Length Of Credit History

Having a long credit history means you have more experience with credit and debt. The more experience you have with handling debt, the more likely it is that you can handle it well. The longer that credit bureaus have had you on file, the better it is for your score.

Another thing that is considered is the average age of your credit card accounts. Opening and closing card accounts on a regular basis are bad for your credit score. Lenders want to see long-term relationships with other lenders.

Weigh The Pros And Cons

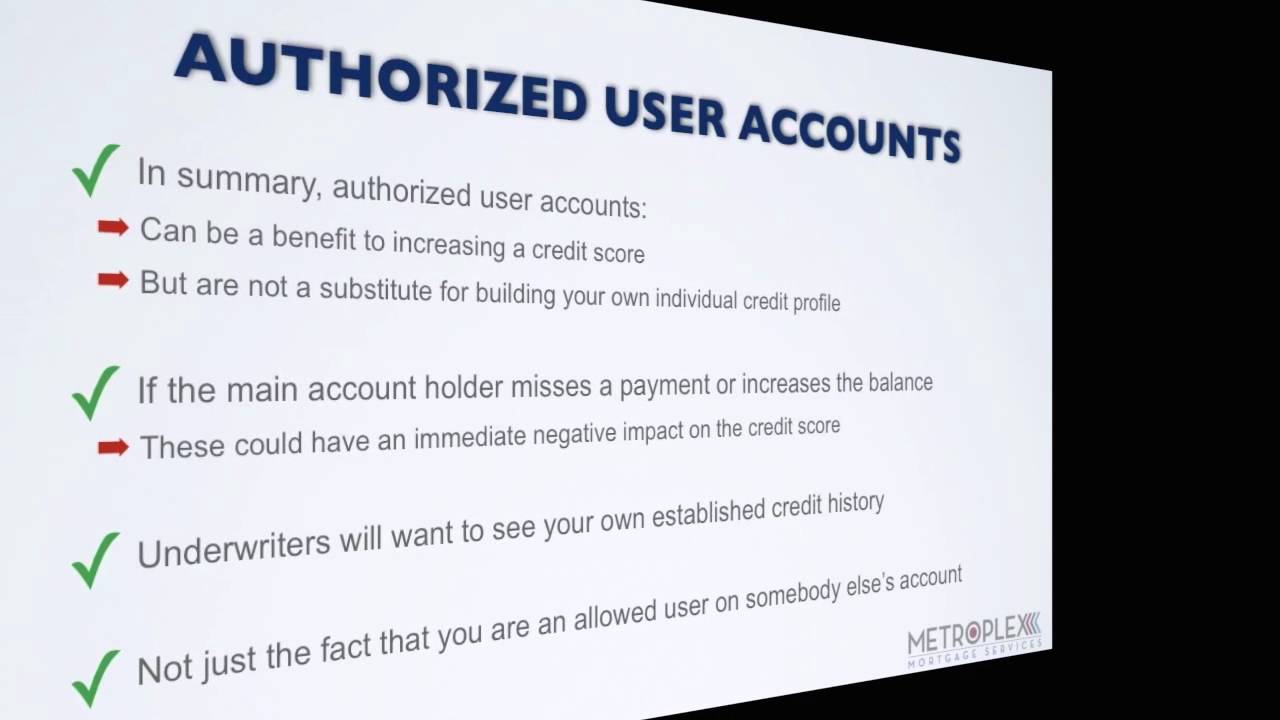

The potential perks of being an authorized user are big, but so are the pitfalls. To avoid disappointment, and jeopardized credit, pick your primary account holder carefully. Then pay close attention to their account usage and payment history. If it’s time to cut ties, know that there are other options for getting started with or improving credit. Removing yourself as an authorized user when necessary is a step toward thoughtful, vigilant financial proficiency.

