When Should You Close An Account

Here are a few situations where we believe that closing an account is an appropriate thing to do:

For example, if you have a credit card that has a hefty annual fee and the rewards provided by the credit card are not worth it for you, you should go ahead and close the credit card.

As an alternative to closing such a card, you should consider switching your account into a credit card that does not have an annual fee. Some banks and card issuers will transfer the accounts entire history to your new free account. So, ask about switching your credit card to a different one prior to closing it down.

A second situation where it may make sense to close an account is that if its a credit card with a high-interest rate and you plan on leaving a balance on the card, you might want to close your high interest rate account and open a card with a lower interest rate.

A third situation where it would make sense to close a credit card is if youre trying to curb your spending and you dont want to be tempted to spend money an open credit card.

Although you can just store your credit card away and leave the account with a $0 balance, some people cant resist the temptation to spend money and find it better to just close down the account to avoid living beyond their means.

Reduction Of Your Credit Mix

Closing an account can have a negative effect on your credit score because it can reduce your credit mix. The credit reporting bureaus reward those who have a more diverse mix of credit accounts, such as credit cards, auto loans, home loans, and student loans.

When you close down an account, you are effectively reducing your credit mix, which can cause a small drop in your credit score since youll have a less diverse pool of accounts. So, if you want to maintain your credit score or improve it, you should avoid closing down accounts.

Closing A Card Hurts The Length Of Your Credit

Having an inactive account shut down can hurt your length of credit history which impacts 15% of your score. If the card closed is one of your older credit cards, this can reduce the average age of your accounts which will lower your score.

Additionally, if it is your oldest credit account, it could impact your score even more since the scoring formula typically looks at your oldest credit line, too.

You May Like: Does Overdraft Affect Credit Rating

Add Positive Data To Your Credit Report

There are a couple of fairly new options that I like which may be attractive to someone in your position, like Experian Boost and UltraFICO. These are programs that allow the consumer to supply positive data in their credit report that can be used to increase scores. This is especially effective for people with limited credit histories. Both are simple to use and results are seen instantly.

To use Experian Boost you must allow the credit bureau to access to your banking information in order to pull things like utility and phone bill payments. Positive payment histories are incorporated in your report and can add points to your score.

UltraFICO looks at your checking and savings account information for positive data such as how much you have in savings, how active your accounts are and how long they have been open.

Both use only positive data and you can enroll or drop out at any time. Also, both only impact your Experian report, so keep that in mind. If you pay rent to a landlord that does not report to the bureaus, consider using a rent payment service that acts as a middleman when you pay your rent, enabling them to report positive rent payment history on your credit reports.

Are Closed Accounts Bad For Your Credit

The impact that a closed account has on your credit depends on the type of the account, and whether the account was in good standing at the time it was closed. For example, closed installment accounts that are in good standing are not bad for your credit. In fact, they will continue to have a positive impact on your credit score so long as they appear on your credit report. However, accounts that are closed in bad standing with negative marks, such as missed payments will have a negative impact on your credit score until theyre ultimately removed from your credit report after 7 years.

That said, closing a account, can have a negative impact on your credit score because it reduces your available credit limit. Reducing your available credit limit could increase your credit utilization , causing your credit score to drop.

This occurs because your credit utilization accounts for 30% of your credit score. Whenever your credit utilization increases, your credit score drops. As a rule of thumb, you should keep your credit utilization below 10% and never exceed 30%. If you exceed 30% credit utilization, you will notice a significant drop in your credit score.

So, if you have a credit card and you barely use that credit card account, consider keeping it open because the available credit limit on your credit has the potential to decrease your credit utilization, the lower your credit utilization, the better your credit score will be.

