What Is A Credit Report And What Does It Include

Reading time: 3 minutes

Highlights:

- A credit report is a summary of how you have handled your credit accounts

- It’s important to check your credit reports regularly to ensure the information is accurate and complete

A credit report is a summary of how you have handled credit accounts, including the types of accounts and your payment history, as well as certain other information thats reported to credit bureaus by your lenders and creditors.

Potential creditors and lenders use credit reports as part of their decision-making process to decide whether to extend you credit and at what terms. Others, such as potential employers or landlords, may also access your credit reports to help them decide whether to offer you a job or a lease. Your credit reports may also be reviewed for insurance purposes or if youre applying for services such as phone, utilities or a mobile phone contract.

For these reasons, it’s important to check your credit reports regularly to ensure the information in them is accurate and complete.

The three that provide credit reports nationwide are Equifax, Experian and TransUnion. Your credit reports from each may not be identical, as some lenders and creditors may not report to all three. Some may report to only two, one or none at all.

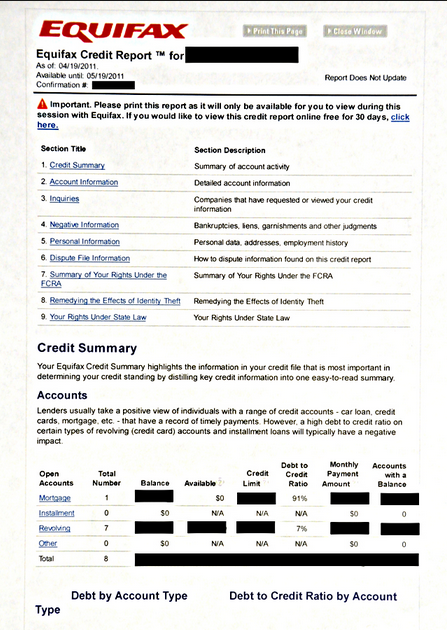

Your Equifax credit report contains the following types of information:

- Identifying information

- Inquiry information

There are two types of inquiries: soft and hard.

- Bankruptcies

- Collections accounts

Understanding Your Equifax Credit Report And Credit History

Reading time: 3 minutes

- Learn what information is on your Equifax credit report

- Hard inquiries on credit reports can impact credit scores

- What to consider before shopping around for a loan

School report cards contain numbers or letters summarizing and evaluating students performance. As they get older, these report cards may be used to help determine students eligibility and acceptance into colleges or other programs.

Your relationship with your Equifax credit report isnt much different. It contains information summarizing how you have handled credit accounts, including the types of accounts and your payment history.

Simply stated, your Equifax credit report is made up of:

-

Personal information such as your full name, address, and Social Security number.

-

as reported to Equifax by your lenders and creditors. This information includes the types of accounts, the date those accounts were opened, your credit limit or loan amount, current balances on the accounts and payment history.

-

Inquiry information. There are two types of inquiries: hard and soft. Read more about inquiries below.

-

Bankruptcies and related details about them, such as the filing date and chapter .

-

Collections accounts. This includes past-due accounts that have been turned over to a collection agency. These can include your credit accounts as well as accounts with doctors, hospitals, banks, retail stores, cable companies or mobile phone providers.

Why inquiries are important

Do your credit homework

The Importance Of A Credit Report

Access to your credit report is important in the U.S. as it’s one of the few ways to get any insight into your credit score.

A credit report, issued by credit companies such as Equifax, Experian or TransUnion, is an overview of how you’ve managed and repaid debt. It’s used in calculating your credit score and is needed to secure loans, rent an apartment, buy a house or car, and even be hired for certain jobs.

To be sure, FICO, which calculates a the credit score of the same name, has offered Spanish-language services since 2012 and Crediverso also recently announced a platform with financial products in Spanish, including credit checks and reports. But, having access to credit reports in Spanish from one of the major credit reporting firms is an important next step for many consumers.

That’s because if a consumer thinks there is an issue with their credit score which could be lowered by incorrect information or identity theft they cannot dispute it with FICO or VantageScore, another credit scoring model.

Instead, they must debate any incorrect information with the credit reporting company to change their credit report.

“If you speak a different language or communicate primarily in a different language, that access doesn’t actually help you,” said Rachel Gittleman, financial services and membership outreach manager at the Consumer Federation of America.

Recommended Reading: How Accurate Is Creditwise Credit Score

The 2017 Equifax Hack

In the fall of 2017, it was announced that Equifax had fallen victim to a massive data breach. Based on information from Equifax, this breach occurred between mid-May and July of 2017.

