Credit Score Loan & Credit Card Options

Percentage of All New Accounts Opened, by Credit Score

| 8.4% |

Just because you can borrow with a 565 credit score doesnt mean you should. You may not qualify for attractive terms at this point. And a little bit of credit improvement could save you a lot of money. For example, a credit score of 580 or higher qualifies you for a lower down payment on an FHA home loan.

Sign Up For Automatic Loan Payments

To help build and maintain a good credit score, one of the best things that you can do is sign up for automatic bill payments.

Almost every lender has an option to sign up for automatic payments and you can usually customize how much you want to pay automatically. Whenever you get a new loan or credit card, sign up for automatic payments and you can be sure that youâll never miss a payment and damage your credit.

Ideally, youâll sign up for automatic payments for your full credit card balance. If you do, youâll never have to worry about paying interest. Still, signing up to make at least the minimum payment automatically prevents you from missing due dates and still leaves you free to make a full payment manually.

Auto Loan Rates For Poor Credit

Theres no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, it could be difficult to get approved for a car loan. Even with the best auto loans for poor credit, watch out for high interest rates, which can make it very expensive to borrow money.

If you have time to build your credit before you apply for a car loan, you may be able to eventually get better rates. But if you dont have time to wait, there are some strategies that can help you get a car loan with bad credit.

- Consider a co-signer if you have a trusted family member or friend with good credit who is willing to share the responsibility of a car loan with you.

- Seek out alternative lenders, such as a credit union or an online lender.

- Ask the dealership if theres a financing department dedicated to working with people with poor credit.

- Use buy-here, pay-here financing only as a last resort.

If your credit could use some work, its especially important to shop around to find the best deal for you. Our auto loan calculator can help you estimate your monthly auto loan payment and understand how much interest you might pay based on the rates, terms and loan amount.

Compare car loans on Credit Karma.

Also Check: Does Apple Card Pull Credit Report

Faqs About Bad Credit Loans

Getting approved for a loan when you have bad credit can feel like youve just been thrown a lifeline, but dont forget that it also comes with risks. Bad credit loans have higher interest rates and fees, and stricter penalties than do conventional loans, and there is far less room for error such as missing a payment.

Here are some other things you need to know about bad credit loans.

How To Turn A 665 Credit Score Into An 850 Credit Score

There are two types of 665 credit score. On the one hand, theres a 665 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 665 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

What A Fair Credit Score Means

An average or fair score means there is still a decent chance youll get accepted but you wont get the best deals or rates. For example, you might get a lower credit limit or a shorter 0% period. Its even more important to use soft checks, particularly on credit card applications, to find out who will accept you.

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

Recommended Reading: How To Report To Credit Bureau As Landlord

Best Auto Loan Rates With A Credit Score Of 560 To 569

Summary: A review of the best car loan rates for new, used & refinanced vehicles based a 560 auto loan credit score.

Your credit score will play a big factor if you are looking to get the best rates for an auto loan in 2019.

It is possible to get the best car loan rates with a subprime credit score in the range of 560 to 569.

And I am going to tell you how!

To get the best auto loan interest rates you will need to make some important choices about your financing options.

The first decision you will need to make is if you will be getting your car loan from the dealership, a bank, credit union, or an online lender.

Check Your Credit Report For Errors

The credit bureaus generate your credit score using the information contained in your credit report. If thereâs a mistake in your credit report, the credit bureaus will calculate your score incorrectly.

Itâs worth taking the time to check your credit report for errors. There are many services that let you view a copy of your report and many lenders and card issuers will let you see a copy of your report as a benefit of having an account.

You can also use annualcreditreport.com to request a copy of your report. By federal law, youâre entitled to a free copy of your report from each credit bureau once per year.

If you notice any mistakes that may damage your credit, reach out to the credit bureau to have it remove the mistake. Depending on the severity of the issue, this can significantly boost your score.

You May Like: Is 586 A Good Credit Score

Pay Down Your Credit Card Balances

Your is the amount of available credit youre using and it accounts for 30% of your overall fico score. The lower your balances are, the higher your score will be. Only your payment history has a bigger impact . If youre carrying a lot of credit card debt then your credit rating is suffering. Try to pay your card balances down to less than 25% of their credit limits.

