Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

Does Checking My Fico Score Lower It

Checking your own credit score is considered a soft inquiry and wont affect your credit. There are other types of soft inquiries that also dont affect your credit score, and several types of hard inquiries that might.

- Payment History this is the most important and accounts for 35% of your FICO 8 Score.

- Length of Credit History A long credit history accounts for 15% of your Score.

Get A Cell Phone On Contract With No Security Deposit

Another drawback of having a bad credit score is that cell phone service providers may not give you a contract. Instead, youll have to choose one of those pay-as-you-go plans that have more expensive phones. At the least, you might have to pay extra on your contract until you’ve established yourself with the provider. People with good credit avoid paying a security deposit and may receive a discounted purchase price on the latest phones by signing a contract.

Read Also: When Does Open Sky Report To Credit Bureaus

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Ways To Improve Your Credit Score

If you want to get a loan or a credit card, you want to have the best credit score possible. If youre looking to improve your score, there are a few things you can focus on:

- Pay your bills on time: This is one of the most important aspects of your credit score, so make sure you are staying up to date on any and all bills you owe each month

- Keep your credit card balances low: While it is important to use your credit cards to prove you can pay them off, make sure to keep your balances relatively low. Generally you want your balance each month to be less than 30% of your total available credit.

- Avoid having too many credit cards: Dont get new credit cards just because you can get a free gift or because the deal looks too good to pass up. Only open new cards as needed.

- Rectify inaccuracies on your credit report: There could be mistakes on your report dragging down your score. Deal with those.

- Dont close your credit card accounts: If you dont use a card anymore, thats fine, but dont close the account. Just keep the card in a drawer.

There isnt any foolproof plan to raise your credit card in a short time frame, so dont fall for anyone telling you thats possible. Just follow these general rules and be smart, and you could see your score rising over time.

Don’t Miss: Remove Repo From Credit

Easier Approval For Rental Houses And Apartments

More landlords are using credit scores as part of their tenant screening process. A bad credit score, especially if its caused by a previous eviction or outstanding rental balance, can severely damage your chances of getting into an apartment. A good credit score saves you the time and hassle of finding a landlord that will approve renters with damaged credit.

Learn About Credit Score Ranges From Fico And Vantagescore And How They Classify Excellent Good Or Poor Credit Scores

By Allan Halcrow | American Express Freelance Contributor

7 Min Read | January 31, 2020 in

Figuring out what a credit score of 640 means isnt really as tough as cracking the Da Vinci Code. But by the time youve considered the various credit score scales , it can certainly feel that way.

Fortunately, you dont need to be the hero of the Da Vinci Code to make sense of your . Thats because the different scales are more similar than different, and the scales are divided into credit score ranges whose names are simple and easy to remember .

Although cracking the credit code wont help you save the world, knowing the credit score range where your score lands can help you understand how lenders may view you in terms of credit risk. That could help you plan various aspects of your life, including the likely success of credit card, loan and rental applications, and whether you can expect to be offered favorable interest rates. And if you dont like the implications of your credit score range, you can take actions that could change it.

The two most commonly used credit scoring models, FICO and VantageScore, both rank credit scores on a scale from 300 to 850 and divide the scale into five credit score ranges. The ranges differ somewhat between the two models, and also have different names. If youve heard of higher scores, its either based on old information or industry-specific scoring models.

- Superprime

- Subprime

Equifax Credit Score Rangesand Others

You May Like: Does A Closed Account Affect Credit

Is 831 A Good Credit Score

A FICO® Score of 831 is well above the average credit score of 704. An 831 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

Is A Credit Score Of 635 Good Or Bad

Your score falls within the range of scores, from 580 to 669, considered Fair. A 635 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

Is it bad to check your credit score often? You can check your credit score as often as you want without hurting your credit, and its a good idea to do so regularly. At the very minimum, its a good idea to check before applying for credit, whether its a home loan, auto loan, credit card or something else.

How can I wipe my credit clean?

You can work to clean your credit report by checking your report for inaccuracies and disputing any errors.

Is a 637 credit score good? Your score falls within the range of scores, from 580 to 669, considered Fair. A 637 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

Recommended Reading: When Does Comenity Bank Report To Credit Bureaus

How To Stay On Top Of Your Credit Score

Generally, people with a good credit score have a long history of making their credit card and other loan payments on time. Payment history typically makes up 35% of the total calculation. Amounts owed typically makes up about 30%. Other considerations are length of , about 15% credit mix , about 10% and new credit about 10%.

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

You May Like: 686 Fico Score

How Are Credit Scores Determined

A credit score is a number that indicates your perceived creditworthiness in the eyes of credit rating companies, banks and other financial institutions. If you have a history of paying your bills on time and only using a small percentage of your available credit, you should have a high score. If youve missed bills, filed for bankruptcy, defaulted on loans or dealt with collections, then your score will likely be lower.

