Keeping Track Of Your Consumer Reports Doesnt Mean Just Keeping Up With The Three Major Consumer Credit Bureaus

Its easy to assume that there are only three consumer credit bureaus: Equifax, Experian and TransUnion. Whenever you look into your , these three major players may seem to be the only ones that are mentioned or matter.

But believe it or not, there are other minor consumer-reporting companies you may have never heard of before. And these smaller bureaus, such as Clarity Services, ChexSystems and MicroBilt/PRBC, also provide reports that lenders can use to help make decisions.

Knowing that these companies exist is half the battle. Read on to learn more about why its important to know about consumer-reporting companies and what you can do with your newfound knowledge.

Who Requests Credit Reports And Scores

A surprising number of businesses are interested in your credit report and score. Good credit scores are viewed as indicators of reliable and responsible financial behavior.

When a business does a credit check, they can make a soft pull or a hard pull on your credit report. Soft pulls are involuntary inquiries during a background check. They dont affect your credit score.

Hard pulls are considered voluntary inquiries, things like when you apply for a credit card, mortgage or auto loan.

Unauthorized hard pulls by a business can negatively impact your credit score. But you can ask the credit bureaus to remove it because the inquiry was made without your consent.

The credit-card industry has the most interest in your credit report because it supplies a temporary loan each time you use on its cards. The other obvious businesses interest in your score are mortgage brokers, auto dealerships and banks.

Some of the less-obvious businesses include insurance companies, employers, landlords, utility companies, licensing agencies, collection agencies and child support enforcement agencies. Each of them can file negative reports with credit bureaus if you fail to make timely payments on your accounts.

The insurance industry says there is statistical proof of a direct correlation between drivers with low credit scores and frequency/severity of accidents .

Building A Good Credit History

| A good credit history is positive when you want it and essential when you need it. |

- Your credit report is your personal history to lenders and others seeking the information. If you pay your obligations within the agreed time and contact creditors if you have temporary problems, your credit history will encourage lenders to grant you credit.

- Cutting up or destroying credit cards does not close an account. You need to contact the company who issued the credit. Closing accounts that you have held for a long time may negatively impact your credit score.

- Errors do occur and the only person who can get them corrected is you. Check your credit report regularly to make sure you agree with the information. If you are turned down for credit, find out why. If the information is not accurate, get it corrected. If the problem is a dispute between you and the lender, include a statement in the file that explains your position.

- Do not pay someone to fix your credit report and remove negative information. If the information is true, it cannot be removed from your report before the drop-off period.

You May Like: Serious Delinquency On Credit Report

Major Credit Card Networks

are companies that process credit card transactions. Each network sets its own processing fees, which merchants must pay for each transaction processed on that network.

Again, there are four main U.S. credit card networks: Amex, Discover, Mastercard, and Visa.

Though all four of these networks are quite large, Visa and Mastercard are among the largest payment card providers in the world, with 3.15 billion and 1.82 billion cards in circulation in 2017 respectively. Visa is topped in size only by Chinas colossal UnionPay.

As of March 2018, Visa has grown even larger, with 3.3 billion cards worldwide.

If youre planning to buy something with a credit card, you have to make sure the merchant accepts credit cards that use the network in question. Visa and Mastercard are accepted by the vast majority of card-accepting merchants around the world, but American Express and Discover are a bit less widespread.

Interestingly enough, industry heavyweights American Express and Discover are unique in that each acts as a credit card network and an issuer.

To see what network your credit card uses, just check the bottom-right corner. Youll usually see the network logo there, or sometimes on the back of the card .

The Chase Sapphire Preferred, with the Visa network logo in the bottom-right corner.

Insider tip

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Open Sky Capital One

The Three Major And The Fourth Credit Bureau

A credit bureau is an agency that collects and maintains consumer credit information for resale to businesses on an official credit report. Most people are familiar with the big three credit bureausEquifax, Experian, and TransUnion. Each is a publicly-traded for-profit company that is subject to some regulations by the governments Fair Credit Reporting Act.

There is a common misconception among consumers that credit reports and scores from these three agencies are the same, which isnt necessarily the case. In fact, there may be discrepancies among the reports, mistakes that could impact credit and even data breaches that endanger your personal information.

