How Does A Sprint Account Affect Your Credit

This can happen if you owe a creditor money and theyve hired someone to collect that money. A Sprint collection account can hurt your credit score and remain on your credit report for up to 7 years regardless of whether you pay it or not. Unfortunately, paying the collection could even lower your credit score.

Do You Need Credit Check For Sprint Unlimited

No credit check requires valid Id. International services are only included with service plans on phone lines with credit check. Sprint Unlimited Premium Plan: Includes unlimited domestic calling, texting, 100GB LTE MHS, VPN & P2P & data. MHS reduced to 3G speeds after 100GB/mo. Third-party content/downloads are addl charge.

Try To Settle With Sprint First

If Sprint hasnt already sent the bill to collections, you should try to settle the matter by trying to contact Sprint directly.

This is generally the best way to resolve the matter and can prevent the debt from being moved to a collection agency.

In general, most companies are willing to work with you if you arent able to pay the full amount immediately.

Ask Sprint if you can work out a payment plan with them in order to pay the account number total balance.

This will keep you in good standing with them and avoid the debt from being sent to collections.

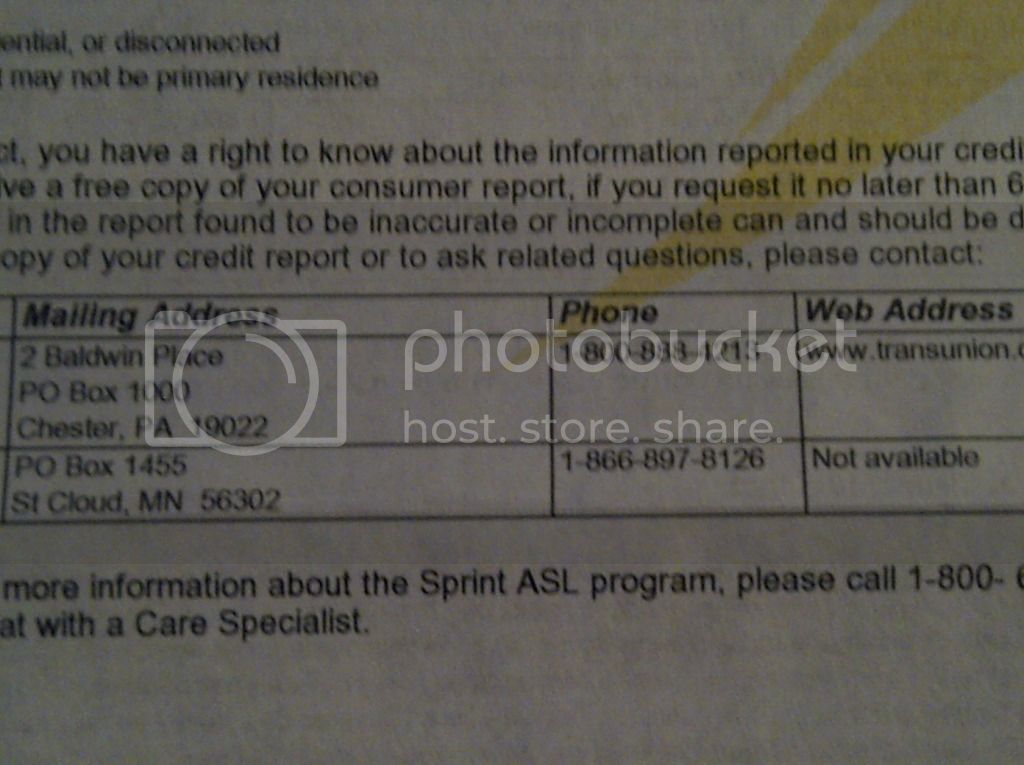

If Sprint has already sent the debt to collections, you will need to request a copy of your credit report to find out who currently owns the debt.

You can do this by contacting the three major credit bureaus and requesting a free copy of your credit report.

You are entitled to one free copy per year under federal law.

From there, you can find out the collection agencys identity and contact information.

You will need this information in order to request debt validation and negotiate a settlement.

If you are overwhelmed by dealing with negative entries on your credit report,we suggest you ask a professional credit repair company for help.