Read Also: What Credit Report Does Target Pull

How Is Payment History Calculated

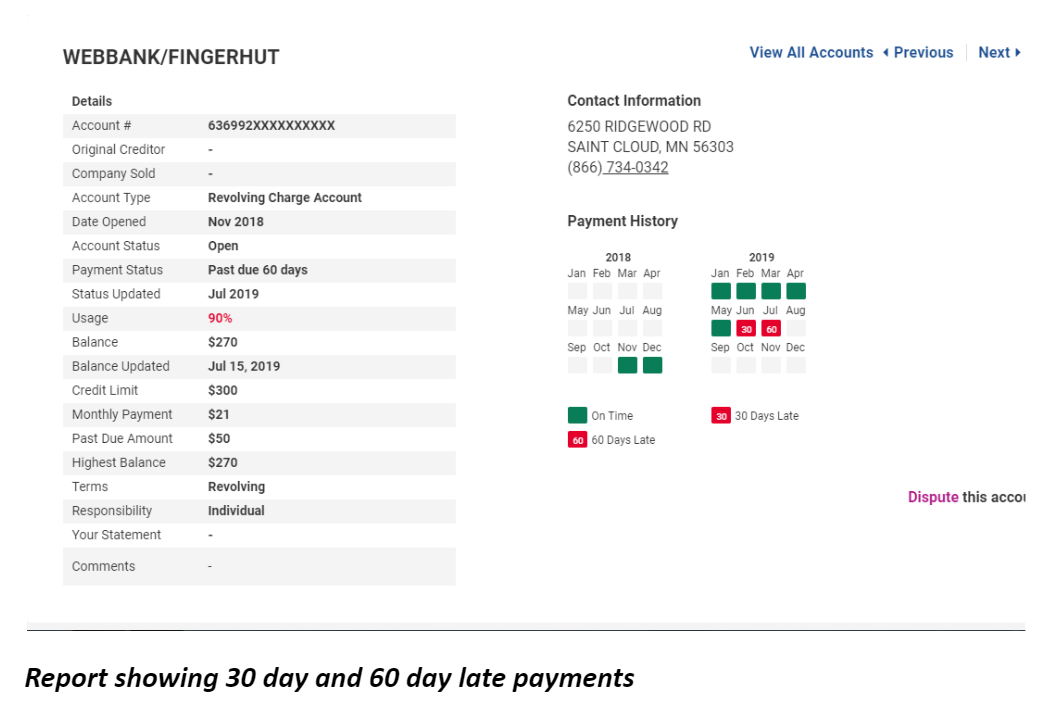

How is a payment defined as on-time or late for the purpose of calculating your credit score?

Payments are reported to the three major consumer credit bureaus as on-time if they are made on or before the date they are due.

Many people wonder what happens if you missed credit card payment or missed credit card payment by one day. Does a one day late payment affect credit score? Fortunately, most lenders also provide a 29-day grace period after the payment due date before reporting a payment as late to the credit bureaus. If you make your payment during this grace period, your payment will be reported as on-time, exactly the same as if you had made it on or before the due date.

The examples below illustrate two different payment patterns and how each would be reported on your credit report and used to calculate your credit score.

Example 1:

All payments made on-time: payments made on or before the due date.

Example 2:

Payments made on-time, except April payment made 17 days late and August payment made 29 days late .

Key:

Payment reported as On-time

X Payment reported as Late

Note that while a payment made after its due date may still be reported as on-time to the credit bureaus, a lender may charge you a late-payment fee for payments made after the due date or after a late fee grace period and a lender may increase your interest rate or decrease the amount of credit available to you.

Example 3:

How To Avoid Late Payments

To help avoid late payments, sign up for reminders and alerts from creditors. Depending on the company, you may be able to get mail, emails, texts or app notifications reminding you of upcoming due dates and the amount due.

You can also sign up for automatic payments, either by setting up bill pay from your bank account or requesting that the creditor pull the money out of your account. But make sure you’ll have enough money in your account, or you could wind up with a late payment, an overdrawn account and fees from both your creditor and bank.

With a credit card, you could set up autopay for the minimum payment amount, which will be either a fixed amount or a percentage of your total balance. Doing so will at least help keep you from accidentally missing a payment and getting charged late feesbut try to pay your balance in full each month to avoid interest charges.

As a last resort, if you’re unable to pay all your bills on time, see if any of your creditors offer a grace period. In some cases, you may be able to pay a bill a few days late without garnering any additional fees or interest. And as long as you pay the bill within 30 days of the due date, there won’t be any negative impact on your credit.

Also Check: When Does Paypal Credit Report To Credit Bureau

Re: Late Payments On Closed Accounts

Yes, they count. Late payments are late payments and they have the same impact on your score on an open account or a closed account. They’ll be there for 7 years. The 30’s and 60’s from what I understand will only impact your score for about 2 years, where the 90+ ones will impact your score for much longer.

Unless the lates are removed, the only thing that will ease the sting of them is time. What matters in terms of scoring is how long ago the late occurred, not whether or not the account is open or closed. In fact, if you closed an account 3 months ago and 4 months ago your second to late payment was late on that account, it will carry more impact than a late payment 2 years ago on a current, open account. It’s all about what was more recent. Hopefully that makes sense.

Dos And Donts Of Closing A Credit Card

There are good reasons for closing a credit card. Whether the temptation of using credit is leading you to constantly overspend and rack up interest, you have so many cards that youre losing track and missing payments, or you want to get rid of a card with a low limit and higher than normal interest rates, cancelling can be the right move.

