Order Your Free Credit Report

Consumers can get free copies of their credit report each year. The Fair Credit Reporting Act requires each of the three nationwide consumer reporting agencies Equifax, Experian, and TransUnion to provide you with a free copy of your credit report, at your request, once every 12 months.

At least once a year, review each one of your three credit reports to:

- ensure that the information is accurate and up-to-date before you apply for a loan, lease a car, get a credit card, buy insurance, or apply for a job.

- help guard against identity theft. If identity thieves use your information to open new account in your name, those unpaid accounts get reported on your credit.

To order your FREE reports:

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

You May Like: Does Paypal Credit Report To Credit Bureaus

How Do I Get My Free Annual Credit Report

By law, under the Fair Credit Reporting Act, you are entitled to a free copy of your credit report every 12 months from each of the three major credit bureaus . In addition, several states offer an additional free credit report per year, including:

- Colorado

- New Jersey

- Vermont

Your free annual credit reports contain the same information that is found on a paid credit report: your open and closed financial accounts, and your payment history for each. Youll generally find payment history for loans, credit cards, and revolving lines of credit. You may also see rental payments if you rent an apartment.

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

You May Like: 586 Credit Score

How To Correct Errors In Your Credit Report

If you see anything you believe is incorrect, contact the credit bureau immediately. You can call the telephone number on the report to speak with someone at the credit bureau. If you find evidence of identity theft, the next steps to take include contacting any creditors involved to close fraudulent accounts and filing a police report. See Identity Theft Victim Checklist, on our web page for more information on what to do.

What Are Credit Reports

Have you ever rented a house, bought a car, or taken out a loan? Then youalong with just about every other consumer in Americahave a credit report.

Think of credit reports as the story of our relationship with our debt. It details the open accounts you have, how much you owe, and how often you make payments on those amounts.

Don’t Miss: When Does Capital One Report To Credit

What If I Find A Problem Or Mistake On My Credit Report

If you have no plans to apply for new credit, it’s a good idea to review your credit report from each bureau on an annual basis. Check to ensure that your identifying information is correct, and that the credit accounts listed in your report are accurately represented.

If you do plan to apply for a new loan or credit card, it’s vital that you check your credit reports beforehand in case there is anything that needs to be cleared up. Negative information in your credit reports can lower your credit scores, and you want your credit scores to be the best they can be before applying for new credit.

Under the Federal Credit Reporting Act, both the credit reporting bureau and the information provider are responsible for correcting any inaccurate or incomplete information in your reports. To get information corrected, you must initiate a dispute with the credit reporting agency. This typically involves submitting your dispute in writing. The credit reporting agency must investigate your dispute within 30 days of your submission.

Experian makes it easy to initiate a dispute online through our Dispute Center. You can also initiate a dispute at Experian by phone or mail see “How to Dispute Credit Report Information” for more details.

