Look For Negative Information In Your Credit History

You may not even know if you have a derogatory account in your credit history. So you should start by getting your free credit report.

You can get your from many different services. But by law, each of the three major reporting bureaus has to give you a free credit report each year. And during the coronavirus pandemic, consumers are entitled to free weekly reports through April 2021, via AnnualCreditReport.com, the official U.S. government website.

When you open your credit report, you can find a list of all derogatory accounts. These include any account with a late or missed payment.

Below is a sample screenshot showing a credit card account that has a 30-day late payment from July 2011. You can see that its a derogatory item from the color some reports show yellow and red boxes and we know that it is a 30-day late payment because the box says 30 in it.

Image: Eric Rosenberg

Look through your credit report and make a list of all negative information. Then compare to your records to make sure everything there is accurate.

If its not accurate, getting it removed is imperative. And if it is accurate, its harder to remove, but still possible.

Addresses And Fax Numbers To Try

Below are some addresses and fax numbers for several of the larger servicers, as listed on their websites. Before mailing or faxing your student loan goodwill letter and other important materials, confirm that you have the right contact information, as some lenders and loan servicers collect correspondence to varying locations depending on your loan type.

Again, it may also be worth phoning your servicer to get the name of someone there that can help you. If you have federal student loans, you can also check this Federal Student Aid page for more contact information.

NelnetDocuments related to deferment, forbearance, repayment plans or enrollment status changes:Attn: Enrollment Processing

Fax: 800-887-5936

Can Student Loans Be Removed From Your Credit Report

You can remove student loans from your credit report under two conditions.

If either condition applies to your student loan, then you can remove the inaccurate item from your report with a dispute.

Recommended Reading: Stoneberry Credit Score

Can Student Loans Be Removed From My Credit Report

The links below contain various information about Can Student Loans Be Removed From My Credit Report that might interest you. The links below contain various information about the keyword that might interest you. Review information from various sources to form a position based on as much information as possible.

- https://www.sofi.com/learn/removing-student-loans-from-credit-report/#:~:text=As%20you%20may%20have%20gleaned%2C%20you%20can%E2%80%99t%20actually,being%20reported%20incorrectly.%20However%2C%20there%E2%80%99s%20a%20bright%20side.

- none

Dont Ignore Your Old Debts Despite The Statute Of Limitations

This statute is, as I said, determined by the state in which you live and once that limit has been reached you can no longer be sued for payment of the debt. One of the reasons you are hearing from your creditor now may be that your loan is approaching the limitations date. Depending on your states law, you may restart the statute of limitations clock if you make any payment or enter into an agreement to repay the debt.

Again, not knowing what type of loan you have makes it more difficult to offer you more specific suggestions. What I can tell you without hesitation, however, is that ignoring the problem is not going to make it go away and will likely make it worse.

I suggest you find out what your options are and make a plan to address any unresolved issues with your loans. A good place to start is the U.S. Department of Educations Office of Federal Student Aid. Even if you have private loans, there is information on this site to get you started. I hope you will check it out, because not doing anything is really not a good option.

Another excellent resource is the National Foundation For Credit Counseling. They offer free or affordable budgeting help as well as expert advice on student loan debt.

