How To Remove Late Payments From Credit Report

* This is not a financial advice article. Speak to a professional financial advisor if you need financial assistance.

Almost everyone has made a late payment on a bill at one time or another. Unfortunately, a late payment could cause a significant decline in your credit score, causing you to pay higher interest rates on loans and credit cards as a result.

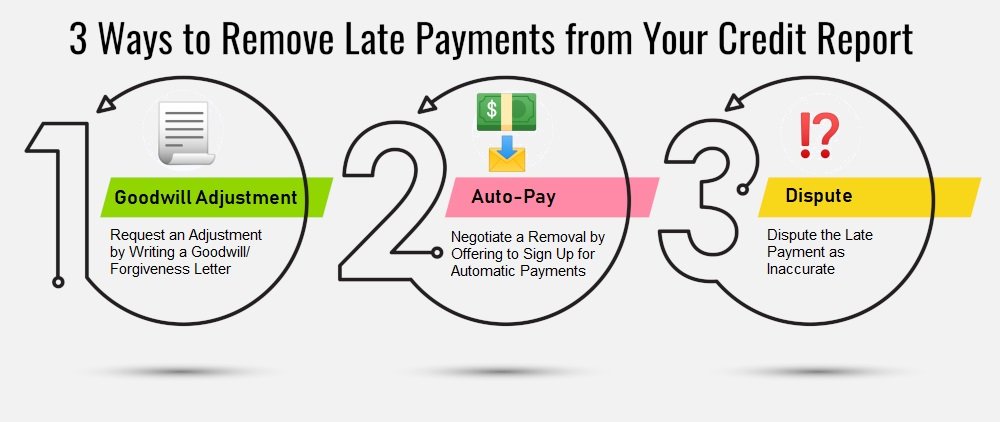

Whether the late payment is your own fault or a mistake by your lender, there are different ways you can get late payments removed from your credit report. Read on for a summary of the most common approaches.

If you dont have the time or energy to handle the process of removing late payments by yourself, check out Credit Saint. Credit Saint is the #1 ranked credit repair company for removing late payments and fixing credit scores.

How Do You Write A Letter To Remove Negative Credit

Asked by: Mr. Guiseppe Ziemann DDS

I’m writing because I noticed your company reported a late payment in on my credit reports. I am requesting a goodwill adjustment to remove this late payment from my TransUnion, Experian and Equifax credit reports. Upon review of my records, I realize that I did indeed miss the payment deadline.

How Do I Get A Copy Of My Credit Report

Right now, its easier than ever to check your credit report more often. Thats because everyone is eligible to get free weekly online credit reports from the three nationwide credit reporting agencies: Equifax, Experian, and Transunion. To get your free reports, go to AnnualCreditReport.com. The credit reporting agencies are making these reports free until April 20, 2022.

Each of the three nationwide credit reporting agencies Equifax, TransUnion, and Experian are already required to provide you, on your request, with a free credit report once every twelve months. Be sure to check your reports for errors and dispute any inaccurate information.

In addition to your free weekly online credit reports until April 20, 2022 and your free annual credit reports, all U.S. consumers are entitled to six free credit reports every 12 months from Equifax through December 2026. You can access these free reports online at AnnualCreditReport.com or get a “myEquifax” account at equifax.com/personal/credit-report-services/free-credit-reports/ or call Equifax at .

You May Like: Does Carmax Work With Poor Credit

How Can I Wipe My Credit Clean

How to Clean Up Your Credit Report

How Often Should I Check My Credit Reports After Talking To My Lender

After making an agreement or accommodation with your lender, you should check your credit reports to make sure that the agreement or accommodation is accurately reflected. For example, if your lender agreed to let you pause one months payment, make sure they didnt report it as delinquent or a missed payment. It could take a month or more for the changes from your lender to show up on your credit reports, but you should check them regularly especially if you are or will be in the market for credit, or if your credit reporting data will be used to make a lending, employment, or housing decision about you. So, check your credit reports after a month or two to see if the reports are accurate.

There are other reports you may want to check too, such as reports that monitor your bank and checking account history, phone, utility, and rental payment history, among others. The CFPB has a list of consumer reporting companies where you can learn more about which reports might be important to you, depending on your specific situation.

You may also be able to get a free copy of your credit scores. Check out the to learn about your options for accessing one of your credit scores free of charge.

Also Check: Free Credit Report Usaa

Never Dispute Or Try To Remove Recent Late Payments Directly With The Credit Bureaus

A lot of credit repair experts encourage you to dispute the late payment with the credit bureau with the idea that it is supposed to miraculously get you results if the creditor does not respond within 30 days.

In reality, this is one of the biggest mistakes you can make.

Why? Simply put, technology. Today, credit bureaus have modernized their systems and switched to automatic dispute verifications where they correspond with the creditor via their data exchange interface, E-Oscar.