Get a secured credit card if you dont have one

If you dont have a credit card, you will need to get one or two to help improve your score. A secured credit card works similarly to an unsecured credit card only they require a deposit equal to the credit limit.

Wait to get a secured card until after you have followed these steps and have waited 30 days. Your credit scores could improve enough for you to be approved for an unsecured credit card.

Can I Buy A House With A 600 Credit Score

According to FHA credit requirements, a score of 580 or higher can qualify you for a mortgage with as little as 3.5% down. Of course, that doesnt guarantee you will get approved, as there are many other factors that need to work in your favor.

In addition to your credit score, a lender is likely to look for things that may include no late payments in the past six to 12 months, a high income and/or low debt-to-income ratio, and a low loan-to-value ratio.

FHA loans have the lowest credit score requirements of all mortgage programs, but not every home can be purchased with an FHA loan. If the seller wont consider an FHA loan, youll need a much higher down payment to compensate for a 600 credit score. Your best bet is to raise your credit score before you apply for a mortgage.

Don’t Miss: Kroll Factual Data Credit Report

How Can I Make Sure I Get Approved For A Car Loan

One way to increase your chances of getting approved is to check your credit score three to six months before you plan to by a new car. This gives you some time to take steps to improve your credit score, such as by paying off outstanding debts.

Another important step you can take is to provide lenders with sufficient information about your employment status and income. If a prospective lender can see that you have a regular income that allows you to make payments on a loan, theyll be more likely to approve your application.

We hope that this rundown of common car loan queries has helped to put you at ease about your upcoming auto purchase. But if you still have questions or would like assistance in getting a car loan, our finance department here at Oxmoor Toyota is waiting to help. Contact our expert financial team today and let them walk you through the preapproval and loan application processes. Then, we can get down to the business of finding you the ideal Toyota to meet your needs.

How To Improve A 565 Credit Score

Its a good idea to grab a copy of all three of your credit reports from Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law to help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items. They have over 28 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Credit Score Personal Loan Options

While this credit score range isnt the lowest on the totem pole, it is still below average. While you should be able to secure a personal loan, your interest rates and terms will definitely be less than favorable. Interests will often vary anywhere from sixteen to eighteen percent, with most leaning towards the higher end of that range. If youd like to secure a lower rate, a cosigner is a good option while you work to build your credit. Guide on poor credit loans

Fha Credit Score Requirements May Vary

The credit scores and qualifying ratios weve mentioned in this post so far are either the minimums required by Rocket Mortgage® or the FHA itself. Other lenders may have their own requirements including, but not limited to, higher FICO® Scores or a larger down payment.

In any case, we encourage you to shop around for the best loan terms and make sure youre comfortable before moving forward.

Also Check: Syncb/ppc On Credit Report

Trouble Finding An Apartment

If youâre shopping for a new apartment, thereâs a good chance that your landlord is going to run a background check on you before offering you a lease. Some lenders, depending on where you live, may check your credit report to make sure youâll pay the rent on time each month.

If a landlord checks your credit and sees that you have a poor credit score, they may decide not to let you rent an apartment. If you live in a hot housing market, you may have to settle for less desirable accommodations because landlords wonât rent to you.

What Is A Good Credit Rating

What is considered a good credit score varies depending on which CRA you get it from, as they all use different methods of measuring and calculating your credit rating, with varying maximum scores and banding systems.

