How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time.;The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:;

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.;

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the;Centers for Disease Control and Prevention.;

What Should I Do If I Dont Have What Is Considered An Excellent Credit Score Of 760+

First, take a deep breath because thankfully, this wont make or break your life.

Yes, having an excellent credit score will save you money and give you access to better deals, but its not even the most important financial thing you should worry about.

For example, knowing your monthly savings rate is more important, since that will actually impact your long-term quality of life. Dont have and use a monthly budget or spending plan? You need one before you start to worry about your credit score.

Ultimately, 35% of your credit score is determined by your payment history, and having a budget is your first line of defense to ensure that youll always have enough to make on-time payments.

However, this also doesnt mean that your credit doesnt matter and that you should ignore it.

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments;

- going over your credit limit

- defaulting on credit agreements;

- bankruptcies, insolvencies and County Court Judgements on your credit history;

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

Recommended Reading: Does Paypal Credit Report To The Credit Bureau

How Long Does It Take To Get A Good Credit Score

It depends on where youre starting from and what challenges youre facing. But building good credit probably wont happen overnight.

If youre brand new to credit, it could take months of using beginner products like secured cards to make significant progress in the types of financial products you qualify for. If you have dings on your credit reports, like late or missed payments or a bankruptcy, it could take years for those derogatory marks to fall off and stop affecting your scores.

But even if you have years left before those derogatory marks officially fall off, you can still see significant progress. The important thing is to work steadily toward getting your credit in good shape and understand that building credit is a journey.

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Student Loan Balances Saw Highest Increase

- 14% of U.S. adults have a student loan.

- The average FICO® Score for someone with a student loan balance in 2020 was 689.

- The percentage of consumers’ student loan accounts 30 or more DPD decreased by 93% in 2020.

Student loan balances saw the most significant spike in 2020, with consumers’ average debt growing by 9%. Much of this is attributable to the suspension of federal student loan repayment that was included in the CARES Act and subsequently extended through January 31, 2021. With fewer people actively paying down student debt, average balances will grow as others add new loans.

Student loans saw delinquency rates plunge, with the percentage of accounts 30 or more DPD decreasing by 93% in 2020. It’s important to view this number in context, however, as the automatic accommodations put in place obviously played a major role in the drop.

The CARES Act paused all federal student loan repayment, effectively placing these accounts in limbo. While paused, student loan accounts are being reported as current, although no payments are required. Once repayment begins, delinquencies may begin to climb again.

Keep Credit Inquiries To A Minimum

People with excellent credit also keep their credit inquiries to a minimum just two in as many years, on average. When we apply for credit whether it’s for a new credit card, a mortgage, or an auto loan and a lender issues a credit check, it will appear on our and may influence our credit score. This is referred to as a hard inquiry.

Too many hard inquiries may raise red flags for lenders,;according to Experian, because they signal a high volume of new accounts in a short period of time, which “may mean you’re having trouble paying bills or are at risk of overspending.” Hard inquiries remain on a credit report for up to two years.

Also Check: Syncb/ppc Closed Account

What Is Excellent Credit

Excellent credit refers to a credit score that falls into the “exceptional” or “excellent” score range of the credit-scoring model used to calculate it.

On Fair Isaac Corporation’s FICO 8 model, the latest version of the FICO scoring model used in 90% of lending decisions, a score of 800 to 850 is considered exceptional. On the VantageScore 3.0 scale, an excellent credit score is 781 to 850.

Excellent credit scores are well above the average score of U.S. consumers and tell lenders that a borrower has an extremely low risk of default.

FICO 8 and VantageScore 3.0 scores range from 300 to 850. Other versions of these scores may have different .

How Do I Get The Highest Credit Score

While it is theoretically possible to achieve a perfect 850 score, statistically it probably wont happen. In fact, about 1% of all consumers will ever see an 850, and if they do, they probably wont see it for long, as FICO scores are constantly recalculated;by the credit bureaus.