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

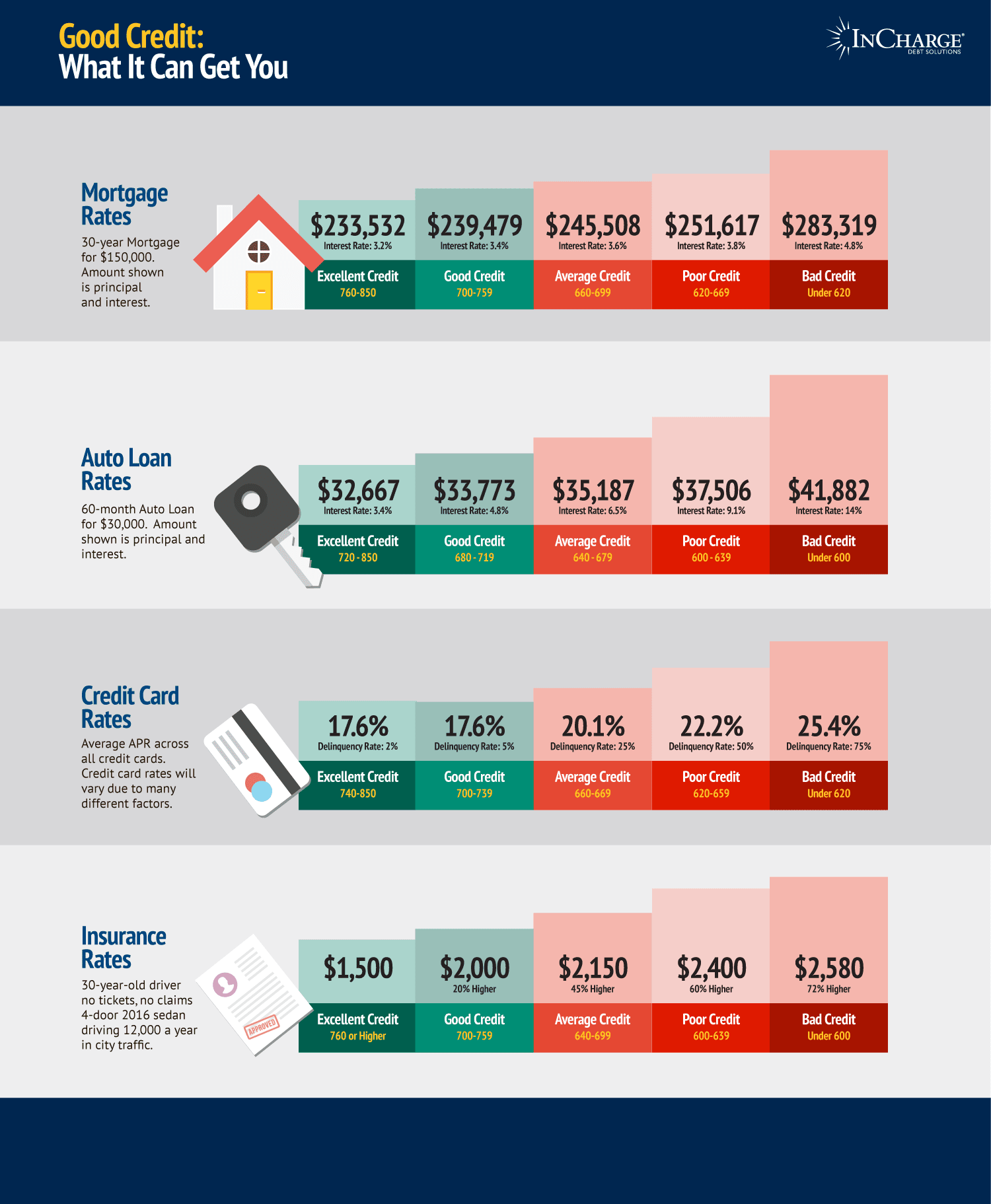

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Don’t Miss: Does Speedy Cash Check Credit

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

Checking Your Credit Report For Free

Private companies called “credit reporting agencies” collect information related to your access to and use of credit. They make that information available to others under certain circumstances in the form of a “credit report.” Lending institutions, employers, insurance agencies, and future creditors make decisions about you from the information in your credit report. Your credit report is an important document, and the law gives you certain protections against the reporting of incorrect information. Knowing your legal rights and remedies is a first step to resolving any problems related to your credit report.

Note: Your Credit Report is Free! Under state and federal law, you are entitled to one free copy of your credit report per calendar year from each of the three main credit reporting agencies noted above. Requesting a copy every year to ensure your report is without errors is worthwhile and recommended. If you ever apply for and are denied credit, you should immediately get a copy of your report to verify that all the information is correct. You have the right to know which credit reporting agency prepared the report that was used in the denial of your credit application. Under state law, you have the right to a free copy of your credit report within 60 days of being denied credit. Visit the annual credit report website or call 322-8228 to request your free annual credit report.

Read Also: Does Loan Me Report To Credit Bureaus

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system: . Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

How To Order Your Free Annual Reports From Equifax Experian And Transunion

You can order your free annual credit reports through a toll-free phone number, online, or by mailing the Order Form at the end of this Information Sheet.

1-877-322-8228Annual Credit Report Request ServiceP. O. Box 105281Atlanta, GA 30348-5281

You have the option of requesting all three reports at once or staggering them. You could create a no-cost version of a credit-monitoring service. Just order a free report from one credit bureau, then four months later from another, and four months after that from the third bureau. That approach won’t give you a complete picture at any one time. Not all creditors provide information to all the bureaus. Monitoring services from the credit bureaus cost from about $40 to over $100 per year.

Don’t Miss: Does Opensky Report To Credit Bureaus

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

You May Like: Why Is There Aargon Agency On My Credit Report

Establishing A Credit History Without A Social Security Number

If you are a recent arrival to the U.S., you will have to establish a credit history so that you can get a car loan or rent an apartment, for instance. Any credit history you had before arriving here will not carry over.

To establish your U.S credit history, you could get a , open a bank account or get a loan with a U.S.-based financial institution. Utility providers could also be reporting on your accounts to the credit bureaus.

And if you need to take out a loan before your U.S. credit history is available, at least one company, Nova Credit, translates your overseas credit history into an equivalent report for the benefit of U.S. lenders.

See related: How to get a credit card without a Social Security number

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.

Ready to help your credit go the distance? Log in or create an account to get started.

Read Also: Does Paypal Credit Report To Credit Bureaus

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Limit Your Requests For New Creditand ‘hard’ Inquiries

There can be two types of inquiries into your credit history, often referred to as “hard” and “soft” inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you preapproved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because you’re facing financial difficulties and are therefore a bigger risk. If you are trying to improve your credit score, avoid applying for new credit for a while.

Recommended Reading: Does Paypal Credit Help Credit Score

Enter Your Personal Information

Once youre on the correct website, click on the button near the top of the page or bottom left that says, Request your free credit reports. Afterward, click on the button with the same words below the line that reads, Fill out a form. Finally, complete the form by entering your name, birthdate, current address and Social Security number .

If you havent lived at your current address for at least two years, youll have to enter your previous address, too.

Accessing Your Credit Report

Your credit report is compiled when you or your lender request it. It contains information that is supplied by lenders, by you and by court records.

In order to obtain your credit report, you must provide your name, address, Social Security number, and date of birth. If you’ve moved within the last two years, you should include your previous address. To protect the security of your personal information, you may be asked a series of questions that only you would know, like your monthly mortgage payment.

Since lenders may review your FICO Scores and credit report from any of the three credit bureaus, it’s suggested that you check your credit report from all three and make sure they’re all accurate.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Recommended Reading: Does Speedy Cash Report To Credit Bureaus