Can Credit Repair Remove Student Loans

Credit repair is a service offered by numerous companies and is the process of fixing inaccurate credit history reports that appear on your credit report. Credit repair canât remove student loans that are correct on your credit report. You can dispute errors on your credit report for free. Be mindful of scams when it comes to companies offering credit repair.

Can You Remove Student Loans From Your Credit Report

If the information about your student loans is legitimate, removing it from your credit report is generally not an option.

One thing to keep in mind is that some companies may promise they can remove student loans from your credit report even if the negative information is accurate these are often scams.

Inaccurate Reporting Of Payments

If your loan has been reported as delinquent or in default to the credit bureaus, but you believe your payments are current, you can request a statement from your loan servicer that shows all the payments made on your student loan account, which you can compare against your bank records.

If some of your payments are missing from the statement provided by your loan servicer, you can provide proof of payment and request that your account be accurately reported to the credit reporting agencies.

In all three cases, if you believe there is any type of error related to your student loan on your credit report, its best practice to also send a written copy of your dispute to the credit bureaus so they are aware that you have reported an error.

Also Check: Does Paypal Credit Report To Credit Bureaus

How To Dispute Credit Report Errors

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Errors on your credit reports can cause your credit scores to be lower than they should be, which can affect your chances of getting a loan or credit card and how much interest you pay. Disputing credit report errors and getting those negative items removed can be a quick route to a better score.

Here’s how to dispute credit report errors and have them removed in four steps.

What Are Nelnets Standard Reporting Practices

These credit reporting practices apply to all of the student loans serviced by Nelnet.

- Nelnet will begin to report a loan delinquent once it is 90 days or more past due.

- Nelnet reports to the credit agencies on a monthly basis, on the last day of every month.

- Nelnet will report each individual loan to the credit agencies as one unique trade line that will appear on your credit report.

- Nelnet does not complete goodwill requests for credit updates.

NOTE: With a good will request, a consumer is not disputing an error. A consumer reaches out directly to the original creditor or collection agency asking for forgiveness for a mistake the consumer made and requesting a goodwill adjustment to information that was accurately reported to the consumer reporting agencies.

You May Like: What Credit Score Does Carmax Use

Types Of Students Loans

Once you have determined that you have no choice but to take out a loan to fund the degree you seek, you have two main options. You can acquire private student loans. These come with all types of nuanced contingencies though and may prove to be more of a hassle than they are worth later on. The alternative is to obtain a federal student loan, which comes in four different varieties:

- Subsidized Your eligibility is based on need and status as an undergraduate student

- Unsubsidized Status as a higher-education student is still required, but it is not based on economic need

- PLUS These are available to graduate and professional students or the legal guardian of a dependent undergraduate. They exist to cover expenses that are otherwise uncovered by aid and

- Consolidation This lets you combine all of the loans you have taken into one sum with a single loan servicer .

Most of these federal routes do not require pulls on your credit to determine whether you have sufficient standing to receive assistance. The big exception to this is the PLUS option. A demonstration of need is not required for this option, but you will have to go through the credit check process to prove eligibility for PLUS. Having a substandard credit history is not always a nail in the coffin if this is the route you need to take. However, it will make obtaining a PLUS more difficult, requiring you to meet additional standards if it does not bar you altogether.

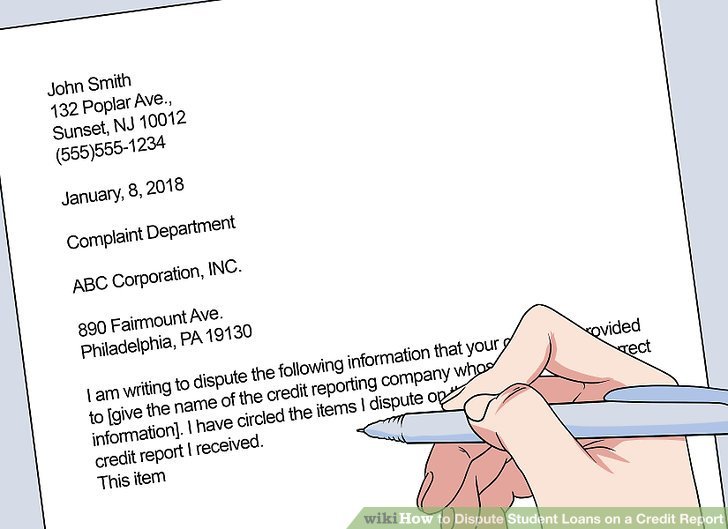

Write A Letter That Concisely Explains Your Case

The letter to your lender are going to be almost like the one you sent to the reporting bureau. Identify the error, why it must be corrected, and inform them that youve filed a dispute with a reporting bureau.

- Use this sample letter as a template: https://www.consumer.ftc.gov/articles/0485-sample-letter-disputing-errors-in your-credit-report-information-providers.

- Your loan service is that of the company that manages and accepts payments toward your loan account. If a replacement service purchased your loan and both accounts appear on your credit report, send a letter to both companies.

