Credit Score Mortgage Rate: What Kind Of Rates Can You Get

An 800 credit score usually comes with low mortgage rates and can help you save thousands of dollars over the life of your loan.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youve managed to earn a credit score of 800 or higher, congratulations! Youve achieved one of the highest scores out there. Credit scores stretch from 300 to 850, and the average Americans score sits at 711 as of October 2020.

Generally, a high credit score shows youve managed debt responsibly in the past and it comes with benefits. Aside from bragging rights, an exceptional credit score makes you an attractive borrower for mortgage lenders and puts the best interest rates within your reach.

Heres what you need to know about credit scores of 800 or higher:

Keep Your Credit Score In Tip

Should you stress if your credit score doesn’t hit the 800 range? Absolutely not. Many borrowers can get loans and adequate interest rates when in the lower credit ranges.

However, you may want to consider boosting your credit if you fall into the “poor” or “fair” categories to make sure you get the absolute best credit offers possible when you want to buy a car, buy a home or utilize credit in other ways.

Tips To Boost Your Credit Score

Scores reflect credit payment patterns over time with more emphasis on recent information. In general, a score may improve, if you:

- Pay your bills on time.

Delinquent payments and collections can have a major negative impact on a score.

- Keep balances low on credit cards and other “revolving credit.”

High outstanding debt can affect a score.

- Apply for and open new credit accounts only as needed.

Don’t open accounts just to have a better credit mix – it probably won’t raise your score.

- Pay off debt rather than moving it around.

Also, don’t close unused cards as a short-term strategy to raise your score. Owing the same amount but having fewer open accounts may lower your score. Review your credit report regularly so you know what is being reported. It won’t affect your score to request and check your own credit report.

- Items that make scores better

Paying your bills on time is the single most important contributor to a good credit score. Even if the debt you owe is a small amount, it is crucial that you make payments on time. In addition, you should minimize outstanding debt, avoid overextending yourself and refrain from applying for credit needlessly.

Applications for credit show up as inquiries on your credit report, indicating to lenders that you may be taking on new debt. It may be to your advantage to use the credit you already have to prove your ongoing ability to manage credit responsibly.

You May Like: Does Apple Card Affect Credit Score

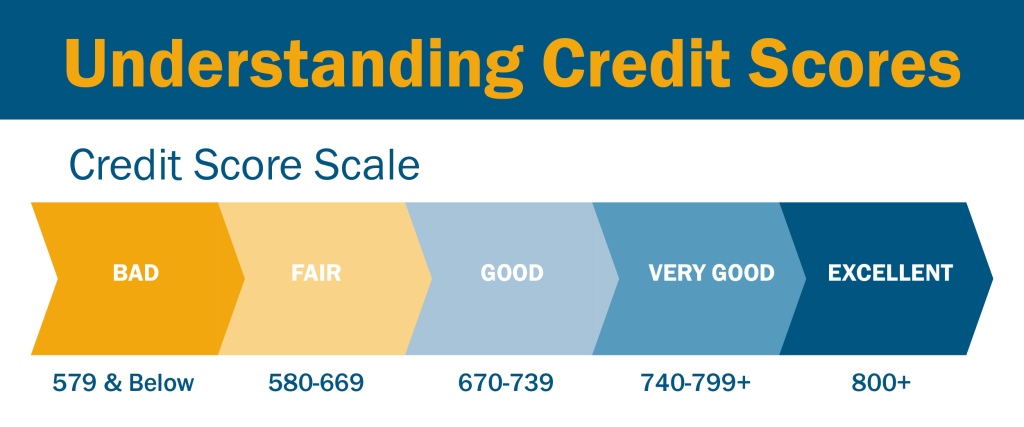

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Percent Of Adults Who Never Check Their Scores

One study conducted by Javelin Strategy & Research and sponsored by TransUnion revealed that 54 percent of adults never check their credit scores8.

Checking your credit score is a crucial aspect of reaching your financial goals and correcting any mistakes in your credit report.

Whether you regularly use a credit card or are paying back loans like student loans, always check your score on a regular basis, whether its through a third-party application or using an established credit reporting company like Experian.

You May Like: How Long Do Inquiries Stay On Chexsystems

What Is The Highest Credit Score

For most situations, 850 is the best FICO score possible. It’s extremely difficult to reach a perfect credit score, though. Only 20% of Americans have a credit score of 800 or higher. Even if you’re one of the people with the best credit score in the country, you might not reach 850.

Wondering how to get a 850 credit score? Here are some ways to improve your credit score — and move closer to the highest credit score you can get:

- Paying off your credit card balance every month

- Correcting errors on your

- Keeping an old credit card open, even if you don’t use it often

- Paying your bills on-time

- Requesting an increase to your credit limit

If you reach a FICO credit score of 800 or higher, you should congratulate yourself. Raising your credit score takes hard work, dedication, and patience. Even if you don’t have perfect credit, an excellent credit score is something to be proud of.

What Does An 812 Credit Score Mean

A credit score of 812 means that your credit reports show that you always pay your bills on time. It indicates to lenders that youre a very low-risk borrower. An 812 credit score is in the highest score bracket in both of the two major credit scoring models in the US , and its well above the national average.

An 812 credit score is very far from the lowest credit score of 300, and its very close to the highest credit score of 850. Your score is good enough to get the best terms on loans and lines of credit from the vast majority of lenders.

