Accessing Your Credit Report

To get your free credit report from each credit reporting agency, visit AnnualCreditReport.com. To access your reports, you will need to provide certain information, including your name, Social Security number and address. You will then be asked to select which of the credit reporting agencies you want to get your report from:

- TransUnion

- Equifax

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Recommended Reading: Does Kornerstone Credit Report To The Credit Bureaus

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Read Also: Brandon Weaver Credit Repair Reviews

Wallethub: Best For Credit Alerts

WalletHub provides you with credit reports from TransUnion and the TransUnion VantageScore. To register, you’ll need to provide your personal details and the last four digits of your Social Security number , and you’ll have to answer a few questions to verify your identity. The site also asks other questions, such as your annual income, monthly expenses, and credit card debt to complete the registration.

The dashboard shows all of your credit accounts and balances while the credit alert section gives you a report card-style letter grade on the factors that influence your score. For example, the site warns you if your debt load is too high relative to your income or if your is too high and hurting your score.

Drop-down menus provide additional details, such as your credit utilization ratio. An easy-to-read version of your credit report shows all of your current and closed accounts, and any negative items, like collection accounts.

A menu bar across the top of the page provides information about financial products and services, such as checking accounts and car loans. WalletHub earns money from some of these companies, which advertise and pay for premium placements on the site.

S To Order A Free Credit Report Online

The steps to ordering a free credit report are straightforward, particularly if you order your report online. It all starts at www.annualcreditreport.com.

Read Also: Credit Score Usaa

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Recommended Reading: How To Unlock Experian Account

How To Get A Free Credit Report From All Three Major Reporting Agencies And Stay Protected

By | Submitted On May 28, 2009

Have you tried to buy a car but were taken by surprise when they told you that you didn’t qualify? Were there charges on your credit that you did not authorize? If this is so, you are not alone, this happens to hundred of people every day and it is easy to protect yourself against this type of crime.

If you do not know what is on your credit report or what your credit score is then you can find out for free. Services allow you to get a free credit report from all three of the major reporting agencies. This gives you the opportunity to take a look at your credit and credit score to see if everything is up to par.

Identify theft occurs every second in America and these digital crimes are increasing. In response to this, many companies have come together to help American protect their credit. After all there is no sense in working so hard and paying off bad debt only to have some criminal ruin your credit in one fail swoop.

The great news is that this is easily prevented and companies charge less than a medium pizza to protect your credit from criminals. If you get a copy of your credit report and you find that there are some charges that you have not authorized, send a registered letter to the credit reporting agency and dispute the charge. You do not need a credit lawyer to do this easy process. It will save you a lot of time.

To read this information and find out how much money you get erased, Click Here

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

Don’t Miss: Sync Ppc On Credit Report

Why Check Your Credit Reports For Free

A lot of people think that checking their credit score once in a while or just a short period before they apply for credit is enough to get by, and many others dont even think that far. The truth is that youre bound to miss a lot if you dont review at least one of your credit reports on a regular basis. Thats problematic because what you dont know about your credit can and will cost you.

Your 3 Free Credit Reports

Your credit reports provide important information about your credit history. Its a good idea to regularly review them to ensure the information they include is accurate and to monitor for any signs of identity theft.

Residents of the United States are always eligible for one free copy of their credit report from each of the three national credit reporting agencies every 12 months as part of the Federal Fair and Accurate Credit Transactions Act. To further our commitment to Americans working to manage their credit health during and beyond the COVID-19 health crisis, TransUnion is offering free weekly credit reports online through April 2021.

