PayPal doesnt report your credit activity to the credit bureaus after the initial inquiry to set you up, which means your activity on this line of credit doesnt affect your credit score.

Can You Get Scammed With Paypal

There are plenty of scam artists online who will accept PayPal or any other form of payment and deliver nothing in return, or nothing that resembles what you paid for. In that case, the PayPal protection program promises to fully reimburse your loss.

This is a generous policy, and there are at least two good reasons for it: PayPal can then collect enough information to report the malefactors to the authorities, and it can provide the confidence that its users need to use the PayPal platform.

One other type of scam to watch out for: If you get an email suggesting you download a new version of the PayPal app, don’t click on it. Go to the PayPal site and confirm that there is a new version.

Don’t Miss: When Do Credit Cards Report Late Payments

Re: What Are My Approval Chances For Paypal 2% Mastercard

I wanted to get the Marvel Mastercard for quite a while myself, but had to put it back on the shelf for the time being due to its having higher score requirements and its rewards structure only giving 1% on most purchases outside the entertainment/media/restaurant categories . The PayPal 2%’s straight 2% CB on everything, in the end, proved more attractive, and I ended up getting $6K SL – second-highest SL on any card on my current credit journey – ;on a 665 TU with a nearly 4-year-old Chapter 7 BK on my record; well worth the cold-app HP. Your scores are on the lowish side and your BK discharge is recent, but on the other hand you don’t have a lot of inquiries weighing you down, so if you really want this card, go ahead and try; the worst that can happen is they’ll say no.

*This feature still tempts me, candidly, so after six to eight months of gardening I may revisit the issue.

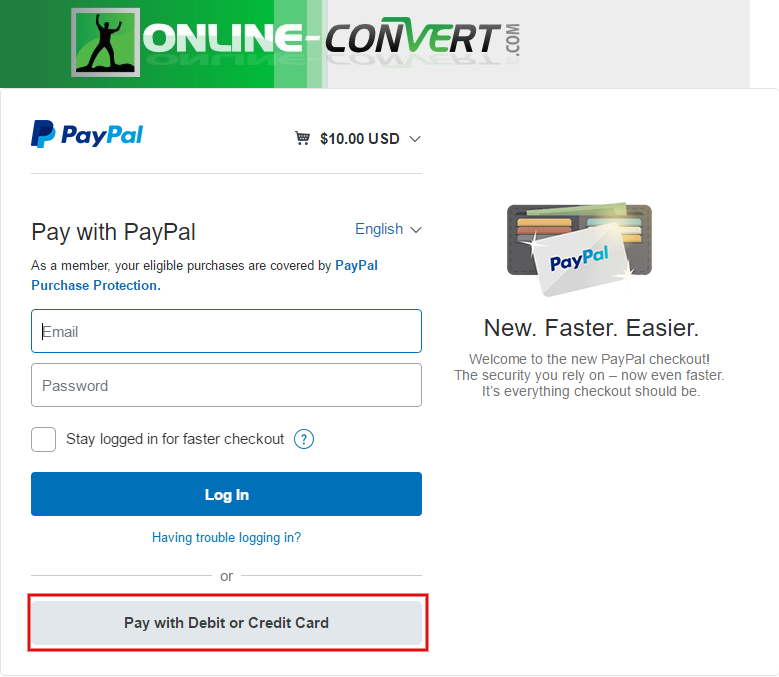

What Can You Use Paypal Credit For

Its possible to use PayPal Credit for any PayPal purchase when you decide to pay with your PayPal account instead of entering your account information for a credit card, debit card, or checking account.

PayPal states that millions of online stores accept PayPal Credit payments. Some examples can include clothing, electronics, travel, and merchandise. Shoppers will see a PayPal Credit button as a payment method at participating online stores.

Related Articles:

The comments on this page are not provided, reviewed, or otherwise approved by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Editorial Note: The editorial content on this page is not provided by any bank, credit card issuer, airlines or hotel chain, and has not been reviewed, approved or otherwise endorsed by any of these entities.

