How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

The 5 Benefits Of Maintaining Good Credit

Attaining and maintaining good credit can be a process, but its definitely one thats well worth your time. There are many benefits that can come with having a positive credit report and a high credit score.

Some of the primary benefits of maintaining good credit are:

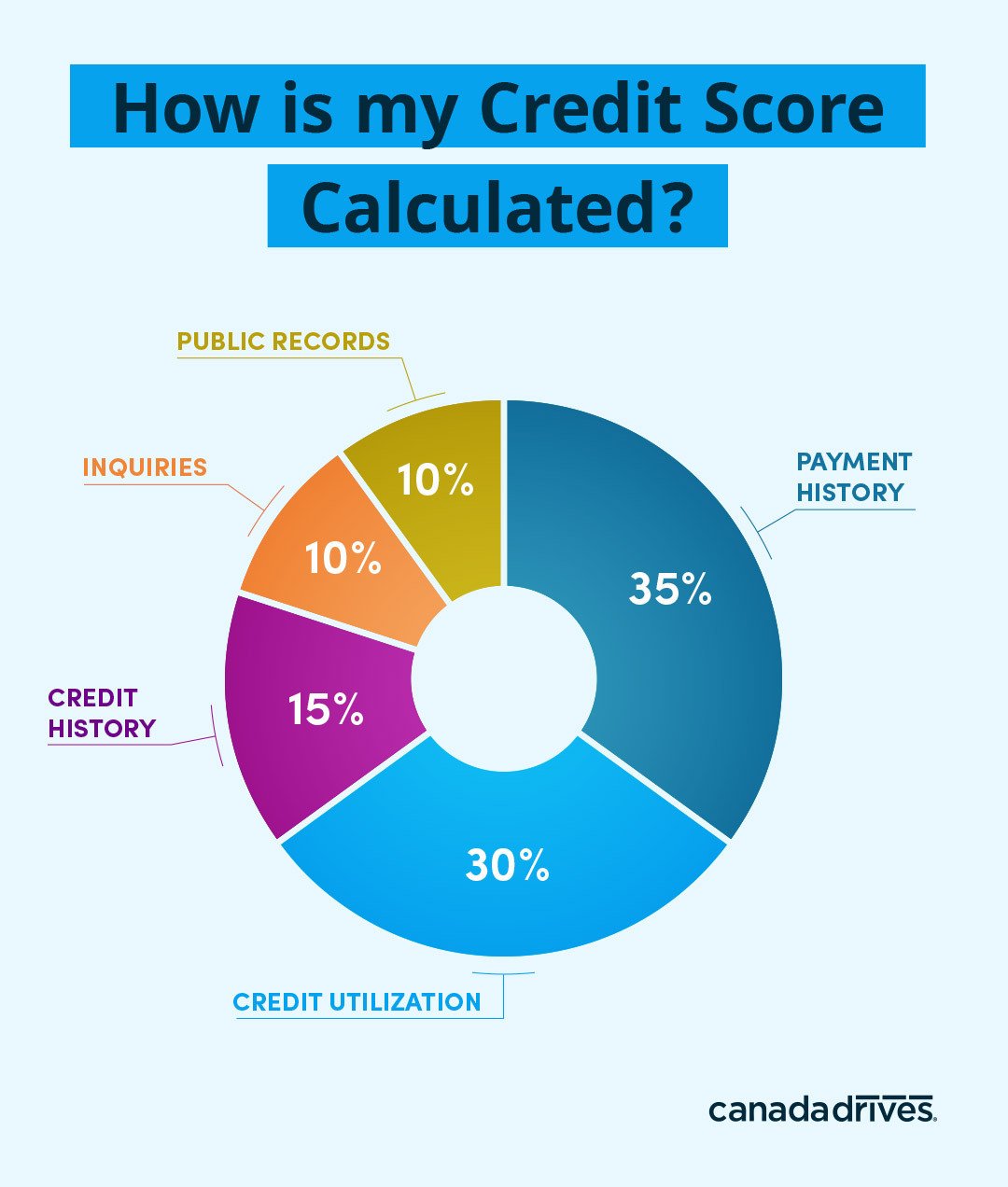

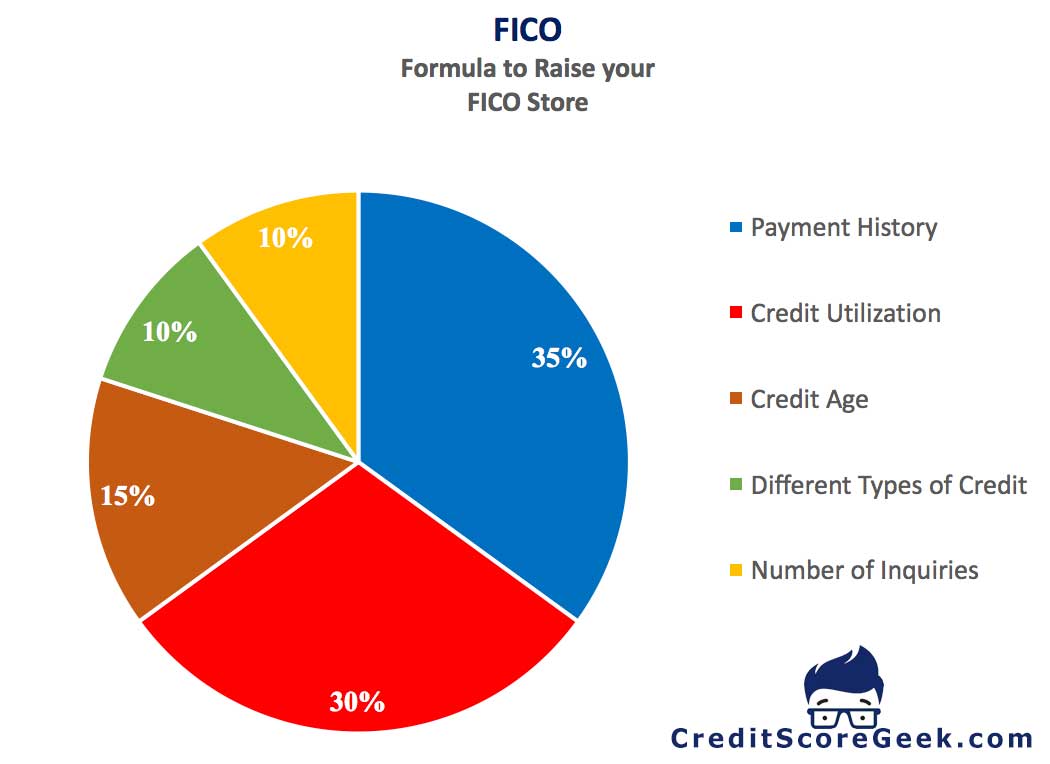

Most Recent Credit Activity

The final 10% of the credit score calculator is based on information about your most recent credit activity. Regardless of your reasons, opening new accounts and applying for new loans in a short period will hurt your credit score. Creditors see such frantic financial behavior as alarming and one that calls for a harsh creditworthiness assessment. To avoid falling for this typical mistake, try to spread your financial activities and inquiries over a longer period, otherwise, make sure you at least have a good explanation.

As explained earlier, it is your responsibility to look into the often unmatching credit scores calculated by different credit bureaus. With the above information, you should now have a clear understanding of how to do that. However, as you probably know, calculating your credit score is only part of the equation. What is more important is how you can improve it and become a favorable debtor that creditors can trust and accept to take on. Improving your credit score is worth taking the time to look for new and creative ways to make it happen. Even if you think you dont need it today, you should make that a priority because you will definitely need it at some point in the future.