Hence, unlike the older days, no phone calls or handwritten communication is exchanged between bureaus and creditors. This interface verifies millions of accounts that are disputed by consumers every month in a matter of minutes. It does so by simply cross-referencing databases of the bureaus and creditors.

Situations where credit bureau disputes may work:

However, may work with a minor degree of success for one type of late payment:

A very old late payment on an account thats been closed for at least 3-4 years or longer. They can also be effective for questionable older collection accounts and charge-offs if you utilize the dispute the right strategy.

Feel like you may need help removing late payments from your record? Click the link below to book your free consultation.

Avoiding Late Payments With Autopay

Which brings me to my final tip. The best way to save your credit score is by avoiding late payments altogether by setting up autopay. This is the easiest way to ensure youre never missing a due date I actually ended up setting up autopay across all of my credit card accounts after my mistake with confusing due dates earlier this year.

Its easy to set up autopay online or in your issuer app, and you can generally set them up to cover your minimum payment, statement amount , or some other fixed amount .

Recommended Reading: How Do I Unlock My Credit Report

B: Identity Any Extenuating Circumstances Or Errors That Led To Late Payments

If you can prove that a third party mistake or some extenuating circumstances led to the late payment AND the late payment was not due to your financial inability to pay, then youre in luck.

But beware, creditors will never remove a late payment due to financial hardship or job loss.

However, if you can show documented proof of the extenuating circumstances that led to the late payment along with a copy of a bank statement showing a healthy balance of a few thousand dollars, then creditors may agree to remove late payments under the following circumstances:

Examples of Circumstances:

If you are able to prove a scenario like the one listed above, you will need to ask for the address, fax, or email for the creditors Credit Bureau Department, to whom youll fax this information for review.

Payments More Than 30 Days Late

Once a late payment hits your credit reports, your credit score will likely drop from 90 to 110 points. Consumers with high credit scores may see a bigger drop than those with low scores.

The first delinquency impacts FICO Score more than a different consumer who might have multiple delinquencies on credit history, said Tommy Lee, principal scientist at FICO.

Some lenders dont report a payment late until its 60 days past due. However, you shouldnt count on this when planning your payment. The later you pay, the worse the impact on your credit score. Late payments show on your credit report as 30, 60, 90, 120 and 150 days late.

Heres an example of the effect a 30-day delinquency has on two different consumers:

| 30-day delinquency |

| 90-110 |

*Note this study was done on selected consumer profiles, and there are a wide range of profiles so results may vary.

Read Also: Does Drivetime Report To Credit Bureaus

How Can I Dispute A Legitimate Late Payment

The Fair Credit Reporting Act gives you the right to dispute items on your credit report. In that way, you can protect yourself from unseemly creditors and overwhelmed credit bureaus.

When youre faced with a legitimate late payment, the key is to look for anything reported incorrectly within the entry on your credit report. Examples:

- Misspelled word

- Incorrect dollar amount

- Any other errors

If you hit a wall here, try to find something that might be wrong. For instance: you can potentially dispute the late payment if the creditor is no longer in business or another company has acquired them.

Try to find something questionable to dispute. The idea here is to find a creditor that may have a hard time validating the late payment when the credit bureaus request supporting documentation for your dispute.

HOW TO SEND A CREDIT DISPUTE LETTER

Once youve found your error or suspected error, you need to send Send these to each of the credit bureaus reporting the erroneous information.

You can send these either . In your letter, you should identify the error in question, and ask for them to remove the entire entry from your credit report.

Once the credit bureau receives your claim, they will label the item you flagged for review as in dispute on your credit report. Over the next 30 days, the bureau must investigate your claim. They will notify you of their findings.

How To Avoid Late Credit Card Payments

You likely have a busy life, and sometimes, it can be easy to forget a payment. One solution is to set up an automatic payment from your checking account to be sure you make your credit card payments on time. You can also check with your issuer to see if you can set up text and/or email alerts to remind you when your bill is due. For example, with Discover you can login to your account and navigate to the Manage Alerts page to view your options and set up the alerts that best serve you.

Recommended Reading: How Long Before Eviction Shows On Credit Report

Can I Get Some Help With This

Some of the methods I covered are quick and easy, but some of them require a fair amount of time and effort. If it starts to feel like your situation calls for more than what you are personally capable of handling, you may want to consider procuring the services of a quality credit repair company.

A good credit repair company can help you with any of these options, because they have experts that handle these issues each and every day. Ive used credit repair companies to remove late payments from my report, and Ive found them to be extremely helpful and well worth the cost.

There are several ways to attempt to remove late payments from your credit report, and its ultimately up to you to develop your plan and make it happen. Working to improve your credit always a worthwhile endeavor, regardless of how it all shakes out.

