Why We Dont Add Tradelines To Itins

This post stands as our policy paper on adding tradelines to ITINs. We wont do it for the reasons listed above.

Nevertheless, there are options.

You can connect with us by emailing info@superiortradelines.com or to get started.

We look forward to working for you and helping with your credit goals.

This is 100% inaccurate.

You 100% can use an ITIN to build credit. In fact, its necessary if you dont have an SSN.

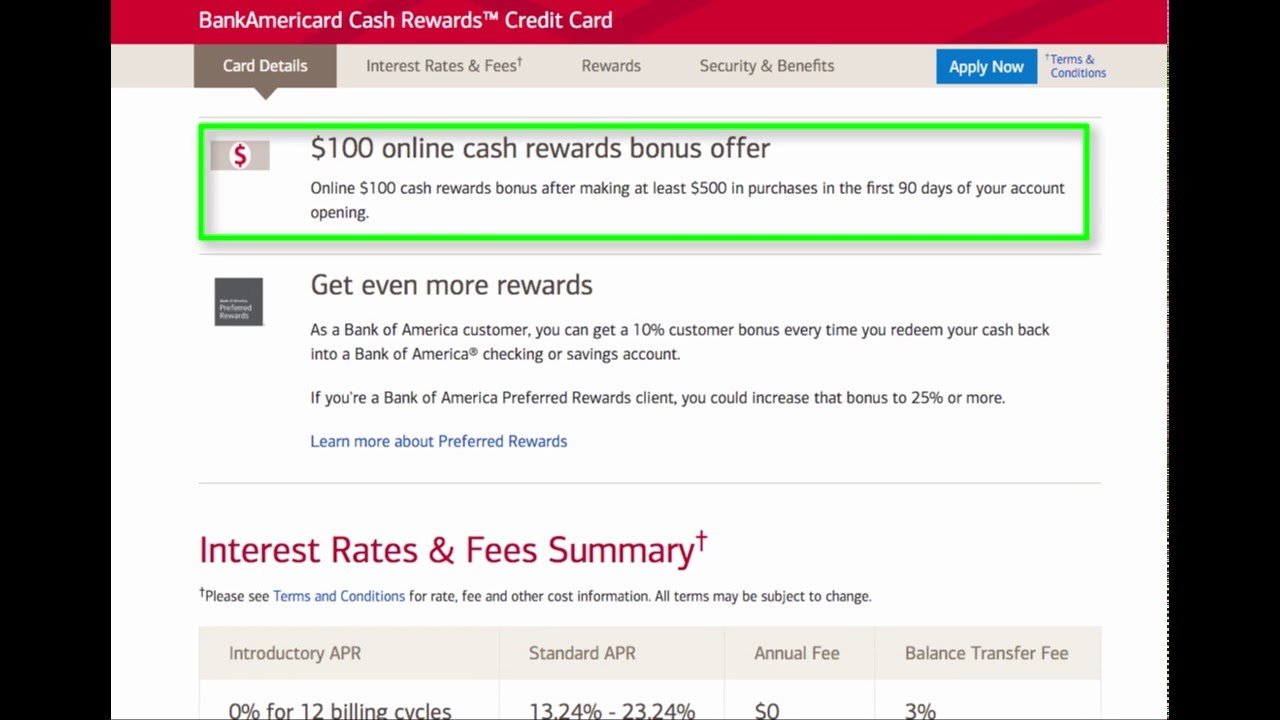

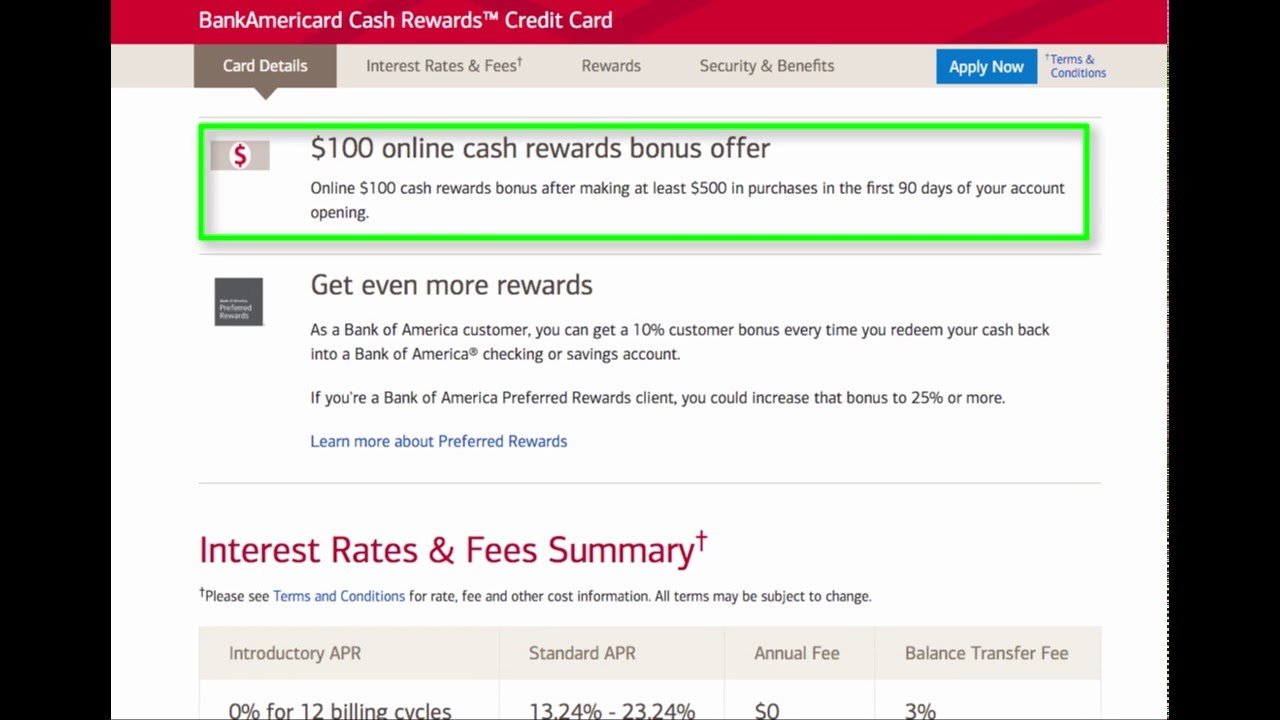

American Express, Chase, Capital One, BoA, Citi Bank and a couple of others let you get credit products with an ITIN. During the application process, you CANNOT skip the SSN field and by placing your ITIN they are able to verify your credit.

If Im wrong then you should probably tell that to the 800+ credit score Ive obtained by having an ITIN and living somewhere else in the world.

1/5 rating for this article.

Is the Federal Trade Commission a sufficient source? If so:Or,they may direct you to apply for an EIN an Employer Identification Number from the Internal Revenue Service . EINs are legitimate numbers, typically used by businesses to report financial information to the IRS and Social Security Administration but an EIN is not a substitute for your Social Security numberThe credit repair companies may tell you to apply for credit using the CPN or EIN, rather than your own Social Security number. And they may lie and tell you that this process is legal. But its a scam

Crediverso Credit Check Features

The Crediverso Credit Check has you fill out a quick online form with basic information to get the free credit report. You can fill out the form in English or Spanish, and use an ITIN number if you don’t have a social security number.

After verifying your identity, you’ll receive the credit report. The credit report uses the VantageScore 3.0 model to get an estimate of your credit score.

