Get Started Today With A Free Online Credit Report Consultation

- FREE Credit Score

loading…

By clicking “Submit” I agree by electronic signature to: be contacted about credit repair or credit repair marketing by a live agent, artificial or prerecorded voice and SMS text at my residential or cellular number, dialed manually or by autodialer, and by email and the Privacy Policy and Terms of Use .

Better Credit Card Offers

High-qualified borrowers with credit scores of at least 800 can qualify for the best 0% APR credit cards. These cards come with interest-free periods that last for up to 21 months on balance transfers and purchases. As long as you repay the balance in full before the promotional period expires, you can avoid interest payments.

Additionally, youll likely qualify for some of the best travel credit cards. Some of these cards come with generous travel bonuses after you reach their minimum spending requirements.

Why Experts Say 760 Is The Credit Score To Aim For

While it might be exciting for some to aim to join the 850 club, it comes with no additional benefits that you likely won’t already get with a 760 score.

“The best published interest rates for auto loans are 720+ and for mortgages 760+,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “As such, I always tell people, shoot for 760 or better. That way, they’re safe for all loan types and cards.”

For Jim Droske, president of the credit counseling company Illinois Credit Services , the threshold is 760 as well. But he says aiming for 780 is even better to be “the safest” in any type of lending situation. Anything higher, though, won’t be more beneficial, nor would it get you a better offer with more favorable terms.

“If you’re above 760, or 780, certainly you’re already getting the best you can get,” Droske tells CNBC Select. “You’re already hitting that pinnacle of what care about.” A high enough credit score shows lenders and credit card issuers that you are less of a risk and more likely to pay back the loan, versus if you had a lower credit score.

“Anything above that is really just maybe a little pride,” says Droske. “When you have already reached the summit, no need to look for a ladder.”

Don’t Miss: Does Affirm Pull Your Credit

How To Get An 800 Credit Score

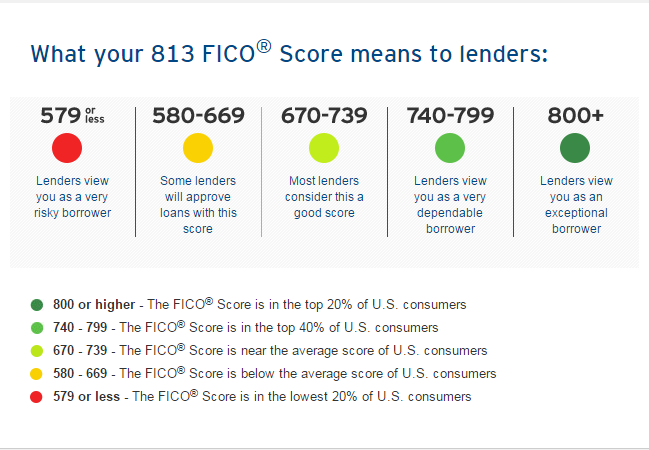

According to the Fair Isaac Corporation, the creator of the FICO scoring system, the average consumer credit score hovers around 700, which is considered a good score. Anything that falls between 740 to 799 is very good, and anything above 800 is considered exceptional. But not many people reach the exceptional range. Only a little over 20% of consumers ever earn a score of 800 or higher.

Why? People with 800 credit scores use credit differently than the vast majority of credit users. Sure, they do some of the same things you do: never miss a payment, try to keep their credit utilization low, and scan their credit report for errors. However, they are much more zealous and use different thresholds for success than the average consumer.

