Do You Offer Tire Dealers

Acima: Acima offers a no-credit-needed financing solution that tire dealers can offer to their potential customers at the

point of sale. Acimas product is 100% webbased and paperless, which equals quick turnaround from application to funding. Acima employs the largest nationwide outside sales force in the industry, which provides in-person enrollment, training, and ongoing support to its dealer partners.

Kornerstone Credit: We provide flexible, no-credit-needed financing for tires and parts.

Progressive: Progressive Leasing offers virtual lease-to-own services to tire and wheel dealers. Virtual lease-to-own is a flexible alternative to traditional credit that allows customers with less-than-perfect credit to obtain the tires and wheels they need to travel the roads safely.

With a Progressive lease, we purchase the merchandise the customer selects from the retailer. Then, the customer signs an agreement to lease that merchandise from Progressive. Progressive owns the merchandise, but the customer can take ownership after making all required lease payments or through an early buyout option.

While there is a cost associated with Progressives leasing services, we dont charge interest.

Our customers may cancel the lease at any time without penalty and, if current on all payments, without any further payment obligation.

West Creek: We offer high-approval financing for consumers who dont qualify for traditional financing. Our product

MTD: How do your offerings benefit

Are There An Application Fee With Acima

You will not pay an application fee when applying for Acima credit. But your total lease payments do include the Acima cash price for a particular merchandise, and the cost of the lease service.

Depending on where you live, youre also required to pay sales tax on each rental payment.

Always make your rental payments on time.

Late payments might result in additional fees.

Not Sure If Acima Is Right For You Consider These Alternatives

- Avant personal loan: If youd like more time to pay off your merchandise, an Avant personal loan may be a better option since it offers longer loan repayment terms.

- Affirm personal loan: Since some retailers that partner with Affirm offer no-interest loans, an Affirm personal loan may be a more affordable option.

About the author:

