How Do I Establish A Good Credit Rating

The easiest way to establish a good credit rating is to pay your bills on time. If you don’t have a credit card, apply for one, and use it responsibly. If you make your minimum payments, you can develop a good credit history. This will have a positive impact on your ability to borrow in the future.

To find out more about establishing credit, talk to a CIBC advisor.

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

How Does Information Get On My Credit Report And Is It Updated On A Regular Basis

When you have an account with a lender, theyll typically submit account updates to at least one of the three major credit reporting agencies TransUnion, Equifax and Experian. Since lenders dont always report to all three agencies, the information on your credit reports may vary.

Its also important to note that lenders report at different times of the month, so you might see slight differences in your reports, and therefore your credit scores, at any given time.

Don’t Miss: Are Apartment Credit Checks Hard Inquiries

How To Minimize The Number Of Hard Inquiries You Have

Hard inquiries aren’t bad to have even if they may cause a slight temporary dip in your credit scores but it can be good practice to know how to minimize the number of inquiries on your credit report.

Below, CNBC Select rounded up some general guidelines to keep track of your hard inquiries:

- Don’t apply for several credit cards within a short timeframe. Experts generally recommend only applying for a credit card every six months.

- Only apply for credit cards you would actually benefit from using.

- Make sure you check your credit score beforehand . You can do so for free with most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey .

- Before applying for a credit card, shop around with prequalification tools, which allow you to check your likelihood of qualifying for a card without damaging your credit.

What If I Find A Problem Or Mistake On My Credit Report

If you have no plans to apply for new credit, it’s a good idea to review your credit report from each bureau on an annual basis. Check to ensure that your identifying information is correct, and that the credit accounts listed in your report are accurately represented.

If you do plan to apply for a new loan or credit card, it’s vital that you check your credit reports beforehand in case there is anything that needs to be cleared up. Negative information in your credit reports can lower your credit scores, and you want your credit scores to be the best they can be before applying for new credit.

Under the Federal Credit Reporting Act, both the credit reporting bureau and the information provider are responsible for correcting any inaccurate or incomplete information in your reports. To get information corrected, you must initiate a dispute with the credit reporting agency. This typically involves submitting your dispute in writing. The credit reporting agency must investigate your dispute within 30 days of your submission.

Experian makes it easy to initiate a dispute online through our Dispute Center. You can also initiate a dispute at Experian by phone or mail see “How to Dispute Credit Report Information” for more details.

Read Also: Speedy Cash Repayment Plan

Top Sources For Free Credit Scores

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Also Check: Does Zzounds Do A Credit Check

What Kind Of Information Appears On Your Credit Report

Interpreting your credit report gets confusing because the credit bureaus report more than just your account information. You may have to dig through several pages of other data to find an error in one of your accounts.

Inaccuracies can appear in other sections of your credit report such as your personal information and public records, too. Those errors could also cause problems in the future.

So lets break down the kinds of data you can find and correct in your credit reports from the three major credit bureaus Equifax, Experian, and TransUnion.

Information reported includes:

What’s In Your Credit Report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO® Scores to inform future lenders about your creditworthiness.

Although each of the credit bureausExperian, Equifax and TransUnionformat and report your information differently, all credit reports contain basically the same categories of information.These four categories are: identifying information, credit accounts, credit inquiries and public records.

Recommended Reading: Carmax Financing 650 Credit Score

How To Log A Dispute

The National Credit Act provides you with the right to dispute any factually incorrect information on your credit report generated by a credit bureau and to have this information corrected.

Logging a dispute with Experian is free of charge. Why pay one of the many credit clearing companies that charge money for doing something that you could do for free? Once you have logged a dispute with us, we have 20 business days to investigate the dispute. To find out more about logging a dispute at Experian, please visit our blog by clicking here.

In the event that you are not satisfied with the outcome of the dispute, you may refer the matter as follows:

Bank account information:

- National Credit Regulator 0860 627 627

Retail and other non-bank information:

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

You May Like: Capital One Remove Authorized User

What Is A Credit Rating

A credit rating is a measure of how dependable you are in repaying your debts. Most credit-reporting agencies will give you a rating on a scale of 1 to 9, others will assign letters corresponding to the type of credit you’re using. For example, a rating of “1” means you pay your bills within 30 days of the due date, while a rating of “9” can mean that you never pay your bills at all.