Also Check: Unlock Transunion Account

Your Annual Credit Report Is Now Available Weekly And Its Still Free

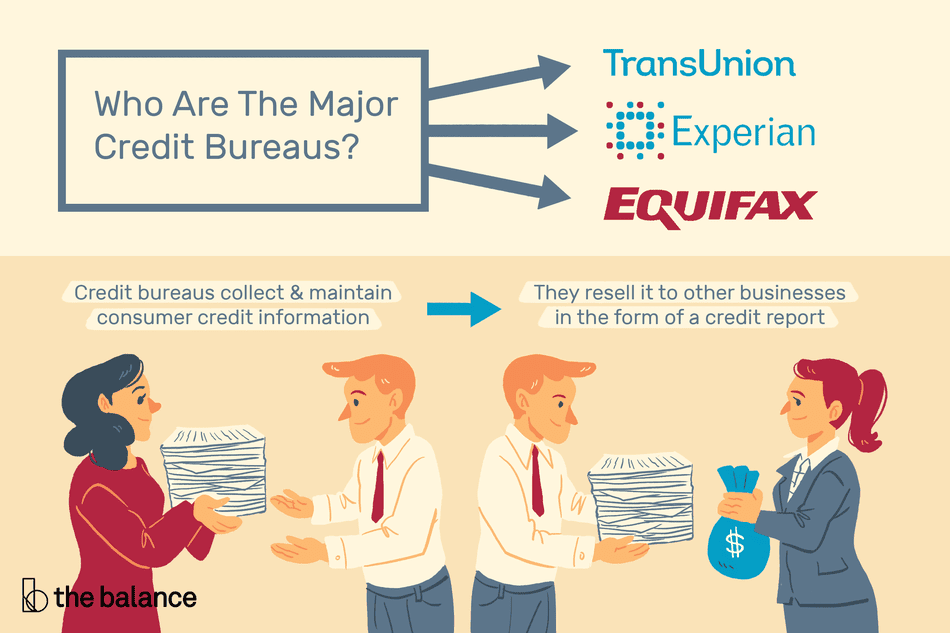

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

Is It True You Should Check Your Credit Report From Each Of The Three Main Credit Bureaus At Least Once Per Year By Requesting Copies From Annualcreditreport Com

Asked by: Dr. Nathaniel Mitchell

It’s a good idea to check your credit reports at least once a year. … You’re entitled to a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus by visiting www.annualcreditreport.com. You can also create a myEquifax account to get six free Equifax credit

280-850

Read Also: Affirm Credit Score Required

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

Read Also: Ccb Credit Inquiry

Do I Have To Pay For My Credit Report

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

Best For Credit Monitoring: Credit Karma

Youll have access to your credit report information along with an explanation of the factors that are currently contributing to your credit score. Credit Karma also uses your free credit report information to show credit card and loan offers that you may qualify for based on your credit standing. You dont have to take advantage of these offers if youre not on the market for a new credit card or loan product.

Recommended Reading: Which Credit Bureau Does Comenity Bank Use

Free Annual Credit Report Site

Experian, Equifax, and TransUnion have come together to make it easy to obtain your free annual credit report. Through this centralized website, you can fill out a relatively simple form to request your credit report from one, two, or all three of the credit reporting agencies once every 12 months.

To request a copy of your free credit report, you input the following information:

- Full name

- Social security number

- Current address

- Previous address if youve moved within the last two years

Once youve completed the online form, you are then asked which reports you would like to receive. Because you are only entitled to one free credit report per 12 months, it may be beneficial to request one at a time instead of all three at once. Staggering your credit report requests gives you the opportunity to review your credit report from one of the three credit reporting agencies every four months , as opposed to all of them just once every year.

After youve selected which report you want to receive, you will be asked to verify your identity. A series of questions regarding your previous accounts, addresses, or employment may be asked to complete this step. After verifying, you will be able to view your credit report on your computer as a secure file.

How To Get Your Free Credit Report From Each Bureau

To get your free credit reports from each bureau, follow these steps:

Recommended Reading: What Is A Leasingdesk Score

What Is A Credit Score

A credit score is a three-digit number, typically ranging from 300 to 850, that is the result of an analysis of your credit file. That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history, from your current and past credit accounts .

Credit score ranges vary based on the model used and the credit bureau that pulls the score. The ratings typically include bad/poor, fair/average, good and excellent/exceptional. The rating you receive depends on the you have. Below, you can check which rating you fall into, using estimates from Experian.

| Rating |

|---|

| 800-850 |

Requesting Credit Reports By Phone Or Mail

If youd like to request your free credit report without using the online platform, you may do so by phone or through U.S. mail. You may call 1-877-322-8228 to request your free credit report copy after you verify your identity by providing your full name, date of birth, address, and social security number.

If you wish to request your credit report by mail, you must print out the Annual Credit Report Request Form and mail it to the following address:

Also Check: Free Karmascore

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

How To Fix Credit Report Errors

Given the importance of the information in your credit reports to so many aspects of your life, you want that information to be error-free. Once you receive your free credit reports, youll want to review them thoroughly, looking for any possible mistakes.

What kind of mistakes should you look for? They could include outdated information such as a late payment you made more than seven years ago, the period after which credit reporting agencies should remove such information from your credit report. You might also look out for any collections accounts that you paid off, but that still show as unpaid, or something as simple as an incorrect name.

If you find a mistake, you can take steps to fix itthrough either the company with whom you did business that made the error or working directly with the credit reporting agencies. Disputing a credit report error isnt necessarily difficult, but it can take a bit of effort. We spell out whats involved in our article, How to Dispute a Credit Report in 4 Easy Steps.

Read Also: Navy Federal Personal Loan Approval Odds

Do I Need To Check All Three Credit Reports

Many people don’t know they have multiple credit reports. And if they do, they might not realize that each credit bureau might not have exactly the same information as the others. The potential differences from one report to another are precisely why you should check all three of your credit reports.