Read More

Recommended Reading: What Score Do You Need For Care Credit

When Will My Payment Be/how Much Will My Payments Be

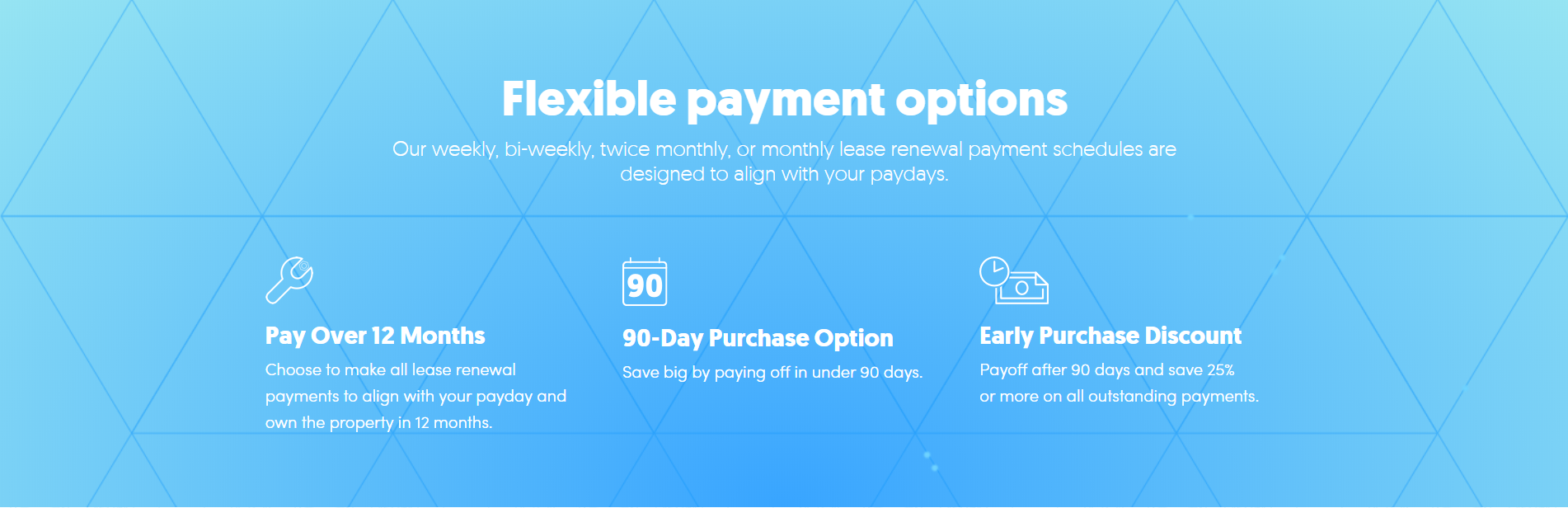

Your renewal payments are based on the value of the merchandise you select and the cost of lease services. Once you pick out the merchandise, we will create a lease agreement based on the value of the leasable items. You can review your renewal payment amounts and frequency prior to signing the lease agreement.

The due dates of your renewal payments are based on the pay dates you enter on your application. After you make your first renewal payment, youre able to change your payment frequency if needed.

Your regularly scheduled renewal payments will not purchase the property in 90 days. Call or chat with our helpful customer service to set up your 90-day payment plan.

How Does Acima Credit Work

Acima partners with multiple merchants to help you get the merchandise you need when you need it.

The financing program is simple.

Once you find what youre looking for, Acima will purchase the merchandise from the retailer and then rent it to you. Its not a type of layaway program, though. Youll take the item home after purchasing it with Acima credit.

That said:

Technically, Acima still owns the merchandise.

So youll make your lease payments directly to Acima. Once youve paid off the lease, youll own the merchandise outright.

Its important to note, you can only use Acima with their participating merchants.

The good news is that the company works with several different merchants.

Use Acima credit when buying tires, furniture, mattresses, appliances, home electronics, eyewear, and more.

Heres what you need to know about Acima financing.

You May Like: Does Paypal Credit Report To Credit Bureaus

What Do I Need To Qualify

- US government-issued photo ID and SS# or ITIN#. Three months of history with your current employer or current source of income.

- Deposits totaling at least $1,000 per month into a checking account that has been open for 90 days or more.

- No NSFs, excessive overdrafts, or negative balances on your current checking account.

Does Acima Build Credit

While many financial institutions may refuse to issue new credit -Acima we will. Acima will give you the opportunity to prove your creditworthiness through performance on a new trade line. Acima partnered with a number of credit bureaus, including Experian. And this partnership means we can report your payment history directly to these bureaus, giving you the opportunity to build and/or restore your credit

Also Check: Is Paypal Credit Reported To The Credit Bureaus

How Unreported Accounts Impact Your Credit Score

based only on the information on your credit report at the time the credit score is generated.

It does not consider what used to be on your credit report last year or even last week. If an account never appeared on your credit report, there should be no change to your credit score based on your payment behavior with that particular account. However, you may be missing out on a potential credit score boost from timely payments on an account.

On the other hand, your credit score could rise or fall if an account falls off your credit report, for example, because the credit reporting time limit has passed.

Its hard to predict which way your credit score will go because it depends on the account that falls off and all the other information on your credit report.

Businesses arent required to report to the credit bureaus its strictly voluntary. If an account isnt showing on your credit report and you think it should be, contact the business to find out their credit reporting policies. There may have been a mistake with your account, and the business can update the credit bureaus with the correct information.

How To Get The New Acima Leasepay Card

Customers can now pre-register now for the new Acima LeasePay card.

Starting this summer, consumers will be able to use the Acima LeasePay card at participating merchants across Acima’s mobile app, marketplace and web browser extension.

While Acima says that customers don’t need to have a good credit score in order to be approved for a lease, the website states that eligibility requirements include a 3-month income history, monthly income of $1,000 or more and a checking account for at least 90 days in positive standing . Consider applying if you have low or no credit but a source of income.

There is also a welcome offer for consumers: Get instant approval for a lease transaction by applying through the mobile app and, if eligible, receive access to up to $4,000 through the Acima LeasePay card. This $4,000 limit can be used to complete lease transactions at participating Acima merchants for any qualified goods in the U.S.

Once approved, customers can instantly access their Acima LeasePay card directly through the mobile app so lease transactions are quicker than ever. While there is only the virtual card option at the moment, Acima plans to issue a physical payments card in the future.

The Acima LeasePay card is currently not available in MN, NJ, WI or WY.