An “R” rating is also included in your credit score. This rating is assigned by lenders based on your past history of borrowing and paying off debts, and it can range from 1 through 9. An R1 rating is the best, meaning you pay your debts on time, within 30 days, and an R9 is the worst.

Your credit rating is not established by the government or by financial institutions – it is established by you. If you don’t pay your bills on time or fail to repay a loan, you may be reported to a credit bureau.

Whats The Difference Between A Credit Score And A Credit Report

Your credit report is a record detailing all of your credit history, while your credit score is a numerical score that is calculated based on the information in your credit report. To use an analogy, if your credit report is a report card detailing all your past assignments, your credit score is your final grade in a class.

One important thing to know is that you can dispute information on your credit report, but you cant dispute your credit score. If you notice any errors or inconsistencies on your credit report, you should report them to the credit bureaus immediately to avoid any negative effects on your credit score. Conversely, if you notice a sudden drop in your credit score, you should check your credit report to discover why and report any potential mistakes.

Another thing to remember is that youre legally entitled to a free copy of your credit report annually, but theres no such law regarding your credit score. Most credit card companies and banks provide credit score updates for free.

Don’t Miss: What Credit Score Do You Need For Comenity Bank

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Best For Credit Monitoring: Credit Karma

Youll have access to your credit report information along with an explanation of the factors that are currently contributing to your credit score. Credit Karma also uses your free credit report information to show credit card and loan offers that you may qualify for based on your credit standing. You dont have to take advantage of these offers if youre not on the market for a new credit card or loan product.

Read Also: Opensky Locked Account

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

How To View Your Credit Report For Free

Chris Hoffman is Editor-in-Chief of How-To Geek. He’s written about technology for over a decade and was a PCWorld columnist for two years. Chris has written for The New York Times, been interviewed as a technology expert on TV stations like Miami’s NBC 6, and had his work covered by news outlets like the BBC. Since 2011, Chris has written over 2,000 articles that have been read nearly one billion times—and that’s just here at How-To Geek. Read more…

If you keep a regular eye on your credit report, youll notice when identity thieves open accounts in your name and when errors are listed that might cause you problems in the future. Heres how to do it for free.

US law entitles you to a free yearly credit report directly from each agency, but youll have to go elsewhere if you want to get your credit report more frequently. Dont worryits still free.

Also Check: Credit Score To Be Approved For Amazon Credit Card

What Is A Free Credit Report

The free My Credit Check and My Credit Expert services generate full free credit reporst which provide a comprehensive records of your financial history, detailed information on your borrowing and spending habits, payment trends and contact details. Information includes accounts you opened, payments youve skipped, judgments taken against you and what you owe your creditors.

How To Update Information On Your Credit Report

In a Nutshell

The offers that appear on our platform are from third party advertisers from which Credit Karma receives compensation. This compensation may impact how and where products appear on this site . It is this compensation that enables Credit Karma to provide you with services like free access to your credit score and report. Credit Karma strives to provide a wide array of offers for our members, but our offers do not represent all financial services companies or products.

Don’t Miss: Affirm Approval Odds

How Is My Credit Report Used

Your credit report is a history of how youre using and have used credit in the past.

Before making a major purchase such as a home or car, its a good idea to check your credit report, as it can affect your ability to be approved for more credit, as well as get hired for a job or rent an apartment.

You can request a copy of your credit report directly from the two main credit reporting agencies in Canada, Equifax and TransUnion. Youre entitled to one free copy of your credit report from each credit reporting agency once a year.

You can also view your TransUnion credit report for free any time at .

Generate Your Report Online

Once you access your credit reports, download them to your computer or print them before you exit out of the window for later review.

If you have trouble requesting an online copy of your credit reports, you can also request to receive a free copy by mail or phone. To receive a free copy by mail, fill out the mail request form and send it to this address:

Annual Credit Report Request ServiceP.O. Box 105281

The form asks you the same questions as the online form.