Don’t Miss: How To Get Credit Report Without Social Security Number

Why Do I Have So Many Student Loans On My Credit Report

Student loans are often a necessary part of the path to getting a college degree. While the idea of taking on debt is rarely fun, these loans act as an investment in yourself and your pursuit of a healthier financial future. But managing those student loans can seem daunting. You may have several loans that need to be paid to multiple servicers. Some student loans may have different terms, payment dates and repayment options, creating a web of loans and documents you need to manage.

Its understandable that you may turn to your credit report to get some clarity, only to see more student loan accounts than you think you have. Dont be alarmed if this has happened to you, as there may be a reason for it.

How To Dispute Student Loans On Your Credit Report

Youll have a hard time removing student loans from your credit report if the negative information is legitimate. But there may be instances when the details are inaccurate. In these cases, you can dispute the information with your creditor or the credit reporting agencies.

If you want to start with your loan servicer or lender, heres how to dispute delinquent student loans or loans in default:

- Write a dispute letter: Its best to complete this process in writing, so you have a paper trail you can refer back to in the future if needed. Write a letter to your servicer notifying them of the inaccuracy and requesting that they remove it from your credit reports.

- Gather supporting documentation: Before you send your letter, gather some documentation to support your claim. This can include bank statements or emails from the servicer showing you made on-time payments or any other reason why you believe the delinquency or default notation was made in error.

- Wait for a decision: Once you submit your letter, it may take a couple of weeks to get a response. If you dont hear back in two or three weeks, contact the servicer to follow up on your letter.

If youre having a hard time dealing with your loan servicer or youd simply rather not deal with them, you can also file a dispute directly with the credit reporting agencies. You can typically do this online, but still, make sure you provide supporting documentation for your claim.

Also Check: Paypal Working Capital Phone Number

Why You Should Keep Student Loans On Your Credit Report

While you may be able to get certain negative information related to your student loans removed from your credit report, its important to remember that you cant remove the loans themselves.

And that can actually be a good thing. While negative information remains on your credit reports for seven years, positive information stays for 10 years. If you make all of your payments on time, even if youve slipped up in the past, that positive payment history can help increase your credit score.

In fact, while negative information can hurt your credit, FICO favors newer information over older items, so paying on time can help make up for past missteps.

Write To The Credit Reporting Company

Tell the credit reporting company, in writing, what information you think is inaccurate. Heres a sample dispute letter. Include copies of documents that support your position.

In addition to providing your complete name and address, your letter should clearly identify each item in your report you dispute, state the facts and explain why you dispute the information, and request that it be removed or corrected.

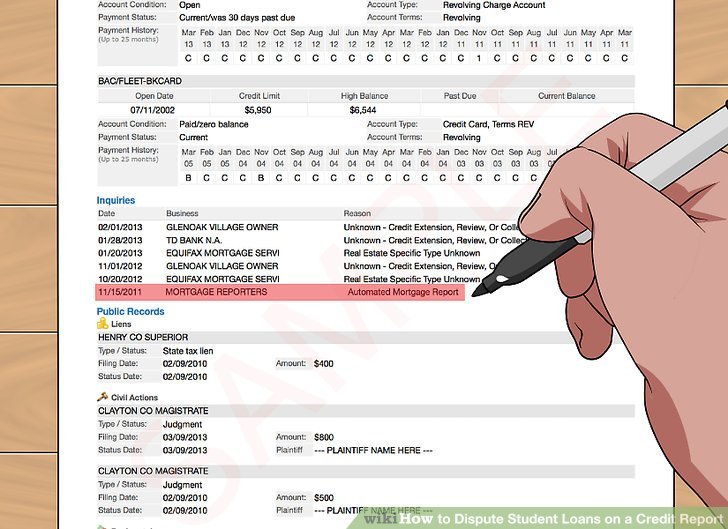

You may want to enclose a copy of your report with the items in question circled.

Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. Keep copies of your dispute letter and enclosures.

Read Also: Credit Score Without Social Security Number

Talk To Your Loan Servicer About A Solution

Within just a few enterprise days of receiving your packet, your loan servicer ought to contact you, almost certainly by phone. If they decided they made an error, theyll let you understand how theyre taking steps to appropriate the issue.

- If they dismiss your dispute, youll be able to nonetheless work with the credit reporting bureau to appropriate the error.

- Even in case your loan servicer informs you theyve corrected the error, you must nonetheless comply with up with the credit reporting bureau.

CSN Team

Get Your Free Credit Report

The first step in disputing student loan errors on your credit report is getting a free copy of your credit report from each of the three major credit bureaus. Youâll want to request a credit report from Experian, TransUnion, and Equifax. The easiest way to do this is to go to annualcreditreport.com and request your free copy. This website is the official website approved by the government to get your free credit report.

Normally, youâre entitled to one free credit report per year from each major credit bureau. New regulations due to Covid-19 temporarily allow a free weekly report. You must go through the process separately for each credit bureau. If you donât have internet access, you can call 322-8228 to get your free credit report.

Recommended Reading: Does Apple Card Pull Credit Report

What To Do If A Student Loan Is Misreported

The moment you recognize a student loan error, misreported item, or something that just looks questionable on your credit report, its a good idea to contact that loan servicer. You can do this via their customer service number, but its also a good idea to send an email or even a certified letter to get a record of your inquiry.

