Voluntary Is Better Than Involuntary Repossession

If you know in advance that you cant make the required payments on your auto loan, its better to come clean than wait. You can return the vehicle and apologize. In such scenarios, the lender is far more likely to listen to you if you ask for alternative terms. Repossession is often the last resort, so dont make the lender feel youve forced their hand.

What Is A Repossession Anyway

If you’ve ever fallen behind on your car payment for too long, you probably know what a repossession isit’s when the car lender takes back possession of the car, sometimes without your permission or a court order, because of those missed payments.;

What gives the lender the right to seize your car?

Well, when you signed up for your car loan, you might remember signing a lot of paperwork with the lender that contained certain terms and conditionsand one of those conditions gives the car lender the legal right to repossess your car if you fail to make your payments.

It’s important to know that these creditor’s don’t have carte blanche authority, howevermost states have laws that govern how your creditor may repossess the vehicle, so it might be worth contacting your state Attorney General if you feel you’ve been mistreated.

A Repossession Remains On Your Credit Report For Seven Years

If you are late on a payment and subsequently catch up, the late payment will be erased after seven years, but not the whole account. In such case, only delinquencies dating back to the day the account became current and beyond the seven-year threshold would be erased. The report will retain the remainder of the accounts history.

If there are no further delinquencies in the accounts history, the status of the account will change to positive. Positive accounts stay on your credit record for ten years after they are closed, or forever if they are still active.

Because the account was never made current in the event of a repossession, the whole account will be deleted seven years from the initial delinquency date. The initial delinquency date is the first missed payment that resulted in the repossession.

Additionally, the credit report contains additional dates. Several of the dates you may notice are the accounts opening date, its closing date, the date of the accounts most recent payment or activity, and the date the lender last updated the account. None of these dates are indicative of when bad information on a credit report will be erased.

includes the date the account will be closed as part of the account information on a credit report whenever feasible. You may see a note next to your account that says this account is planned to remain active until MM-CCYY. The date shown is the date on which the account will be deleted from your credit report.

Don’t Miss: How To Get Rid Of Inquiries On Your Credit Report

Can You Get A Car Loan With Repossession

Its improbable that youd be able to secure a car loan with a repossession on your credit report because it hurts your reliability as a borrower.

Major banks tend to reject loan applications if the applicant has had a recent repossession. Youd need at least two years of clean payment history to be eligible.;

As for private lenders, some offer a second-chance financing service. They have flexible credit score requirements, but theyll probably charge you a very high interest rate with additional fees so that its worth the risk.

Even with these flexible criteria, they might require your repossession to be at least a few months old. Also, consider the income requirements, which will probably be no less than $1000 .

If you want our opinion, this isnt such a good idea since your credit is already in bad shape. You wouldnt want to place yourself in a much pressing financial crisis. Instead, a more responsible route would be handling the repossession at hand before proceeding with a new car loan.

Negotiate The Payment Terms

It may be a long shot, but its worth trying to negotiate the loan terms so that you can carry on paying your installments. You can do that with your lender, whether thats a bank, an online lender, or an in-house finance company. Furthermore, you might need to get them to reduce your monthly installments and, of course, give you your car back.

Nothing can force your lender to agree; nevertheless, defaults arent profitable to any involved parties. So, it may be in their best interest to negotiate because you owe them money, and theyd very much like it back. The tricky part here is to reach the right person, meaning you need to contact someone capable of making policy decisions.

Afterward, you may offer your lender a deal where you pay them back, and they remove the repossession item off your credit report and give you back your car. Of course, negotiating with your lender would be fruitless if theyve already sold your vehicle, in which case your remaining option is credit repair.

However, if youre successful in doing that, they should then contact the credit bureaus to remove the repossession from your report. Finally, you must request guarantees in writing, allowing you to dispute this entry later on if you need to.

Also Check: How To Get Charge Offs Off Of Your Credit Report

How To Recover From A Car Repossession In 5 Steps

How long does a voluntary repossession stay on your credit report? Neglecting important repairs or getting into an accident while uninsured may land you;

Nov 25, 2019 Over the years, hes been a salesman, a repo man, and until 2015, Kenneth advises all credit repair specialists to ask your client where;

Mar 13, 2020 A car repossession could happen if you fall behind on monthly payments. This can hurt your credit for up;

Improve Your Credit After A Repo W/help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals is here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

Also Check: How To Remove Serious Delinquency On Credit Report

Consult A Credit Repair Company

Seeking out professional help from a credit repair company can either be your first or last option. If you have gone through all the steps indicated above and youre still unsuccessful, consulting with a credit repair company could help.

