How To Get A Charge

Removing a charge-off from your credit report is difficult to do. Once your account hits charge-off status, itll stay on your credit report for seven yearseven if you turn it into a paid charge-off.

The good news is that after seven years the negative information completely disappears from your credit reports, thanks to the Fair Credit Reporting Act.

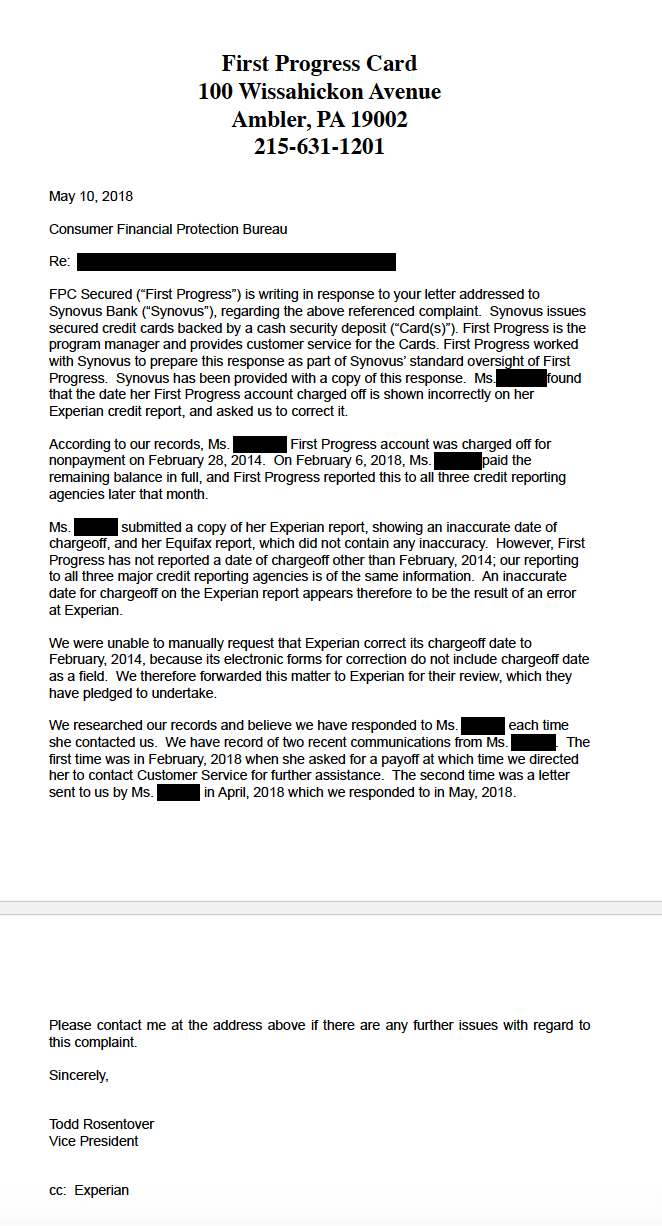

The best chance you have at getting it erased from your report in the meantime is to dispute it with one of the major credit reporting agencies that reported the inaccurate information.

The only way you can dispute a charge-off with a bureau is if you believe it was reported by mistake. If you initiate a dispute, the credit bureau will be required by law to look into the claim and correct it or remove it if theres an error.

Do You Still Have To Pay A Charged

Even though the credit card issuer has declared a loss on your account, you’re still responsible for repaying the debt. The creditor can still attempt to collect the debt and might even assign or sell the debt to a third-party debt collector who will pick up the collection activities.

Rather than having the convenience of paying your balance over time, the full balance of the charge-off is due. You may be able to negotiate with the creditor for a short-term installment plan, but this is ultimately at the creditor’s discretion. It all depends on how likely they think they are to get the full amount from you.

You won’t be responsible for paying a charge-off if the debt is discharged in bankruptcy or the creditor cancels the debt.

What Does Credit Card Charge

When a credit card account goes 180 days past due, the credit card company must close and charge off the account. This means the account is permanently closed and written off as a loss to the company, although the debt is still owed.

You could find that reaching out to your credit card company is helpful. Many creditors may be willing to work with you.