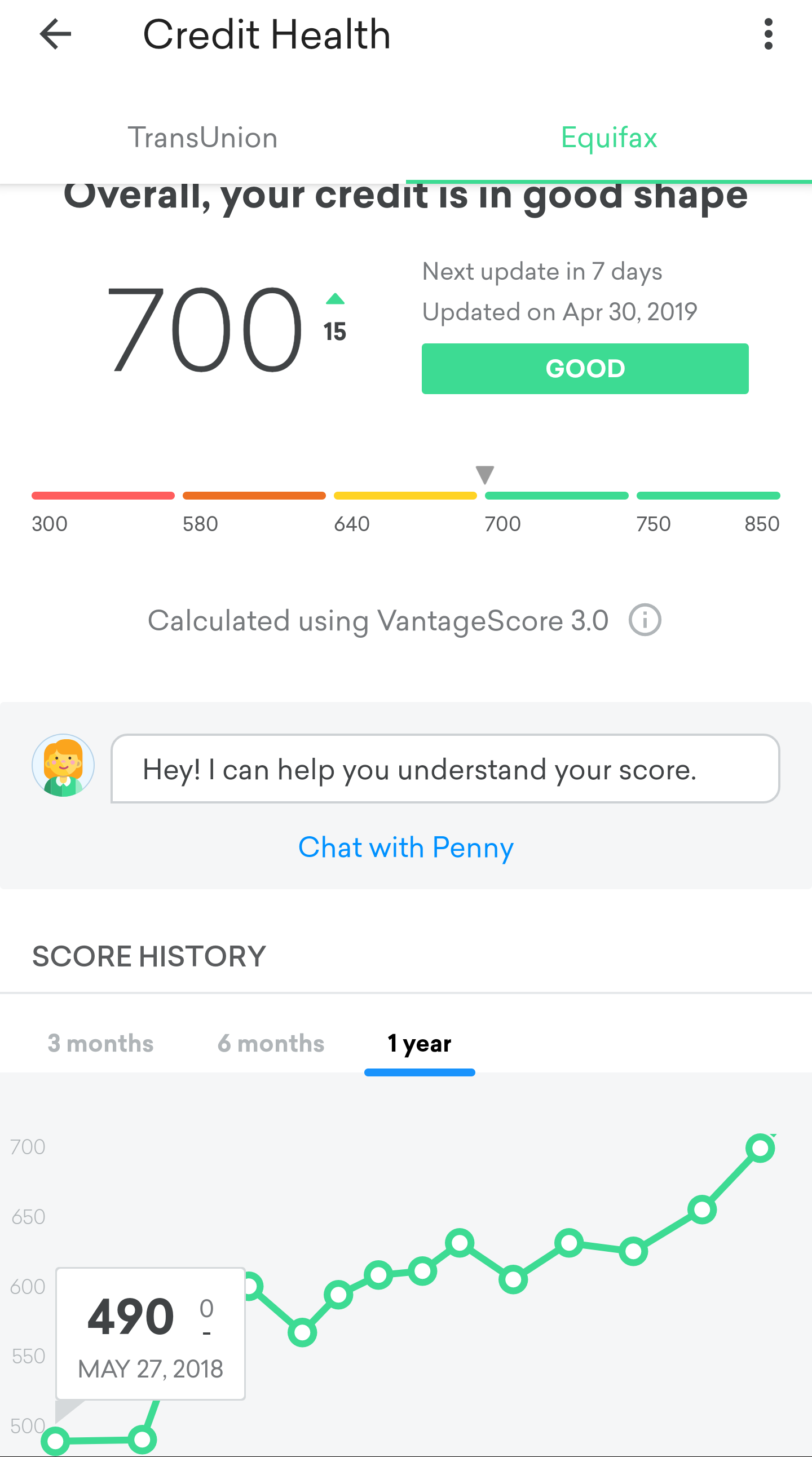

Remember to keep track of your score!

Editorial Disclaimer

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news from product reviews to credit advice with our newsletter in your inbox twice a week.

Recommended Reading: Coaf Credit Inquiry

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.

Recommended Reading: What Credit Score Does Carmax Use

How To Dispute Student Loans On Your Credit Report

Youll have a hard time removing student loans from your credit report if the negative information is legitimate. But there may be instances when the details are inaccurate. In these cases, you can dispute the information with your creditor or the credit reporting agencies.

If you want to start with your loan servicer or lender, heres how to dispute delinquent student loans or loans in default:

- Write a dispute letter: Its best to complete this process in writing, so you have a paper trail you can refer back to in the future if needed. Write a letter to your servicer notifying them of the inaccuracy and requesting that they remove it from your credit reports.

- Gather supporting documentation: Before you send your letter, gather some documentation to support your claim. This can include bank statements or emails from the servicer showing you made on-time payments or any other reason why you believe the delinquency or default notation was made in error.

- Wait for a decision: Once you submit your letter, it may take a couple of weeks to get a response. If you dont hear back in two or three weeks, contact the servicer to follow up on your letter.

If youre having a hard time dealing with your loan servicer or youd simply rather not deal with them, you can also file a dispute directly with the credit reporting agencies. You can typically do this online, but still, make sure you provide supporting documentation for your claim.

What Happens If You Default On Student Loans

A student loan default can affect you in many ways. Penalties of default include the following.

To collect on federal student loans, your loan holder can garnish your wages and withhold your tax refunds and other government payments, like Social Security checks.

Private student loan holders cant take your tax refunds or Social Security payments, but they can take you to court. If they receive a judgment in their favor, they can garnish money from your paychecks or even your bank accounts to pay your defaulted loan.

A student loan default and the late payments that preceded it can remain on your credit report for seven years. This negative mark can make borrowing for a car, home or additional schooling more expensive or potentially impossible. Default can also hurt your ability to rent an apartment, sign up for a new cell phone plan or even get a job.

Late fees and interest will continue to build on your debt, increasing the amount you owe. You can also be charged costs for the collection of your defaulted loan. These collection costs may be as much as 25% of your loan’s balance.

For example, lets say you owe $30,000 at the time of default. You could have to pay as much as $7,500 in collection costs on top of that $30,000 balance to pay off your loan.

If you have a student loan default, you cant take on additional student loans or receive other federal aid to return to school.

