How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

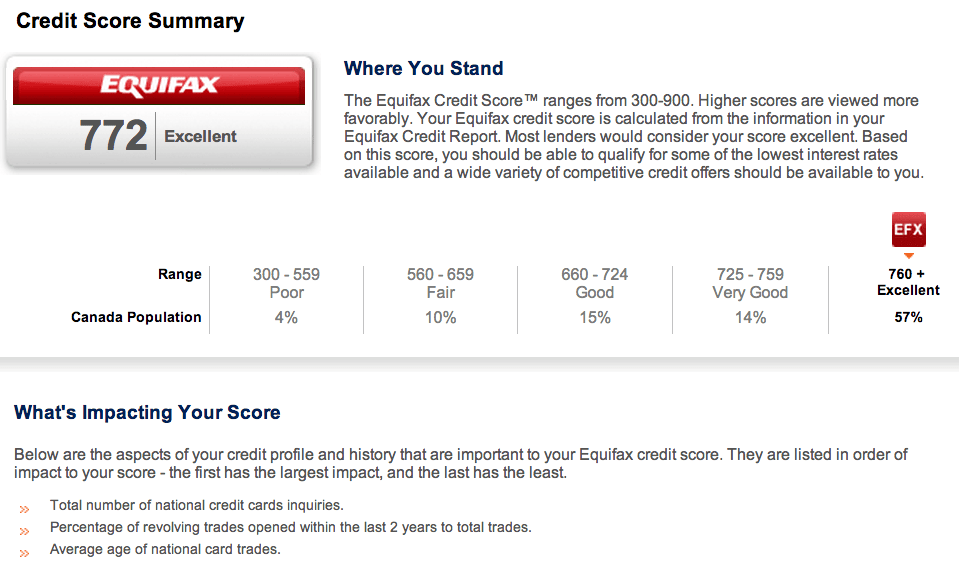

Credit Score: Is It Good Or Bad

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 772 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders.

25% of all consumers have FICO® Scores in the Very Good range.

Approximately 1% of consumers with Very Good FICO® Scores are likely to become seriously delinquent in the future.

How To Get A 772 Credit Score

Theres no one path you can follow to get an excellent credit score, but there are some key factors to be aware of while you continue to build and maintain it.

Even if youre holding steady with excellent credit, its still a good idea to understand these credit factors especially if youre in the market for a new loan or youre aiming for the highest score.

Recommended Reading: When Do Credit Card Companies Report Balances To Credit Bureaus

Tips To Get A Perfect Credit Score

The first thing to keep in mind is that obtaining a perfect credit score takes time.

Its rather easy to remove negative items from your credit report and get a better score, but a perfect score is another story.

Now, assuming you dont have any negative items on your credit report like late payments or a collections account, lets get into the more advanced credit behavior youll need to learn and put into practice.

Keep in mind that all of the steps outlined below are based on my personal experience, not random advice Ive read on the internet.

Can I Get A Personal Loan Or Credit Card W/ A 772 Credit Score

Like home and car loans, a personal loan and credit card is easy to get with a 772 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 772 score means you likely have few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Also Check: Does Titlemax Go On Your Credit

What Is A Good Cibil Score

A good CIBIL score is a CIBIL score between 700 and 900. A good CIBIL score will be followed by many benefits such as quicker approval, a low-interest rate on the credit facility, a higher loan amount, a longer repayment period, and more. Furthermore, multiple lenders will be willing to approve your loan so that you can make a choice about the lender you wish to borrow money from.

Age Of Your Credit History

Another factor weighed in your credit scores is the age of your credit history, or how long your active accounts have been open.

Canceling a credit card can affect the age of your credit history, especially if its a card youve had for a while, so weigh that potential impact when youre deciding whether to close a card. Only time can offset the impact of closing an older account, but youll also lose the credit limit amount on a closed card, which can negatively affect your credit utilization rate.

Heads up that card issuers may decide to close your accounts if youre not actively using them, so make sure you keep any accounts you dont want closed active with at least an occasional minimal purchase.

You May Like: Credit Score Needed For Les Schwab Credit

How To Improve Your Credit Score From 772 To 800+

A credit score of 772 is on the brink of perfection, and you probably wont have to change much to join the 800+ credit score club. Your personalized credit analysis from WalletHub will tell you what needs improvement and exactly how to fix it.

A few things in particular tend to stand between a credit score of 772 and perfect credit, though. And if you do nothing else, make sure to take the following steps.

What Type Of Financing Can You Get

If you are looking for personal loans, boat loans, car loan, RV loan, car leasing, conventional mortgages, FHA loans, small business loans or looking to take advantage of fallen interest rates by refinancing an existing loan, nothing should be hard for you. The likelihood that you will be denied any financing with this credit score is extremely low, and it is just up to you to make sure that you continue managing your credit well.

You May Like: Does Klarna Financing Report To Credit Bureaus

Heres How To Get A 772 Credit Score:

Dont Apply For Multiple Credit Cards

The best reason to avoid this practice is because you dont need to. If your FICO Score is 750 and above, approval is practically guaranteed.