Heres a deeper breakdown of what goes into the creation of your credit score:

- Payment history: 35% of your score

- 30% of your score

- 15% of your score

- New credit applications: 10% of your score

- 10% of your score

The most well-known provider of credit scores is the Fair Isaac Corporation, or FICO. However, each of the three credit bureaus has its own take on your score. This is known as a VantageScore, and it is a modified version of your FICO score thats based on both the credit bureaus scoring models and their own information on your credit history.

There are also different FICO credit scores for bank cards, auto loans and more. Thats why a single person can have several credit scores. Different bureaus may treat credit events or authorized user accounts differently, so you may have excellent credit according to your Transunion credit score, but still be in the good range with your Equifax score.

There Are Ways To Improve It

An excellent credit score is like the top math score on the SAT. With both, 800 is exceptional.

But if your credit score isn’t near that number, you should know what constitutes a good credit score that will let you qualify for a loan at a decent interest rate.

The answer: It should be at least in the mid to high 600s.

If your score isn’t that high yet, you’ll need to exercise good borrowing behavior, take some strategic steps, and have patience. You may also want to take advantage of two new programs offered by credit industry companies that are designed to improve those numbers .

The FICO score is the brand of credit score used by most consumer lenders, so it’s the one to pay the most attention to. FICO credit scores typically range from a low of 300 to a high of 850. When you get a credit score report from your lender, your number is often depicted on a continuum like a spectrum or rainbow, with bright green denoting the 800 range and red representingwell, you know.

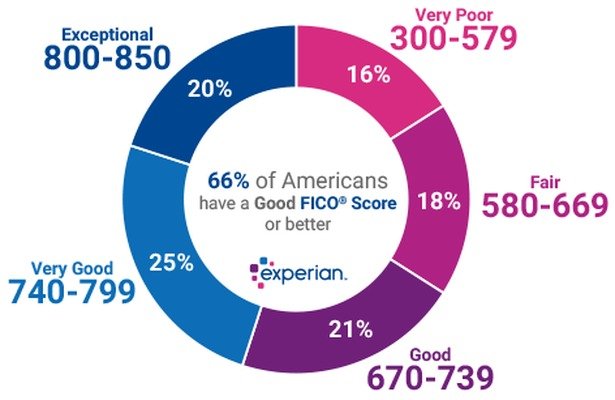

FICO says there’s no “cutoff” where, say, a good credit score becomes a very good credit score, or a very good credit score becomes exceptional. But Experian, one of three major credit bureaus that supply data used in the FICO score, lays out the boundaries this way:

Also Check: Care Credit Credit Score Requirements

What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

The Credit Score Needed To Buy A House

Your FICO score plays a major role in your ability to secure a mortgage. The type of mortgage that youre looking to secure will determine what your score should be. According to QuickenLoans, these are the following credit scores you need to work with lenders14:

- Conventional Mortgage: 620

- FHA Loan With 3.5 Percent Down: 580

- FHA Loan With 10 Percent Down: 500

If you fall below these guidelines, ask yourself, how long does it take to build credit? Then, come up with a plan of action to help you work towards your goal.

Read Also: Cbcinnovis Credit Check

What Is A Good/bad Credit Score

There is no âmagicâ credit score that will guarantee that you get accepted for credit. Also, different lenders are looking for different things, so you might get refused credit by one lender and accepted by another.

Remember, your credit score is a useful indication of your creditworthiness, but lenders will look at other factors before deciding whether to lend to you.

What Are Fico Credit Score Ranges

FICO® Scores are calculated with algorithms created by the Fair Isaac Corp., which is why theyre called FICO® Credit Scores. FICO® Scores generally range from 300 to 850.

There are five levels of credit score ranges on the FICO® Score scale.

- Exceptional: A score of 800 or above puts you in the highest FICO® Credit Score range. Falling anywhere in the exceptional range means you should qualify for most credit card offers as long as you meet other application requirements.

- Very Good: The very good range usually means you have a credit score of 744 799. People in this range are considered dependable borrowers.

- Good: If your score is between 670-739, youll fall into the good range. This means youre considered dependable, but you may have had a late payment in the past, carry higher debt levels or you may not have a long credit history.

- Fair: A credit score of 580 669 means youre in the fair range. You likely made a payment that was 30 days late or more, carry a high debt load and this means you wont be eligible for the best interest rates.

- Poor: When you have defaulted on loans or frequently pay your bills more than a month late, your credit score is likely to be poor, and you may not qualify for a credit card or loan if you apply.

You May Like: Will Paypal Credit Affect Credit Score

Is 711 A Good Credit Score In Canada

There is a maximum credit score range of 300 to 900 in Canada, and 900 being a perfect score is the minimum score. Your score will most likely range from 760 to 900 if your method is correct. The more you contribute toward debt, the lower your score will fall, so the better the chance you have of getting approved.

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Recommended Reading: Sywmc On Credit Report

What Are The Factors That Affect Your Cibil Score

Given the significance of your CIBIL score, it is important to ensure that it’s always towards the higher side. To do this, it is vital to be aware of the factors that affect your credit score and control them accordingly. Here are the factors that affect your CIBIL score:

- Your income

- Any defaults, delays, or lapses in previous credit repayment

- Rejections for loans that you have applied for