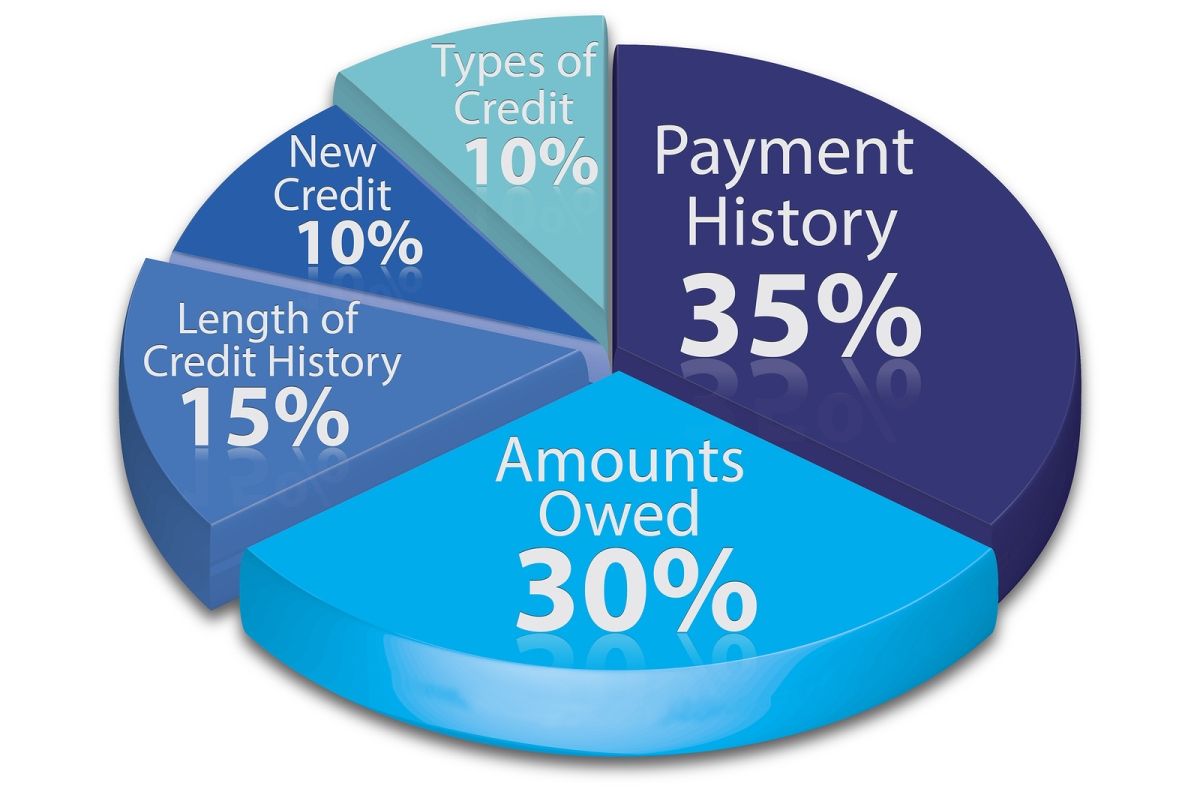

Keep Your Credit Utilization Rate Low

The second most important credit score factor behind payment history is your it accounts for 30% of your credit score. Your credit utilization ratio measures the amount of credit you use vs. your total credit limit. If your total credit limit is $10,000, aim to use no more than 30% of it$3,000. To boost your credit score, keep your ratio closer to 0%, if possible.

Don’t Miss: Does Opensky Increase Credit Limit

Avoid Making Too Many Credit Inquiries

Even though it may seem like making hard inquiries doesn’t have much impact, it can still make the difference between a score of 800 and a 780.

As such, it’s better to be fully prepared when applying to apply for a credit card or loan to get it done in one shot and avoid making multiple inquiries.

Monitor And Protect Your Credit

Its essential that you regularly monitor your credit reports to ensure there is no wrong information on them that might ding your credit score and if there is, make sure you dispute any errors. Consider enrolling in a credit monitoring service that will alert you when anything changes on your credit report. You can also order free copies of your credit reports from AnnualCreditReport.com to make sure they contain completely accurate information.

In addition, you can sign up with an identity theft protection service, which will alert you anyone tries to make changes to your address, orders new services or applies for payday loans. Check out the Federal Trade Commissions advice regarding identity protection services to learn more.

More From GOBankingRates

You May Like: Credit Score For Apple Card

Age Of Your Credit History

Another factor weighed in your credit scores is the age of your credit history, or how long your active accounts have been open.

Canceling a credit card can affect the age of your credit history, especially if its a card youve had for a while, so weigh that potential impact when youre deciding whether to close a card. Only time can offset the impact of closing an older account, but youll also lose the credit limit amount on a closed card, which can negatively affect your credit utilization rate.

Heads up that card issuers may decide to close your accounts if youre not actively using them, so make sure you keep any accounts you dont want closed active with at least an occasional minimal purchase.

Always Review Your Credit Reports And Credit Score

One thing you must always do is to keep tabs on your credit reports and credit score. You dont want to do everything right, only to discover that your efforts dont reflect on your credit score report. A report by the Federal Trade Commission showed that 1 in every 5 consumers get an error on their credit report.