Also Check: How To Get Charge Offs Off Of Your Credit Report

What Cards Can I Get

This table breaks down the types of cards you might be able to get depending on your FICO scores, but keep in mind your income and the specific credit history on your credit reports can play a big role. Remember, the only way to know for sure whether youll be approved for a card is to apply.

| FICO score | ||

|---|---|---|

| Bad | Low | Secured cards. Unsecured cards designed for people with bad credit, which tend to have bad terms and worse customer service. |

Bad Credit: Under 600

If youre in the last group and have bad credit because youve missed payments, had collection accounts, or a foreclosure, you need to take special steps to get approved for a credit card.

If youre in this situation, you should only apply for a credit card in an effort to begin rebuilding credit .;Usually, this means applying for a secured credit card.

A secured credit card requires a security deposit before you can begin making charges. That security deposit acts as your credit limit. Although that may sound like a debit card or prepaid card, the secured credit card will report your payment history to the credit bureaus, which debit and prepaid cards do not do. After a year or so of using a secured card, you may be able to upgrade to an unsecured account and get your deposit back.

I recommend the Secured Mastercard® from Capital One;to help get your credit back on track.

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

How It Works For Purchases

If you shop at an online retailer that accepts PayPal, you should see PayPal Credit as an option. On purchases of $99 or more, youll have six months to complete the payments without interest. For purchases that are less than $99, youll have to pay the balance in full to avoid paying interest.

As with a credit card, each month youll have a minimum payment due. You can set up automatic payments or pay manually through your PayPal account.

Does Paypal Credit Report To The Credit Bureaus

Before 2019, PayPal credit did not report information to the three credit bureaus. It was like a . However, this policy has since changed.

As they explicitly say in their terms of service, we may report information about your account to credit bureaus.

Late payments, missed payments, or other defaults on your account may be shown in your credit report.

So, if you make a late payment, miss a payment, or default on a payment, PayPal credit will report it to all three credit bureaus.

After PayPal provides the three credit bureaus with this report, it will appear on your next credit report damaging your credit.

Related:Best Credit Monitoring Services

What Are My Approval Chances For Paypal 2% Mastercard

Hello everyone,

I’m trying to decide if I should go for this card or not. My credit profile is as follows:

– Current FICO scores: 656 EQ, 638 EX, 634 TU

– Inquiries: 1 EQ, 2 EX, 3 TU

– 2 open CCs: Capital One Quicksilver $1500 CL opened late December 2017, BCU opened early January 2018.

– 1 open;SSL installment loan since January.

– Overall utilization: Revolving is 1.5% . Installment is 7.8% .

From what I have read, Synchrony almost exclusively pulls TU which is my lowest score. Only reason I’m considering them is because they are somewhat BK-friendly but they’re also YMMV bigtime. And it looks like the Paypal card might be their flagship so I don’t know if it’s even worth taking a risk with the INQ. Does anyone have any experience with their requirements?

Scores Needed For Paypal Credit And Amazon Store Cards

i was just curious if anyone knew what score model and what score would be a safe bet to app for these? i have a cap1 secured card but would like to ad these as i use both paypal and amazon a lot. my fico 8 is EQ 625, TU 599, EX 608. I do have a few collections and late payments and 2 co credit cards for hsbc abd credit one from 2011. Just dont want to waste the inquiry if i’m not where i need to be.

What Are The Benifets Of Paypal’s Cashback Mastercard

Benefits of the PayPal Cashback Mastercard include no annual fees and 2% cashback on every purchase. Qualifying for a PayPal Cashback Mastercard requires a minimum credit score of 640. If your credit needs work, Credit Glory helps you fix your credit , so you qualify for a great rate on your PayPal card.