When you get a credit report, an online platform will use either a VantageScore model or FICO score to determine your score. The FICO score is more commonly used in scoring models, however, the VantageScore has grown in popularity and will look at slightly different factors to determine your score.

Below your , you’ll get a breakdown of how your credit score was determined and a rating of “low,” “good” or “excellent.” On the side, you’ll get a few notes that describe the positive factors in your credit score as well as what could be improved.

Crediverso does a soft credit pull, so won’t affect your credit score if you make several inquiries in a short time. Other online platforms like Credit Karma also offer a soft credit pull that won’t affect your score.

Security Freezes And Fraud Alerts

Beginning in 2018, security freezes are free in Wisconsin. You can find more information about security freezes in the UW-Madison Division of Extension Credit Report Freeze fact sheet. If you believe you are the victim of identity theft, visit the Federal Trade Commissions identity theft website, which lists the steps you need to take. The

Read Also: Does Paypal Credit Report To Credit Bureaus

Also Check: How Long Do A Repo Stay On Your Credit

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Practice Good Credit Habits For A Higher Score

If youve estimated your FICO score and the results arent what you were expecting, taking action to improve your score is the next step.

While you cant wave a magic wand and raise your score overnight, you can make a difference over time by using credit wisely.

Keeping these tips in mind could help you achieve the positive change youre after:

Don’t Miss: Can You Use Affirm In Store At Walmart

Become An Authorized User

If you have a close friend or relative in the U.S., you may want to consider asking that person to add you as an authorized user on one of their credit cards.

Why? Being an authorized user can positively affect factors that go into your credit score like payment history, age of credit history and number of total accounts.

