Why You Should Aim To Pay Off Your Debts Anyway

Because paying off an installment loan can ding your credit score, do not keep it open for the sake of maintaining a high score. You wont need to pay unnecessary interest overtime to save some points, as well as your three-digit score can bounce back.

The average credit score recovery time after closing an account is 3 months. Making a series of monthly on-time bill payments is the fast route to improving your score.

Remember: your credit score is one piece of your overall financial health, emphasizing the importance of reducing interest and overall debt. That you are making the effort for engaging and taking control of your credit health makes it more possible you will reach your financial goals over time.

Need credit repair services?

You may still have questions about repairing your credit even if youre planning on paying off debt. Our experts at Masters Credit Consultants are ready to help answer your questions and get your credit score improved!

Why Did My Credit Score Drop After Paying Debt

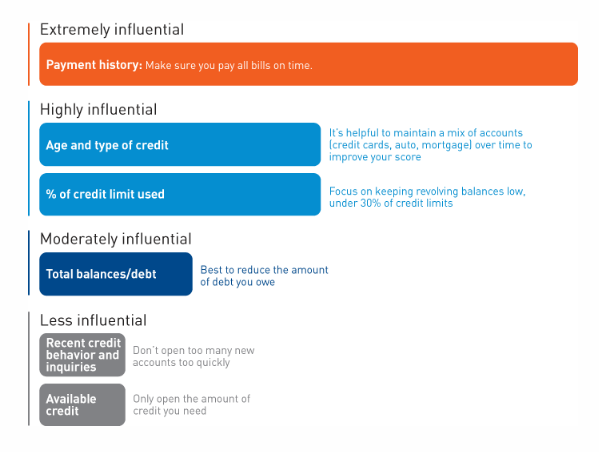

There are several factors that make up your credit score, and paying off debt does not positively affect all of them. Paying off debt may lower your credit score if it changes your credit mix, or average account age. Here are some scenarios that could negatively affect your credit score:

- You eliminated your only installment loan or revolving debt: Creditors like to see that youre able to manage various types of debt. And if eliminating a particular debt makes your credit report less diverse, it can negatively affect your score. For example, if you pay off an auto loan and are left with only credit cards, your credit mix suffers.

- Youve increased your overall credit utilization: Keeping the overall utilization of your available credit low results in a better score. But when you pay off a revolving line of credit or credit card in its entirety and close the account or let the account go inactive , it decreases the total amount of credit you have available, potentially increasing your remaining utilization rate.

- Youve lowered the average age of your accounts: The longer your accounts have been open and in good standing, the better. Having a 20-year old account on your report is a good sign, even if you dont use it closing that account and being left with accounts no more than five years old dramatically reduces the average age of your accounts.

Q: How Do I Pay Off My Debt

Ans: You can repay debt in various ways. For instance, you can settle your debts through OVLG’s debt settlement program wherein you have to pay less than what you owe. If you don’t like the features of a settlement program, then you can amalgamate your debts into a single monthly payment at a low-interest rate.

Despite the numerous benefits of a debt settlement and consolidation program, if you want to avoid both of them, then to get free debt counseling and explore little known ways to pay back your creditors.

Articles you may like:

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Monitor Score Changes With Creditwise From Capital One

Staying on top of the information in your credit report can help alert you to potential problems. But waitâdoesnât checking your credit report hurt your credit score?

Thankfully, thatâs a myth. The Consumer Financial Protection Bureau confirms that requesting your credit report wonât hurt your credit score.

You could use a credit monitoring tool like . CreditWise is free and available to everyoneânot just Capital One customers.

With CreditWise, you can access your free TransUnion® credit reports and weekly VantageScore® 3.0 credit score anytime, without hurting your score. You can even see the potential impacts of financial decisions on your credit score before you make them with the CreditWise Simulator.

You can also get free copies of your credit reports from all three major credit bureausâEquifax®, Experian® and TransUnion. Just call 877-322-8228 or visit AnnualCreditReport.com to learn how.

It’s Not Credit Repair

Rapid rescoring isn’t credit repairits just an express lane for getting information to credit bureaus. You can’t dispute anything and everything that brings down your score , and the service won’t help you negotiate settlements with creditors. You’ll need to take action to improve your credit legitimately and then get a rapid rescore to have those actions reflected in your credit reports and credit score quickly.

Recommended Reading: How To Remove Car Repossession From Credit Report

What Information Is Kept By Credit Reference Agencies

Credit reference agencies are companies which are allowed to collect and keep information about consumers’ borrowing and financial behaviour. When you apply for credit or a loan, you sign an application form which gives the lender permission to check the information on your . Lenders use this information to make decisions about whether or not to lend to you. If a lender refuses you credit after checking your credit reference file they must tell you why credit has been refused and give you the details of the credit reference agency they used.