During this time, hackers accessed consumers names and addresses, as well as more sensitive personal data such as birth dates and Social Security Numbers.

In addition, approximately 209,000 people had their credit card numbers compromised during this attack, and roughly 182,000 individuals had their personal data accessed via the hacking of dispute documents that contained personal identifying information.11

Further investigation showed that approximately 2.4 million U.S. consumers had partial drivers license information compromised.

The Equifax hack was not just contained to consumers in the United States information from individuals in Canada and the UK was also compromised. While there is no way to completely eliminate the threat of identity theft, Equifax has taken steps to assist consumers who may have had their data stolen.

Hot Tip: For more details regarding the 2017 Equifax hack, as well as information about what you can do if you feel you were affected by this data breach, go to the 2017 Cybersecurity Incident and Important Consumer Education page.

How To Dispute Your Equifax Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Its smart to review your credit reports regularly to double-check the information being submitted by lenders, credit card issuers, public agencies and sometimes landlords.

Federal law gives you the right to see the data that the three major credit bureaus Equifax, Experian and TransUnion have collected. Use AnnualCreditReport.com to request the free reports youre entitled to. Errors in your credit reports can cost you points on your credit scores, so fixing mistakes is worth the effort.

If you find an error in your Equifax report for example, a late payment you believe was made on time you can dispute it.

Read Also: How To Get A Repo Removed From Your Credit

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

How To Check Your Credit Report

It’s easy to check your credit report:

- Request your free credit report from Experian at any time.

- Check your at any time

- Visit annualcreditreport.com to request one free credit report from each of the 3 major credit reporting agencies every 12 months.

Who Can Check My Credit Report?

The Fair Credit Reporting Act limits who can view your credit report and for what reasons. Generally, the following people and organizations can view your credit report:

Recommended Reading: How To Unlock My Experian Credit Report

How Do Your Debts Show Up On Your Credit Report

When your creditors and lenders send your information to the credit reporting agencies, each account comes with two identifiers, a number, and a letter. Heres what they are and what they mean:

Letters Stand for the Type of Account

Installment

You pay back your loan in fixed installments until the loan is paid back in full. Examples of this type of account are car loans or personal loans.

Open status

You can borrow money when you need to, up to a certain limit. A line of credit will show up as an open status account on your credit report.

Revolving

You can borrow specific amounts of money up until youve researched your limit your payments fluctuate depending on how much youve borrowed. A credit card is an example of revolving credit.

Mortgage

Mortgages do not always show up on credit reports, it depends on the credit reporting agency.

Numbers Represent a Rating

0 = Account is too new to rate, not yet used.

1 = Paid off within the agreed time limit.

2 = Late payment, 31-59 days late.

3 = Late payment, 6089 days late.

4= Late payment, 90119 days late.

5 = Late payment, more than 120 days late.

6 = Not used.

7 = Account is currently in consolidation, consumer proposal, debt management program.

8= Repossession.

9= Bad debt, accounts that have been sent to collections or are in bankruptcy.

What Information Is In A Credit Report

Learn about positive and negative information on your credit report, and how creditors may use this information. 2:21

A credit report is a summary of your credit history. Potential creditors and lenders use credit reports as part of their decision-making process to choose whether to extend you credit and at what interest rate. It’s important to check your credit report regularly because creditors and lenders use the information in it, such as your payment history and the number of active credit accounts, also known as tradelines, to evaluate your creditworthiness.

There are two nationwide credit reporting agencies Equifax and TransUnion both of which maintain consumer credit reports containing information reported to them by lenders and creditors. Your credit report may not be identical with each of the two agencies, as some lenders may report information to both of them, just one, or sometimes none at all.

Recommended Reading: Sync/ppc On Credit Report

On Your Equifax Credit Report

Your payment history breakdown is fairly straightforward in Equifax credit files. Therefore, the meaning of the numbers, letters and symbols used in Equifax credit reports are generally pretty easy to understand.

Overall, you want to see a lot of asterisk signs that look like this: *.

Thats because an asterisk symbol on an Equifax credit report means pays or paid as agreed.

The vast majority of other notations indicate negative marks on your Equifax credit file, although there are a few exceptions to this.

For example: if a creditor simply didnt report information about you for some reason in a given month or year, that account history will be classified as Not Reported and you will see a code that says NR.

This NR code is neutral its not positive or negative for your credit file.

But pretty much everything else shows that you have credit blemishes.

Equifax Will Now Offer Credit Reports In Spanish

Equifax will offer Spanish-translated credit reports for free, both online and via mail, the credit reporting company said Monday.