About Rick Miller

Rick is a former US Army Aviator, West Point graduate, and Darden MBA. He owns and operates a successful Real Estate Investment firm, and he enjoys spending time with his wife and three children in Hartford, CT.

How Long Do Late Payments Stay On Your Credit Report

Late payments remain on your credit report for seven years. However, contrary to popular belief, you do NOT have to wait up to seven years before being able to get a mortgage, car loan, or any other type of credit again.

Your credit score will steadily rise as time goes on. Even better is that there are several ways to get the late payment permanently deleted.

Keep reading to find out how you can get a late payment removed from your credit reports.

Recommended Reading: How To Remove Serious Delinquency From Credit Report

How Much Does A Late Payment Hurt My Credit

If you have perfect or near-perfect credit, a late payment could knock upwards of 100 points off your FICO score.

As you can see, a single late payment can have a bigger impact on your credit file than you may think.

Thats because payment history comprises 35% the biggest chunk of your credit score.

When you already have excellent credit, you have more room for one negative item to take a big hit.

A single late payment will have a smaller impact if your credit file already has some problems such as multiple late payments or a charge-off or collection account.

File A Credit Dispute

If you find any errors on your credit report, you can file a dispute with the credit bureau that generated the report. You can also dispute the mistake with the creditor.

You can start this process by sending a dispute letter to each credit bureau that reported the mistake. The dispute letter should clearly state the negative information youre disputing, include any documentation of the inaccurate information, and request that the item is corrected or removed.

After receiving your dispute letter, the creditor or credit bureau has 30-45 days after receiving your dispute to investigate the claim. You should be notified of the results after the creditor or credit bureau has finished their investigation.

If the creditor or credit bureau has proof that the information they are reporting is correct, it will stay on your credit report. However, if they agree that the information is incorrect, they must remove it from your credit report.

You May Like: Pre Approval Hurt Credit Score

Will Creditors Delete My Late Payment History If I Submit A Goodwill Letter

Now that weve explored late payment disputes, lets talk about goodwill letters.

If youre familiar with the subject, you may know that goodwill letters used to work to some extent to remove late payments from your credit record. However, that was 10-15 years ago.

However, at this point in time, the bottom line isgoodwill letters do not work. In fact, many bank websites say so explicitly.

Whats more, submitting a goodwill letter may actually decrease the chances of removing a late payment from your record .

But the sad part is, every self-proclaimed credit expert still claims you will achieve forgiveness on a late payment with a goodwill letter.

Signs to lookout for

As a result, many folks end up wasting their time sending courtesy removal requests to creditors. Lots of other people have wasted money with ineffective credit repair companies, including the likes of and Lexington Law Firm, whove been known to prey on customers and have been sued by one of the governments regulating agencies.

Want more proof that goodwill letters are a waste of time? Check this out: Here is Bank of Americas own website stating that goodwill letters will not work. Bank of America says the following:

Were required to report complete and accurate information, and thats why we arent able to honor requests for goodwill adjustments.

Hire A Credit Repair Professional

Lastly, you can hire a credit repair company to do all this difficult work for you.

Hiring a credit repair company can save you lots of time and effort, and as these companies are professional credit experts, they are much more likely to get results.

For this, I suggest you check out Lexington Law Credit Repair. Give them a call at 1-844-331-6062 or Check out our review of their service.

Also Check: Chase Sapphire Preferred Credit Score Requirement

How To Get Late Payments Off Your Credit Report

As youre likely now discovering, late payments can have a lot of weight on your credit scores. If that wasnt bad enough, late payments can also stay on your credit reports for many years. Yikes! The good news, late payments are not difficult to get removed. Ive been able to remove several late payments and Im going to share how I was able to pull it off.

The Late Payment Occurred More Than Seven Years Ago

If a late payment is correctly reported, it should fall off your credit reports after seven years.

Lets say youve missed a payment by 30 days, then 60 days and then 90 days. Even though this one late account can lead to multiple negative marks on your credit reports, the original delinquency is the one that starts the clock. That means the entire sequence should disappear seven years from the first date the payment was late.

If you see a late payment thats more than seven years old, it could be a mistake, and you may want to dispute it.

You May Like: What Is Serious Delinquency On Credit Report

How Long Do Late Payments Stay On Your Credit

If you dont have your late payments removed from your credit, they can stay on your credit report for a full 7 years! Late payments hurt you the most when they first hit your credit. As the years pass by, the effects on your credit scores will become less and less. Heres the problem, if a lender sees this, it could knock you out of a loan or credit. It happened to me. Even when you catch up, late payments can stay on your credit report. While they will report as paid, its still a huge red flag for lenders, banks, etc. Ready to learn how to get your late payments removed from your credit? Lets get to it!