Ways To Remove Late Payments From Your Credit Report

Summary: In this article we will explain in detail how to delete a late payment from your credit report.

Late Payments can have a significant negative impact on your credit score. In fact, a single late payment on your credit report can cause a drop of more than 100 points.

A low credit rating can result in you having to pay higher interest on loans, higher premiums on insurance, and not being approved for mortgages, among other things.

Fortunately, there are five main methods that you can use to remove late payments from your credit report. Well go through each of these processes in detail. So, lets begin.

How Long Do Late Payments Affect My Credit Score

Once a late payment is listed on your credit report, it can stay there for seven years. Thats a long time. However, the impact of a late payment decreases with time. Recent late payments affect your credit score more than late payments from years ago.

Several other factors determine the impact of a late payment. If the payment amount is large, it will count against your credit score more than a small payment would. If you frequently miss payments, or are late paying more than one credit account, you can expect larger drops in your credit score. And if your credit score is high, a late payment will have more impact than if your credit score was low to begin with.

Common Credit Report Errors

According to the Consumer Financial Protection Bureau, these are the most common errors consumers find on their credit history:

Mistaken identity

- Wrong name, address or phone number

- Accounts from someone with a similar name

- New credit accounts opened by someone who stole your identity

Incorrect account status

- Accounts wrongfully labeled as open, past due or delinquent

- Accounts that wrongfully listed you as the owner instead of authorized user

- Wrong date for the last payment received, date the account was opened or delinquency status

- Same debt listed multiple times

Data management

- Information that is not removed, despite already being disputed and corrected

- Accounts that are listed multiple times, with different creditors

Balance

- Incorrect credit limit

You May Like: Does Snap Finance Report To Credit

How Long Late Payments Are On Your Credit Report

The bad news is how long it takes for late payments to fall off your credit report. It takes seven years even if you pay the past due balance and even if you pay off and close the account.

The good news is that new information pushes those late payments further and further down your report as its added. That means things like on-time payments and reductions in your utilization will become more prominent than those late payments eventually and much more quickly than seven years.

How To Remove Late Payment From Credit Report Due To Covid

Hello –

I purchased a new vehicle back in 2019 and had my payments set up on direct automatic payments. I never missed a payment. Then in Jan 2020, what we know now as Covid hit me hard. I ended up in the hospital for a few weeks and obviously was not getting paid from my job. I applied For disability, but they can be very slow to start releasing funds. Once I was able, from the hospital bed I reached out to Capital One Auto Financing. I explained My situation to a rep and asked if my automatic payments could be taken off. They offered me no other alternative except to pay when I was able to. But i was Honest and forthcoming with them and as they expected, I wasnt able to make my January payment.

Finally in Feb, I received my disability and pay everything in full. Past due, current and any late fees so that I would be current again. Once again I also put my payments on automatic direct payments. My credit soon dropped about 30 points and I saw the 30 day late on my report.

I reached Out to Capital One and spoke with a manager. She explained there was nothing that could be done and that she was unable to remove the 30 day late. She advised me to dispute it with the credit bureaus and to state that I was affected by covid, etc. I also offered proof of my being hospitalized, which she said wasn’t necessary.

Recommended Reading: What If My Credit Score Goes Up Before Closing

How Long Will A Late Payment Stay On A Credit Report

Once a late payment is recorded on your credit report, you should know that it will be there for six years. Fortunately, as time passes, the impact on your score will decrease, because lenders care more about your recent credit history instead of the old one.

Therefore, its always important to keep up with future payments even though you were unable to make one payment on time. Your score will also improve over time, so it will be easier to get approved for credit.

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently at the very least annually, if not more often to catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major once a year. However, because of the pandemic, all three bureaus are offering free weekly reports through the end of 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to check your reports from all three bureaus since each one can include different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service

P.O. Box 105281

Other ways to get your credit report

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance or employment in the past 60 days based on your credit

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

To request additional copies, contact the bureaus directly. Heres how to do it:

For a more detailed guide on how to request copies, make sure to read our article on how to check your credit report.