The move will help more than 62 million Spanish speakers in the U.S. Equifax is the first credit reporting firm to offer the service.

“We recognize there is a clear demand for broader availability of information in Spanish, and we created this Spanish-language report to meet the growing demands,” said Beverly Anderson, president of global consumer solutions at Equifax, in a statement. “We want to expand access to and understanding of credit, especially to vulnerable and historically underserved communities, so that they are empowered to move forward in all aspects of their financial journey.”

More from Invest in You:These 6 psychological biases may be holding you back from building wealth

Also Check: Syncb Credit Inquiry

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

How To Read An Equifax Credit Report: Inquiries Section

This section lists all inquiries that were requested against your credit file. In Equifax credit reports, this section is divided into two subcategories:

- Inquiries that can be viewed by lenders and other companies. These inquiries are called hard inquiries and may affect your credit score. These inquiries are made by potential creditors who are assessing whether to approve your request for a new line of credit. These inquiries list the name of the company that asked for the information and the date on which they requested it.

- Inquiries that are not displayed to companies. These inquiries, also called soft inquiries, do not affect your credit score and include requests made by pre-approved credit line providers and insurance companies. Here, the name of the company that made the request and the date and the type of inquiry will be listed.

Recommended Reading: Syncb Inquiry

Equifax Credit Reports And Scores

Equifax can provide you with a free copy of your credit report once every 12 months. You can also get a free copy of your credit report if you have been declined credit in the past 90 days or if you had an item corrected on your Equifax credit report.

If you dont meet the criteria for a free credit report, you can pay for a once-off copy of your report or you can sign-up to a paid plan. This can provide up to 12 credit reports a year and your credit score monthly.

How Does Equifax Calculate Your Credit Score

Equifax calculates your credit score based on the information in your credit report at the time your score is requested. In addition to looking at your repayment history and any adverse events, such as overdue debts and court judgments, Equifax says it also takes into account factors such as:

- The type of credit providers you have applied to in the past for example, non-traditional lenders may have a different level of risk than banks and credit unions.

- The type and size of credit requested in your application for example, a mortgage may have a different level of risk compared to a credit card or a personal loan.

- The number and pattern of credit enquiries you have made for example, if you shop around for credit and apply to multiple providers in a short amount of time, this can have a negative impact on your credit score.

- Your personal details, such as your age, length of employment and how long youve lived your current address.

- The age of your credit report for example, a new file with little credit information may be different to an older file with a longer credit history.

Also Check: What Is Credit Bureau Report

Who Can See My Credit Report

Most people cant legally use your personal information to access your credit report. However, there are several types of organizations that are allowed to pull your credit: banks, creditors, lenders, insurance companies, potential landlords, collections agencies, potential employers and the government.

The laws about who can access your credit score are different from state to state. If youre worried at all, do some research and find out what the law is where you live.

How To Read Your Equifax Credit Report

by Prudent Financial Services | May 16, 2016 | , Equifax Credit Report

Last week we discussed the importance of your credit report and how to request it, and to follow it up, this week we are going to walk you through how to read your Equifax credit report. To better understand how you look to creditors and potential lenders, it really helps to understand your credit report and what each section of the report means.

The credit report is broken into sections. The first section is pretty straightforward. It deals with all of your personal information, such as your name, date of birth, SIN, etc. Make sure that all of this information is correct. None of this information actually impacts your credit score, but it is important to ensure that it is accurate.

The second section of the credit report deals with inquiries these do impact your score. Anytime you apply for credit and your report is pulled, an inquiry gets reported to Equifax. Too many inquiries will drag down the credit score because you look like a credit seeker someone living outside your means or continually turned down for credit. This is why it is important to keep inquiries to a minimum as much as possible.

With each type of rating there is a number that represents how you pay the credit item.

If a rating drops from 2-5 and the account is paid up to date, the rating will return to 1. Once the rating is a 9 it stays that way whether you pay it off or not.

Don’t Miss: How To Report A Death To Credit Bureaus

Take Any Advice Or Pointers

Your credit report, right below your credit score, will outline precisely whats dragging your score down. It will list three factors in order of importance to guide you on what you can do to improve your ranking. Read this section carefully.

Some examples of pointers include: Missed payments in the past two years, accounts going into collections, abusing your credit utilization ratio, opening too many accounts, or even not opening enough. There are hundreds of potential reasons that the report could generate.

Dont be too discouraged if your credit score isnt perfect. Keep in mind, your financial institution and creditors arent focusing solely on the number. They work in other internal factors, too, such as your client history and their own risk algorithms.

Recommended Reading: How To Boost Credit Score 100 Points