On the other hand, if you do not want to deal with the dispute process yourself and you would rather pay a professional to do it for you, then contact a credit repair company from the beginning. This could save you time and effort especially if you want to start the process as soon as possible. In choosing a credit repair company, you have to be careful and diligent. Research the company carefully and read reviews before signing up with them.

How To Prevent A Repossession

Many people go through financial troubles at some point. If you’re struggling to stay on top of your payments, you should communicate this with your lender to see if you can change your payment plan.

For car loans, if you know your financial hardships are going to be temporary, you can talk to your lender and see if they’ll let you skip payments for a month or two. Some auto lenders allow this without penalizing you, but you need to communicate with them or else you will be penalized. Working things out with your creditor may prevent a repossession and allow you to keep the property.

Recommended Reading: How To Get Fico Credit Score

Start Removing Your Repos Today

Hopefully, the above article has answered all of your burning questions, such as can a repossession be removed and how. Perhaps you are stressed about your current score because you need to obtain a large amount of financing for a future project. Or, you need an auto loan and with a repo on your profile, youre not going to get one. The above process should be sufficient to get you on the right track.

Remember that you do not have to walk this journey alone. There are hundreds of people who are trained in improving your financial standing. They know all of the special tips and tricks to remove repos that you may not be able to on your own. Whether you want to do it DIY style or with professional assistance, get started today and achieve your economic goals!

Founder of Credit Repair Partner. I worked in the credit repair industry for about 10 years. I love, helping people become smarter about their credit and finances.

Removing A Repossession From Your Report

It may seem a formidable task: attempting to understand what is needed to remove the repossession.

But sensibly, you can hire a credit repair firm to handle the messy work for you.

With low rates, you should be able to afford the small investment into clearing &improving your credit.

I found that the persistence and experience my chosen firm used in tackling my credit report woes led to the removal of over 8 items.

When I decided to remove negative items on my own, I found that I needed to understand the rules to gain a successful removal.

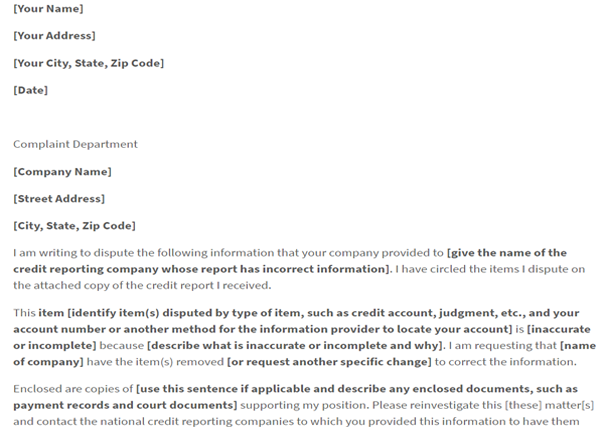

First, you want to ask the credit bureau to verify your debt, whether by letter or online form. You will wait until the credit bureau responds with a resolution, preferably in your favor.

Since this is a repossession, you want to ask for verification of debt, rather than dispute that the debt belongs to you, unless you are absolutely sure the debt is not yours and may be fraud.

Another way to remove a repossession is to reinstate the loan and ask the lender for more favorable terms and to remove the repossession from your report. You will want to get this all in writing, keeping a record of your new agreed upon terms.

Once you restart your payments paying them on time, you should see more positive affects to your credit report.

Also Check: How To Print Out My Credit Report

Negotiate With Your Lender

The first thing you need to do is see if you can reach a new agreement with your lender about any remaining balance. You dont want any residual debt to drag you even further down.

If you can accomplish that, see whether you can renegotiate the original loan as well. Your lender is probably selling the repossessed property at a loss, so if you can pay the original loan, that is better for them in the long term. Identify why you couldnt pay your original loan, and make every reasonable attempt to show that you can pay these new terms now.

Why Is A Good Or Excellent Credit Score Important

As mentioned above, a low score may lead to higher interest rates and additional fees for future auto loans. If your creditor has reported a repossession to the credit bureaus, you can bet this will be the case.

The consequences dont stop at future auto loans, though. Your credit score can affect whether you can get a mortgage in the future. For this reason, credit repair for repossessions is such an essential step for safeguarding your future.

Read Also: Does Checking Your Credit Score Affect Your Credit Rating

How To Remove Repossession From Credit Report

Having a car or house repossessed is something most people fear when going through tough financial times. Unfortunately, more consumers than youd believe have had something repoed at least once in the past and that puts a nasty blemish on their credit report.