You May Like: Does Capital One Report Authorized Users To Credit Bureaus

How To Estimate Your Credit Score

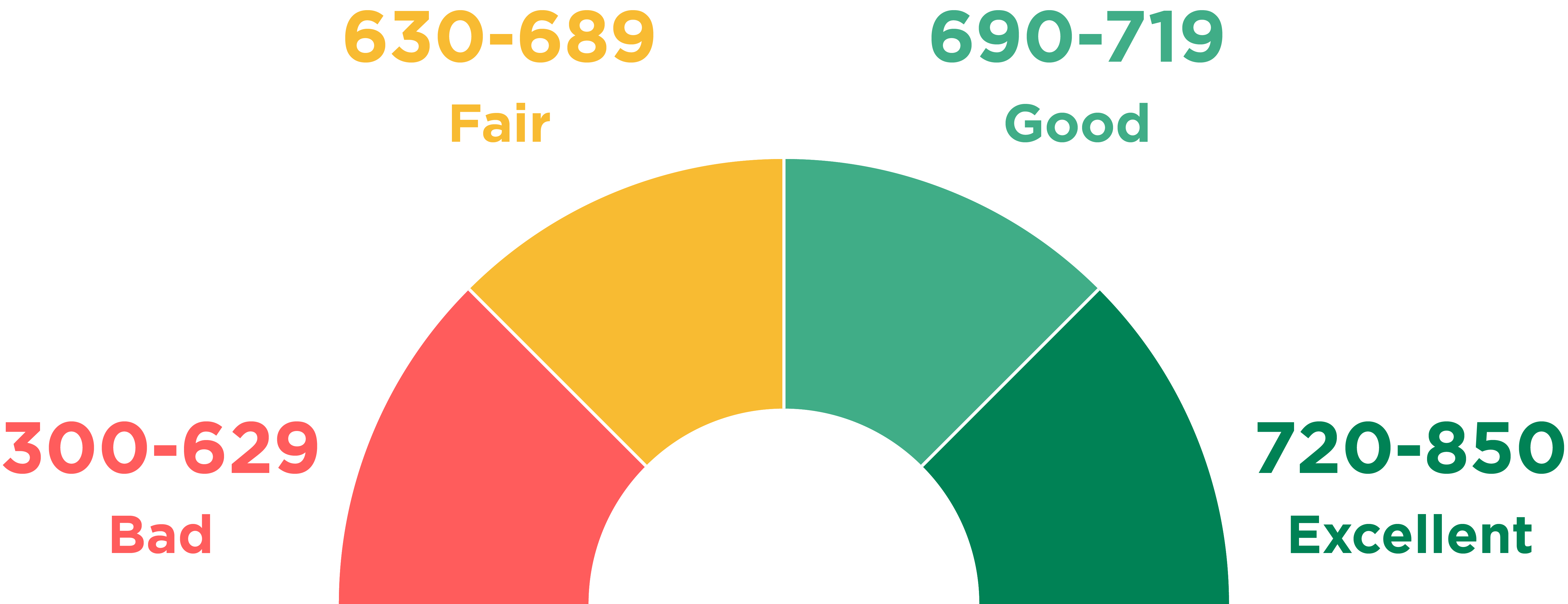

By answering eight simple questions, we can guess your likely credit score range: Excellent, Good, Fair, Limited, or Bad. Although this doesnt replace tracking your actual credit score, it can provide quick estimate if you dont want to create an account at a monitoring site right now.

There are several reasons why you want to understand your creditworthiness before you apply for a loan or credit card:

Bank Of Baroda Relying On Cibil Score To Control Retail Npas

In a bid to control defaulters, Bank of Baroda is being extra careful of it retail customers. Over 50% of the banks home loan borrowers have minimal risk with high credit scores. Moreover, it is also offering the lowest rates in the market at present thereby giving a tough competition to the bigger banks like State Bank of India and HDFC Ltd. Bank of Baroda was one of the first banks to base the interest rates for home loans on the Cibil scores. The rate of interest varied from 8.65% to 9.65% depending on the CIBIL score. Thanks to the tighter norm of checking the CIBIL score, BoB has improved its portfolio. The bank had 57% borrowers with a CIBIL score of 760 and above. Retail loans at BoB were growing at 33.55% over the previous year. There was an exponential increase in the auto personal loans as both of them registered an increase of 39% as on half year ended September 2018, as compared to the previous year. The bank expects to grow at a similar pace in the second of the fiscal. The total retail non-performing assets of the bank are at Rs.1,827 crore, which is 2.40% of its total NPA pool. This is an improvement from March 2018 when the bank’s retail NPAs were 2.83% of the total NPAs.

In the first 6 months of FY19, BoB has 75% of new customers with a CIBIL score of 760 and above, said Virendra Sethi, general manager in charge of retail loans at BOB. In addition, Bank of Baroda is also

27 December 2018

Also Check: Syncbppc

Icra: Small Finance Banks Expected To Grow At 25

A latest report from the credit rating agency ICRA has revealed that small finance banks are likely to grow at 25-30% over the medium-term. The report added that the growth is possible if SFBs can arrange additional external capital of Rs.4,000-Rs.6,000 crore till FY23.

The operating expense ratio of the bank deposits has been high mainly due to factors like setting up and upgrade of existing branches, systems upgrade, and the hiring of manpower. These banks have witnessed growth in assets under management, deposits, and better return on their equities, besides mitigating business risks through diversification. The banks reported an annualised growth of 33% in the asset under management by December 2018 which stood at Rs.64,325 crore.