There are three credit reference agencies – Experian, Equifax and TransUnion. All the credit reference agencies keep information about you and a lender can consult one or more of them when making a decision.

The credit reference agencies keep the following information:

If there has been any fraud against you, for example if someone has used your identity, there may be a marker against your name to protect you. You will be able to see this on your credit file.

You Don’t Have A Uniform Credit Rating

There’s no such thing as a credit blacklist. This is a myth. In the UK, there’s no uniform credit rating or score, and there’s no blacklist of banned people.

Each lender scores you differently and secretly.

This means just because one lender has rejected you, it doesn’t automatically mean others will. Though after a rejection, it’s always important to check your credit file for errors before applying again.

Of course, if you’ve got a poor credit history, or had problems, it can feel like you’re blacklisted. Credit scoring is intuitive would you lend to someone with a history of not repaying? However, on occasion there are firms that specialise in lending to those who have had past problems though they then charge a whacking rate.

The tools that lenders use to decide aren’t universal either. As well as your credit file, they also look at application information and any past dealings they’ve had with you, and use the three sources of information to build up a picture of you.

Don’t Miss: Is 766 A Good Credit Score

Make The Most Of A Thin Credit File

Having a thin credit file means you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways you can fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isn’t normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with no or limited credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. Rental Kharma and RentTrack, for example, will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

Youve Recently Opened Or Applied For Multiple Lines Of Credit

When you open several credit accounts in a short period of time, you represent more of a risk to lenders. For this reason, your credit scores may drop if youve had several hard credit inquiries placed on your credit reports recently.

Its important to point out that checking or monitoring your credit with tools like Credit Karma doesnt affect your scores because it only results in a soft credit inquiry.

If youre rate shopping, FICO® recommends that you do so in a short period of time. For example, if youre shopping for a mortgage or auto loan within a 30-day period, the credit bureaus will typically group the inquiries together. But if youre considering applying for a credit card, keep in mind that youll get a ding on your credit reports for each credit card you apply for, no matter how close those hard inquiries are over a matter of days. So be sure to only apply for credit cards that you truly need.

Also Check: What Is Syncb Ntwk On Credit Report

Change In Credit Utilization Rate

Your is another important factor in determining credit scores. VantageScore says that its extremely influential, and FICO® says that it accounts for 30% of your overall score.

If you spent more than usual last month , it will increase your credit utilization rate. How far will your scores drop because of it? The effect will vary, depending on how much your ratio of credit used versus available credit went up. To keep your credit scores steady, the Consumer Financial Protection Bureau, or CFPB, recommends that consumers keep their credit utilization rate below 30%.

Imagine that you have a $10,000 credit limit, of which you typically only use $1,500 . If your spending one month increases to $2,500, your utilization ratio will still be solid overall at 25%. But if your spending suddenly increased to $5,000 , your scores could start showing a decline.

How Long Does It Take For Your Credit Score To Recover After Taking A Hit

In order to understand how long it might take you personally to improve your credit, it can be helpful to look at one FICO study of the average amount of time it takes to recover your credit score back to its original number after a negative mark on your credit report.

This study was only done for mortgage payments, but its likely that itd be similar for other types of negative marks, such as paying your student loans late or having a car repossessed if you dont pay your auto loan.

| Starting credit score of 680 | Starting credit score of 720 | Starting credit score of 780 |

|---|---|---|

| 30-day late payment | ||

| 7-10 years | ||

| Note: Figures are approximations. |

In general, the longer you forgo a payment you owe, the longer itll take to recover. And the higher your credit score was to begin, the longer it will take to recover. Know that there are things you can do to prevent this from happening and to build credit in the meantime.

Don’t Miss: Les Schwab Credit Score Requirements

How Quickly Will My Credit Score Update After Paying Off Debt

Financial consumers who pay off debt deserve praise. They also deserve to know when their credit scores will reflect those payments.

Americans are taking a hard line on debt in 2021, with many households making debt reduction a priority.

According to a December 2020 study from Fidelity Investments:

- 44% of Americans vowed to save more money in 2021

- 43% said they were going to aggressively pay down household debt

- 54% said they wanted to lead a debt-free life

The link between debt reduction and credit scores

Increasingly, Americans who pay down debt are asking a simple question “When will I see my credit score rise after I pay down debt?”

