What Can I Expect As A Result Of My Credit Report Dispute

Equifax and TransUnion have a similar dispute process. After you submit your required forms, Equifax and TransUnion will review all the information you give them and even contact the creditor to confirm whether or not they did a hard pull on your file. If necessary, they may contact you for additional information. If there is an error, the credit bureau will update your credit file. If the creditor states that the hard inquiry was legitimate, the credit bureau will not remove it from your report.

Once the investigation is completed, both bureaus will send you a letter or email outlining the results of their investigation. Equifax states that it can take from 5 to 20 business days to process a dispute. TransUnion estimates that investigations take up to 30 days.

Why Should You Remove Hard Inquiries From Your Credit Report

A single hard inquiry may not affect your score if your credit is good. However several inquiries with a short credit record can lower your credit score significantly. This in turn impacts negatively on your creditworthiness.

Removing a hard inquiry can increase your score by up to 5 points. Getting rid of a few of these inquiries can significantly increase your chances of being eligible for a loan and getting one at a good rate.

Inquiries Affect Your Credit Score Less Over Time

Even though the impact on your credit scores lessens over time, lenders will still be able to see the full list of hard inquiries at the bottom of your credit report for a full 2 years.

Also, remember that the difference between being approved or denied for credit, or getting a lower or higher interest rate, is typically decided based on pre-set score ranges.

If your credit score is on the cusp between poor and fair, 5-10 points might make all the difference in getting better loan terms.

One or two hard inquiries could be all that is standing between you and better interest rates or access to a loan at all. So while hard inquiries may not have a huge impact on some peoples credit scores, they can leave a lasting imprint on the financial lives of many.

You May Like: What Is Considered A Serious Delinquency On Credit Report

Check Your Credit Report

The first step in removing hard inquiries is to evaluate your credit report. You can get a free credit report from AnnualCreditReport.com. Dont assume they are all the same because each report will have different information. Examine all three credit bureau reports: Equifax, TransUnion, and Experian. Credit reports are free annually, so its a good financial habit to do this once a year.

Plan Before Shopping For A Loan

Before shopping for a loan, it’s always smart to proactively plan your finances.

First, learn whether the type of credit you’re applying for can have its hard inquiries treated as a single inquiry. If so, determine the applicable timeframe. Then you can plan your shopping period accordingly.

Second, you may also want to check your credit reports before getting quotes to understand what information is reported. Find out how to request a free credit report from Equifax.

If you’re worried about the effect that multiple hard inquiries may have on your credit reports, it may be tempting to accept an offer early rather than allow multiple hard inquiries on your credit. However, consider your individual situation carefully before cutting your shopping period short. In many cases, the impact hard inquiries have on your credit scores from shopping around will likely be minimal compared to the long-term benefits of finding a loan with a lower interest rate. The more informed you are about what happens when you apply for a loan, the better you can prepare for the process before you start shopping.

Don’t Miss: Does Aarons Build Your Credit

Write A Letter To The Creditors

Armed with the addresses of each creditor, write a letter notifying them of the disputed inquiries. The letter should include any documentation that supports your claims. These can be payment records that contradict the items in dispute. Request them to contact the reporting bureau that they gave the information to and have them remove the items from your records.

Hard And Soft Credit Inquiries

While creditors can pull your credit reports and report to determine whether you are in good standing, they have key differences. A hard credit inquiry may contain different information than a soft credit inquiry. A creditor or another entity conducting a soft credit inquiry for marketing or promotional purposes may only have access to a portion of your report. A hard credit inquiry is required to obtain your complete credit file.

Hard credit inquiries may also have negative effects on credit scores by decreasing your score. Soft inquiries can still be noted on credit reports, but they do not lower credit scores or show up on credit reports. A lender or creditor must have your permission before they can conduct hard inquiries. You can usually dispute a hard credit inquiry that was done without you knowing or consenting.

You May Like: What Credit Score Do You Need For Chase Sapphire Reserve

How Do I Remove Hard And Soft Inquiries From My Credit Report

When someone pulls your credit, its reported as either a hard or soft inquiry. Hard inquiries can trigger a temporary drop in your score, raising red flags to potential lenders. Soft credit pulls have minimal impact on your credit, and they typically dont factor into a lenders loan or line of credit approval decisions.

Soft credit checks are indisputable since creditors, lenders, and lenders can run them without prior approval. A hard credit check will remain on your profile for two years and could impact your score for up to a year.