Read Also: How To Get Fico Credit Score

How To Remove Late Payments From Credit Report

As weve just outlined, late payments can have a big impact on your overall credit. Your score will likely drop as a result, and it will affect your ability to access credit in the future.

Therefore, its important to do everything in your power to remove late payments as quickly as possible. Lets get into how you can accomplish late payment removal.

When Does The Timeline Start

The timeline for a late payment begins on the day of the original delinquency date. For example, if your credit card bill was due in April 2020 and you paid it in May, the late payment falls off in April of 2026. If you neglected to pay in April, May, and June but got caught up in July, the late payments would still fall off in April 2026.

Don’t Miss: Is 783 A Good Credit Score

Top Credit Card Wipes Out Interest Until 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, you’ll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

Request A Goodwill Adjustment

This is an ideal option if you generally have a good payment history with your creditor and have been a customer for a while.

To do this, write a goodwill letter to the credit card issuer or lender and explain your situation. Credit card companies have some flexibility when it comes to reporting late payments. They can remove late payments from your credit report under the right circumstances.

Did you have an unexpected expense arise last month that made you late? Are you trying to perfect your credit score so you can get a mortgage or an auto loan?

Include your personal story in the goodwill letter so that the customer service representative reading your letter understands why this would be helpful.

Many people succeed with this method because creditors dont want to risk losing your account because of a single disagreement.