Are Authorized Users Responsible For Debt

To make you an authorized user, the primary account holder simply adds your name to their credit card account, giving you authorization to use it. As an authorized user, youre not legally responsible to pay the credit card bill or any debts that build up. This is still the primary account holders responsibility.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Getting Added As An Authorized User Can Work For Credit Building

A credit check is not required to become an authorized user on someone else’s card. Yet banks and card issuers will often report the full payment history of the card, including the names of each individual card user, to the three main credit bureaus: Equifax, Experian and TransUnion.

That’s how the authorized user approach serves as a credit building tactic. You don’t need good credit to become an authorized user, but if the bank or issuer reports your card’s full on-time payment history to the credit bureaus, you can begin to build a positive credit history.

Removing Yourself From Someone Elses Account

Even if the primary cardholder wont remove you as an authorized user, you can get yourself removed from the account. The best way to do this is to contact the credit card company and ask that they remove you as an authorized user. If the card company wont do it, you can go through the dispute process with the credit bureaus to get the account removed from your report.

If you do this, make sure to destroy the credit card so you dont accidentally use it to make purchases. You could be guilty of fraud if you make purchases on a card that you are no longer an authorized user of.

Recommended Reading: Does Zzounds Report To Credit Bureau

Removing Yourself As The Authorized User

If you’ve decided to remove yourself as an authorized user, weve outlined two methods that you can follow below.

The easiest method is for the primary cardholders to call their credit card company and tell them they would like to remove you as an authorized user on their account. They must provide your name and the last four digits of the credit card number. Its always wise to follow up with a certified letter with the same information to ensure that the credit card company removes the user.

If you are the authorized user and want to remove yourself, you can use the same method, but you must verify your identity. They may also ask to speak to original cardholder to ensure that you are who you say you are since its someone elses account.

How Do I Build Credit As An Authorized User

How to build your credit as an authorized userRequest to be added: Ask a friend or relative with good credit to add you as an authorized user. Focus on a payment plan: The primary cardholder is responsible for paying the bill, but any missed or late payments will appear on both parties credit reports.More items

Read Also: How To Get A Detailed Credit Report

Is An Authorized User The Same As A Co

While being added as an authorized user is not the same as earning credit card approval through a co-signer, they are both options to start your credit history if you have little to no credit. There are some important differences between getting added to a card as an authorized user or signing up for a card with a co-signer:;

How To Remove Or Get Removed As An Authorized User On A Credit Card

The primary account owner can remove an authorized user at any time. It’s often possible to do so online, but calling is your best bet if you’re unable to find a way to do so on the issuer’s website or mobile app. You may also be able to remove yourself by requesting the change directly with the credit card issuer.

Keep in mind that your credit may be affected after the removal. If it was a card with a long history and you don’t have any other accounts of similar age, or you have little credit otherwise, you may see a drop in your credit score.

You May Like: Does Having A Overdraft Affect Credit Rating

How Does Adding An Authorized User Affect My Credit

If you’re an authorized user on someone else’s card, it may or may not affect your credit. Whether it does will depend on whether the card issuer reports your activity to the credit bureaus and whether any of the credit bureaus count your activity as an authorized user toward your credit score. If it is counted, then your account activity, as well as the primary user’s activity, will have an impact depending on whether it’s positive or negative activity.

Tiffany Raised Her Credit By Adding An Authorized User

Description: Tiffany a 25 year old was approached by her younger brother about adding him as an authorized user. She already had good credit and he did not have any. Knowing her brother was trustworthy, she added him in June 2018. As you can see by the timeline, because of adding him, her score rose 25 points in three months. Here is how.

| Factor |

|---|

You May Like: How To Have Collections Removed From Credit Report

What Is A Credit Score

A credit score is a numerical representation of someones trustworthiness when it comes to borrowing money. A high score means lenders can trust you to pay back any loans you receive.