You May Like: How Do I Get A Repo Off My Credit

Request Communication Through Us Mail

Debt collectors are notorious for saying one thing over the phone and turning around and doing the opposite.

Thats why it is highly important to conduct all of your communication with Sprint collections through U.S. Mail.

Under the Fair Debt Collection Practices Act , you have the right to request that Sprint collections contact you specifically through U.S. Mail.

This can help you hold them accountable for what they say to you as well as prevent excessive or abusive communication.

Make sure you hold onto all of your communication with the debt collectors so that you can refer back to them later if you need to.

When Sprint or a third-party collector contacts you next, tell them that you are aware of your rights under the FDCPA and would like to communicate strictly in writing through U.S. Mail.

If they begin to argue with you, tell them that they are in violation of the FDCPA and hang up.

How To Remove Sprint Collections From Your Credit Reports

There are two ways to try to remove a Sprint Collections mark from your credit report. If you discover that the claim is fake or even that it has incorrect information, you can send a dispute letter to the three credit bureaus asking to have it removed.

If the debt is legitimate, you must try a different approach. Once youve paid off the owed money, send a good-faith letter asking if the item can be deleted from your accounts now that it has been resolved.

Recommended Reading: Mprcc On Credit Report

What Are The Human Limitations For The Sprint

It’s one thing to plan the perfect sprint on paper, but at the end of the day, it’s a team of real people who need to carry out the sprint project.

Are there enough team members with the right programming expertise to do the sprint? Are team members already juggling other projects? If so, which tasks take priority? And, of course, is the proposed sprint deadline a reasonable one?

How Collection Agencies Acquire Your Debts

It’s important to note that debt collectors buy debt for “pennies on the dollar.” Because your original credit account was so delinquent, it was viewed as unlikely to ever be paid by the creditor and was likely sold to a debt collector for a steep discount.

In fact, one recent report found that debt buyers pay an average of just $0.04 for every dollar of the debt’s face value. So, if you owed a creditor $5,000, a debt collector likely paid in the ballpark of $200 to buy this debt.

Because the debt collector likely paid so little to buy your debt, you have significant room to negotiate a settlement. It’s not uncommon for a $1,000 collections account to be settled for $300 or so, for example.

Also Check: Do Authorized Users Build Credit Capital One

S To Remove Sprint Collections From Your Credit Report

Like any bill, if you dont pay your Sprint cell phone bill, it will go to collections. When that happens, you not only show that you dont make your payments on time, but it also hurts your credit score a lot.

This is all for a bill that normally doesnt appear on your credit report. Sprint doesnt report cellphone payments to the credit bureaus unless you default. Typically this means you havent paid your bill for 3 months or more, but each situation differs.

If you find Sprint Collections on your credit report, its important to know how to remove it. Leaving it there damages your credit score and makes it hard to get more credit in the future. Fortunately, its an easy collection to take care of with the right steps.

How Does Credit Affect Eligibility For Phone Service

People typically think of their credit scores as impacting their ability to get loans.

Hearing that it can also impact their ability to get something like phone service might be a surprise. Still, it makes sense if you think about it.

With a loan, a lender is providing you with money up front. You promise to pay it back over time.

With phone service, the provider gives you phone service up front. You promise to pay for the service each month. In a way, the agreement for a loan and the agreement for paying a monthly phone bill are similar.

If you have bad credit, a phone provider might think you wont pay your monthly bill. That makes them less willing to offer service.

That said:

You May Like: Syncb Ppc Account

How To Improve Your Credit

If you want to improve your credit, the best way to do it is to spend months and years paying your bills on time.

Building a long history of on-time payments is the best way to get your credit score into the seven or eight-hundreds. Even one missed payment can be a major setback in building your credit.

If you dont have months or years before the time youll need to have a good score, there are some short-term fixes you can try.

Sprint Credit Check For Iphone: Know This Before You Sign Up

If youre planning to get a new wireless service through Sprint, youll most likely need to undergo a credit check. Sprint requires a credit check for new customers and new lines, and the good news is the have one of the lowest initial security deposits in the industry. If youre going to get a new service from Sprint, heres what you should know first.Update: We have created a new tool that lets you estimate your required deposit amount for wireless service with Sprint based on your credit score. This allows you to compare deposits between various carriers based on historical data.