“There is nothing worse than actively trying to improve your credit score, and we’ve all been there,” said Chris Panteli, founder of Life Upswing, a U.K.-based financial news and advice platform. “Its frustrating not knowing if all that hard work has actually had an effect.”

If fingers need to be pointed at delayed credit scoring cycles, then point them at the credit card companies, banks, retailers and other lenders who provide the credit to consumers in the first place.

Not sure where you fit on the credit score spectrum? Then you should start using a credit monitoring service to track changes to your credit score. Credible can get you set up with a free service today.

Checking schedules

Will Paying Off A Collections Account Improve My Credit Score

Categories

Having debt is something that nearly everyone will have to experience at some point during their lives. While some people only acquire debt that they can afford to pay off, there are also those who end up getting in way over their heads. When this occurs, it is common for people to be unable to make payments on their mortgage, credit card, auto loan, or any other debt they might have accumulated.

to learn how you can consolidate your credit card debt.

Unfortunately, if these kinds of debts go unpaid for a long time, there is a chance that a collections agency might be sent after you in order to try and get payment. Before we go any further into the article, lets take a closer look at what collections accounts actually are and what they aim to do.

You May Like: Carmax Loans For Bad Credit

Estimating Credit Score Changes

While youre waiting for your credit report and score to update, you can use a credit score simulator to estimate how your credit score might change. Credit Karma and myFICO both offer credit score simulators that can show how your credit score might change if the information on your credit report changes, like if you pay off an account or open a new loan, for example.

How Is My Credit Score Calculated

When considering how debt settlement affects your credit score, first its helpful to understand the factors involved, and how each is weighed. There are three main consumer credit reporting bureaus Experian, Equifax and TransUnion and each have their own credit scoring methodology similar to the original FICO credit scoring model created in the 1950s. Here well focus on the traditional scoring model, which is made up of five different categories, each weighing differently on your final credit score:

1. Payment history: 35%

The payments youve made on things like credit cards, your auto loan and even student loans make up your payment history. If youve never made a late payment, chances are your payment history is giving your credit scores a nice boost. Late payments, though, especially those that are 90-or-more days late, can really ding your scores.

2. Credit utilization: 30%

3. Length of credit history: 15%

This is just what it sounds like a measure of how long youve had credit accounts in your name. Fortunately, your length of credit history accounts for just 15% of your score, but it can be frustrating if its routinely dragging down your scores, even just a little. Some people without a credit history or a thin credit profile start with secured credit cards to help them get started.

4. New credit: 10%

5. Credit mix: 10%

Don’t Miss: Credit Score Without Social Security Number

Use Experian Boost To Report Council Tax And Netflix Subscriptions

In November 2020, Experian launched a new tool to help people quickly improve their credit scores.

Experian Boost uses open banking to allow you to grant Experian access to your current account information.

The tool allows you to unlock previously hidden information on your salary, council tax payments, savings habits and even your subscription payment information.

Experian says that 17 million people could boost their credit scores by up to 66 points by using the tool.

Find out more:Experian Boost explained

Best Ways To Improve Your Credit Score

The most important thing you can do to improve your credit score is to make all of your payments on time. Maintaining low balances relative to your total limitsespecially for credit cardsis another crucial thing you can do to improve your credit score. Together, these two factorspayment history and credit usageaccount for 65% of your score.

An easy way to avoid late payments is to on all of your bills. It can be tough to keep track of multiple bills due at varying times manually pay every month. Autopay can remove that friction and youll never have to worry about a late payment. Just be sure that you have enough in your bank account to cover the automatic payment each otherwise, it will count as a negative mark, which is what youre trying to avoid in the first place.

You May Like: Does Paypal Credit Report To Credit Bureaus

Avoid Expensive Credit Repair Companies

You might see adverts from firms that claim to repair your credit rating. Most of them simply advise you on how to obtain your credit file and improve your credit rating but you dont need to pay for that, you can do it yourself.

Some might claim that they can do things that legally they cant, or even encourage you to lie to the credit reference agencies.

Its important to not even consider using these firms.

Theres Good Debt And Bad Debt

What makes debt good? Its debt you paid off as you agreed to do. The three big credit bureaus Equifax, Experian, and TransUnion base their scores on how well you handle your debt. If you have no debt at all, you can have problems. Last year, one Debt.com intern recounted her problems getting a credit card because she had no credit history. She was 19 and had always used cash.

Bad debt is much easier to spot: You run up huge credit card bills that you cant afford to pay off, and you end up getting harassed by debt collectors.

The lesson here: The longer you have a history of good debt, the better your credit score. This is a good reason not to close old accounts where youve had a solid repayment record.

Don’t Miss: Paypal Credit Credit Bureau