And its not like you can know with absolute certainty what is affecting your credit score. FICO says 35% of your score derives from your payment history and 30% from the amount you owe . Length of credit history counts for 15%, and a mix of accounts and new credit inquiries are factored in at 10% each.;Of course, in actually calculating the score, each of these categories is broken down even further, and FICO doesnt disclose how that works.

The credit bureaus that create credit scores may also change how they make their calculationssometimes for your benefit. Changes were made in 2014 and 2017, for example, to reduce the weight of medical bills, tax liens, and civil judgments. However, changes made in January 2020 for FICO 10 involving trending data, credit card debt, personal loans, and delinquencies may make getting a higher score more difficult.

Recommended Reading: Which Business Credit Cards Do Not Report Personal Credit

New Credit And Credit Mix

Coming in at 10% with FICO and less influential for VantageScore are new credit accounts. Just like closing old accounts, you want to be careful about opening new ones. Opening new accounts creates uncertainty and can signal increased risk to lenders, which will bring your score down, at least in the short term.

As for credit mix called credit experience by VantageScore this is really where VantageScore and FICO differ. FICO only considers credit mix as 10% of your credit score while VantageScore weighs it as highly influential. This area accounts for the variety of credit extended to you, including credit cards, mortgages, student loans and car loans.

See related: 13 bad credit habits you need to break now

Do You Need An 800 Credit Score

Have you always been insatiably curious about your credit score? I am. In my mind, my credit score is kind of like a report card, like a race toward personal best.

Despite widespread media reports of Americans’ debt challenges, most consumers have credit scores that fall between 600 and 750. More good news: In 2020, the average FICO Score in the U.S. reached a record high 710, according to Experian.

So, speaking of an 800 credit score what is it and should you work toward achieving it? Let’s dive in.