Read Also: How To Unlock My Experian Credit Report

Why Care About Your Credit Score

So, why should you care about your credit if you can get phone service without a good score?

The main reason to be concerned about your credit is that it has a major impact on every aspect of your financial life.

It affects which loans you qualify for and how much interest you pay. Plus, as weve discussed, it can affect your ability to sign up for services that bill you monthly.

Having good credit makes many parts of your financial life easier, so taking care of your credit score is important.

Will I Need To Pay A Deposit

Depending on your credit history, you may be required to pay a deposit, or you may be denied for service altogether. In most cases, even a very low credit score or no credit at all will get you approved for service with a deposit, while those who have declared bankruptcy recently may be denied for service completely. Sprint has one of the lowest initial deposits of only $50, but it may be as high as $1,000. This deposit may be required per line, not per account. According to Sprint, most people are asked to pay a deposit of $50 to $750 to establish service. According to their Terms and Services, they reserve the right to change the deposit at any time, and the deposit, the length of time they hold your deposit and any changes to the deposit amount is determined by your payment and credit history. This means you may get your deposit back after 1 year or even 2 years, assuming your account stays current and you dont have your service disconnected for non-payment during that time.

Don’t Miss: Does Paypal Credit Report

Can Sprint Sue Me For Missing A Payment

While this is unlikely, Sprint has the right to sue you or pursue civil litigation. However, bringing you to court is expensive, so unless you owe thousands of dollars, this is an unlikely situation.

With that said, if Sprint is threatening legal action, then seek professional legal counsel.

Hire A Reputable Credit Repair Company

The best way to deal with Sprint Collections is by getting help from a .

This is the quickest and safest way to remove a negative item from your credit report. For years, credit repair companies have helped consumers clean up their credit report, build credit, and more. They know the credit industry like it is the back of their hand.

We recommend . This credit repair firm is powered by a team of credit experts and is affordable. They are notorious for helping consumers navigate the most complex credit situations, and I am sure they can help you.

> > Learn More: Read Our Review

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Credit Unions Participate In Love My Credit Union Rewards And Sprint Cu Employee Cellebration Sweepstakes

Livonia, Michigan Love My Credit Union® Rewards CU Solutions Groups premier membership enhancement program and Sprint recently concluded their joint CU Employee CELLebration Sweepstakes. The contest, which offered credit union employees a chance to win one of 15 Samsung Galaxy Note9 smartphones and the chance to win $5,000 for their credit union, was a thank you for the great work that credit unions and their employees do every day.

The CU Employee CELLebration Sweepstakes ran from November 12, 2018 to December 14, 2018 and saw participation from 160 credit unions. Credit union employees were eligible to submit a contest entry for every phone line on their personal Sprint account, with winners drawn randomly. In addition to awarding 15 Samsung smartphones, the contest presented three credit unions each with a prize of $5,000 to either use for an employee appreciation event or to donate to their charity of choice.

“The advocacy for Sprint Cash Rewards by credit union employees has led to more than $95 million deposited into credit union members accounts over the past two years,” said David Dean, Senior Vice President of Marketing Solutions and Business Development at CU Solutions Group. “Its this dedication on the front line that makes a real difference in peoples lives and were thrilled for this opportunity to say thank you to all of them.

About CU Solutions Group

Daniel Curren, Director of Integrated Marketing, CU Solutions Group734-793-3469

What Is Erc Collections

ERC Collections, also known as Enhanced Recovery Company or Enhanced Resource Centers, works on behalf of other companies or banks to collect on debts people have defaulted on.

You may have seen ERC Collections listed on an account that went to collections after your original account got charged-off. In some cases, you wont see ERC Collections on your credit reports even if the company has contacted you about an account.

There are a number of possible reasons legit and not for getting a collections call that you dont recognize from your credit reports. So whatever the situation, the first thing you should do after youre contacted by a debt collector is make sure that the debt is yours and that the debt collector is entitled to collect on that debt.