If someone runs a hard inquiry without your authorization, this is considered fraud. In that case, you can file a dispute directly with the credit bureaus to remove it from your profile.

What Is A Hard Credit Inquiry And How Does It Affect Your Credit Score

When you apply for a credit card, loan, mortgage, or any other type of financing, a credit check is almost always performed by the lender, typically a bank or credit card company. This triggers a hard inquiry into your credit history to see if youre qualified.

Hard inquiries have a relatively small impact on your credit score. They typically only shave a few points off of your score, and only count for 10% of your FICO score.

So lets say youre on a hunt for a new credit card. It may be easier to apply for a bunch of credit cards at once and see which ones you qualify for. But is that smart?

Dont Miss: What Does Filing For Bankruptcy Do To Your Credit Score

Recommended Reading: How Long A Repossession Stay On Your Credit

How Long Will A Hard Inquiry Stay On My Credit Report

Hard inquiries stay on your credit report for 2 years. They do not affect your credit score that long, but theyll always be that little red flag on your credit report, forcing lenders to see it.

Old inquiries do not often harm anything, but recent inquiries could be an issue.

If nothing else, lenders may ask about them. They may want proof that the inquiry did not result in new credit if they dont see a tradeline that coincides with the inquiry.

It may be harder to prove that you do not have a new tradeline than if you did. Inquiries cause headaches that you just dont need.

Only apply for credit when you need it to avoid these issues.

When Can You Benefit From Inquiry Removal

- When you apply for a Mortgage loan If you have a credit score above 680 and are trying to get a loan, it is prudent to get the inquiry removed from your credit report. A crucial point to note here is that there should be no negative impact on your credit history such as late payments or bankruptcies.

- When you are looking for business loan funding Out of all the different types of lenders, business credit lenders treat inquires the harshest, especially business-related inquiries and recent inquiries. They even turn down people with perfect credit scores just because they have too many inquiries. Creditors rely heavily on debt-to-income ratios to make lending decisions. Since business loans generally do not reflect on personal credit reports, a business credit lender has no way to determine how many pre-existing business loans an applicant has. Therefore, they look at business loan related inquiries to understand if the applicant has any pre-existing business loans. They are also concerned with recent inquiries, as recently opened accounts may take up to 90 days to appear on the . Usually, for business or any type of corporate credit, having several business loan inquiries may disqualify you as a debtor. Additionally, credit card companies, like those offering rewards programs, often decline applications based on excessive inquiries.

Read Also: How To Check Credit Score Usaa

What Is A Hard Credit Inquiry

When you apply for some form of credit , a lender first must check your credit. To do this, they conduct a hard pull of your credit report basically, a thorough review of your entire credit history.

This enables a lender to see where youve finished in front where youve faltered or where youve failed . Based on this hard credit check, they can make a determination if youre creditworthy enough to borrow money. This is all a natural and necessary step in the pursuit of credit. And its required by law the Fair Credit Reporting Act, to be exact for the three major credit bureaus to report hard credit checks.

Dont confuse this with a soft credit check, like reviewing your own credit, or getting pre-approved for a personal loan with SuperMoneys comparison tools. For instance, you could check your rates with the following lenders without hurting your credit score. However, if you accept the loan offer, then you may get a hard credit inquiry on your report.

How Do I Protect Myself From Fraudulent Hard Inquiries

Inaccurate information on your credit report is uncommon, but it does happen. Check your regularly to avoid fraudulent and other incorrect information going unnoticed. Review whats listed and keep an eye out for anything unfamiliar.

Its impossible to prevent all identity theft, but keeping track of your credit history will keep you in a better position to stop a bad situation from getting much worse.

You should also consider placing a fraud alert on your credit record as soon as you think you are or may be a victim of identity theft. This will make it more difficult for criminals to start a new account in your name.

Putting your credit report under a credit freeze provides even more security. A freeze prevents companies from making any inquiries. While youre looking for a loan or credit, you can unfreeze your credit report to allow a legitimate hard inquiry to go through.

Also Check: How Can I Check My Credit Score With Itin

How To Minimize The Impact Of Hard Inquiries On Your Credit

Itâs important to do some comparison shopping when youâre looking for a new credit card or loan. You may not be able to avoid new hard inquiries on your credit report, but there are a few ways to reduce the impact of shopping around:

- Time your applications strategically. If youâre shopping for a mortgage or an auto loan, make all of your applications within a 14-day window. If you stick within this timeframe, all of your applications will be calculated as just one hard inquiry.