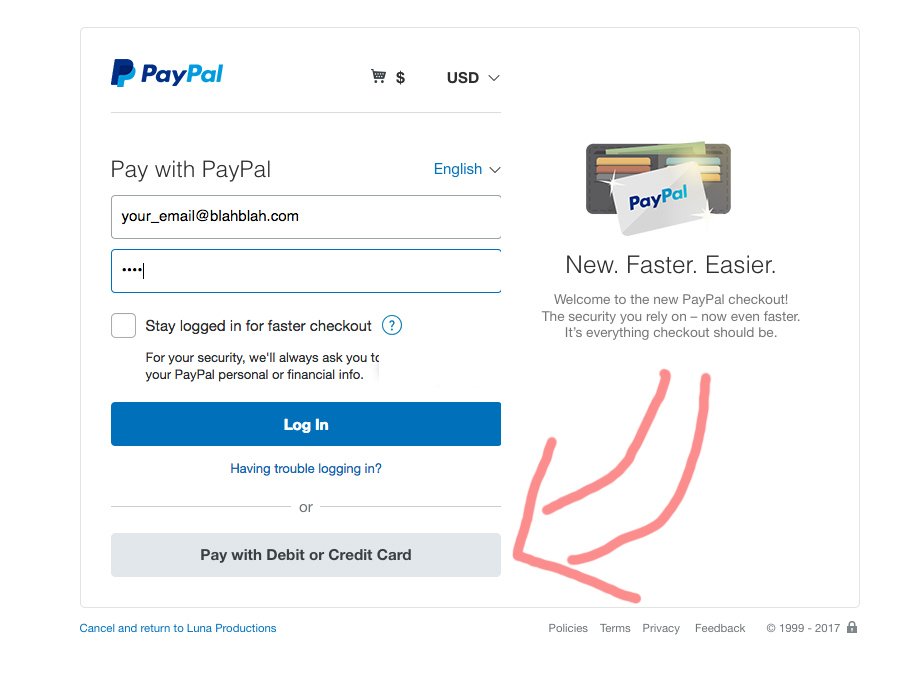

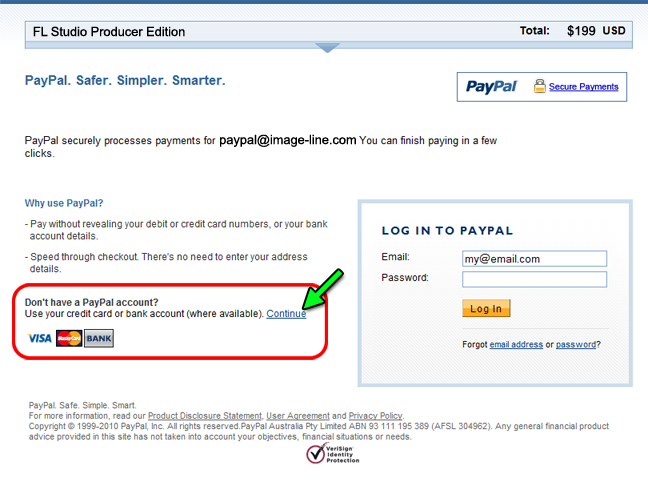

Applying For Paypal Credit

How do I apply for PayPal Credit?

When you apply for PayPal Credit, youll be asked to provide your date of birth, your income after taxes, the last 4 digits of your Social Security number, and agree to the Terms and Conditions. Youll know within seconds if you are approved. And heres the cool thing: your PayPal Credit account will be linked to your account with PayPal and youll see it as a payment option every time you check out with PayPal.

What if I do not currently have an account with PayPal?

What does Subject to Credit Approval mean?

Purchases Can Have 0% Interest

PayPal Credit currently waives all interest charges on $99+ purchases that you fully repay within 6 months of the original purchase date. If you dont pay off the balance, interest charges apply from the purchase date as a consequence.

This 0% APR promotion isnt an introductory offer but only applies to single items that cost at least $99.

Purchases $98.99 or less automatically accrue interest until paid off.

Synchrony Bank Amazon Store Card

You can buy just about everything on Amazon and with an Amazon card, shopping is not only easier but more rewardingliterally! The perks start the minute youre approved with an Synchrony Bank Amazon gift card .The card itself also comes with some financing options. For example, you can use it to finance a purchase of at least $149 and as long as you pay that in full within 6 months, you wont pay a penny in interest. If the purchase is above $599, you have 12 months to pay it off without paying interest.

