Who Can Access My Credit Report If Its Frozen

As a reminder, a freeze on your credit report will prevent lenders and creditors from accessing your credit history. So, dont expect to get approved for a personal loan, auto loan, home loan, or a new credit card as long as the freeze is in place.

Entities that can access your credit report even with a credit freeze in place include the following:

- The company that provides or monitors your credit report

- The government and courts

- Companies investigating individuals for possible fraud

- Collection agencies

How To Unfreeze Credit With Experian

Experian is the only credit bureau that requires a PIN to unfreeze your credit.

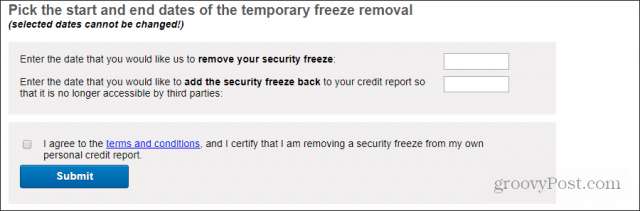

An Experian credit freeze lift can be for a specific time there’s no maximum. The online form warns, however, that you can’t change the date range for unfreezing your credit once you’ve submitted it.

Experian also offers a single-use PIN that can help ensure your information is seen only by a creditor you authorize, so it isn’t exposed needlessly. Experian gives you the PIN, and you give it to the entity checking your credit.

Contact info:Experian Experian Security Freeze, P.O. Box 9554, Allen, TX 75013 888-397-3742.

Comparing Credit Freezes And Credit Locks

| Cost |

TransUnion: Free with TransUnions TrueIdentity credit monitoring service. $19.95 a month with the TrueIdentity Premium service. You cant sign up for a credit lock without enrolling in one of the programs. Equifax: Free Experian: Free for the first 30 days, then $19.99 a month to keep the credit lock in place, after the free trial ends. |

|

| What it does | Prevents lenders and other financial institutions from accessing your credit reports unless you unfreeze them. | Also prevents most lenders from accessing your credit reports until you unlock them. |

| The big differences | A credit freeze is always free. It may take more steps and time to unfreeze your reports. | You must pay to lock your reports with some bureaus. Locking and unlocking your reports, though, is a simpler process. |

Read Also: Does Speedy Cash Report To Credit Bureaus

How Long Should Unfreeze Your Credit Report

You can remove the freeze on your credit report for as long as you need. In most cases, consumers request a freeze removal so that they can apply for new credit. So, the length of time you need to unfreeze your credit report will depend on the kind of loan youre applying for.

Its best to choose a temporary lift freeze. Leaving your credit report unfrozen for a long period will put it at risk of identity theft and credit fraud. Protect yourself by lifting the credit report freeze for a limited time only.

How To Unfreeze Credit At Transunion

- For TransUnion online freeze lifts you will have to sign up for a TransUnion account, obtaining a username and password.

- However, once you sign up for that account you will not need a PIN.

- You then can lift the freeze for a range of up to 30 days, beginning on a start date you choose.

- You can also lift the freeze for certain creditors for whom you can create an access code to be used during a limited time.

This differs from Experians single-use code because it can give multiple creditors access to your file during the time window.

Recommended Reading: When Does Paypal Report To Credit Bureau

How To Lock Your Credit Report At Transunion

TransUnions credit lock program is called TrueIdentity, and its also free. Like with Equifax, you can lock and unlock your credit quickly on a smartphone or computer. The program also gives you access to your TransUnion® credit report, free monitoring alerts and up to $25,000 in identity theft insurance. TransUnion also has a premium product, called Credit Lock Plus, that allows you to lock your credit reports with both TransUnion and Equifax but it costs $19.95 a month. You can sign up for the free TrueIdentity program on TransUnions website.

How To Lock Your Credit Report At Experian

Experians program, CreditLock, is offered as part of a larger service, Experian CreditWorksSM Premium. It costs $4.99 the first month, and $24.99 a month after that. The program comes with other perks, like credit monitoring for all three bureaus, monthly FICO® credit scores and reports for all three bureaus, up to $1 million in identity theft insurance, and a dedicated agent to help you if you think youre a victim of fraud or identity theft. You can enroll on Experians website.

Recommended Reading: When Does Usaa Report To Credit Bureaus

Should I Temporarily Unfreeze My Credit Report

There are two ways to temporarily unfreeze credit:

- If you’re applying for a loan, you could ask your lender which bureau they use and unfreeze just that account for a specified date range, or you can unfreeze indefinitely and refreeze once the process is done. Just make sure not to forget to refreeze.

- You can lift a freeze for a specified number of days .

Temporarily unfreezing your credit is safer than permanently unfreezing credit, as it can still protect you against identity theft. Also, if you do a temporary unfreeze, you won’t need to worry about remembering to freeze your credit again.