Checking your credit score is easy with the numerous free credit scoring websites available. With some of these websites, you get more than just your credit score progress. They give recommendations and tips on how you can increase your credit score.

Typically, your credit score is calculated from your credit reports, listed on the credit bureaus. Reviewing these reports helps you ascertain they are accurate and that the credit-scoring agencies get the correct information. Inaccurate data, such as an indication of late payment, can hurt your credit score.

If you want to check your reports for free, you can visit AnnualCreditReport.com.

Read Also: Kroll Factual Data Complaints

How Long Does It Take To Improve An Exceptional Credit Score

Once you get to an exceptional credit score, your primary focus will be to maintain your score, not necessarily improve it. As weve previously mentioned, an 800 credit score is essentially a perfect score. An increase from 800 to 850 likely wont result in much of a difference in loan approvals, loan rates or loan terms. Instead, youll want to do everything in your power to stay at this credit range and not go down.

How Good Is A Credit Score Of 750

Youre still well above the average with a 750 credit score, and you wont have trouble opening a credit card or getting a loan. Most lenders consider a 750 credit score to be in the very good range, which is a single step below exceptional.

A 750 score isnt something to worry about, but you may want to work on pushing your score into the 800s. Borrowers with scores in the 800s get the absolute best interest rates and credit card offers. It can be worth the extra effort to improve your score if you want the best of the best. Its usually not difficult to boost your score from 750 to 800. Keep making your payments on time, manage your bills and youll see results.

Read Also: Are Apartment Credit Checks Hard Inquiries

Avoid Hard Inquiries Into Your Credit Score

A hard inquiry into your credit scores comes from financial institutions when you are inquiring about a new credit facility, such as a mortgage, auto loan, or credit card. If a landlord checks your score, then the bureaus do not consider this as a hard inquiry.

If youre considering about taking on new debts, then shop around for the best rates, and make a list of your preferred providers. Start with the first lender on your list, and wait for their decision, before moving onto the next.

This strategy reduces inquires into your credit report, improving your FICO score.

Monitor Your Credit Report

Your credit report gives you insight into your current state of creditworthiness. Use the information in this article to regularly check in on your credit report.

Since the three credit bureaus allow you to obtain a free credit report once a year, stagger out your request every four months. This strategy will enable you to keep tabs on any new collections or mistakes on your statement.

There are private companies that also allow you to receive a free report on your FICO score as well. Try using creditsesame.com, creditkarma.com, wallethub.com, to get an update on your latest score. Make use of government and financial agencies such as annualcreditreport.com, and myfico.com as well.

If you notice any errors on your report, contact the bureaus immediately, and start the dispute process to clear your credit report. Using this strategy, you minimize any damage to your financial health while giving yourself a roadmap to follow to maintain your credit score.

Recommended Reading: Can Landlord Report To Credit Bureau

You’ll Receive Better Credit Card Offers

You don’t need perfect credit to get a credit card when you’re young they hand them out like candy but the higher your credit score, the more perks you’ll get. Some people with low credit scores can only qualify for secured credit cards, which require a security deposit. But as your credit score improves and you hit the 800 mark, you’ll qualify for some of the best credit cards around. These might include features such as unique rewards programs, concierge service, and other high-end benefits and unique perks just for proving you know how to manage credit.

Protect Your Exceptional Credit Score

People with Exceptional credit scores can be prime targets for identity theft, one of the fastest-growing criminal activities.

85% of identity theft incidents involve fraudulent use of credit cards and account information.

A credit score monitoring service is like a home security system for your score. It can alert you if your score starts to slip and, if it starts to dip below the Exceptional range of 800-850, you can act quickly to try to help it recover.

An identity theft protection service can alert you if there is suspicious activity detected on your credit report, so you can react before fraudulent activity threatens your Exceptional FICO® Score.

Don’t Miss: Open Sky Increase Credit Limit

What It Means To Have A Credit Score Over 800

Is 800 a good credit score? Having a credit score over 800 isnt just goodaccording to the FICO credit scoring system, its exceptional. Although both the FICO and VantageScore credit scoring systems go all the way up to 850, you actually dont need to hit 850 to reap the same benefits as those with a perfect credit score.