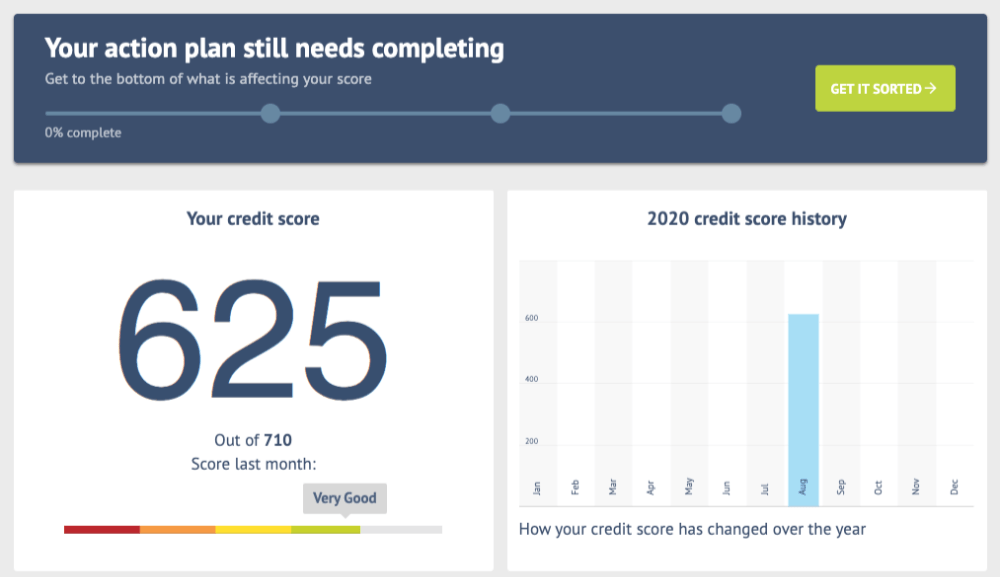

For example, Experian measures your score between 0 and 999, while Equifax has a maximum credit score of 700 this means that what credit scores they consider as good will be different.

Here are the maximum credit scores of the three main credit reference agencies in the UK:

- Experian: 0-999

- Equifax: 0-700

- TransUnion: 0-710

NOTE: There is no magic number that will guarantee your approval for credit, so you may want to do a multi-agency credit check before applying in order to get the most accurate representation of your credit status.

You May Like: How To Remove Verizon Collection From Credit Report

Best Online Auto Loan Rates By State

Whether you live in California or Texas, we have found the best online auto loans by state for you.

If you want to get the best possible car loan rates in your state

Simply click on the state that you live in below and fill out a quick, free, no-obligation application to start driving your new car!

Errors In Your Credit Reports

Our credit reports contain valid information about where we live, our mode of paying bills-electronic or cash-, our police records and financial sensitivities like being sued, suing someone or declaring bankruptcy. This information is sold to insurance companies, credit lenders, employers and other businesses that use this data to gauge our insurance, credit, employment and housing applications. It is recommended by experts to review credit reports intermittently, some organizations follow this stringently.

Why is there a need to review our credit reports you ask? Simply because:

- The data in our reports affect our chances of being granted or rejected a loan and how much we are willing to pay for borrowing a loan.

- To verify that the information is accurate and up to date and complete. This will minimize complications when applying for loans or jobs or when purchasing houses or automobiles.

- To help protect us against identity theft which is basically when someone uses our personal information such as our name, Social Security number or credit card number to open up new credit accounts. Unpaid bills under this account get reported as ours on the credit record. Such inaccurate information can greatly minimize our chances of getting a credit.

Recommended Reading: Credit Score 584

Can You Be Denied A Loan After Preapproval

Preapprovals are usually very accurate, since theyre based on a credit inquiry carried out by the lender. This means that in most cases, your application will be approved after preapproval. However, if your circumstances change between your preapproval request and your loan application, its possible that your application could be denied. For example, if you lose your job after getting preapproved to buy a Toyota, your change in employment status may cause the lender to turn you down.

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Also Check: Does Paypal Credit Report To Credit Bureaus

What Is The Minimum Credit Score For A Loan

The minimum credit score required for any loan depends on several factors, including the type of loan and the amount needed. In addition to your credit score, a lender will consider other personal financial information, such as your earnings, job stability, overall debt, bankruptcy or defaults, length of credit history, recent financial record, and other mitigating circumstances.

The loan request is scrutinized to determine whether enough positive factors exist to overcome a low credit score. Things such as the down payment amount, whether there is collateral as in the case of a vehicle loan or mortgage, the loan term, APR all these factors will also come into play.