- Apply selectively. Reduce the number of applications you submit by getting selective about where you apply. Compare rates and fees first, and see if the lender offers prequalification. Prequalification can allow you to get quotes on interest rates, fees and loan amounts without a hard inquiry.

- Practice good credit habits. Virtually all other credit activities have a bigger effect on your credit scores than hard inquiries. Even if you have to add multiple hard inquiries to your reports, you can keep your credit rating high by staying current on loan payments and keeping your credit card balances to a minimum.

Read Also: Lending Club Review Bbb

You Did Not Authorize The Hard Pull

Can you remove hard inquiries from your credit report if you did not authorize it? The answer is YES.

A company can only perform a hard pull on your credit report if you give them permission to do so. Even if you recognize the company or if you have a current account with the lender, they are not legally allowed to do a hard inquiry unless you give them your authorization.

If you believe that the hard inquiry was done without your permission, you can dispute this inquiry. The lender or the credit bureau can then remove it from your credit report.

Don’t Miss: Aargon Collection Agency Bbb

Why Should I Care About Hard Inquiries

Hard inquiries are different from other inquiries listed on your report because they will affect your FICO score.

Anytime you give a lender permission to pull your credit, itll be reported on your credit history.

You may be wondering what happens if you need to shop multiple lenders for a loan.

After all, there are times you need to compare lenders when you need a mortgage or auto loan and they all need to pull your credit.

Thankfully, while you are shopping for your particular loan, you will be granted a 45-day time period to receive multiple rate quotes which will all count as only one hard inquiry.

So is there a way to dispute a hard inquiry and have it removed?

Its possible a hard inquiry can affect your score as much as 5 points.

And heres another shocker A hard inquiry can stay on your report for up to two years.

After all, two years is a long time when youre working hard to improve your credit score.

How To Remove Hard Inquiries

Wondering how to remove hard inquiries from your credit report? Unlike most things in the world of credit, there actually is a simple formula to follow once you have identified a removable hard pull:

- Take note of the characteristics of the pull, including its date and source

- Write this information, along with an explanation of how it is mistaken, in a letter

- Submit the letter to the department of your financial institution dedicated to disputing hard credit inquiries

- Monitor your pending verdict if your argument is accepted, your institution will remove the hard inquiries you contested.

If you are unsuccessful in your attempt, it is typically for good reason. However, if the challenge youre submitting is really a mistake, then you are not out of options. Under the FCRA, you can submit an additional statement to supplement your original one. This acts as somewhat of an appeal. Your challenge will be reconsidered taking into account any new information you provide. However, because you are given a small limit on the number of words this appeal can contain, use them wisely. Concentrate on hard evidence that the mistake is not your fault.

You May Like: Sprint Collections Agency

How Many Points Does A Hard Inquiry Deduct From Your Credit Score

As Canadaâs credit bureaus donât reveal the exact algorithms they use to calculate your credit score, itâs impossible to say exactly how much a hard inquiry will cause your credit score to decrease. Obviously, the higher your credit score, the better you are positioned to weather a few negative hits.

How Do I Know If I Have Too Many Credit Inquiries

There is no concrete number of how many credit inquiries is too many. If youre concerned about the number of inquiries on your credit report, the first step is to get a free copy of your credit reports. Its not so much about the number of inquiries, but more so the time between them.

For example, if youve applied for five credit cards in a period of three months and have five hard inquiries as a result, its likely to be considered as a negative detail on your report. In contrast, having five hard credit inquiries listed over a period of five years will have far less of an impact or perhaps no impact at all.

What to do if you think you have too many inquiries on your credit report

If youve looked at your credit report and think the number of credit inquiries listed could have a negative impact on your credit score, you can start to improve your credit score in other ways.

You May Like: Usaa Credit Card Credit Score

Send A Dispute Letter To The Credit Bureaus

If you canât get satisfaction from the creditor who is listed as making the inquiry, your next move is to reach out to Equifax and/or TransUnion directly and lodge an official about the hard pull. By law, a credit bureau must investigate any information on your credit report that you allege is an error.