If you have an 800 FICO score, you have an extremely positive credit history. There are no missed payments or to lower your credit score from its exceptional ranking. Its likely that you have been using credit successfully for many years, and you probably have a healthy mix of credit accounts that includes both revolving credit and installment credit . In short, you are the ideal credit consumerresponsible, financially savvy and unlikely to default on your credit obligations.

Essentially, having a credit score over 800 means that there isnt anything else you can do to make your credit score better. All you can do now is maintain the healthy credit habits that got you your 800+ credit score in the first place.

Ways Life Is Amazing With An 800 Credit Score

Disclaimer: This site contains affiliate links from which we receive a compensation . But they do not affect the opinions and recommendations of the authors.

Wise Bread is an independent, award-winning consumer publication established in 2006. Our finance columns have been reprinted on MSN, Yahoo Finance, US News, Business Insider, Money Magazine, and Time Magazine.

Like many news outlets our publication is supported by ad revenue from companies whose products appear on our site. This revenue may affect the location and order in which products appear. But revenue considerations do not impact the objectivity of our content. While our team has dedicated thousands of hours to research, we aren’t able to cover every product in the marketplace.

For example, Wise Bread has partnerships with brands including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi, Discover, and Amazon.

You may think an 800+ credit score is out of reach given that only 18.3% of consumers have scores that high but it’s possible if you know how to manage your credit.

Also Check: Klarna Credit Approval Odds

What Percentage Of The Population Has A Credit Score Over 800

In April 2018, about 21% of the population had a credit score between 800-850, which represents the higher echelons of credit score possibilities.

However, that doesn’t mean that most Americans don’t fall into those “upper ranges.” In fact, by 2020, 69% of Americans had a “good” credit score at 670 or above. Americans have worked to get their credit into a better position than last year and even increased their scores three percentage points compared to last year.

How’d they do it? reduced by 14% last year and credit utilization also dropped 3.5%, to 25.3% in 2020.

So Is An 800 Score Worth It

The answer is yes! But a credit score of 750 is probably just as good.

Aiming for 800 and above might be enticing, but its not always necessary, Griffin said. Scores of 800 or above may earn you bragging rights, but they wont net you better terms. Your goal should be to have a score high enough to get you the best rates and scores greater than 750 will qualify you for the best rates.

So, the numbers game for credit scores is like every other statistical measurement in your life: How high is high enough?

If youre happy at 750 and getting the best rates you can go for it!

But if you want to feel like a millionaire without have the bank account to prove it take your best swing at 800 and let the privileges fall where they will!

5 Minute Read

Also Check: Does Affirm Build Credit

Improve Your Credit Health With Creditboost

Now that you know how to get your credit score to 800, itll be that much easier to accomplish your goal and work towards a brighter financial future. Take the first step towards improving your credit by reporting all on-time past and current rent payments through CreditBoost. Create an account to get started today.

*CreditBoost results may vary by individual.

Do You Need An 850 Credit Score

Nothing magical will happen if your credit score of 800 ticks up to 850. And most importantly, you probably wont save more money. You dont need to take our word for it, though. We consulted a panel of financial experts, all of whom said the same thing.

Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Opinions expressed here are the authors alone and have not been approved or otherwise endorsed by any financial institution, including those that are WalletHub advertising partners. Our content is intended for informational purposes only, and we encourage everyone to respect our content guidelines. Please keep in mind that it is not a financial institutions responsibility to ensure all posts and questions are answered.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

Don’t Miss: How To Remove Hard Inquiries From Your Credit Report

The Best Credit Cards For Excellent Credit

With excellent credit, you could be eligible for some of the best credit card offers.

This might include premium rewards cards that come with more-valuable rewards and top-notch perks like travel credits, free hotel nights, airport lounge access, complimentary upgrades and elite status. Keep in mind that these cards also tend to carry expensive annual fees and higher interest rates if you carry a balance. So youll have to weigh the benefits against the costs to see if its worth it for your wallet.

On the other hand, if youre paying down credit card debt, you also might see offers for the best balance transfer cards that come with longer 0% intro APR periods and higher credit limits.

Explore on Credit Karma to see whats available.

Make Sure Your Credit Utilization Ratio Remains Low

The total amount of credit you have available compared with the amount youre utilizing counts for 30% of your score. Lenders typically like to see borrowers using no more than 30% of their available credit. For example, if you have a credit card with a $5,000 limit, dont utilize more than 30% $1,500 of it.

Recommended Reading: Suncoast Credit Union Truecar