Becoming an authorized user is a relatively easy and effective way to build credit, but its important to know that if the account does show up on your credit reports, your credit can be negatively impacted if the main cardholder misses a payment or has a high credit utilization ratio.

How Does A Bankruptcy Impact My Fico Score

A bankruptcy is considered a very negative event by FICO® Scores. As long as the bankruptcy is listed on your credit report, it will be factored into your scores. How much of an impact it will have on your score will depend on your entire credit profile. As the bankruptcy item ages, its impact on a FICO® Score gradually decreases. Typically, here is how long you can expect bankruptcies to remain on your credit reports :

- Chapter 11 and 7 bankruptcies up to 10 years.

- Completed Chapter 13 bankruptcies up to 7 years.

These dates and time periods refer to the public record item associated with filing for bankruptcy. All of the individual accounts included in the bankruptcy should be removed from your credit reports after 7 years.

You May Like: Can I Buy Appliances With Affirm

How To Get A Credit Score Without A Social Security Number

While a social security number is an identifier that credit bureaus use to locate and collect your information, itâs only one of several identifiers.

We and all of our authors strive to provide you with high-quality content. However, the written content on this website solely represents the views of the authors, unless otherwise specifically cited, but doesnât represent professional financial or legal advice. As we cannot guarantee the accuracy or completeness of the published articles or sources referenced, please use the information at your own discretion.

A credit score is a three-digit number that provides a brief overview of an individualâs personal credit. It significantly impacts important financial matters, such as whether or not you will be approved for lines of credit and loans

A credit score is derived from the details in your credit report. These details are sensitive and include things like your name, your date of birth, your address, and your Social Security number. A credit score can have an impact on many aspects of your life, even if you arenât a resident of the United States. If you are from another country and you donât have a Social Security number , youâll learn more about credit scores, why theyâre important, and how you can establish your credit without a Social Security number below.

Moved to the U.S. from Australia?

Put your international credit score to work in the United States

How To Order Your Free Annual Reports From Equifax Experian And Transunion

You can order your free annual credit reports through a toll-free phone number, online, or by mailing the Order Form at the end of this Information Sheet.

1-877-322-8228Annual Credit Report Request ServiceP. O. Box 105281Atlanta, GA 30348-5281

You have the option of requesting all three reports at once or staggering them. You could create a no-cost version of a credit-monitoring service. Just order a free report from one credit bureau, then four months later from another, and four months after that from the third bureau. That approach wont give you a complete picture at any one time. Not all creditors provide information to all the bureaus. Monitoring services from the credit bureaus cost from about $40 to over $100 per year.

Also Check: Carmax For Bad Credit

How Is A Credit Score Tracked Without An Ssn

Some credit bureaus can locate your credit information with name, date of birth and address. There are several unique identifiers used to match credit account information to a credit file and SSN is only one of them. Having an SSN increases the accuracy of the matching process, but it isnt always required to compile your credit report.

How To Check Your Credit Score With An Itin

So how do you get a ? You can get a credit score if you have provided your lenders with sufficient personal information and if they report it to credit bureaus. You can apply at Experian, Equifax, and TransUnion for your credit score. Some of them may even grant you a free annual credit report.

Go online on the credit bureaus websites and check your credit score without SSN. Enter your personal information and provide your ITIN as another way to distinguish yourself. Pull your report and also verify the validity of the information. You can ask the credit bureaus to change incorrect information about your financial history. Be patient though, because it might take a while to correct errors on your record.

Please note though that not having an SSN will affect the way your credit is reported to credit bureaus. They may not have all of your financial history reported. But having a credit score of any kind is a start.

You May Like: Remove Repossession From Credit Report

What Our Clients Say About Us

I have used Freedomtax for several years. They have done an outstanding job, and fully handled all correspondence to me from the IRS. This is priceless to me. I highly recommend them. It is nice to know IRS issues are fully handled by them.

Carlos and the team are simply amazing! They helped us open and manage our new business. They are always happy to help and answer any questions or concerns, explaining things in a way we can understand. We always come back to them, because the service and effectiveness is top notch. Would highly recommend them to anyone!

Laura Lopez 7 months ago

I’m a UK resident and sold land in the US . Searched all over the internet trying to find someone to help with the paperwork that was required for a non-US citizen to sell land. The service that I received was outstanding… Very professional and excellent communication. I would highly recommend this company.

Lee Mullen 3 weeks ago

Hi, we were recommended to use Freedomtax when we bought our house. We are delighted that we did. Were not used to the tax system in America and Roberto helped us throughout the process, explaining about the system. They were always very helpful and responded quickly to any questions we had. We have no hesitation in recommending them.