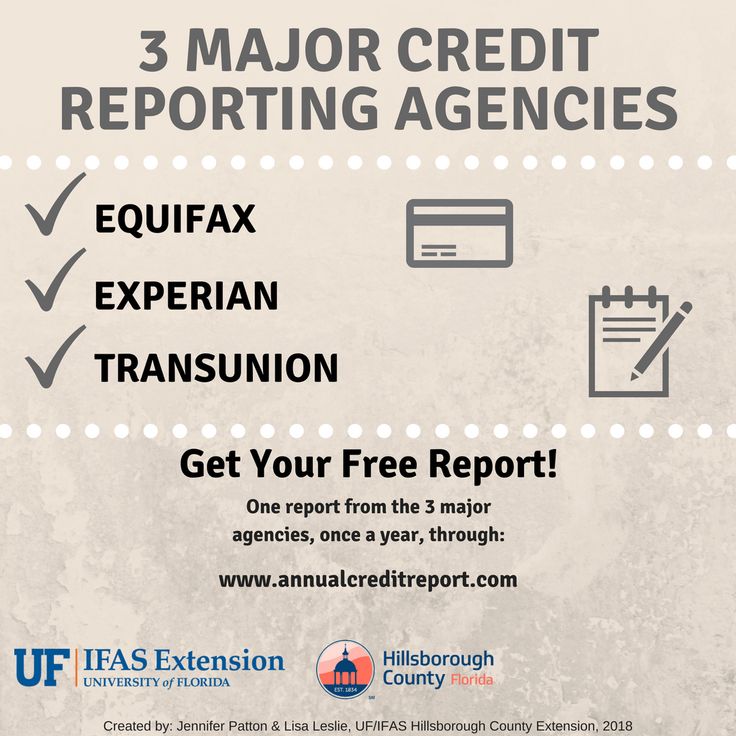

How Do You Contact The Big Three Credit Reporting Agencies

It’s important that you check your credit reports regularly to make sure they don’t contain outdated or incorrect information that could negatively impact your credit score.

You can obtain all three of your free credit reports once a year at AnnualCreditReport.com.

If you find errors on your reports, there are two ways of fixing them: disputing the error directly with the corresponding credit bureau for free or hiring a agency to do it for you.

If you don’t have time to file a dispute on your own and have money to spend, check out our list ofbest credit repair agencies for more information.

But if you want to dispute the error yourself, all three bureaus allow you to do so online, via postal mail or over the phone

| Dispute online |

- Banks or credit unions

- Landlords and residential real estate companies

The CFPB states your information can be shared with these entities for the purpose of employment screening, verifying your creditworthiness for a financial product or determining your eligibility for government assistance.

Also Check: Does Affirm Do A Hard Credit Check

Check Your Credit Report From Each Bureau

Free credit reporting services provide information from a single credit bureau. Remember that there are still two other reports you absolutely have to check out. Its possible the information across all three reports could be slightly different.

Most importantly, the credit report youre seeing could be squeaky clean while the one from the other bureaus includes inaccurate or outdated information. These errors could potentially affect your credit health. Its of utmost importance to compare the information across all three reports. Anything that shouldn’t be there can and must be removed.

Keep in mind, though, that information won’t be removed if you can’t provide enough evidence to the bureaus of its inaccuracy.

The Three Nationwide Credit Reporting Agencies And Other Credit Bureaus

The three nationwide credit reporting agencies are:

- Equifax

- Experian, and

- TransUnion.

If you have any form of credit, then it’s almost certain that all three of these agencies have a credit report on file for you.

Contact Information for the Three Nationwide Credit Reporting Agencies

Go to the Equifax, Experian, and TransUnion websites to get contact information for the three nationwide credit reporting agencies.

You May Like: Syncb Ntwk

Information On Credit Report Companies

Most of us all know or have heard of the three large credit bureaus, Experian, TransUnion, and Equifax, but did you know the list of credit reporting agencies is much larger than just those three? Below, is a comprehensive list of CRAs, along with how to contact these credit reporting agencies. The credit reporting agency contact information includes: phone numbers, addresses, and websites.

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Read Also: When Do Creditors Report To The Credit Bureaus

Checking Your Credit Report For Free

Private companies called “credit reporting agencies” collect information related to your access to and use of credit. They make that information available to others under certain circumstances in the form of a “credit report.” Lending institutions, employers, insurance agencies, and future creditors make decisions about you from the information in your credit report. Your credit report is an important document, and the law gives you certain protections against the reporting of incorrect information. Knowing your legal rights and remedies is a first step to resolving any problems related to your credit report.

Note: Your Credit Report is Free! Under state and federal law, you are entitled to one free copy of your credit report per calendar year from each of the three main credit reporting agencies noted above. Requesting a copy every year to ensure your report is without errors is worthwhile and recommended. If you ever apply for and are denied credit, you should immediately get a copy of your report to verify that all the information is correct. You have the right to know which credit reporting agency prepared the report that was used in the denial of your credit application. Under state law, you have the right to a free copy of your credit report within 60 days of being denied credit. Visit the annual credit report website or call 322-8228 to request your free annual credit report.

Fair Credit Reporting Act Regulations

Under the Fair Credit Reporting Act , the bureaus must correct or delete inaccurate or unverified information that appears on a credit report. After being notified, the bureaus have 30 days to comply. If the information has been verified as accurate, it can remain on the report.

But the ability of the credit bureaus to effectively resolve disputes with consumers remains a question. In 2017, the Consumer Financial Protection Bureau reported that 76% of consumers filed complaints about credit reporting, stating that they had incorrect information on their credit reports.

If any of the credit agencies or businesses that use consumer credit reports violate the regulations of the FCRA, they can be sued in state or federal court. Consumers can also put a block on their credit report to prevent unauthorized businesses from buying their personal financial information.