Also Check: What Is The Minimum Credit Score To Buy A Car

Try To Negotiate A Pay

If your debt is still with the original lender, you can ask to pay the debt in full in exchange for the charge-off notation to be removed from your credit report. If your debt has been sold to a third party, you can still try a pay-for-delete arrangement. The debt owner still wants to collect their money, so they might be open to a pay-for-delete arrangement.

If your debt is now sitting with a collection agency, it can work to your advantage. A debt collector can pull your credit report and see if you have ways of paying off the debt, such as a credit line or an available balance on a credit card. This is a strong motivator for the debt owner to work with you.

Additionally, you can assume that if a collection agency now owns your debt, they bought it for a fraction of the total amount. This means theyll potentially be willing to accept less than your total debt amount as payment.

When youre negotiating, some financial experts suggest offering just 25 percent of your original debt if you have a large sum. The collection agency might push back and ask for more, but you can begin negotiations and settle on an amount you deem fair . If you have a small balance, such as $500, its more likely that youll have to pay the full amount to the collection agency.

Dmp Could Help Charge

If trying to deal with charge offs is overwhelming you, it might be wise to find a non-profit and ask for help there. The credit counselors can help you better understand how to manage your money, set up a budget, and, if it helps provide a solution, enroll you in a debt management program .

A DMP is an agreement to pay off the debt in full over a period of time that is agreed upon by both sides. The credit counseling agency might be able to convince the lender to reduce their interest rates, get late fees and other penalties reduced, and thus make it possible for you to solve the problem in a 3-to-5 year time frame.

Once you have paid off the entire amount, you can ask the credit bureaus to change the account status to: paid in full, balance zero. The account will still show that it was charged-off for seven years, but your credit score will improve and future lenders will look more favorably at your status.

Debt settlement is another option, but one that carries severe risk. Debt settlement is when a lender agrees to settle an outstanding debt for less than what is owed sometimes significantly less. Some lenders wont deal with debt settlement agencies.

Another negative to consider in a debt settlement is that if some portion of your debt is forgiven or canceled, you may have to report that amount as income and pay the appropriate taxes.

Read Also: What Credit Score For Fha Loan

You Still Owe Your Debts

Considering your account as uncollectable is an accounting term, and it doesnt affect whether you owe the debt. Your lender is still entitled to the full amount owed, though it can only collect until the state-mandated statute of limitations expires. Your card issuer may still decide to pursue the debt in full, and its legally entitled to do so.

What If The Creditor Wont Budge

This situation is entirely possible and can certainly take the wind out of your sails. That said, you should still make an effort to repay the debt, as having a paid charge-off is much better than an unpaid one on your credit report. If the creditor wont settle or remove it, however, it will remain on your report for seven years.

Also Check: How Long Does Chapter 7 Stay On Credit Report

Is The Debt Past Its Statute Of Limitations

Ask the creditor for the last payment date noted on the account. Legally, theyre required to answer honestly if they know. If the debt is older than the statute of limitations in the presiding state, a debt collector can no longer sue you in court for repayment. However, in many places, debt collectors can still try to collect on old debts beyond the expiration of the statute of limitations and the account will still be reported on your credit report for seven years.

Consumers can ignore collection efforts and threats at this point, but creditors are free to try to collect old debt, says Sullivan.

Ultimately, if the charge-off account does belong to you, youre legally responsible for paying the debt. Some collectors agree to settle for a reduced amount, and you might decide to pay the settlement amount. Its best to consult with a debt attorney about the options available to you at this point.

When To Negotiate With A Creditor

This likely won’t work if the charged-off account belongs to you and all the information being reported about it is accurate. In that scenario, you could try negotiating with the creditor or debt collector to update or remove the charge-off account from your credit file. This is called “pay for delete,” and essentially you’re asking for the account to be removed from your credit reports in exchange for a fee.

Pay for delete arrangements are legal under the Fair Credit Reporting Act, but there are a few things to know. First, creditors aren’t obligated to honor your request and remove charge-offs from your credit. So while you can ask for a pay-for-delete, there’s no guarantee that a creditor or debt collector will agree to it.