Using Credit For Home

Buying a house;involves more than simply making payments on your mortgage. The simple truth is that when you own a home, you’re going to have house-related expenses. However, it’s not always possible to drop large amounts of cash on big-ticket items like new appliances, home repairs, or maintenance.

- Use a low-interest credit card: one convenient way to pay for immediate, unexpected, or emergency home costs is with a credit card. Consider getting a low-interest card that you set aside for this purpose while you build an emergency fund. Remember to apply for the card <em>after</em> closing on your house, though, so you don’t impact your credit. This gives you the option to fund an unexpected housing cost immediately. Use a credit card for things like an emergency furnace repair or an appliance service call.

- Use a line of credit: another option for larger home expenses or repairs is a line of credit. A line of credit works like a credit card in that you can borrow up to a limit. You only pay interest on what you borrow, and then make monthly payments to pay it back. Line of credit rates are often lower than credit card interest rates, and a strong credit score could reduce your rate even further.

Double Check Your Application

Even if youve got the best credit score, messing up on your application can lead to you getting denied. So make sure to fill out all the requested information carefully and then, before you submit, be sure to double check every single item to make sure its correct and complete. You dont want a minor mistake on the form to be the one thing standing between you and the awesome perks of that store card!Whether youre just trying to make your shopping experience more rewarding or looking for a good way to start building your credit, Synchrony Bank has some great options for just about every credit score. Start by looking into one of the cards mentioned above but if none of those meet your needs, theyve got nearly 100 other cards to choose from so you will definitely find something that works for you!

Pros And Cons Of Paypal Credit

-

Promotional periods give you extra time to pay off large purchases with no interest.

-

Purchase protection and free returns

-

Easy application process

-

Costly if you dont pay off your purchase in time

-

You cant use it in brick-and-mortar; stores.

-

No opportunity to earn rewards

-

Not ideal for sending money to others

Who The Paypal Cashback Mastercard Is Best For

The PayPal Cashback Mastercard® is best for existing PayPal customers who want a straightforward way to earn cashback on all of their everyday purchases.

If a cardholder is a heavy online shopper, the Cashback Mastercard may also be a good choice because they can easily earn cash back from using the card as a payment option when they pay online using PayPal, then credit the cash back to their PayPal balance for future purchases.

Is It Hard To Get Approved For Furniture Financing

Bad credit can make it tough to finance a furniture purchase. If youre willing to shop around, however, you can find reasonable financing deals from retailers, loan marketplaces, and credit card issuers so you can get the furniture you need. Compare personal loan rates from multiple lenders in minutes.

When Using Paypal Or A Credit Card Online

- Make online purchases only on secure sites. These usually have a url that starts with “https” and display a symbol of a lock. These are signals that the connection between your web browser and the site’s server is encrypted. This is by no means guaranteed protection but it closes off one avenue for fraud.

- Don’t use the public Wi-Fi available at coffee shops and airports. Use a;virtual private network; instead.

- Don’t store your credit card information online at your favorite retailers. Type it in every time.

- Beware of phishing attacks. These usually arrive via an email or text message promising you something great, if you only click this link.

- Change the passwords on your credit card accounts frequently, and don’t use your name, your kids’ birth dates, or any other too-obvious password.

Do I Have To Pay Paypal Credit Fees

You will have to pay fees on some aspects of PayPal Credit.; For example, if you use it as a payment option for sending money through PayPal, the standard PayPal fees will apply.; Also, if you miss a minimum monthly payment on your PayPal Credit account, you will be charged a penalty of up to $35.

Also note that you will accrue interest charges if you do not completely pay for a particular purchase made through PayPal within a specific amount of time.; The annual interest rate on purchases made through PayPal Credit is 19.99%, and the minimum interest charge is $2.

See our Is PayPal Free article for a list of transaction fees associated with using PayPal, including sending money.