ICRA added that it expects SFBs loan portfolio to grow at 25-30% over the medium-term. Meanwhile, the microfinance share has been declining to around 40% by March 2020. The SFBs would require external capital of Rs.4,000-6,000 crore till FY23 for meeting the projected growth rate. The credit rating agency also stated that these banks were able to diversify their product mix, which resulted in a decline in the share of microfinance as an asset class to 44% as of December 2018 from 60% as of March 2017.

18 March 2019

Too Much Credit Card Debt

The idea that late payments damage credit scores is an easy concept for most consumers to understand. However, the fact that having too much credit card debt can also lower a consumers credit scores is often surprising. The assumption is that as long as you make your payments on time then all is well.

Yet credit card debt is capable of lowering a consumers credit scores almost as much as late payments. Around 30% of the points in your FICO and VantageScore credit scores come from the debt category. While not all of that 30% is based on credit card utilization, your credit card balance-to-limit ratio is a significant factor within the category. Credit scoring models reward consumers for maintaining low balances relative to their credit limits.

Recommended Reading: Remove Repo From Credit

Building A Credit Scorecard

The target variable usually takes a binary form, depending on the data, it can be 0 for performing customers and 1 to indicate defaulted customers or customers more than 90 days late on their payment. In the rest of this article, we will refer Bad Customers as the ones in some sort of default, and Good Customer for the others.

Minimum Requirements For A Fico Score

FICO Scores are the most common brand of credit score lenders use in the United States. In order for a FICO Score to be generated, your credit report must meet the following minimum requirements:

- Your credit report must have at least one account thats been open for six months or longer. It only takes one account to qualify for a FICO Score. Your credit report must have at least one undisputed account that has been updated in the last six months. If you only have one account, and the account is in dispute, you wont have a FICO Score.

- Your credit report must be free of deceased indicators including accounts that you might possibly share with another person that has been reported as deceased to the credit reporting agencies. If there is any record of you or a joint account holder being deceased, a FICO Score will not be generated.

Read Also: Zebit Pros And Cons

How To Maintain Your Good Credit Score

Once you build or improve your credit score, the next step is to maintain it. Keeping your credit score above 670 will make your life easier in many ways. To ensure it stays in the good or excellent range with minimal surprises, you’ll want to start developing these simple habits:

- Tip 1: Pay bills on time and in full

- Tip 2: Maintain a low credit utilization rate

- Tip 3: Limit new credit applications

Option : Apply For A Secured Credit Card

A secured card is nearly identical to an unsecured card in that you receive a credit limit, can incur interest charges and in some cases can even earn rewards. The big difference is you’re required to make a deposit in order to receive a line of credit. The amount you deposit usually becomes your credit limit.

Deposits typically start at $200 and can range up to $2,500. If you want a higher credit limit, you’ll usually need to deposit more money.

The amount you deposit acts as collateral if you default on payments, but it’s completely refundable if you pay off your balance in full and close your account or upgrade to an unsecured card.

When you use a secured card responsibly , this information will be sent to the credit bureaus , which helps raise your credit score and put you on the path to qualifying for an unsecured card.

Here is our top pick for the best secured credit card with low interest from a major bank:

See our methodology, terms apply.

Also Check: What Is Syncb Ntwk On Credit Report

Who Can View Your Credit Information

There are a number of different individuals and entities that can view your credit information. These include banks and other lenders, credit card companies, and retail stores, cell phone companies, utility companies, potential employers, and potential future landlords.

Bottom Line: Reviewing your credit score can save lenders and other creditors a lot of time, instead of reviewing your entire credit report to determine your past payment history and the likelihood of repaying your debt responsibly.

Myth : Carrying A Balance Helps Your Credit Score

Carrying a balance on your credit card doesn’t help your credit score, it only has the potential to hurt it and it will end up becoming expensive over time paying interest. Not to mention, it’s a waste of money to pay interest on your balance if you can afford to pay off your credit card bill in full each month.

If you do have a credit card balance that you need to pay off over time, consider transferring it to a card with temporary 0% APR. It won’t necessarily change your credit score, but a 0% APR card can save you on interest and help you pay off your balance faster, which ultimately helps out both your score and your budget.