When To Use A Credit Freeze

You should freeze your credit if you believe youve been the victim of identity theft or if your personal or financial information has been exposed in a data breach. Freezing your credit can help keep predators from opening new accounts in your name.

But this isnt the only time you should consider a credit freeze. If you want to help protect yourself from identity theft, you should keep your credit frozen at all times unless you are actively applying for a new credit card or loan. When you are applying for credit or debt, you can unfreeze your credit temporarily.

Make sure, though, that you freeze your credit at all three credit bureaus.

Also Check: Can A Repo Be Removed From Credit Report

How To Temporarily Lift Your Credit Freeze

Unfreezing your credit report temporarily is useful if you know the specific window when the lender will pull your credit. It will allow lenders access to your report, maintain protection of your credit after they pull it and you wont have to remember to log in again to refreeze your credit.

Heres how to temporarily lift your credit freeze:

To make things easy, you can schedule your freeze removal up to 15 days in advance of when you plan on having your creditor pull your report. So, if you wish to unfreeze more than 15 days from today, just plan to log in closer to the date when you want your credit report unfrozen.

Timing And Cost Of Lifting A Credit Freeze

The Fair Credit Reporting Act requires that both freezing your credit and lifting a freeze be free.

In terms of timing, a credit freeze must be removed no later than one hour after a credit bureau receives your request by phone or online. If you mail in a request to have a freeze lifted, credit bureaus have three business days after receiving it to lift the credit freeze.

Read Also: Credit Score Of 672

How Do I Unlock My Equifax Credit Report

To lock your Equifax Credit Report:

Why is my credit locked?

A report lock or has the same impact on your reports as a security freeze, but isnt exactly the same. A report lock generally prevents access to your reports to open new accounts. If you want to apply for , you must unlock your report to allow a check.

How To Unfreeze Credit

Unfreezing credit, sometimes called thawing, can be done on a temporary or permanent basis.

Itâs free to unfreeze your credit, but the process is different at each bureau. Hereâs what they say:

- Equifax: You can manage and unfreeze your account in multiple ways. But it might make sense to use the same method you used to place the freeze. You can , call 888-298-0045 or use the same form to submit a request through the mail.

- Experian: Make sure you have the PIN you were given when you placed your freeze. Itâs crucial whether youâre removing a freeze online or over the phone . If you donât remember your PIN, youâll have to go through the verification process again. You can also submit through the mail, but youâll need to provide the same information and documents used to freeze your credit.

- TransUnion: The bureau says that the simplest way to remove a freeze is to do it online. You may also be able to do it over the phone or through the mail. You can call TransUnion at 888-909-8872 to find out more.

You May Like: How To Remove Repossession From Credit Report

When Should I Consider A Credit Freeze

You might consider a credit freeze if you know your information has been exposed in a data breach. Why? Cybercriminals may have accessed your personal information, which could be used to commit financial fraud.

Often, the exposed information which might include personally identifiable information like your name, address, date of birth, and Social Security number is sold on the dark web. If you think youve been a victim of identity theft, a credit freeze might be a smart move.

Other examples? You might also consider freezing your credit if you start to receive bills for credit accounts you didnt open. For instance, it could be a medical bill you dont recognize. Or you might receive calls from a collection agency seeking payment on a credit line you never opened. These are signs that youre a victim of identity theft.

How To Freeze Credit For A Parent Or Other Adult

If youâre in charge of caring for a loved one, you may be able to place a security freeze on their behalf if you have power of attorney or a court order.

In some cases, the process is similar to placing a freeze for a child:

- Equifax has an adult freeze request form with full directions. It includes a list of documents you must provide to verify your identity and a mailing address where you can send your request.

- Experian directs people to use the same request form for adults and minors.

- TransUnion says you can call 888-909-8872 to start the process.

You May Like: Capital One Authorized User Policy

What Is A Credit Freeze

A credit freeze or security freeze allows you to restrict access to your . Freezing your credit can help prevent identity thieves from applying for new credit in your name if that requires a hard inquiry of your credit reports.

Freezing your credit doesn’t mean your credit history is completely off-limits to everyone, however. Any companies that you have an existing credit relationship with will still be able to see your credit history even with a freeze in place. And government agencies executing a court order or search warrant will also be able to access your credit file.

Get Started With Freeze For Free Through Our Transunion Service Center Where You Can:

- Control who can access your credit information with Credit FreezeAre you applying for credit or has a lender referred you here to lift a freeze on your TransUnion credit report? Youre in the right place.

- Manage or fix any inaccuracies on your credit report

- Place Fraud Alerts to protect your identity

- Add a note to your report around any COVID-19 or other financial considerations

Don’t Miss: What Company Is Syncb Ppc

When Do You Need To Unfreeze Your Credit

If you can ask TransUnion to freeze your credit report, you also have the option to thaw or unfreeze it.