11 Minute Read

Don’t Miss: What Collection Agency Does Verizon Use

Why Do You Have Different Credit Scores

Itâs important to know that itâs normal to have several different credit scores. But what does that have to do with credit bureaus and your credit reports?It might help to think of your credit scores as a quick summary of your credit reports. And remember that credit bureaus compile those credit reports.

To put it simply: There are multiple credit bureaus, credit-scoring companies and scoring models. So your credit scores can be different depending on what information is used to calculate them, which company is doing the calculating and when theyâre calculated.

Whatâs a Credit-Scoring Model?

A model might use information from just one or a combination of different credit reports. Then, each credit-scoring model might assign different levels of importance to that information.

And thatâs not all. According to the CFPB, your score can even change depending on the day itâs calculated or the type of credit youâre applying for.

Some lenders might even have their own custom credit-scoring models that they use to make credit decisions, according to the CFPB. And some credit bureaus offer their own credit scores, too.

Itâs understandable if this all feels a little complicated.

Remember: There are multiple credit bureaus, credit-scoring companies and scoring models. So your credit scores can be different depending on what information is used to calculate them, which company is doing the calculating and when theyâre calculated.

If Your Credit Is Poor Or Nonexistent

If youre totally new to the world of credit, or if you have bad credit scores, then your credit card options will be limited. Fortunately, many of the major credit card companies offer cards specifically designed for building credit.

Your best option will usually be a secured card.

To get a secured credit card, you apply as usual, but you also have to provide a refundable security deposit that serves as collateral and sets your .

Use your secured credit card responsibly, and over time, you may improve your credit enough that youre eligible for an unsecured card, which will generally provide a higher credit line. In certain cases, you may even be provided with an upgraded card automatically.

Just be careful once youre offered a new credit card with a higher credit limit, as irresponsible spending can pave the way for a downward spiral into crippling credit card debt.

There are some unsecured cards, like the Journey Student Rewards from Capital One , where you may be approved even with limited or no credit history, but these cards are less common.

Major Credit Cards for Building or Improving Credit

- Additional Cards Annual FeeN/A

- Foreign Transaction FeeNone

You also may be automatically considered for a credit limit increase after six months from when your card account is opened.

Don’t Miss: How To Get An Eviction Removed From Your Record

What Are The Big Three Credit Bureaus

There are three main credit bureaus in the United States: Equifax, Experian, and TransUnion.

Although credit reporting agencies obtain information from many of the same sources, they are not affiliated. That means they employ different credit scoring methods to determine your , so your scores from each bureau may be different.

While there are multiple credit scoring models, two companies lead this industry in the United States: FICO and VantageScore. The vast majority of financial institutions use FICO scores to determine if borrowers are creditworthy.

Both FICO and VantageScore models have a scoring range from 300 to 850. While lenders are the ones that determine what score range they consider good, a FICO score of at least 670 and a VantageScore of 700 will generally qualify as good credit.

The Three Major Consumer Credit Bureaus Are Equifax Experian And Transunion

A credit bureau is a company that gathers and stores various types of information about you and your financial accounts and history. It draws on this information to create your credit reports, which in turn form the basis for your credit scores.

The three major credit bureaus are often grouped together. But theyre separate companies that compete for the business of , who may use the credit reports and scores from these bureaus to help them make lending decisions. And theyre not the only three bureaus out there.

Keep reading to learn about the data the credit bureaus collect, how credit bureaus get the information they use to create your reports and scores, and how you can contact them if you think somethings wrong.

Recommended Reading: Paypal Credit Fico

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

What Data Do The Credit Bureaus Maintain

Your credit reports will include identifying information, such as your name, birthdate, Social Security number and addresses .

They also can contain:

-

A list of current and past credit accounts.

-

Payment history, such as whether you paid on time.

-

Negative information, such as missed payments, collections, bankruptcies, repossessions and foreclosures. Each type of negative mark must come off your report after a set time, usually seven years.

-

A record of who has accessed your credit report, for instance when you apply for credit or when a marketer wants to preapprove you for an offer.

If data privacy is a concern, you should know that credit bureaus are highly regulated by the Fair Credit Reporting Act, or FCRA, which puts limitations on how they collect and share your personal data.

» MORE: See what other types of data reports show about you

Recommended Reading: Opensky Credit Card Delivery

Are There Other Credit Bureaus

Although the big three are arguably the most important, there are a few lesser-known credit bureaus in the U.S. There are also a number of consumer reporting agencies that track niche data like utility payments and rental history.

Here are some common agencies you may come across:

- Experian RentBureau: Rental payment data

- ChexSystems: Checking and savings account data

- LexisNexis CLUE : Insurance and claims data

- Innovis: ID verification and credit history data

- National Consumer Telecom & Utilities Exchange: Utilities data

- Certegy: Check history

In most cases, you won’t deal directly with these agencies. But if you’ve ever been turned down for a bank account or utility hookup, data from one of these bureaus may have been involved in the decision.