Here is our pick for the best balance transfer credit card with the longest intro period:

Recommended Reading: What Is Synchrony Bank Ppc

How Many Credit Scores Do You Have

While there are several different versions of the , the most commonly used version is the FICO score. Developed by FICO, formerly Fair Isaac Company, the FICO score is used by many creditors and lenders to decide whether or not to extend credit to you. According to myFICO.com, the consumer division of FICO, there are at least 10 different FICO scores used for varying purposes.

The VantageScore, which was created by the three credit bureaus, is another common credit score. Many free credit score services offer the VantageScore 3.0.

What Is Amounts Owed

In a very general sense, Amounts owed refers to how much debt you carry in total. However, the amount of debt you have is not as significant to your credit score as your credit utilization. When a high percentage of a person’s available credit is been used, this can indicate that a person is overextended, and is more likely to make late or missed payments.

You May Like: Opensky Credit Card Delivery

What Exactly Is A Credit Score

In its most basic sense, your credit score is a number that has been assigned to you based on multiple criteria, which indicates to lenders and creditors your overall capacity to repay a loan and/or handle future credit.

Your credit score can have a big impact on many key aspects of your life. There are other credit scoring models in use, such as VantageScore or models built by lending or insurance companies, but its estimated that the FICO credit score is used in more than 90% of lending decisions by top lenders in the U.S.¹

FICO stands for the Fair Isaac Corporation, which is the company that developed the credit scoring system. In the case of credit scores, FICO will take your credit information and use it to help lenders and creditors determine whether you would be a good credit risk. FICO uses the information provided by the big credit bureaus in order to calculate your credit score.

Bottom Line:Today, it isnt just lenders and that review your credit score. There is a long list of other organizations and entities that may wish to view your credit history before moving forward with transactions that involve you.

Because lenders and creditors place a high weight on your credit score, this information can essentially either help you or hurt you when youre applying for a mortgage or other loan, as well as in other types of transactions like obtaining a credit card.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Don’t Miss: How To Get Rid Of A Repo On Your Credit

Length Of Your Credit History

The length of your credit history also plays into the overall weighting of your credit score. In this case, a longer credit history will typically yield a higher credit score. If you have a long history of credit , then lenders and creditors will have more information with which to assess your overall creditworthiness.

Here, your various loans and other sources of credit are all averaged together. A long history of credit can be an indicator that youve been able to successfully obtain and manage your credit over the years.

Because of this, it makes sense to keep more of your credit cards open longer, even if you havent used them in a long time canceling them could actually lower your overall credit score.

Transunion Cibil And Ecommerce Ties Up With Employment And E Commerce Firms

In order to aid employee screening and e-Commerce companies make informed and faster decisions based on the individuals credit behaviour, TransUnion CIBIL has partnered with these firms with the intention of utilising data in order to make better and quicker screening decisions. On e-Commerce portals, the credit screening application happens, as of now, after the consumer provides his/her application. But with the new initiative, consumers will have access to CIBIL Score and Report and not just offers that they are eligible for.

This in turn will decrease the rate of rejection on all applications and thus ensures that the process is faster, much more efficient and easier as well. In order to encourage transparency and also create awareness, the CIBIL Score as well as report will be shared with customers without their having to pay additional charges.

18 April 2017

Read Also: What Is Syncb Ntwk On Credit Report

The Biggest Credit Score Myths

Like any industry, credit and lending is always changing. As the economy fluctuates up and down and federal regulations change to provide new guidelines and protections for consumers, it’s no surprise that credit card issuers change the qualifications for their financial services and products. You’ve probably heard a lot of credit card myths from people who’ve been in the game for a long time. But the truth is you shouldn’t always listen to them.

Below, we outline some of the most persistent credit card myths and explain exactly what’s true for today’s credit card user.

- Myth 1: You should never close your oldest credit card

- Myth 2: You need a perfect credit score

- Myth 3: Carrying a balance helps your credit score

- Myth 4: Checking your credit score will lower it

Why Is Your Credit Score Important

Your credit score is important for several reasons. First, depending on what your score is, it can be a primary factor in determining whether or not you are approved for a loan. Lending money or providing someone with credit can be a risky endeavor for lenders and creditors.

Before these entities move forward with approving an application for a new loan, lease, etc., theyll want to know just how much risk they may be taking on or whether they should even move forward with the transaction at all.

Your credit score is also important because it can factor into a lenders or a creditors decision about the terms that you are likely to get.

Bottom Line: A higher credit score will not only improve your chances of getting approved for a loan or credit, but it will also determine how favorable your interest rate will be.

Read Also: Report Death To Credit Bureaus