Here are the reasons to lift the freeze on your credit report:

- If youre applying for a loan. Lenders and credit card issuers need to check your creditworthiness and pull your credit report to help them decide whether to approve your application or not.

- If youre going apartment or house hunting. Whether youre planning to buy or rent, landlords and creditors providing home loans need to access your credit history.

- If youre applying for utility services. Utility companies may conduct a credit check if you wish to install new services on your new home.

- If youre buying a new phone. Cell phone providers will check your credit report first if you want to purchase a new phone in installments.

- If youre looking for a job. Employers may check your credit report, especially if youre applying for a job that deals with money all the time.

Keep in mind that removing the credit report freeze means you wont be protected from possible identity theft and fraud. Unfreeze your credit only if you have to and for a limited time only until youve fixed the problem with your compromised information.

Can I freeze or Unfreeze my Credit Reports on All Major Credit Bureaus at One Time? No. You have to get in touch with each of the credit reporting agencies to freeze and unfreeze your credit report.

What Are My Choices For Unfreezing Credit

You can temporarily unfreeze credit in two ways:

-

Lift a freeze for a certain number of days. You might do this if you’re shopping for a mortgage or car loan or applying for a credit card.

-

Allow access to a specific creditor.

If you are applying for a loan, you may be able to ask the lender which credit bureau will be used and unfreeze only that one.

Permanently unfreezing your credit is also an option, but NerdWallet doesn’t recommend giving up the protections a freeze gives you. Temporarily lifting a freeze occasionally is much less trouble than unwinding the effects of identity theft.

You have to unfreeze your credit with each credit bureau individually. Experian requires a PIN to lift a credit freeze, while TransUnion and Equifax require that you set up online accounts.

You can unfreeze and freeze your credit reports online or by mail. You need a PIN to unfreeze your Experian credit report. TransUnion and Equifax require that you set up accounts to freeze or lift a freeze online.

Unless you use postal mail, unfreezing your credit reports online takes effect within minutes of requesting it. Freezing and unfreezing your credit reports is free. You can also freeze and unfreeze your child’s credit for free.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Read Also: How To Get Credit Report With Itin Number

Why Would I Lift A Credit Freeze

The process of enacting a credit freeze on your credit file involves the creation of a unique personal identification number with each of the three major credit bureaus. This PIN can be used to temporarily lift or permanently unfreeze a credit freeze when a new, legitimate application for credit is submitted.

Because credit decisions cannot be made without a full review of your credit report and history, you may want to lift a credit freeze when you are applying for a new credit card, personal loan, mortgage or line-of-credit.

Once the application is approved, you can reinstate the credit freeze if you deem it necessary.

How To Keep Track Of Your Pin

If youre worried about losing your PIN, there are many ways to store it securely. According to Russell Schrader, former executive director of the National Cyber Security Alliance, common PIN storage options include using a password manager, hiding it in your phone, writing it down on a piece of paper and putting it in a desk or keeping it in a document with other passwords thats stored on an external hard drive. Schrader explains the goal is to make it so that if somebody stumbles upon your PIN, they dont know what it is.

Since Experian and TransUnion both allow you to create your own PIN, you can choose numbers that are easy for you to remember but difficult for others to guess. Instead of choosing your birthday, for example, use the birthday of a favorite fictional character. Anything that makes your PIN a little more memorable can help.

Read Also: Does Removing An Authorized User Hurt Their Credit Score

Reporting Problems With Your Credit Freeze

All three credit reporting bureaus are legally required to freeze your credit report at your request, at no charge. However, you can submit a complaint if you believe one of these agencies is not placing the credit freeze properly. Complaints can be registered with the Consumer Finance Protection Bureau online or by calling 855-411-2372.

You May Like: Opensky Credit

How To Start A Credit Freeze

You must freeze your credit at all three credit bureaus separately. The bureaus will provide you with a PIN that you can use to freeze and unfreeze your credit. Dont lose that number. Note, though, that Equifax no longer requires you to enter a PIN when freezing or unfreezing your credit.

Experian: You can start your Experian freeze either online or by calling the bureau at 888-397-3742.

TransUnion: Start a TransUnion freeze online or by calling 888-909-8872.

Equifax: You can freeze your credit with Equifax online or by calling 888-298-0045.

How much does a credit freeze cost? There is never a charge to freeze your credit. This is a free service.

How long does a credit freeze last? A credit freeze remains active until you ask the credit bureaus to remove it. According to the FTC, if you request that your credit be unfrozen online or by phone, the bureaus must lift your freeze within an hour. Many consumers lift freezes temporarily when they are applying for new credit or loans.

How long does it take for a freeze to go into effect? Different states have different regulations regarding security freezes. In California, the credit bureaus are required to freeze your credit no later than three days after receiving your request. In New Hampshire, the bureaus must freeze your credit within five business days of receiving your request. In New Jersey, that time limit is again three days.

Don’t Miss: Does Lending Club Show On Credit Report