Its just a matter of selecting the card that will work best for you. You should also be aware that applying for multiple credit cards wont necessarily improve your chances of success.

One reason a credit card issuer may reject your application is that too many inquiries on your credit report could be an indication youre looking to build up your credit availability in a hurry.

They may still approve your application, but it might be with a very low credit limit.

Also Check: Coaf Inquiry

Don’t Risk Damaging Your Score

Breaking your good pattern of always paying your bills on time, then suddenly missing payments or only making part payment has the potential to harm your score. These are two red flags to avoid that can raise your credit score and not scare off any card issuers or lenders.

With such an excellent credit score, you wouldn’t want to break your good payment habits or do anything that can put your credit score at risk, like making late payments.

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

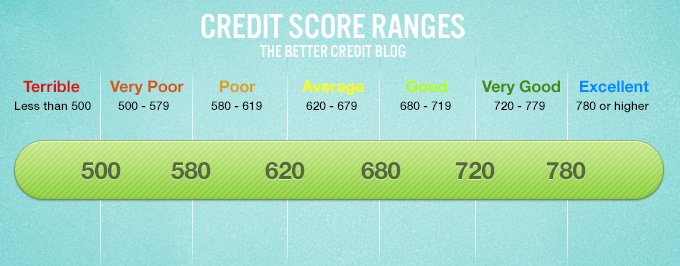

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

Don’t Miss: Kroll Factual Data Complaints

Good Credit Score: 670 To 739

Scores ranging between 670-739 are regarded as good credits. This range also includes the average credit score for American residents. Most lenders view consumers with credit scores within this range as acceptable borrowers.

If your credit score is within this range, you are likely to qualify for a wide lineup of credit cards as well as loans. But, you might be charged a higher interest rate than if your score was in the previous two categories.

Also, keep in mind that theres a lot of difference within this range when it comes to credit approval. It may be easier to get a credit card with a 702 credit score than it is to get a 673 credit score credit card application approved. Similarly, a 722 credit score auto loan interest rate is bound to be better than the interest rate on a 670 credit score auto loan.

Credit Score Credit Card Options

With your score of 772, you should be approved for most credit cards. And since your credit score is relatively high, youll often get the cards with the best perks. This can include sign-up bonuses, no annual fees, travel programs, airport lounge or hotel perks and more.

Your score should secure you an average interest rate of 13.5 percent, while those with deep subprime credit scores will often have a rate above 20 percent.

You May Like: How Can You Remove Hard Inquiries From Your Credit Report

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

Mortgage With 772 Credit Score

Mortgages are ideal to have when a person wants to purchase a first home, a second home or even a vacation home. For those that want to use the home for other purposes, this loan would be ideal. When the person has a 772 FICO score, they are then able to qualify for a wide variety of mortgage loans. They have to provide proof of income, but as far as the credit score, you should have no issue. Just ensures that your debt to income ratio is lower.

Don’t Miss: Opensky Locked Account

Shield Your Credit Score From Fraud

People with Very Good credit scores can be attractive targets for identity thieves, eager to hijack your hard-won credit history. To guard against this possibility, consider using credit-monitoring and identity theft-protection services that can detect unauthorized credit activity. Credit monitoring and identity theft protection services with credit lock features can alert you before criminals can take out bogus loans in your name.

was the most common form of identity theft , followed by employment or tax-related fraud , phone or utilities fraud , and bank fraud in 2017, according to the FTC.

What Does A 772 Credit Score Mean Pros And Cons Of Having This Credit Score

Those that have this credit score do not really have any cons, as this is one of the highest scores they can get. Though they are not at the very top of the ladder, they have a couple ways they can improve the score to get it to the top such as paying their payments on time, using the right amount of credit and never defaulting on their loans.

In terms of pros, a 772 credit score shows that you are a trustworthy, reliable borrower and that you would be ideal to loan money too for mortgage loans, vehicle loans, credit cards, lines of credit and a wealth of other money loaning services offered through various financial institutions.

Recommended Reading: Aargon Agency Debt Collector

The Average American Credit Score

The average FICO score in the United States is 706. But this varies based on a variety of factors. Most peoples’ . Some states have higher or lower average credit scores, too. For example, Minnesotans on average have the highest FICO credit scores in the nation at 733.

As of this report, 55% of Americans have a FICO score of 740 or higher. This has historically been the case, but the decade of steady economic growth since the Great Recession has caused Americans’ credit profiles to improve significantly. Credit scores are higher when fewer consumers have serious delinquencies weighing down their scores. The state of the economy can influence whether or not people are financially able to avoid credit score pitfalls from year to year.

Is 722 A Good Credit Rating Knowyourcreditscorenet

16-10-2021 ·A 722 Credit Score Is Considered A Good Credit Score By Many Lenders. Percentage of generation with 700749 credit scores Generation 14.7%: Good score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates and better terms.

You May Like: How To Get Repossession Off Credit Report

How Long Does It Take To Get A 772 Credit Score

It depends where you started out.

If you had good credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.