Second, if they do agree, you’ll likely need to pay the account in full. However, if an account has been delinquent for some time, the creditor may be willing to accept a settlement in which you pay less than the full amount. Either way, you’ll almost certainly have to pay something toward the debt.

Read Also: How Does Credit Score Work

If The Debt Is Accurate And Unpaid Try Paying It Off

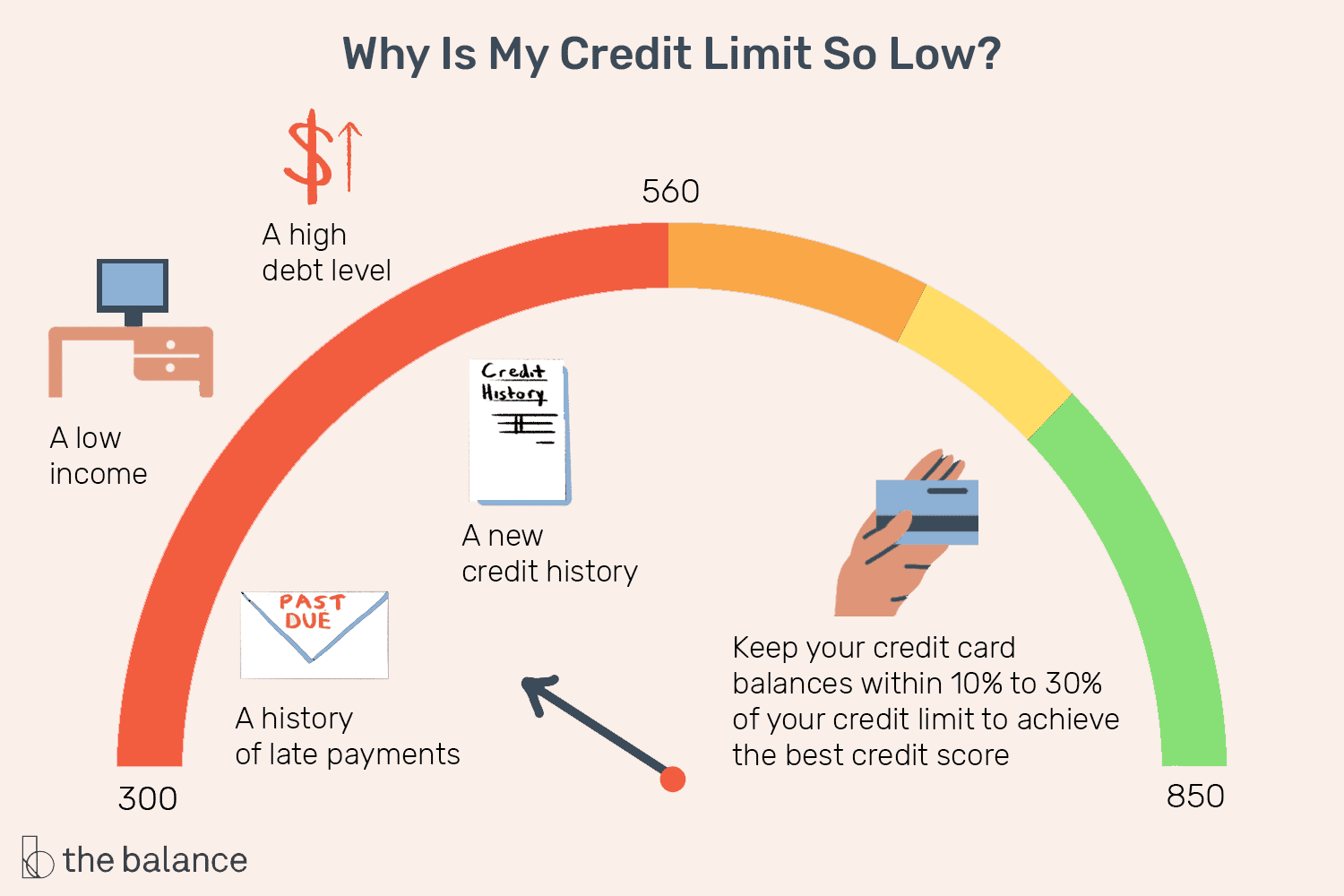

A valid charge-off account that remains on your credit report can result in a bad credit score. A paid charge-off wont have as much of a negative impact. And some credit scoring models, like VantageScore, dont penalize a consumer’s score as much for older or paid-off charge-off accounts.