Read Also: What Is Syncb/ppc

Account Not Showing On Your Credit Report Here’s Why

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina. He is a CFP, registered investment advisor, and he owns his own financial advisory firm. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

When you’re reviewing your , you may notice that some of your financial accounts don’t show up. In some situations, you may see accounts on your credit report from one bureau but not on the other two. Or, there may be accounts that dont appear on any of your credit reports from any of the major credit bureaus.

There are a few explanations for this, and it’s all based on how credit reporting works.

Do Customers Own The Merchandise

We buy the product from you and our lease-to-own solutions provide a clear path to ownership for our customers. Once a lease begins, the customer has three options. First, they can acquire ownership of the item by making the number of lease renewal payments disclosed in their agreement. Second, at any time during the lease they can exercise an early purchase option and purchase the item at a discount to the total cost of the lease. The earlier this decision is made, the larger the discount. And third, if the lease no longer fits within their budget, they can make the decision to return the item to us in good condition and have no further payment obligation.

Read Also: Cbcinnovis On My Credit Report

Acima Credit May Be A Good Option If You:

Must buy something immediately and you dont have savings or a credit card: Given the high costs, it makes sense only if you pay off the lease within 90 days. Paying it off over 12 months doubles the cost of your purchase.

Acima also reports payment activity to credit bureau Experian, so timely payments may help build your credit.

Who Is Acima Financing Good For

If you have less-than-perfect credit, need to buy something immediately and only need the loan short-term strictly less than 90 days Acima could work for you.

But if theres any doubt you can repay it that quickly, youll want to avoid this lease-to-own financing. If your credit is in pretty good shape, consider other financing such as a personal loan or a credit card, which may cost less and come with longer repayment terms than Acima offers.

You May Like: Check Credit Score Without Social Security Number

Beware The Fine Print

Read your lease agreement in full before you sign it. Take note of the total lease amount, which is the sum of all payments over the full 12-, 18- or 24-month term. The contract will also list other potential charges you could face, including those for lost or damaged property, repossession, collection and redelivery fees.

How To Apply For Acima Credit

Applying for Acima credit is fast and simple. But the process is slightly different compared to applying for a credit card or a personal loan.

Typically, you apply for financing first, and then use this financing to pay for merchandise.

With Acima, the first step is to find a participating merchant. Use the websites Find a Store search tool to locate participating merchants in your area.

Enter your zip code and youll see a list of retailers in your city and surrounding cities. Find and select a merchant, and then click Apply for Acima credit.

You can apply online or in-person at the retailers store.

The application is also straightforward. Youll provide basic information, such as:

- first and last name

- Social Security number or individual taxpayer identification number

- phone number

Once youve provided the requested information, hit submit for an instant decision.

Recommended Reading: What Is Cbcinnovis On My Credit Report

Can I Use My Lease Approval Amount At Any Store

Your approval amount can be used for eligible items at online retailers in the Acima MarketPlace and in our mobile app, as well as thousands of brick-and-mortar stores, which you can find by using our store locator. Were always looking for ways to expand your choices, so keep an eye out for additional ways to shop in the near future.

Acima Credit Retail Financing Review

Acima Credit is an alternative lender that provides point-of-sale financing for lease-to-own purchases of various merchandise, including furniture, electronics, auto parts, and appliances. This type of financing can be a good fit for those with less than perfect credit scores, but for others, there are cheaper financing options such as personal loans and even credit cards. Headquartered in Sandy, UT, the company was founded in 2013 as an innovative FinTech startup named Simple Finance, but it changed the name to Acima.

Check Your Personal Loan Rates

Answer a few questions to see which personal loans you pre-qualify for. Its quick and easy, and it will not impact your credit score.

with our trusted partners at Bankrate.com

We follow a rigorous editorial policy designed to keep our writers and editors independent. Articles may reference products from our partners, so heres more information on how we make money.

How we make money

In this article

Read Also: What Day Does Opensky Report To Credit Bureaus

Ers Beyond Fico Scores

Acima: Without giving up our secret sauce, there is more to a person than their FICO score. We believe FICO is an outdated solution to a new age problem. Acima doesnt care much about what happened years ago, we care about where your customers are now. We require three things from a customer: be a real person who we can identify, have a traditional checking account in good standing, and have a source of reliable income. If consumers can meet those three criteria, they should apply and be confident they will be approved.