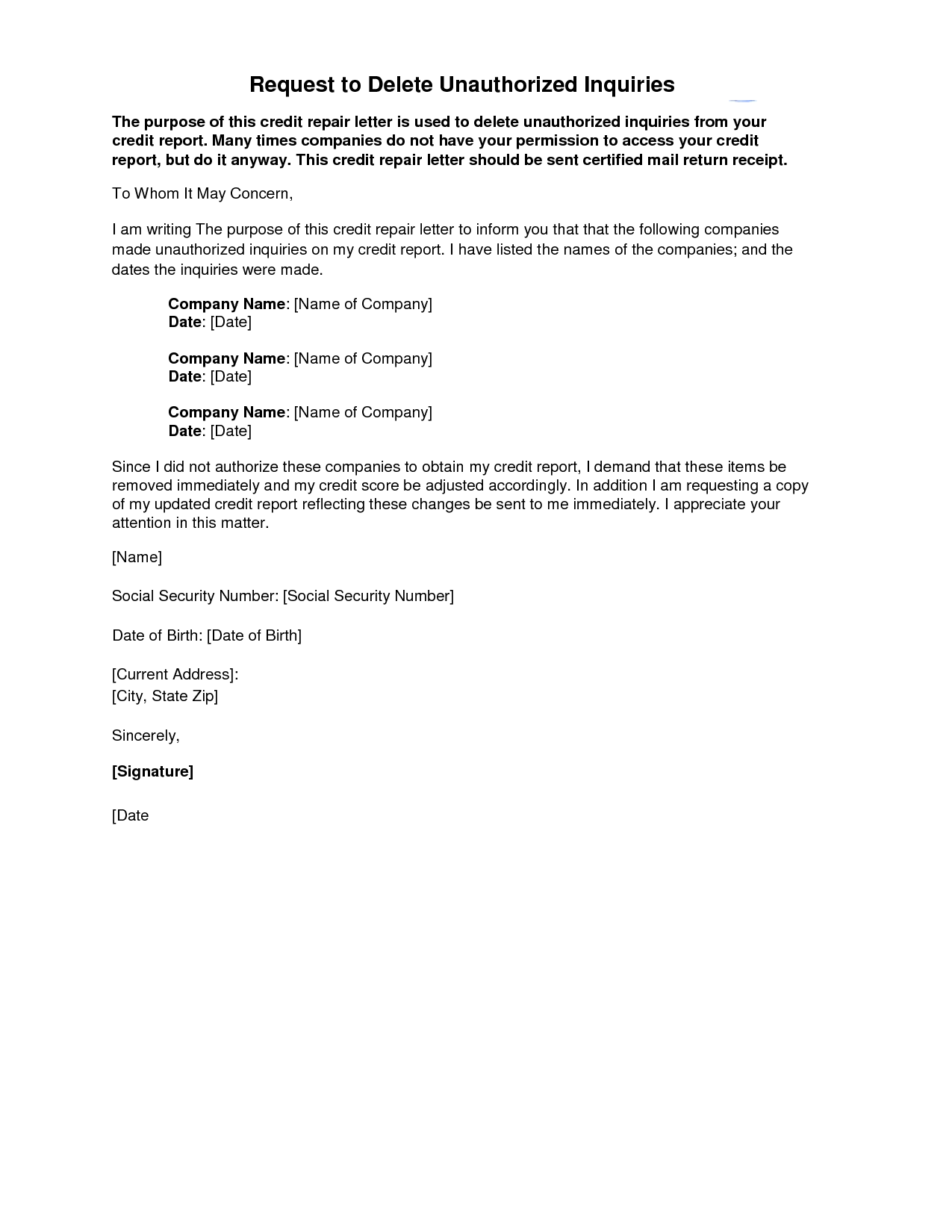

Letter Templates For Disputing Hard Inquiries

If you want to dispute a hard inquiry on your credit file, you will need to send a letter, return receipt requested, and keep a copy of the letter and post office receipt for your records. Consider sending letters to both the credit reporting agencies and the financial institution that requested the hard pull on your file. These templates are based on examples provided by the Consumer Financial Protection Bureau. Make sure you adapt them to your personal situation.

Hard inquiry dispute letter template to credit reporting agencies

- Date of birth

Letter to financial institutions requesting validation

Re: Disputing error on credit report

Dear ,

I am writing to request a correction of the following hard inquiries that appear on my consumer report:

Hard inquiry 1

- Account Number or other information to identify account:

- Dates associated with the item being disputed:

- Explanation of item being disputed:

- My report includes accounts with a reported name that is different than mine.

- I dont recognize the accounts in question.

- Im the victim of identity theft, and I dont recognize one or more of the accounts on my report.

- Other

Dispute 2

Thank you for your assistance.

Sincerely,

Read Also: Cbna Stands For