Dispute Credit Report Errors

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also call, but you may not be able to complete your dispute over the phone. Here’s information for each bureau:

How to dispute Equifax credit report errors

-

Write to Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on how to dispute your TransUnion credit report for details.

Don’t Miss: How To Check Credit Score Without Social Security Number

Submit A Complaint With The Cfpb If Youre Not Satisfied

If the error wasnt corrected or if you dont get a response within 30 days, file a complaint with the buyer Financial Protections Bureau . Submit your complaint here: https://www.consumerfinance.gov/complaint/#credit-reporting. You ought to get a response within 15 days.

Youll provide the CFPB with the dates, amounts, companies involved, and other details about your dispute. The complaint form allows you to upload digital copies of any supporting documents. After submitting your complaint, the CFPB will contact you and discuss solutions, like action, within 15 days.

Can I Remove Student Loans From My Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

You can have information on your credit report removed or corrected if itâs not accurate. Three main consumer reporting agencies provide credit reports. Also known as credit bureaus, they are Equifax, Experian, and TransUnion. They have a duty to report your credit history accurately, including student loans and payment histories. While incorrect information can be fixed, you canât remove information from your credit report that is accurate.

You can have information on your credit report removed or corrected if itâs not accurate. Three main consumer reporting agencies provide credit reports. Also known as credit bureaus, they are Equifax, Experian, and TransUnion. They have a duty to report your credit history accurately, including student loans and payment histories. While incorrect information can be fixed, you canât remove information from your credit report that is accurate.

If youâve defaulted on a student loan, there are steps you can take to get back in good standing and improve your credit score.

Don’t Miss: Does Loan Me Report To Credit Bureaus

How To Dispute Student Loans On A Credit Report

This article was co-authored by our trained team of editors and researchers who validated it for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.There are 11 references cited in this article, which can be found at the bottom of the page. This article has been viewed 36,202 times.Learn more…

If your credit report lists your student loans inaccurately, file a dispute with one of the credit reporting bureaus, which are Experian, Equifax, and TransUnion. Write a dispute letter, print a copy of your credit report with the errors highlighted, and make copies of documents that support your case. Assemble another packet with these items to send to your lender. Mail both packets, and follow up with the reporting bureau within 30 days. Get fresh copies of your credit report, verify the corrections were made and, if necessary, update anyone who’s checked your credit within the last 6 months.

Make Copies For Your Records

Before dropping your dispute letters in the mail, make copies of them for your files.

Do the same with all of your documentation, but be sure to keep the originals and send the copies after all, items can get lost in the mail. Keeping the originals will give you peace of mind, and ensure you have everything you need if you have to resend the letter and documentation.

To avoid the possibility of your letter being lost without your knowing it, send your disputes through certified mail with a return receipt requested. Upon receipt, the return request postcard will be mailed back to you, providing proof that the document was received and on what exact date.

Also Check: Zebit Report To Credit Bureau

Mail A Dispute Letter Instead Of Filing A Form Online

Its true that submitting on-line is quicker and simpler however on-line types usually embody undesirable phrases. For instance, by submitting on-line, you would possibly involuntarily comply with an arbitration clause. What this implies is that you simply gainedt have the ability to convey the reporting bureau to court docket in the event that they dont resolve your dispute. The reporting businesses mailing addresses are:

- TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016.

- Experian, P.O. Box 4500, Allen, TX 75013.

- Equifax, P.O. Box 740256, Atlanta, GA 30374.

- You solely have to contact 1 credit reporting bureau. If they decide the error must be corrected, theyll notify the opposite 2 bureaus.

Check All Three Credit Reports For Errors

Through April 2022, youre entitled to free weekly credit reports from the three major credit reporting bureaus: Experian, Equifax and TransUnion. Request them by using AnnualCreditReport.com.

There may be small differences among your reports, because some creditors dont report your account activity to all three bureaus. But if negative information has popped up on one report, its wise to see whether its also on the other two.

There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

Also Check: Aargon Collection Agency Address

What Can I Do About Defaulted Federal Student Loans

If youâre in default on one or more of your federal student loans, there are steps you can take to get back in good standing.

To find out if your federal student loan is in default, you can:

-

Check with your student loan servicer.

-

Check with the Department of Education by logging into studentaid.gov to see your repayment status.

-

Check your credit report to see the status of your federal student loans.

You can get federal student loans out of default by consolidating your loans or completing loan rehabilitation.

Loan Consolidation

A Direct Consolidation Loan will pay off your federal student loans with a new loan, which merges the previous loans. To consolidate one or more defaulted federal student loans into a new Direct Consolidation Loan, you must either agree to repay the new loan under an income-driven repayment plan or make three consecutive, on-time monthly payments toward the defaulted loan before you consolidate it.

After federal student loans are consolidated, the loans will no longer be in default. This means that the borrower will again be eligible to receive federal financial aid. Consolidated federal loans are eligible for deferment, forbearance, repayment plan options, and loan forgiveness programs.

Federal Student Loan Rehabilitation