What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

What Does Your Credit Score Mean

Your credit score measures how often you pay bills on-time , how close you are to your credit limits , and how much experience you have with managing debt .

A higher credit score can give you more options for borrowing money. It also qualify you for low-interest loans, which can save you tens of thousands of dollars in interest.

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that you have undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

Recommended Reading: How Much Does Transunion Charge For Credit Report

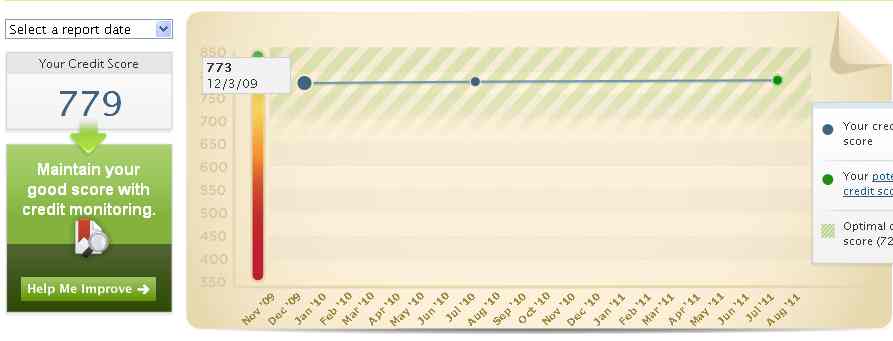

What Affects 779 Credit Score Negatively

When dealing with a credit score, any negative information will cause it to get lowered. This is not ideal for anyone. However, there are many ways that a person can work to boost their credit score and make it more positive. Even though you are at a 779 FICO credit score, you can still maintain or even grow that score by following some credit-worthy tips.

Dispute any negative reports that are on your credit report that you did not make or that are untrue. Disputing these and then having them cleared from the report helps.

Always make on time payments to uphold the credit score that you have.

Keep the credit usage to around 30% of what you currently have available. You can go a small amount above this, but make sure to pay it off so that it is below the 30% mark.

Take out loans responsibly to make sure that you are able to afford the payments that come with them.

Keep accounts open, the longer the account is open, the better it will have an impact on the credit score in a positive way.

Refrain from opening up many new accounts over the years, as the newer ones can negatively impact a credit score.

Keep the amount of times that your credit is hard checked in balance. Hard inquiries on your score can cause it to go down a few points.

Have a good mix of debt loans, vehicles, mortgage, credit cards and other credit. Having a mix shows youre good and responsible with all types of debt.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments;

- going over your credit limit

- defaulting on credit agreements;

- bankruptcies, insolvencies and County Court Judgements on your credit history;

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

You May Like: Does Bluebird Report To Credit Bureaus

Learn More About Your Credit Score

A 779 credit score is Very Good, but it can be even better. Boosting your score into the Exceptional range could let you qualify you for the very best interest rates and terms. A great starting point is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Some Lenders Use Their Own Ranges

Many lenders adopt the ranges used by FICO® and VantageScore. Others may develop their own classifications. Major lenders may use different ranges to classify potential borrowers by risk level. Many lenders publish their credit score ranges or provide them on request.If youre considering applying for a credit card or a significant loan, find out what score ranges the lenders youre considering use. Check your score and see where you fit. Dont just consider the minimum standard for approval. Check the ranges that the lender uses to determine interest rates.

You May Like: What Credit Score Does Carmax Use

How To Get The Best Credit Score

Start off by consistently paying all of your bills on time and in full. This is the best thing you can do for your credit score because it accounts for 35% the biggest factor considered!

You should also order a free copy of your credit report to get an idea of what exactly is bogging down your score. Is there anything on there thats incorrect or out of date? You might be able to dispute it and have it removed.

In the event you have multiple negative items, you could greatly benefit from talking to a credit repair company to help you clean up your credit history.

How To Improve A 779 Credit Score

Its a good idea to grab a copy of all three of your credit reports from Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law to help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items. They have over 28 years of experience and have removed over 10 million negative items for their clients in 2018 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

You May Like: How Long For Things To Fall Off Credit Report

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 779

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

Use Your Credit Card But Never Max It Out

Im not the type of person who buys everything on my credit card. I do use one of my credit cards a lot, however.

Ive found I need to use the credit card a lot to get the highest FICO score possible. The caveat is that you should never max out the card. In fact, I recommend you pay it down every month and never get even close to the credit limit.

As a general rule, you should try to keep your . In other words, if you have a credit card with a total credit limit of $1,000, never rack up more than $250 worth of charges on the card.

This is why its also important to have a credit card with a high limit. For example, my main credit card has a credit limit of $30,000, and I never get even close to 25% utilization.

If you dont have a card with a high enough limit to keep you comfortably under 25% utilization, give the creditor a call and request that they up the credit limit.

Read Also: How To Get A Debt Collection Removed From Credit Report

S To Improve Your 779 Credit Score

Improving your 779 credit score can take a lot of work, but following these steps can make all the difference. It will take time, but you can see your credit score go up within a year, which could save you countless amounts on interest rates. Dedicating the effort to improving your credit is worth the investment.

How To Read Your Credit Report

Your credit report contains both personal information and financial information. Your credit report illustrates who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. Your credit report is the report card of your financial life and understanding how to read it can help you take control of your finances and be prepared for any of your future credit needs.;

Don’t Miss: How To Read A Transunion Credit Report

What Are The Benefits Of A Good Credit Score

Making timely repayments of loans and credit card bills can fetch you a good credit score. This has numerous benefits. Here, we have listed some of the major benefits of a good credit score:

1. Low-Interest Rates on All Types of Loans

This is a major benefit when it comes to having a good credit score. Everyone aims to maintain good credit so that loans can be availed at low-interest rates. This can further help in paying off loans faster and reduces a significant amount of financial burden. Even a slight reduction in big-ticket loans such as home loan, loan against property, etc., can save you a lot of money in the long run.

2. Improved Approval Chances for Loans and Credit Card

Every lender first goes through your credit score and reports as soon as you apply for a loan or credit card. This is called a hard enquiry and it can also impact your credit score. The impact can hurt your credit score in case the application gets rejected. However, with a good credit score, the credit approval chances are higher since lenders will not have a strong reason to reject your application.

3. Higher Credit Limits

4. More Negotiating Power

Here’s What Americans’ Fico Scores Look Like

by The Ascent Staff | July 29, 2020

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

The average American has a FICO credit score of 706. But unless your credit score is exactly 706, this doesn’t tell you much about where you stand. Wondering how you compare with other American consumers? Here’s a look at the current distribution of FICO scores, and some guidelines that can help you interpret what your score means.

Read Also: Do Medical Bills Show Up On Credit Report

Credit Score: Is It Good Or Bad

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 779 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders.

25% of all consumers have FICO® Scores in the Very Good range.

Approximately 1% of consumers with Very Good FICO® Scores are likely to become seriously delinquent in the future.

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Read Also: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Credit Score Is It Good Or Bad How To Improve Your 779 Fico Score

Before you can do anything to increase your 779 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

Don’t Miss: What Does Filing For Bankruptcy Do To Your Credit Score

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits; aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them.;Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account;cuts into your overall credit limit,;driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and;several in a short time can add up.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .

Heres How To Get A 775 Credit Score:

Also Check: Can You Have A Bankruptcy Removed From Your Credit Report