Usually, when someone talks about their credit score, theyre referring to their FICO score. FICO scores were first introduced in 1989 by Fair Isaac Corporation. Today, there are three companies, TransUnion, Experian, and Equifax, that track consumers FICO scores. These as needed.

How To Add An Authorized User To Your Account

To add an authorized user, youll need to contact your credit card issuer. They typically ask for the personal information of the one you are adding such as their name, birth date and Social Security number. Once the process is finalized, you can request for the new user to receive a card of their own.

Don’t Miss: Will Paying Off Collections Help My Credit Score

What To Consider When Becoming An Authorized User

You should first consider your reasons for being an authorized user. If your goal is to build credit, you should work towards building your own credit and only use this as a stepping stone. Make sure you handle your own credit and that of the primary account holder responsibly.

Look at the account as temporary assistance rather than counting on it for the long term. It will have less of a negative impact when youre removed if you have built up your own credit profile.

Make sure you know the person well and trust them before being added to their account. Set ground rules about your role. Are you responsible for making payments or will you be expected to pay off the balance as it comes due? Both of you should be on the same page as to how you will handle credit.

Becoming an authorized user on an account is one way to help a person begin to build their credit history. However, it is not without some risks and challenges. Be prepared to deal with these so that you can reap the benefits.

How To Remove Yourself As An Authorized User

If you discover the primary cardholder isnt making on-time bill payments, you may decide that cutting ties is the best way to go.

and ask to have your name removed as an authorized user.

It should take only a few days, and the issuer will cease making reports under your name to credit bureaus.

At some point, that account should vanish from your report entirely. Just remember that doing so removes both good and bad information from your credit report.

» MORE: Should you make your teen an authorized user on your credit card?

Don’t Miss: Which Business Credit Cards Do Not Report Personal Credit

Do Authorized Users Build Credit

An authorized user builds credit when the credit account holder maintains responsible credit habits that help a credit score grow, such as making on-time payments and paying off balances in full. If youd rather not take out a secured credit card, you can also look into credit cards for people with low credit scores.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: What Credit Score Do You Need To Refinance Your House

Which Banks And Issuers Offer Joint Credit Cards

This type of credit card is relatively uncommon because issuers prefer to have just one user ultimately on the hook for an account. That noted, there are three players offering joint credit cards today:

- PNC Bank: Some applications have a dedicated section for a co-applicant, who will need to provide the basics: date of birth, Social Security number, phone and email address.

- U.S. Bank: Once you’re a cardholder, you can call U.S. Bank at 800-285-8585 and ask customer service to add a joint owner. They’ll send you a form you’ll both need to fill out and sign. If approved, your partner will receive a card in their name.

- : Many credit unions offer a joint credit card, including Veridian, AllSouth Credit Union and Credit Union of Denver. Contact your local branch to learn more.

Signs You Should Remove Authorized Users From Your Credit Card

It’s generous to let your loved ones piggyback on your good credit and make purchases on your credit card, but you might not want to do it forever. Sometimes, dropping authorized users from your account just makes sense.

“It’s not only financial. It’s emotional,” says Richard Rosso, a financial planner at Clarity Financial in Houston. “It’s a very delicate dance between the primary cardholder and the authorized user.” When managing multiple cardholders becomes more trouble than it’s worth, you may want to take a few off your account.

Here are four signs it might be time to drop authorized users from your card.

1. They constantly overspend.

Suppose you’ve added your college-age kids as authorized users, but they spend too much month after month. This could strain your budget and hurt your credit utilization ratio, or the percentage of your credit limit you’re using. Your credit scores — and your kids’ credit scores — may take a hit.

What to do: First, talk with your kids about how much monthly spending is OK, if you haven’t already. Put an agreement in writing or set limits for different users online if your issuer offers this feature. With some banks, you may also be able to set up text and email notifications to notify you of spending on the account.

2. You’re splitting up.

3. You’re having financial problems.

What to do: Tell your loved ones that you’re taking them off your card so they know what to expect, and then do it.

4. They are financially independent.

Don’t Miss: Why Has My Credit Score Dropped

How Do I Remove Someone From My Credit Card Account

If the other person is an authorized user and you’re the primary cardholder, all you need to do is call the credit card company and ask it to remove the user from your card account. If the other person attempts to use the card after they’re removed from the account, the card will be declined.;

If you are joint credit card holders, removing someone from your credit card is harder. Both account holders must agree to close the account. Before you can close the card, the issuer will require you to pay off the balance. Keep in mind that closing a joint card could affect your credit score since you’re reducing the amount of available credit you have.;

How Can I Add An Authorized User To My Account

Adding an authorized user to your card is usually quick and easy. It might even seem too quick and easy, but that can be true for regular credit card applications too.

You can add additional users to your account at any time, for cards that allow it. Some credit card companies will even let you add authorized users during your initial account application.

We have a set of specific instructions for adding authorized users for each card issuer.

To add an authorized user, just log in to your online account and find the appropriate link. It will probably say something like:

- Authorized Users

- Social Security number

- U.S. citizenship status

- Relationship to primary cardholder

After inputting the required information you can submit your request. The card issuer may approve your request instantly, or it could take some time to verify the identity of the authorized user.

Soon after, either you or the authorized user will receive a new card in the mail. It will need to be activated just like any other card.

Once you add an AU youll be able to set spending limits for that account, if the issuer offers this feature.;Youll typically be able to monitor an authorized users activity, such as by filtering transactions to show which accounts made which purchases.

Some credit card companies may have certain requirements for authorized users, while others may not. American Express, for example, requires additional users to be at least 13, unlike most other issuers.

Also Check: Will Increasing Credit Limit Hurt Score

How Being Added As An Authorized User Can Hurt Your Credit Score

Just as your credit score is affected by the primary users positive history, its also affected by any negative activity. For instance, if the primary account holder fails to make a payment, maxes out their credit limit, or otherwise engages in negative behavior, the authorized users credit score will also be affected.

While it will most likely hurt them more than you, it still damages your credit rating. If youre trying to build or rebuild credit, you could potentially end up doing more harm than good.

Similarly, your actions in using the credit card also impact the account holder. If you charge a bunch of stuff to your credit card, they are ultimately the one responsible for paying the balance.

You may not even be aware of the balance or the impact of your credit card spending spree because the statement goes to the primary account holder rather than you as the authorized user.

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to;this top balance transfer card;secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt.;Read The Ascent’s full review;for free and apply in just 2 minutes.

Recommended Reading: Do Loans Affect Your Credit Score

Total Debt & Debt Utilization Ratios

One area where you can see the difference is in relation to total debt and debt ratios.

As an authorized user, the credit card account doesnt count against you when lenders calculate how much debt you owe to be approved for a loan. With a joint account, the payments and balance count against you and could reduce the amount youre approved for.

What Improves Your Credit Score

Before you can start to work on your credit score, you need to know the proper steps to take that will help you see an increase in your credit score.

We talked with Credit Sesame member, Tiffany, to find out how she raised her credit score by adding her brother as an authorized user. Below is a timeline that shows how her score improved 25 points in just 3 months.

You May Like: How Long Should A Bankruptcy Stay In The Credit Report

How To Get Added As An Authorized User

Ideally, you will find a close relative with excellent credit who is willing to add you as an authorized user.

In order to get added as an authorized user on someone else’s credit card, the cardholder will need to contact their bank or card issuer and request that you be added to their card account. They will need to provide some basic information to confirm your identity, as well as your name, Social Security Number, date of birth and contact information.

If the cardholder’s request gets approved, you will receive a credit card with your name on it that is connected to the original cardholder’s account. That person may opt to set spending limits on your card, depending on whether the bank allows it. Be sure to work with the main account holder so that you can be aware of any rules regarding card usage and specifics regarding payment reimbursement.