Dealing with a debt collector can be stressful and intimidating, and the extra layer of confusion about whether a debt collection agency is legit or not just can add to the stress. But dont let that stop you from standing up for your rights when it comes to debt collection, as laid out by the Fair Debt Collection Practices Act.

To determine whether the debt is legitimate, ask the debt collector to provide written proof. This must include: the debt collectors information, the amount you owe plus any additional fees, what the debt covers, and the name of the original creditor.

Don’t Miss: Itin Credit Report

Is Sprint Collections A Real Company

As with all collection agency-related matters, its important to start by confirming the legitimacy of the company requesting your hard-earned income. In the case of Sprint Collections, it is, indeed, a real company. Technically speaking, its a portion of a company that is part of another company.

In April 2020, Sprint officially completed a merger with fellow telecommunications giant T-Mobile. Even as part of this new business entity, Sprints collections efforts have operated as an in-house element of its larger business operation.

When you get an item on your report explaining that you owe a payment to Sprint Collections, its an internal part of the same organization that you pay for your phone on a monthly basis.

Why Does Sprint Perform A Credit Check

All wireless carriers perform credit checks on new customers or existing customers adding new lines because its much easier to run up a high bill on a cell phone, especially a smartphone. Studies have confirmed that people with bad credit are at a higher risk of default or skipping out on bills, so this credit check is done as a safeguard to avoid sending expensive cell phones to individuals with a history of failing to pay bills. Its definitely true that not everyone with bad credit is irresponsible, and having poor credit doesnt mean you wont pay your cell phone bill on time. Still, Sprint will hedge their bets like all carriers because a cell phone line is a line of credit theyre extending. When Sprint performs a credit check, theyre going to look at how much debt you currently owe, whether you have a history of on-time payments and the limits on your credit accounts to get an overall picture of your financial stability. They will also get your credit score.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Need Sprint Pcs Collections Address

- https://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/NEED-SPRINT-PCS-COLLECTIONS-ADDRESS/td-p/502556

- May 12, 2009 ·The contact number for Sprint PCS is 1-888-211-4727. It’s not specefically to the collections department, but the rep can tranfer you over to that department. Also the general Sprint PCS address from my bill is: PO Box 219554 Kansas City, MO 64121-9554.

I Disputed A Debt And Won Heres How I Did It

One of the frustrating things about improving your credit is that once collection companies see that you have turned over a new leaf and are becoming more responsible they will try to get in on the action.

Back in February I was performing one of my routine monthly credit report reviews and noticed that there was a new collection item on my report. Not only was there a new item, but my score dropped significantly.

I discovered it was an old T-Mobile debt from 2008. They said it was a service termination charge for a T-Mobile account that was open for 21-days. I asked the woman if her company offered pay for delete and she said, No, we arent allowed to do that. I reminded her that by law, they are able to do that. She continued to insist that they were unable to do it, but obviously she didnt know who she was dealing with.

I did not recognize this debt, but I honestly would have paid the debt had they agreed to a pay for delete. Since they wanted to be difficult, I had no choice but to open up my arsenal.

I wrote them a debt collection dispute letter. By law a company has to verify a debt once a consumer requests a verification in order to continue to collect on that debt.

CERTIFIED MAIL

NYC Department of Consumer Affairs License # xxxxxxx

Re: Account # xxxxxxxx

Dear Enhanced Recovery Services

Aside from verifying the debt, do not contact me about this debt. The FDCPA and Rules of the City of New York require that you honor this request.

Sincerely,

Recommended Reading: Credit Score 766 Means

Verify That Its Legitimate

The first thing to do is verify the situation is legitimate. While Sprint Collections may be a real entity, the debt that it is claiming you owe may not be.

This is why you should start the process by sending a debt validation letter. As a legitimate collections agency, Sprint Collections should have no problem communicating with you via snail mail the official way that collections agencies interact. It should also be willing to provide further information regarding the owed debt.

Real debt collectors arent interested in trapping or tricking you. They want to work together to find an amicable solution to the issue. If a collector is threatening you or withholding information, that is always a sign of fraudulent activity.