Recommended Reading: How To Remove Repossession From Credit Report

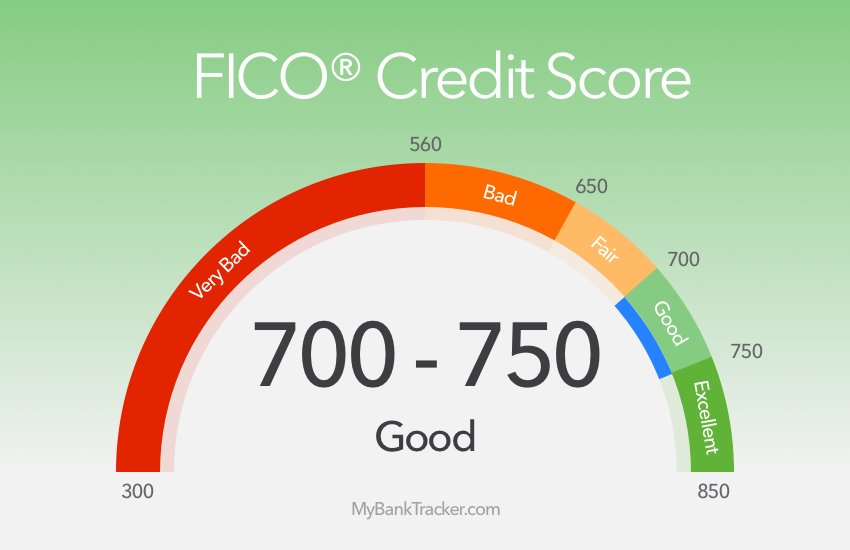

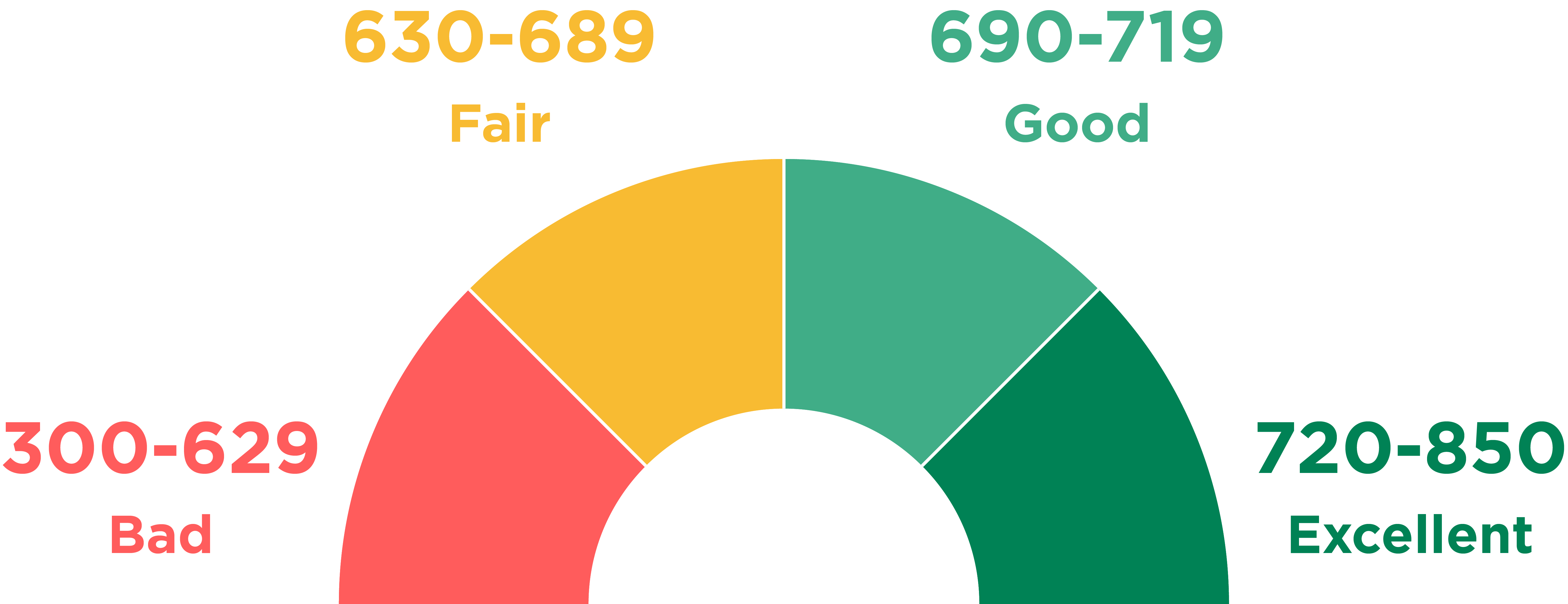

What Is A Good Credit Score Range

When you apply for new credit, lenders use credit scores to predict your level of credit risk.

If you want to figure out what is considered an excellent credit score by a lender, youll need to know the following:

- The credit scoring model the lender is using .

- The range for the credit score the lender is using.

- Which credit report from which credit bureau your score is based on.

You can ask your lender which specific credit report it will pull and and which credit score it will use for your application. Still, deciphering that information can be complicated. Heres the main point to remember:;With any scoring model, the higher your score falls on the scale, the better.

If your lender is using a generic score , here are two credit score range charts that provide insight into how those numbers fall on a scale of very poor, through average credit, and up to exceptional.

| Base FICO Score Ranges |

|---|

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.;

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.;

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

Recommended Reading: Credit Score Itin

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters;

| Installment; | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan.; | |

| Open; | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving; | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R.; | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M.; |

Numbers;

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Why Good Credit Scores Matter

While credit scores help determine your availability of credit and the rate youll pay to access it, what it really measures is your statistically proven likelihood of defaulting on the money you borrow. The greater the risk, the lower your score and the more youll pay to access credit if you can access any credit at all.

In August 2021, the average interest rate on a subprime credit card or a card for customers with subprime credit was 25.88%, while the APR on a low-interest card was 12.96%.

If you carry an average balance of $3,000 month to month on an average subprime credit card, expect to pay about $64 in interest charges. Compare that to $32 in interest charges for an average low-interest credit card, and youre paying twice as much in interest. Low-interest credit cards are typically only available to people with excellent credit scores, and this example demonstrates the importance of building good credit.

Also Check: How To Get Credit Report Without Social Security Number

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout