Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

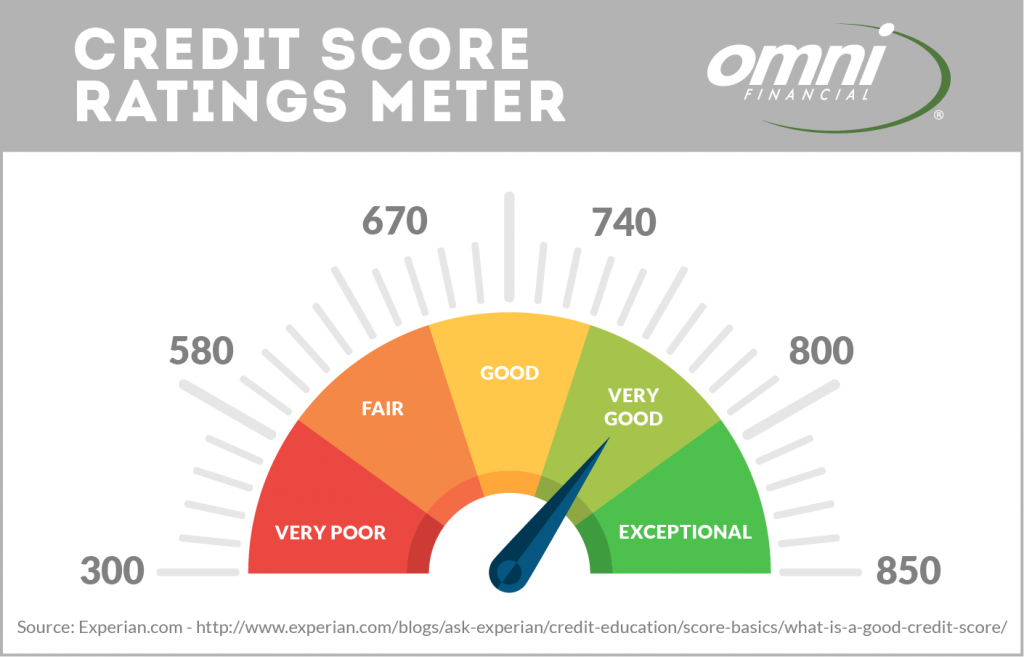

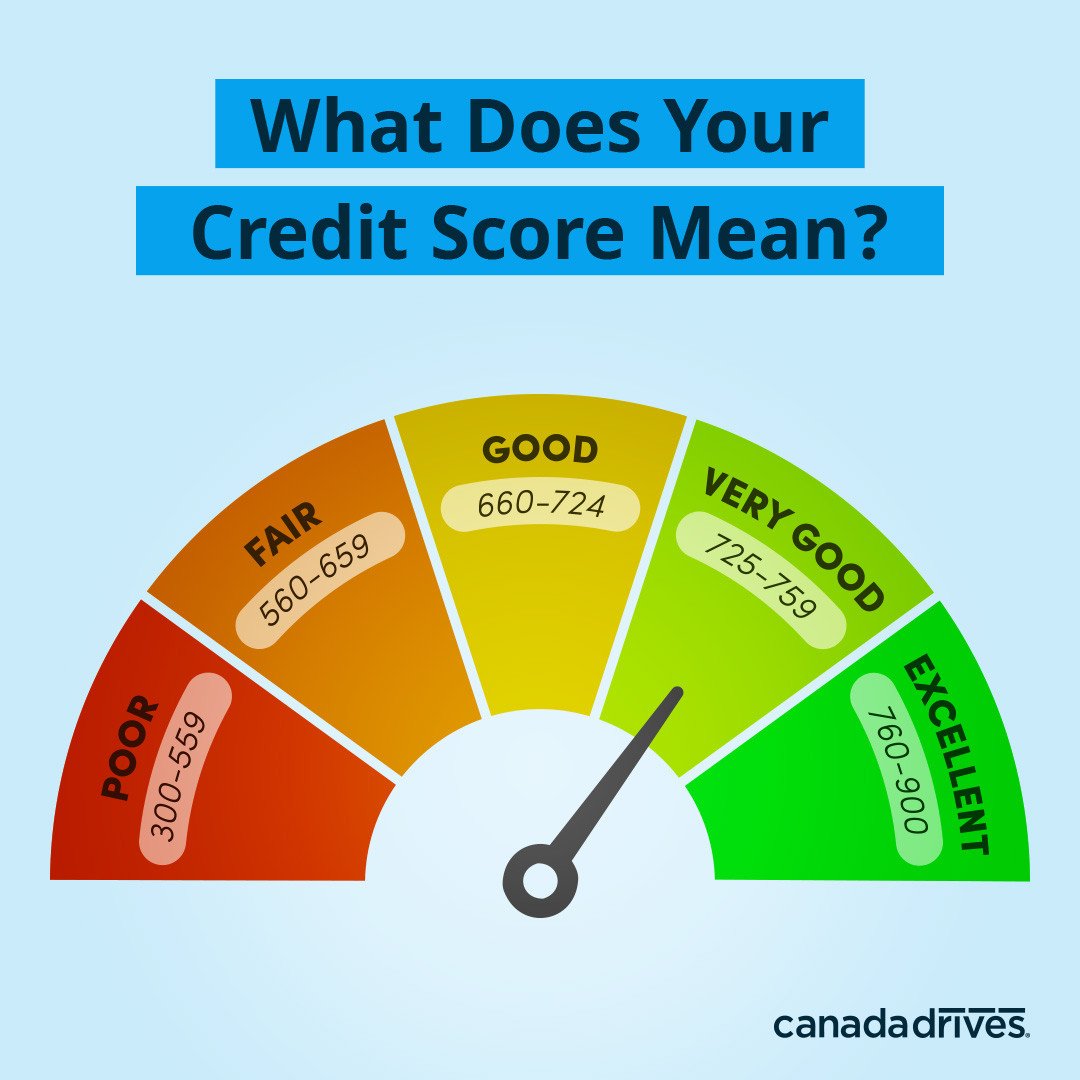

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, there is a minimum credit score youll likely need to buy a house.

What Is The Best Way To Improve Your Credit

Here are 10 ways to improve your credit report: Check your credit report regularly. Refuse any inaccurate information that appears on your credit report. Pay your bills on time every month. Avoid debt. Consider a secured credit card. Diversify your loan portfolio. Keep your old credit account active.

Also Check: Unlock My Experian Credit Report

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

Sure You Can But Holding Onto It Can Be Fleeting

You may have been able to check your credit score lately using a number of free services including from your bank or mortgage lender. But, what good is knowing your FICO score if you dont understand what the number means on the overall reporting scale? Maybe you have a 740 FICO score. If the maximum score is 750, youre pretty much a credit genius. If the max is over 1,000, youre sporting a C averagenot really all that impressive.

So what is the highest credit score possible, and how do you achieve it?

Also Check: Carmax Financing With Bad Credit

How Good Should My Credit Scores Be

To buy a house?A 2019 Credit Karma report found that the average VantageScore 3.0 credit score that first-time homebuyers needed to buy a house in the U.S. was 684 which is at the lower end of the good credit range. But credit requirements vary depending on your state .

To rent an apartment?Prospective landlords may run a credit check before you can sign a lease, but theres no single credit score benchmark you need to hit to be able to rent an apartment. It can depend on the factors the landlord is looking for in a tenant, as well as where youre looking to rent.

To get approved for a credit card?Its possible to get approved for a credit card with poor credit or even no credit at all. Once you know what range your credit scores fall into, you can research cards that suit you and your goals.

If you have no credit, look for secured cards or cards for beginners . If you have limited or poor credit, secured cards or cards advertised for building or rebuilding credit could be a helpful leg up. Once youve improved your credit, you may be able to qualify for more-enticing offers, such as rewards cards or balance transfer cards.

Good credit scores can mean better terms, but its still worth comparison shopping.

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Also Check: Remove Repo From Credit

How Is Fico Different From Vantagescore

Aside from FICO, there’s an entirely separate credit scoring model, called the VantageScore®, which the three major credit reporting agencies released together in 2006. The average VantageScore, according to recent Experian data, is 680.

There are several differences between the FICO and VantageScore models. You could have a VantageScore with just one line of credit to your name, even if it’s less than six months old, for instance. But you won’t have a FICO® Score if you don’t. Plus, a good VantageScore starts at 700, as opposed to 670 on the FICO® Score range.

The two scoring models also differ in the ways they weight certain financial behaviors. The latest VantageScore version is more similar to FICO® Score 9 than FICO® Score 8, which is still most widely used: It doesn’t factor in paid collection accounts and reduces the impact of medical collections on credit scores. VantageScore also considers your historical credit utilization, such as how frequently you pay off your balances in full, rather than capturing it only as a snapshot like a FICO® Score does.

What Is A Bad Credit Score

Based on the FICO® Score range of 300 to 850, a credit score below 669 is considered to be either fair or bad. Lenders often refer to this group as “subprime,” which indicates borrowers who may have a hard time repaying a loan.

A bad credit score can be compared to a bad grade in school, a failing grade on a driving test, or getting bad results for any other type of assessment that uses a numerical ranking to judge performance. Getting the news that your credit scores might be less than stellar can be disheartening, but the good news is you are not stuck with your bad credit scores. Make improvements to a few key credit management habits, and over time, your score will improve.

Don’t Miss: How Many Years Does An Eviction Stay On Your Record

How Does It Work

Although there are many different , your main FICO score is the gold standard that financial institutions use in deciding whether to lend money or issue a credit card to consumers. Your FICO score isnt actually a single score. You have one from each of the three credit reporting agenciesExperian, TransUnion, and Equifax. Each FICO score is based exclusively on the report from that credit bureau.

The score that FICO reports to lenders could be from any one of its 50 different scoring models, but your main score is the middle score from the three credit bureaus, which may have slightly different data. If you have scores of 720, 750, and 770, you have a FICO score of 750.

A perfect score of 850 will give you bragging rights, but any score of 800 or up is considered exceptional and will give you access to the best rates on credit cards, auto loans, and any other loans.

Make Sure There Are No Negative Marks On Your Credit Report

Even if youve never missed a payment, there could be illegitimate negative marks on your credit reports. Be sure to check your Transunion and Equifax credit reports for free from Credit Karma and make sure there are no errors.

If you find incorrect marks on your reports, you can dispute them. Upon receiving a dispute, the credit-reporting companies are required to investigate and fix errors in a timely manner.

Even if you have legitimate negative marks on your credit reports, they will affect your scores less over time and should eventually fall off your reports completely.

Read Also: How To Self Report Utilities To Credit Bureaus

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

How Does High Credit Affect Credit Score

In many cases, high credit doesnt come into play. For the most part, the highest balance youve had on a credit card is only considered when your credit limit is left off your credit report. In that case, your high credit amount will be substituted for your credit limit using the FICO scoring method. And thats where things get messy.

Imagine for a moment you have a credit card with a $20,000 limit, which you used to pay for $4,000 in new home appliances several months ago. Youve been able to pay off $1,000 of the balance since then, but you still owe $3,000. If your high credit amount of $4,000 were listed on your credit report as your credit limit, your current utilization on this credit card would be 75 percent using the following formula:

Current credit card balance / high credit = utilization

This is far from reality since your utilization would be significantly lower if your actual credit limit were being considered. In that case, your utilization would only be 15 percent.

Since credit reporting agency Experian recommends you should strive to keep your utilization on individual accounts below 25 to 30 percent, its no wonder high credit could damage a credit score in the scenario above. Experian also notes that consumers with the best credit scores keep their utilization below 10 percent in most cases, so thats something to keep in mind.

Read Also: Usaa Credit Score Free

Tips To Manage Your Credit Utilization Percentage

To manage your credit utilization, especially if your credit cards get a good workout each month, one of the easiest things to do is to set up balance alerts that notify you if your balance exceeds a certain preset limit. Besides keeping an eye on your balances, you can take a number of other steps:

Pay Your Bills On Time

The frequency of your on-time payments is the factor that influences your scores the most.

Setting up automatic payments on your credit card bills can be a helpful way to avoid forgetting a payment, but make sure you have enough money in your accounts to cover automatic payments. Otherwise, you may have to pay fees.

Read Also: Aoc’s Credit Score

What Is A Good Credit Score To Avail Of A Home Loan

To avail a home loan, you need to ensure that you have a CIBIL score at least above 650. Since a home loan is a secured loan, lenders have the option of seizing your home if you are unable to repay the loan. This is why a slightly lower credit score is allowed. However, it is in your best interest to maintain a good credit score so you can get a larger loan amount at nominal interest

You can maintain a good CIBIL score by following these simple steps:

- Pay your EMIs on time to create a proper track record

- Avoid having a credit card that you dont use cancel dormant credit cards

- Manage your credit cards carefully by setting payment reminders or limit your use to one credit card

- Avoid re-applying for loans or credit cards that you did not get approved for in quick succession

- Dont make too many loan applications in a short span of time

- Choose lengthy loan tenors with care and try to make part-prepayments when you can

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Recommended Reading: Check Credit Score Without Social Security Number

Does Removing Hard Inquiries Improve Your Credit Score

Yes, having hard inquiries removed from your report will improve your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

How Do You Build Up Your Credit

Here are four ways to increase your credit with a credit card: Open your first credit card account. Have a secured credit card. Open a shared account or become an authorized user. Request an increase in your credit limit.

Credit score for home loanWhat is an acceptable credit score to a home loan?740 to 850: good670-739: fair or acceptable580 to 669: below average or weak300 to 579: badWhat is the perfect CIBIL score for a home loan?The ideal CIBIL score for home loans is 750 or higher. This score is excellent and will keep your chances of admission and recognition up to par. This is a testament to your dedication and financial preparation.

Recommended Reading: Is 524 Credit Score Bad

Student Loan Balances Saw Highest Increase

- 14% of U.S. adults have a student loan.

- The average FICO® Score for someone with a student loan balance in 2020 was 689.

- The percentage of consumers’ student loan accounts 30 or more DPD decreased by 93% in 2020.

Student loan balances saw the most significant spike in 2020, with consumers’ average debt growing by 9%. Much of this is attributable to the suspension of federal student loan repayment that was included in the CARES Act and subsequently extended through January 31, 2021. With fewer people actively paying down student debt, average balances will grow as others add new loans.

Student loans saw delinquency rates plunge, with the percentage of accounts 30 or more DPD decreasing by 93% in 2020. It’s important to view this number in context, however, as the automatic accommodations put in place obviously played a major role in the drop.

The CARES Act paused all federal student loan repayment, effectively placing these accounts in limbo. While paused, student loan accounts are being reported as current, although no payments are required. Once repayment begins, delinquencies may begin to climb again.