Steve Brockley 1 month ago

Stefanus Ronald 4 months ago

Establishing A Credit History Without A Social Security Number

If you are a recent arrival to the U.S., you will have to establish a credit history so that you can get a car loan or rent an apartment, for instance. Any credit history you had before arriving here will not carry over.

To establish your U.S credit history, you could get a , open a bank account or get a loan with a U.S.-based financial institution. Utility providers could also be reporting on your accounts to the credit bureaus.

And if you need to take out a loan before your U.S. credit history is available, at least one company, Nova Credit, translates your overseas credit history into an equivalent report for the benefit of U.S. lenders.

See related: How to get a credit card without a Social Security number

Also Check: Will Evictions Show On Credit Report

No New Credit Account And Hard Injuries

In order to keep your credit scores high, you need not have any credit account, auto loan, mortgage type for more than five years. In addition, you must not keep hard injuries also for more than two years. Hard injuries are the ones when you apply for credit while a soft injury is when a consumer checks their credit for obtaining their own information.

ITIN numbers and SSN numbers are different from one and another. Also, both of them serve two different purposes. For this reason, most of the people question, how to check credit score with ITIN number. Though, it is not very difficult to check it. You can use Experian, TransUnion and Equifax by sending a post mail at the specified address and access to your credit reports and know your credit score. Now that you know how to check credit score with ITIN number, we hope you will be able to help others as well. Good Luck!

Please follow and like us:

Originally published at www.itinnumberonline.com on February 23, 2016.

What Are Inquiries And How Do They Impact Fico Scores

Inquiries may or may not affect FICO® Scores. Credit inquiries are classified as either hard inquiries or soft inquiriesonly hard inquiries have an effect on FICO® Scores.

Soft inquiries are all credit inquiries where your credit is NOT being reviewed by a prospective lender. FICO® Scores do not take into account any involuntary inquiries made by businesses with which you did not apply for credit, inquiries from employers, or your own requests to see your credit report. Soft inquiries also include inquiries from businesses checking your credit to offer you goods or services and credit checks from businesses with which you already have a credit account. If you are receiving FICO® Scores for free from a business with which you already have a credit account, there is no additional inquiry made on your credit report. FICO® Scores take into account only voluntary inquiries that result from your application for credit. Hard inquiries include credit checks when youve applied for an auto loan, mortgage, credit card or other types of loans. Each of these types of credit checks count as a single inquiry. Inquiries may have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk.

You May Like: Is 524 Bad Credit

Youre Wrong No Youre Wrong No Youre Wronger

I suppose we address popular topics because we always receive our fair share of criticism in the comment section of our blog posts.

In this case, in the comment section below, weve shifted from ITINs to EINs. EINs, for the purpose of evading your SSN, are not different than ITINs, CPNs, etc.

This is consistent with the Federal Trade Commissions view.

Aside from the risk of civil fines from the FTC, the FTC suggests improper EIN use could end with jail time.

Payday Loans And Title Loans

Many people looking for a personal loan that have no credit history turn to payday loans or title loans. Both offer fast cash but can be costly decisions that arent good for your long-term financial health. For this reason, these companies are often referred to a predatory lenders.

Payday Loans

These loan companies provide short-term loans at a very high cost. The loans come with high fees that can keep many borrowers trapped in a repayment cycle that never seems to end. Payday loan companies require that you commit to a repayment that includes a fee. If you cant repay the loan when it comes due, you will be hit with additional fees and very high annual percentage rates .

Title Loans

Title loan shops are all over the place. They require you to use your car as collateral for a short-term loan. Typically, you must own your car to qualify for this loan. Again, the annual percent rate and fees get extraordinarily high, especially if youre late on the payment. Its quick cash, but its also a quick way to lose your car.

Read Also: Which Bureau Does Care Credit Pull

Need A Loan Get Ane In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Utilize

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications go amend loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact yous with regard to your application. Provide any additional information if required. Before long you’ll accept your loan offering. Some lenders transport a promissory note with your loan offering. Sign and return that notation if you wish to accept the loan offer.

Repay

The loan so gets disbursed into your U.S. depository financial institution account within a reasonable number of days . Now yous need to set up your repayment method. You lot can cull an autopay method online to assistance you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.Southward. at rates lower than any other lender. Stilt is committed to helping immigrants build a better fiscal futurity.

We take a holistic underwriting approach to decide your interest rates and make certain you go the lowest rate possible.

Learn what others are saying about us on Google, Yelp, and Facebook or visit us at https://world wide web.stilt.com. If yous have any questions, send us an email at

Frank Gogol

Electric current States: AZ, IL, FL, TX, PA, CA, MI, WA, UT, OH, GA, NY, NJ, WI, MA, VA.