To put your score of 812 into context, heres how it compares with the average for various generations:

Also Check: How To Remove Repossession From Credit Report

A Good Credit Store Is Important If You Need To Acquire Financing For A Car Home Yes A 696 Is A Very Good Credit Score

Getting more starts with knowing your scores. Don’t owe people too much money, pay your bills on time, and. An 812 credit score is considered exceptional. According to experian, only 8% of people with a good score are likely to become seriously delinquent in the future. further down the scoring bracket, getting a loan can become more difficult. A good credit score can mean more than just a good interest rate on a loan: When you apply for credit, the lender will review your below, cnbc select explains what is a good credit score for fico and vantagescore, how good credit can help you, tips on getting a. Is 812 a good credit score? Wondering is 812 credit score good or bad? Referring to your credit score by either of these two categories would be technically correct. A good credit store is important if you need to acquire financing for a car, home yes, a 696 is a very good credit score. And exceptional from 800 to 850. A fico® score of 812 is well above the average credit score of 704. Anytime you apply for credit, the lender or creditor will want to know, up front, how likely you are to meet your financial obligations.

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that youhave undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

You May Like: How To Get Rid Of Repo On Credit

Credit Score: What Does It Mean

19-05-2021 ·An 812 credit score is often considered very good or even excellent. A very good or excellent credit score can mean youre more likely to be approved for good offers and rates when it comes to mortgages, auto loans and credit cards with rewards and other perks. This is because a high credit score may indicate that youre less risky to

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

Also Check: What Credit Report Does Chase Pull

What Is A Credit Score

A credit score is expressed in the form of a three-digit number that ranges between 300 to 900. It is a representation of an individuals creditworthiness. Lenders refer to your credit score before approving your credit application. A good credit score is certainly a winner in every loan or credit application. A credit score of 750 and above is considered a good credit score.

In India, credit scores are generated by credit bureaus like Equifax, CIBIL, Experian, CRIF High Mark, etc. Credit scores from each credit bureau may vary slightly since they have a different algorithm for calculating credit scores.

Do A Loan And Insurance Checkup

When I first started tracking my score I discovered I had a negative item a late payment from a store credit card of all things, says Philip Taylor, blogger from PT Money.

As a result, he ended up just shy of the score he needed to get the best mortgage interest rate when he bought his first home. I made it a mission to improve my score by the time I purchased a second home, says Taylor. He spent the next few years being meticulous about his credit, and he did indeed qualify for that better rate the second time around.

From home mortgages to auto loans to student loans, a great credit score can also put you in a prime position to refinance for a better interest rate, says Foguth. Look at the largest interest rates youre paying, and renegotiate those.

Refinancing almost always requires strong credit in order to get approved, and the better it is, the more likely youll score the lowest rate possible.

Likewise, Griffin recommends checking in with your auto and home insurance companies and comparing quotes from other insurers. Credit scores have been developed for the insurance industry, and they use that information to help them set rates when you first become a customer, he says. Sometimes switching over once your credit has improved can pay off.

Tip:When refinancing or changing insurance providers, be sure to consider all of the other factors and fine print to make sure youre actually upgrading to a better deal.

Recommended Reading: What Credit Score Is Needed To Buy A Car At Carmax

Average Mortgage Rates For An 800 Credit Score

Your in whether youll qualify for a mortgage and receive a good interest rate.

The table below shows a sampling of interest rates from our partner lenders. You can fill in your financial information and select a credit score range of Excellent to see what kind of mortgage rates are available to you in your area.

These rates reflect the annual percentage rate , which includes the interest rate plus lender fees. The APR is a good metric to check when comparing mortgage offers because it reflects the total cost of borrowing. Qualifying for a lower APR can help you save thousands of dollars over the life of the loan.

For example:

On the other hand, a borrower with a 620 credit score might receive an APR of 3.966% and pay $950 per month. That $150 difference in monthly payments adds up to $54,000 over the life of the loan.

But you dont need to seek perfection. If you can improve your credit score by just a few points, it might put you in the next credit score range and make you eligible for a better interest rate.

Enter your loan information to calculate how much you could pay

|

While some of these factors are out of your control, you can work on other areas to boost your chances of getting a low mortgage rate regardless of your credit score. Here are some factors you can control:

Credible makes getting a mortgage easy

Now You Qualify For The Lowest Interest Rates And Best Credit Cards

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If youve got your credit score over 800, well done. That demonstrates to lenders that you are an exceptional borrower and puts you well above the average score of U.S. consumers. In addition to bragging rights, an 800-plus credit score can qualify you for better offers and faster approvals when you apply for new credit. Heres what you need to know to make the most of that 800-plus credit score.

Also Check: Attcidls

Percent Of The Us Population That Has A Fico Score Below 550

Fortunately, a low percentage of the U.S. population appears to have low FICO scores. Data released by FICO in 2019 reveals that only 11.1 percent of the U.S. population has a FICO score ranging between 300 and 54913.

It also reveals a downward trend, indicating that the average FICO score is on the rise and the average credit card debt and other debts are on the decline for Americans.

What Counts Towards Your 812 Credit Score

In essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 812 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

Recommended Reading: How To Get Rid Of Serious Delinquency On Credit Report

Monitor And Manage Your Exceptional Credit Score

A FICO® Score of 812 is an accomplishment built up over time. It takes discipline and consistency to build up an Exceptional credit score. Additional care and attention can help you keep hang on to it.

Whether instinctively or on purpose, you’re doing a remarkable job navigating the factors that determine credit scores:

Utilization rate on revolving credit. Utilization, or usage rate, is a measure of how close you are to maxing out credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

If you keep your utilization rates at or below 30% on all accounts in total and on each individual accountmost experts agree you’ll avoid lowering your credit scores. Letting utilization creep higher will depress your score, and approaching 100% can seriously drive down your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Time is on your side. Length of credit history is responsible for as much as 15% of your credit score.If all other score influences hold constant, a longer credit history will yield a higher credit score than a shorter one.