You can pay the full balance all at once or in installments. Another option would be to settle for a lower amount. Paying the account in full looks better on your credit report than settling, but doing something about a charge-off is better than keeping an unpaid charge-off on your credit.

How Long Does A Charge

The biggest knock against your credit score is when you accrue late or missed payments, and every one of those stays on your credit report for seven years. Every month a payment is missed, your score will go down. Considering a charge-off occurs after six months of past-due payments, your credit score will already be significantly damaged by that point. The additional negative mark will cause your credit score to decrease yet again, but it will also become a major red flag to anyone who views your credit report. For example, a credit card company will use the information to determine whether to approve a credit card application. The exact number of points your score will decrease depends on the scoring system the credit reporting agency uses, such as FICO Score or VantageScore.

Read Also: Does Your Credit Score Drop When You Check It

What If You Don’t Pay Your Charge

If you choose not to pay the charge-off, it will continue to be listed as an outstanding debt on your credit report. As long as the charge-off remains unpaid, you may have trouble getting approved for credit cards, loans, and other credit-based services (like an apartment.

The creditor or the assigned debt collector can pursue you for an unpaid charge-off indefinitely. They can do this by calling, sending letters, and updating your credit report. As long as the debt is within your state’s statute of limitations, they can even sue you for the debt.

When You Can’t Get Your Way

If your negotiation fails, and you cant get the creditor to budge, decide whether you want to pay the account or not. Even though the account will continue to be reported as charged off until the credit reporting time limit is up, it will affect your credit score less as time passes. However, some lenders will not grant you new credit or loans until youve taken care of all past-due accounts. So, if you plan to get a mortgage or auto loan in the next seven years, its better to pay the account. Once its paid, make sure your credit report reflects the payment.

Don’t Miss: Which Gives Credit To Sources In A Research Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Recommended Reading: Is 686 A Good Credit Score

How Does A Charge

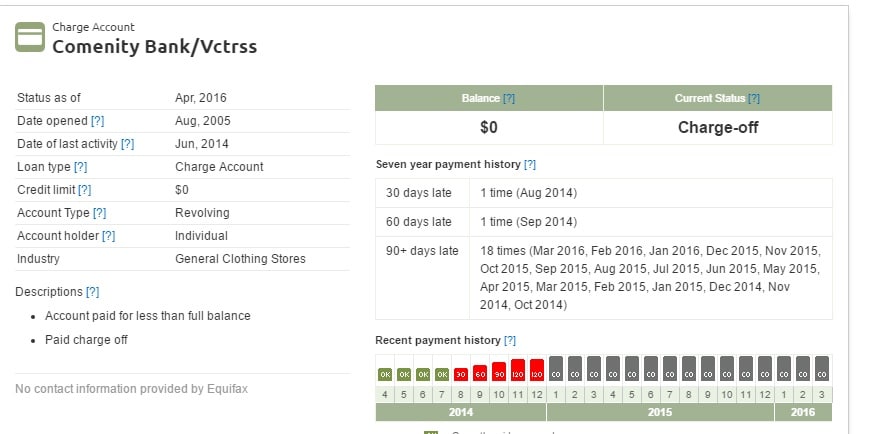

Once the creditor writes off your account, it may report the account as charged off to the credit bureaus, which translates as a derogatory mark on your reports.

This derogatory mark can stay on your reports for up to a seven-year period from the date of the first payment you missed.

The creditor may have sold your account to a third-party collections agency if the debt was unsecured. In that case, the account could also appear as an account in collections on your reports.

If this happens, your may dip, and it may be more difficult to qualify for credit or get competitive interest rates.

What Does A Charge

If the creditor subsequently sells your debt to a collection agency, the balance due on the charged-off account will change to zero, but the charged-off account will remain on your credit report for seven years. At that point there’s nothing you can do to remove it unless you can prove the entry is inaccurate.