If you are trying to repair your credit or are simply looking to get that repossession removed from your credit report because you feel it is there unjustly, there are things you can do but you need to act. You should know that the quicker you act, the easier it will be to keep your credit history intact. Here is some of what you should know.

Can Lexington Law Remove A Repo: Credit Repair Reviews

Imagine watching your vehicle being towed away, not because it was parked at the wrong spot but because it is being repossessed as you have defaulted on your auto loan.;

This gets reported to the consumer credit bureaus and can live on your report for up to seven years.

So, can Lexington law remove a repo? Yes, they can help with all disputes.

Still each case is different so give them a call;for free consultation,;see links below or watch our review at the bottom of the page.

Call Lexington Law For Free Consultation

Recommended Reading: How To Get Credit Report Without Social Security Number

How You Can Improve Your Credit Report After Repossession

Checking your credit report regularly can help avoid long-term damage. Remember you can dispute incorrect information. This often happens when one credit account is listed twice or if there has been . When you get your free credit report, make sure there are no duplicate accounts or charges you didnât authorize. Clerical errors and identity fraud are more common than you think.

You can also start repairing credit yourself by taking out new, small loans that you can repay on time. This is especially useful for people who have just filed for bankruptcy. While they may be the most hesitant to borrow again, borrowing small amounts with a manageable monthly payment is a great way to rebuild âgoodâ credit. A secured credit card with a low monthly limit also adds positive credit to your history.

Over time, the new positive history will replace old negative items and poor marks on your credit score become less important. Remember, your credit report is always changing, so itâs important to start including some âgood gradesâ that show youâve improved. As you become more consistent in paying debts on time, you inspire confidence in lenders. In return, they will extend you more credit.

Can Repossessions Be Removed From A Credit Report

There are a couple of things you can do to try to remove one:

-

Negotiate with your lender: Your lender loses money when they repossess. Paying off your debt is cheaper and more convenient for them, even if you pay less than what you owe.

You can try renegotiating with them to see if you can settle your debt and remove it from your credit reports. If they agree to this, make sure to get it in writing and that you follow through with the terms you and your lender agreed to.

- File a dispute: If you go through your credit reports and see anything reported inaccurately about your repossession, you can dispute it with the credit bureaus.

If you do this, the credit bureaus must investigate and will ask the creditor to verify the information regarding your repossession. If the lender can’t prove that your debt is accurate, fair or substantiated , then the credit bureaus can remove the repossession from your credit reports.

Your window to negotiate with your lender may be short or already closed if theyve already repossessed your asset. In this case, filing a dispute is the option to consider.

Also Check: Will Increasing Credit Limit Hurt Score

Open A Secured Credit Card

Similar to a credit-builder loan, secured credit cards help boost your credit score by reporting positive payment activity to the credit bureaus. However, you must pay a security deposit equal to the credit limit to open an account. And your funds will be tied up until you close the account or the credit card issuer converts it to an unsecured account.

I’m Allison Martin, a Certified Financial Education Instructor , syndicated financial writer, speaker, and author. Over the past five years, I’ve managed to escape a draining career and triple my income, all while raising two handsome boys that hold the keys to my heart. My work has been featured on The Wall Street Journal, ABC, MSN Money, Yahoo! Finance, Fox Business, Credit.com, MoneyTalksNews, Investopedia, AAACreditGuide, The Simple Dollar, and a host of other reputable publications. I also travel around the nation facilitating financial literacy and business workshops to people from all walks of life. Whether you’re looking for a financial writer, speaker for your next event, a quick “pick-me-up”, or dose of inspiration, I may be able to help you out. Thanks for stopping by, and welcome to my world.

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Also Check: How To Get A Credit Report For A Landlord

What Happens If I Cant Remove The Repossession Off My Credit Report

Since weve gone through your options for removing a repossession, we think its only fair to explore a possible outcome: your inability to remove it. In that case, youll have to wait seven years for it to disappear. The silver lining is that your repossession wont impact your credit score for the whole period.

Even though an old item on your report will affect your credit score, recent items hold more weight, rendering old ones less relevant. To elaborate, payment history comprises 35% of your score. In contrast, credit utilization, credit history length, total debt, number of new credit accounts, and the diversity of your credit mix are more dominant factors.

Fortunately, this means you can build your credit score once again by making sure that your recent activity is up to par, thus increasing your credit score.