» MORE:How to go back to school with defaulted loans

Don’t Miss: Does Opensky Report To Credit Bureaus

Defaulting On Student Loans

If your student loan continues to be delinquent, the loan may go into default . The point when a loan is considered to be in default varies depending on the type of student loan you received.

For a loan made under the William D. Ford Federal Direct Loan Program or the Federal Family Education Loan Program, youre considered to be in default if you dont make your scheduled student loan payments for a period of at least 270 days .

For a loan made under the Federal Perkins Loan Program, the holder of the loan may declare the loan to be in default if you dont make any scheduled payment by its due date.

The consequences of defaulting on your student loans can be quite severe, including the following:

The entire unpaid balance of your student loans, including interest, could be due in full immediately.

The government can begin to garnish your wages by up to 15%, meaning your employer is required to withhold a portion of your pay and send it directly to your loan holder.

Your tax return and federal benefits payments may be withheld and applied to cover the costs of your defaulted loan.

You could lose eligibility for any further federal student aid.

If you are having difficulty making regular payments on your federal or private student loans, there are steps you can take before the consequences of defaulting kick in. For instance, you could apply for a student loan deferment, which allows you to temporarily stop making your federal student loan payments.

When Do Student Loans Have A Negative Impact

As with any loan, making late payments can impact your credit. Your delinquency won’t be reported to the three major credit bureaus until you’re 90 days delinquent on a federal loan, so you have a little time to catch up if the situation is very temporary or if a missed payment was an oversight.

It’s considered to be in default once your loan payment has been delinquent for 270 days. A student loan default could remain on your credit report for seven years. It can take years to reestablish good credit when your loan goes into default. The government can garnish your pay and withhold any federal income tax refund you might have counted on to get out of the situation.

There are also some federal benefits you might not be eligible for if you’re in default. Talk to your servicer about rehabilitation options so you can reposition yourself to take advantage of programs and protections available to borrowers.

Private lenders aren’t required to follow the same guidelines as federal student loan servicers, and they might not wait 90 days to report a missed payment. They might also have different guidelines for default. Each private lender is different, but it can begin pulling down your credit score as soon as it starts reporting missed or late payments.

Don’t Miss: Open Sky Not Reporting

The Response To My Goodwill Letter

The goal of the letter was to show that I was: 1) taking responsibility of the late payment and 1) that I was open to do what I needed to do to assure them that it would not happen again. Unfortunately, I was not successful.

The goodwill letter actually backfired on me a bit. They sent me a response back saying that since there was no mistake on XXXXs account and that I had admitted fault they were not allowed to remove the late payments from my report.

I was very bummed and kind of regretted even sending in the letter since now it looked like I may have made matters even worse by admitting fault on the record. Yet, I wasnt quite ready to give up and I decided to do a little bit more research just in case.

Related: How Does Payment History Affect Your Credit Score?

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Will Applying For Paypal Credit Affect My Credit Score

On Credit Karma You Can Very Easily Dispute Accounts And It Takes About 30 Seconds

How to remove student loans from credit report reddit. If either condition applies to your student loan, then you can remove the inaccurate item from your report with a dispute. The federal government started directly loaning to students. Student loans are a type of installment loan, like an auto loan or a mortgage.

How do you remove student loans from your report? The creditor agreed to remove this account from my credit report. You have paid off your student loan, but it’s still showing on your credit report.

The reporting bureaus are required by law to handle disputes in a timely manner, typically 30 days or less, according to the federal trade commission. As soon as you get the bill. Typically, you have three possibilities in this scenario:

This is obviously easier said than done, as the average student loan balance is in the tens of thousands of dollars. I’m not sure who you would contact to. My guess is you have a lot of other negative factors on your credit report, like late or missed payments, or even credit card or utility charge offs.

It is a feature called direct dispute and it allows you to choose 2 reasons as to why you’re disputing the account. This all confused me because on my credit reports, each loan just says us dept of education.that’s it. 1 point · 2 years ago.

The loan is a private loan, with inaccurately reported information. With a student loan default under my belt, my credit score got beat up. But if theyre federal loans, that doesnt apply.

How To Remove Student Loan Late Payments From Your Credit Report

This is the story of how I was able to remove student loan late payments from my credit report.

As soon as I found out the amazing travel benefits created by some of the best travel credit cards I was anxious to jump into signing up for new cards and redeeming miles for some amazing trips.

Unfortunately, living abroad in the UK had caused a rift in communication between myself and one of my student loan lenders and I wasnt aware that my in-school deferment had not been applied.

So one day, as Im getting ready to start applying for some credit cards, I go to and check my credit score and I see its in the 500sand showing SIX late payments!

Thus, my hopes for getting any kind of worthwhile credit card were pretty much gone and I started to deal with the realization that it would take about 7 years for these negative marks to be removed.

Don’t Miss: Does Paypal Credit Affect Credit