Note that a charge-off does not mean your debt is forgiven. You are still legally responsible for repaying the outstanding amount. As long as the account entry is designated as a charge-off and displays an outstanding balance, you can contact the creditor to make payment. Doing so will change the account designation from “Charge-Off” to “Paid Charge-Off.” The listing will still remain on your credit report for seven years. Paid charge-offs are still considered derogatory entries on your credit report, but some lenders view them as less negative than unpaid charge-offs.

Don’t Miss: What Happens To Your Credit Score When You Get Married

Make A Plan To Pay Off Debt

The best option is to resolve the debt with the original investor. Ideally, you would somehow come into enough money to pay off the debt in full. If this happens, be sure your credit report reflects that the debt was paid in full.

Failing that, you should contact the creditor directly or hire an attorney to negotiate a resolution that both sides can live with.

Know how much a month you can afford before starting this process. Only agree to pay what you can reasonably afford each month. When you are finished negotiating and are satisfied with the agreement, ask to see it in writing and have the creditor/collection agency sign it. Never send money before seeing a signed agreement, especially when dealing with a collection agency.

Often a debt will be sold from company to company. Debt collection agencies can buy and sell debts without notifying you, so make sure you send the payment to the correct company. If you are unsure, you can always request verification that the debt indeed belongs to the company.

When Removing A Charge

If you’ve tried to negotiate with a creditor for the removal of a charge-off but hit a dead end, your only option may be to simply wait it out until the seven-year mark passes. Once that period is up, the charge-off will fall off your credit report naturally and no longer be included in your credit score calculations.

Again, this doesn’t mean that you can ignore the debt altogether. You’re still legally obligated to pay it. At some point, however, the statute of limitations on the debt may expire. When that occurs, debt collectors can no longer sue you to recover the money. The statute of limitations for different types of debt varies from state to state.

Read Also: Is 594 A Good Credit Score

How Do You Remove A Charge

According to Freddie Huynh, vice president of data optimization at Freedom Debt Relief, if a charge-off listed on your credit reports is legitimate, there isnt a whole lot that a consumer can do to remove it.

One thing you can do is try to negotiate with the original lender. If the lender hasnt sold the account, you can offer to pay the debt in full in exchange for the charge-off note to be removed from your reports.

Some debt collectors may offer to remove the charge-off note from your credit reports this is sometimes known as a pay for delete offer. But keep in mind that lenders are required to report accurate and complete information, so any pay for delete service is unlikely to be successful.

Otherwise, you can just wait out the clock. A charge-off should automatically drop off your credit reports after seven years.

Should You Pay Charged

The outstanding balance on a charge-off account is still your debt, and you are legally responsible to pay itto the original creditor or the agency that buys the debt. Furthermore, lenders who see unpaid charge-offs or collections may question your willingness and ability to repay future debts. Some will likely consider any charge-off grounds for declining a credit application, but some lenders will view paid charge-offs more favorably than unpaid accounts.

Recommended Reading: How To Contact Free Credit Report Com

Hire A Credit Repair Company If You Need Help

Although even the best credit repair companies will pretty much do the same thing you can, they may get things done quicker and potentially get better results. These professionals may also have insight into other personal finance strategies that may boost your credit score even more.

The key to working with a credit repair company is proper vetting. Ensure that youre dealing with a reputable service that uses effective, non-fraudulent ways to remove charge-offs from your credit report.

Check sites like the Better Business Bureau, Trustpilot, the Consumer Financial Protection Bureau or Google Reviews to ensure the company doesnt engage in unethical, shady practices around .

A charged-off account is one that your original creditor deems as uncollectible and is written off from their books. Say you’ve fallen behind on your credit card payments and have accumulated a substantial amount of credit card debt. If your credit card issuer determined you’re delinquent, , they can then write it off as bad debt.

Once an account is charged-off, the creditor reports it to the CRAs, which update your credit files. Then, usually, the original creditor will sell this account to a third-party debt collector, which will then contact you to pursue the charged-off debt.