Also Check: What Does Transferred Closed Mean On Credit Report

Review Your Credit Reports

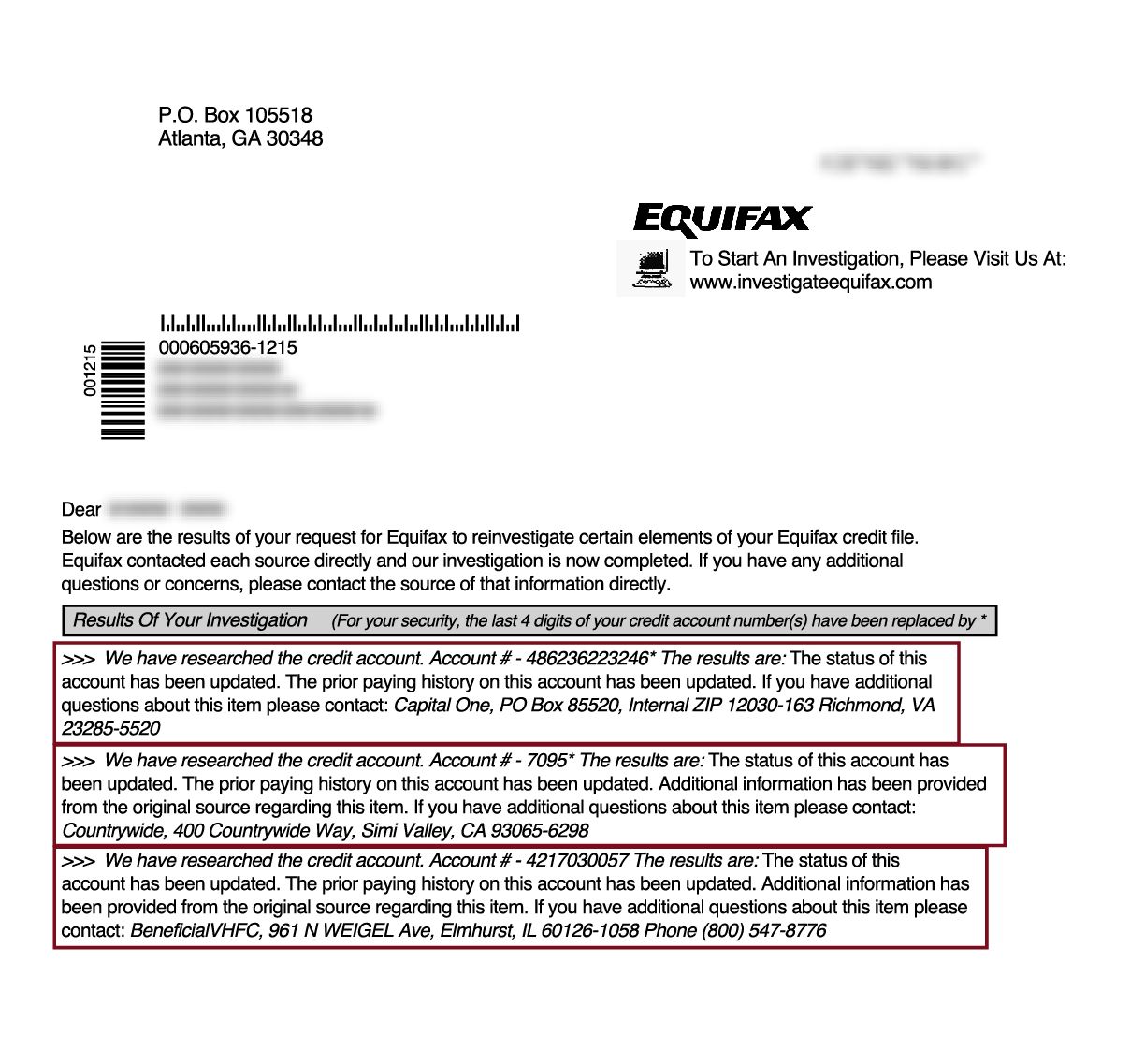

Regularly reviewing your from the three major consumer credit bureaus Equifax, Experian and TransUnion could help you spot something is amiss, such as a mistakenly reported late payment.

A late payment is commonly associated with a credit account. Depending on which credit bureau provides the credit report with the late payment listed, it may be highlighted in some way . And depending on the credit bureau, your reports may also indicate how late the payment was.

Because your credit reports may not be identical, its important to review your reports from all three of the major consumer credit bureaus.

Goodwill Adjustment With Phone Call/letter

You can try for a goodwill adjustment on two fronts: by phone and by mail. Some people try just one or the other, while some try both. Occasionally, people report success from calling and sending multiple letters over time, but we cant verify this.

Whether youre on the phone or writing a letter, remember that youre at fault here and asking forgiveness. Your tone should reflect that. Be polite, thankful, and conscientious. Above all, dont get angry or demanding.

Here are some examples to get you started on the phone or with your goodwill letter. If you get a positive response from the lender, try to also get it in writing.

Phone

You can use this script to start the conversation about removing your late payment. Be sure to have your explanation ready for why you were late. If you dont have a perfect payment history, youll have to adjust this slightly to reflect your actual situation.

For credit cards, call the number on the back of your card to speak with the issuer, or check out our listing of backdoor credit card company phone numbers.

Late payment goodwill adjustment sample phone script

Hello, my name is . I recently made a late payment on my account, which was a total accident.

As you can see, my payment history is perfect other than this one mistake. I ended up paying late because . The late payment is also showing up on my credit reports and its done a lot of damage to my credit scores.

That should get the ball rolling in the right direction.

Also Check: Is 820 A Good Credit Score

How Do You Dispute An Accurately Reported Late Payment

If you really did make a late payment, theres still a chance you can have it removed from your credit reports. This might be a slim chance, but its worth trying because late payments can potentially have such a significant impact on your credit.

For these methods, youll just contact the lender or creditor, rather than the credit bureaus. Youre basically pleading your case and asking it to forgive the late payment its under no obligation to actually do so. If the lender decides to report the account as current instead of delinquent as a result, this is typically known as a goodwill adjustment.

This might work if you have an otherwise excellent payment history with that lender, and have been a responsible customer except for this mistake. If there was a technical error that prevented you from paying on time, like an issue with the payment system, that could work in your favor. Or, if there was some major life event that prevented you from paying by the due date, your card issuer may be sympathetic to that as well.

If your history is less than ideal and shows several late payments and other negative marks, you probably wont have much success with a goodwill adjustment. Still, it might be worth a shot, depending on your situation. The effort will only cost you a little time.

There are only two steps in this process:

MoneyHack

Borrowing With Poor Credit

Your scores will be lower if late payments remain on your credit reports, but that doesnt mean you cant borrow money. The key is to avoid predatory lenders who charge high fees and interest rates.