Kornerstone Credit: We utilize proprietary data that looks beyond credit scores. We believe a customers job and banking history are worth more than their FICO score. No matter a customers credit history, they can still be approved for up to $5,000.

Progressive: We look at many data points besides credit scores including things like employment and banking history. By doing so we are able to approve many customers with less than perfect credit or with a thin credit file or no credit file.

Snap: There are numerous factors that come into play beyond FICO. Snap uses over 9,000 data points in its machinelearning models versus other credit models that use about 200. It is this significant difference in the amount of data and how it is compiled that leads to the Snap difference in approval rates.

MTD: How can dealers contact you?

West Creek: 844.WC.TIRES 928-4737, www.westcreekfin.com/mtd.

A PROVIDER OF LEASES AND LOANS

MTD: What services and products

Re: Question On Charged Off Account With Acima

COs hurt you in several ways – first off it’s the worst of the derogatory status that isn’t a collection, judgment, or BK and puts you into a “dirty” scorecard. If it’s reporting CO every month, it’s further suppressing your scores. AND if that’s not enough, as firemedic points out, the past due balance is counting against your credit utilization .

If it’s reporting monthly and it appears that it is – once you settle, it will stop reporting and the $0 balance will no longer be hurting your Util scores. These are great things for your scores.

In my experience with COs – unless it’s very old, not reporting monthly, and/or about to fall off your credit report at the 7 year mark, you should settle or pay it.

You May Like: Minimum Credit Score For Carmax

How The New Acima Leasepay Card Works

Through the Mastercard payment network, Acima purchases the selected item directly from the retailers and then leases the merchandise to the customer under a flexible lease-to-own transaction. By agreeing to making small payments over time, customers can immediately get access to the things they need while also having the opportunity to eventually own the products. Customers are not locked into a long-term debt obligation .

While there are no interest rates or late fees associated with Acima’s lease-to-own transactions, failing to renew your lease in a timely manner will result in a set fee that is disclosed in each agreement. The fee varies by state and each state has varying grace periods before the fee can be charged.

Here’s a step-by-step breakdown of how someone would make a lease transaction with the Acima LeasePay card:

Online Stores That Accept Acima Credit To Buy Now Pay Later

Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Acima lease-to-own program allow you to get key items like furniture, mattresses, appliances, tires, electronics, jewelry, and moreall without credit*. Search for a store and apply online, or go straight to a location where they can help you out as well. No credit is needed with Acima Credit.

Buy what you need when you need it up to $5000, and they’ll give you 12 months to pay it off with flexible payment options . They even offer a 25% off early payoff discount.

- No Credit Scores

- Instant Approvals

- Easy Payment Options

Here is the list of online stores that accept Acima Credit for payment to buy now and pay later:

In This Post:

Recommended Reading: Cbcinnovis Hard Inquiry

Use Acima For Needs Versus Wants

Acima can be a pricey way to buy the things you need, so try to limit your shopping to exactly that: needs versus wants. For example, replacing a broken washing machine or buying a set of tires for winter is probably a better use of an Acima lease than, say, purchasing a brand-new flat-screen TV.

Is Acima Credit Right For You

Acima Credit is an attractive financing solution if you have bad credit or no credit. But, unless youre able to pay back the credit in 90 days, this lease-purchase option is expensive.

Also, youre only able to use Acima with certain retailers.

If you prefer the flexibility and convenience of using a credit account anywhere, you might have a better experience with a secured credit card. These credit cards are easier to get without prior credit history or bad credit.

Similarly, Acima might not be the best choice if you have good credit. You should consider other financing options. These include a credit card or a personal loan. In most cases, youll receive a lower interest rate and pay less out-of-pocket.

But if you absolutely need tires, appliances, or other merchandise, and a personal loan or secured credit card isnt an option, Acima might work for you.

Just make sure you make timely payments, so you can build a stronger credit history.

And if possible, pay off the loan as soon as possible within 90 days to reduce your out-of-pocket expense.

Don’t Miss: How To Get A Bankruptcy Off Your Credit Report