If you plan on cancelling one of your credit cards, consider the following dos and donts to minimize the impact on your credit score.

Dont Miss: How To Unlock My Experian Credit Report

Read Also: Does Paypal Working Capital Report To Credit Bureaus

What Happens When You Make A Late Payment

It depends on how much you owe and how late your payment actually is, but theres no getting around it: Late payments can hurt your credit.

If you can, pay off the overdue account in full within 30 days of missing the payment. This will keep your account from going into default. If the account continues to go unpaid for 60 days, you could see another negative impact to your scores. And after 90 days, your account might be reported as delinquent, which will continue to have a negative impact on your overall credit health.

Here are some things you might encounter after making a late payment on a credit card or other line of credit.

The consequences of making a late payment can feel harsh. But dont let it discourage you from working toward future financial goals. Credit scores can bounce back with time, hard work and patience. The best thing you can do is start working on rebuilding your on-time payment streak if possible even if that means making the minimum payment each month. Making more and more on-time payments and actively reducing the amount you owe can diminish the impact on your scores over time.

And, as best you can, dont let future payments become delinquent or get sent to collections. An account reported in collections could stay on your credit reports for up to seven years and cause even more damage than a late payment.

Look For Closed Account Errors On Your Credit Report

Around 20% of people have an error on their credit report, so there is a good chance something is wrong on yours.

One common error is the account open/closed status, among other errors. Many errors are not in your favor and could harm your chances of getting approved for a new credit card or loan account in the future.

Thats one reason its a good idea to check your credit report regularly. You can get your credit report for free from AnnualCreditReport.com, a government-mandated website.

If you find any errors, you can file a dispute with the respective credit bureau for a remedy.

In most cases, you cannot remove accurate information from your credit report, including closed accounts. You can send a written request or call the lender to remove an account from your credit report, but that decision is ultimately at their discretion.

Don’t Miss: What Is Syncb Ntwk On Credit Report

What Affects Your Credit Score

Your provides a snapshot for prospective lenders, landlords, and employers of how you handle credit. For any mortgage, car loan, personal loan, or credit card you have had, your credit report lists such details as the creditor’s name, your payment history, account balance, and, in the case of credit cards and other revolving debt, what percentage of your available credit that you have used.

Credit reporting agencies, colloquially known as , also take this information and plug it into proprietary algorithms that assign you a numerical score, known as your credit score. If you do not pay your creditors, pay them late, or have a tendency to max out your credit cards, that kind of negative information is visible on your credit report, which can lower your credit score and may prevent you from receiving additional credit, an apartment, or even a job.

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

Don’t Miss: Is 611 A Good Credit Score

Does Closing A Checking Or Savings Account Affect Your Credit

Closing a checking, savings, or any other type of deposit account will not affect your credit score. This is so because the status of deposit accounts, such as checking and savings accounts is not reported to the credit reporting bureaus. As such, closing such an account has no impact on your credit score.

However, if you leave an unpaid balance on a checking or savings account, this could indirectly hurt your credit score. For example, if you leave a negative balance, your bank may sell the negative balance to a collection agency. The collection agency may cause significant damage to your credit score by adding a collection account to your credit report. A single collection account may cause your credit score to drop by 100 or more points. The higher your credit score, the bigger the drop will be.

To avoid this situation, you should contact your bank to ensure that the balance on your account is $0. This will help any negative balance from being sold to a collection account and damaging your credit score.

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Read Also: How To Take A Repo Off Your Credit

Get Your Late Payments Professionally Removed

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

What To Do If Youve Made A Late Payment

If your bills are past due, the sooner you can pay the bill, the better. The damaging effect of a late payment on your credit scores can increase the longer you wait.

If youve made a late payment recently, here are some things you can try.

- Request removal of a late payment fee. If youre in otherwise good standing with your bank, or if its your first time missing a payment, consider asking your bank to forgive or remove the late fee.

- Work to reset your penalty interest rate. If a late payment caused your interest rate to increase, your issuer is generally required to reset your interest rate back to the pre-penalty rate if you make six months of on-time payments. If you can, make it a goal to get back on track with on-time payments, which could help you pay less interest on your accounts in the long run.

- Pay all accounts on time. If a late payment caused your credit scores to drop, the best thing you can do is to continue making on-time payments on all of your accounts. After a few months of consistent on-time payments, your credit scores could slowly improve. An easy way to prevent late payments is to set up automatic payments and email or text reminders on your financial accounts.

Read Also: 8773922016