A co-signer may be able to help you get approved for certain types of loans. Your co-signer applies for a loan with you and promises to make the payments if you stop paying on time. Lenders evaluate their credit scores and income to determine their ability to repay the loan. That may be enough to help you qualify, but its risky for the co-signer, because their credit could take a hit if you make late payments.

Recommended Reading: Does Experian Boost Report To All 3 Credit Bureaus

What If Its Not A Mistake

If you made a late payment and it shows up correctly on your credit reports, your chances of getting it removed are slim.

According to a TransUnion spokesperson, If late payment information is indeed accurate and properly reported by a lender, then it cannot be removed from a consumers report by the credit-reporting agency.

You may hear about ways to get an accurately reported late payment removed from your credit reports, but you should know that these methods are probably a scam.

Ultimately, you can avoid late payments on your credit reports by making sure you pay your bills on time and in full. One tip is to set up automatic payments for your credit accounts.

If you do pay late and a late payment ends up on your credit reports, you may be stuck for seven years until the late payment falls off. But its likely that the longer its been, the less impact a late payment can have on your credit, especially if youve since been working on building your credit with responsible use.

Can I Remove Late Payments From My Credit

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Late payments on your credit report can cause a dramatic drop in your credit score. This can in turn substantially increase how much youâll pay for financing. If you find falsely reported late payments on your credit report, you have a right to dispute the incorrect information. In some cases, even if the reported information isnât blatantly inaccurate, you may still be able to negotiate with the creditor to remove the late payment from your credit history. This article will cover how late payments affect your credit report, the difference between when they’re reported correctly and incorrectly on your credit report, and what you can do to remove them.

Written byAttorney Paige Hooper.

Your credit report can have an enormous impact on your personal finances. The information in your credit report is the basis for your credit score. Your credit score can affect your ability to get a credit card, buy or rent a home, set up utilities or phone service, secure an auto loan, or even get a job.

You May Like: How To Get A 700 Credit Score

The Response To The Advisory Opinion Letter

In a couple of days I received a letter via snail mail that upon further consideration my payment history was being revised!

Within a few days I logged in to check and my credit report for another matter and noticed it had shot way up they had removed my late payments!

And what was great was that my credit score had made an astronomical leap. The removal of the late payments coincided with me paying of all my credit card debt and a slew of hard-pull inquiries dropping off my report so my credit score jumped from the 500s to the 800s!

I couldnt believe the change and I was on my way to getting some pretty great credit cards.

When you research the authority of Section 623 and this FTC advisory opinion youll come across a lot of varying accounts and opinions. There are a lot of accounts of using this opinion not working and some others who have had success like I did.

Dont get too discouraged by the negative accounts. I almost never sent in my second letter because it seemed like a wasted effort but thank God that I did I dont even want to think about where my credit score would still be right now if I hadnt.

If you have some late payments that hit while you were supposed to be in an in-school deferment status or in forbearance then I definitely recommend giving this method a try.

Try the good-will letter first and if that doesnt work then youre next step could be using the FTC advisory opinion Section 623. Remember, theres no harm in trying.

Get Help Addressing Late Payments

To make this process easier, you can work with a that will help you address inaccuracies on your credit reports. The credit repair consultants at Lexington Law have the knowledge and, most importantly, the time available to help you through the credit repair process from beginning to end.

Reviewed by Miriam Allred, Associate Attorney at Lexington Law Firm. by Lexington Law.

Miriam Allred was born and raised in Southern California. After high school she joined the US Navy. She then went on to get an Economics degree from Chapman University where she got to enjoy an internship at the United States Supreme Court. Miriam then went to Brigham Young University where she received her Juris Doctor. Prior to joining Lexington Law, Miriam worked as a civil rights attorney dealing with discrimination and sexual harassment. In this role she helped write and create policies and investigate sexual harassment and discrimination complaints. Miriam also has experience in family law. Miriam is licensed to practice in Utah.

Recommended Reading: How Long Do Credit Applications Stay On Your Credit Report