If you prefer calling instead, dial 877-322-8228.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

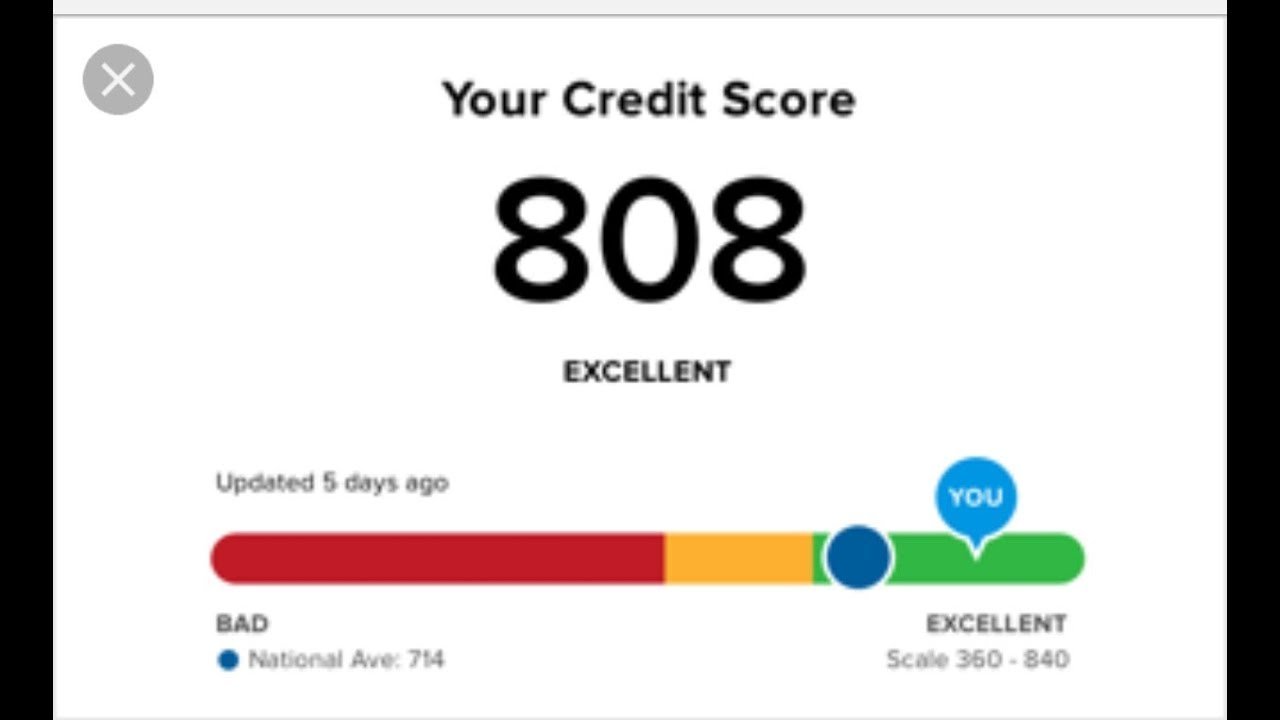

Understanding Your Credit Score

Credit scores range from 300-850, with 850 being the highest. The higher your credit score, the more likely you are to be approved for a loan or credit card with the best interest rate.

Since there are multiple different versions of your credit score, thanks to different formulas and approaches used by different credit bureaus, it can help to view any given credit score as a general representation of your creditworthiness. Different lenders use different scores, so the score a mortgage lender uses might slightly differ from the score a credit card issuer uses.

Most lenders use the FICO score, according to the Federal Trade Commission. Whatever score different lenders use, the higher the better in terms of getting the best rates. But because different lenders use different scores, the Consumer Financial Protection Bureau notes it can pay to shop around.

Also Check: Does Paypal Credit Report To Credit Bureaus

Check And Monitor Your Credit Reports And Credit Scores

Now that you know why your credit is so important, you can see why itâs a good idea to check and monitor your credit. But how do you do it?

How to Request Free Copies of Your Credit Reports

You can get a free copy of your credit report from each of the three major credit bureausâEquifax, Experian and TransUnionâby visiting AnnualCreditReport.com. Youâll need to provide your:

- Legal name.

- Social Security number.

- Current address.

If youâve moved in the past two years, you may need to include your previous address as well. There may be a limit on how often you can obtain your reportâcheck the site for details.

Once youâve provided the information above, youâll pick which credit reports you want before answering a few additional questions that help verify itâs really you. âThese questions are meant to be hard,â according to AnnualCreditReport.com. âYou may even need your records to answer them. They are used to ensure that nobody but you can get your credit information.â

How to Check Your Credit Scores for FreeâWithout Hurting Your Credit

Keep in mind that your credit scores donât actually appear on your credit reports. So what do you do if you want to check your scores?

Depending on your lender, you may be able to find your scores by checking your statement or by logging in to your account online. You can also get your scores directly from the credit bureaus and credit-scoring companiesâbut you might have to pay for them.

Related Content