Write A Goodwill Letter

A goodwill letter is a formal request to a creditor asking for a negative item to be removed.

Although creditors are not required to remove negative items upon request, they may be willing to do so if you have a long history with them or if there were special hardships that led to the negative item.

However, goodwill letters are generally useful only for late or missed payments rather than collections, repossessions or other more significant negative items.

In addition to goodwill letters, you can also request that an account is removed using a pay for delete letter. These letters can lead to an agreement with a collection agency to remove an account in exchange for a set payment. That said, the collection agency may decide not to remove the account, and the original account that went to collections may remain on your report.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

How Do Collections Affect Your Credit

Most accounts end up in collections after being 120 to 180 days past due. During this time, the original creditor may stop contacting you about the debt.

For many people, renewed collection activity comes as a nasty surprise when their debts are turned over to third-party collection agencies that use aggressive tactics.

When collections on your credit report first show up, you can expect your credit score to drop anywhere from 50 to 100 points, depending on how high your credit score was to start. The reason is that payment history has the most significant impact on your credit score.

In general, the better your credit, the worse the hit will be. Over time, the collection account will impact your credit less and less. Before your account is sent to collections, you should receive a final notice from the original creditor.

Its best to try and make payment arrangements at that time so you dont end up with such disastrous effects on your credit score.

Also Check: Why Is Credit Karma So Inaccurate

How Will You Attack Your Settled Account

You know what a settled account is and how it can affect your credit score.

If the account affects your credit score negatively and causing it to drop, its time to start thinking about ways to remove the account from your report.

How to remove settled accounts from credit reports may seem like a long and grueling process, but once the account has been removed you wont be a high risk for financial institutions.

As we have stated, if the account appears to just be hanging out and not affecting your score in a positive or negative way, its best to just let it on your report.

To be honest, showing this payment history can help your credit score as long as you were on time.

Now its time to decide if you will let the settled account stay on your report or if you will take steps to remove it.

For more finical tips and information be sure to check outour website.

Resolve Your Debts Today – See How Much You Can Save

An Unlikely Option: Pay For Delete

Under a pay for delete agreement, debt collectors take the collections account off your credit report in exchange for payment on the debt. The collections account will be deleted, but negative information about late payments to the original creditor will persist.

However, achieving a pay for delete is uncommon, potentially unethical and soon to be outdated. Since debt collectors must report accurate information to credit reporting agencies, deleting correct information falls into a gray area.

You May Like: Itin Credit Score

Wait For Accounts To Drop Off

If you choose not to take steps to remove closed accounts, you’ll be happy to hear that these closed accounts won’t stay on your credit report forever. Depending on the age and status of the account, it may be nearing the credit-reporting time limit for when it will drop off your credit report for good. If that’s the case, all you might have to do is wait a few months for the account to fall off your credit report, and then for your credit report to update.

Most negative information can only be listed on your credit report for seven years from the first date of deliquency.

If the closed account includes negative information that’s older than seven years, you can use the credit report dispute process to remove the account from your credit report.

No law requires credit bureaus to remove a closed account that’s accurately reported and verifiable and doesn’t contain any old, negative information. Instead, the account will likely remain on your credit report for ten years or whatever time period the credit bureau has set for reporting closed accounts. Don’t worrythese types of accounts typically don’t hurt your credit score as long as they have a zero balance.

The Debt Is Then Charged Off Or Sold To Collections

Then, the creditor is likely to charge off the debt. Its status will be changed to “charged off” and “sold to collections.” “Charged off” and “sold to collections” are both considered a final status. Although the account is no longer active, it stays on your credit report.

When the debt is sold or transferred to a debt collector, a new collection account is added to your credit history. It appears as an active account, showing that the debt collector bought the debt from the original creditor. If the debt is sold again to another collection agency, the status of the first collection account is changed to show that it was sold or transferred. Once again, the final status shows that the first collection account is no longer active, but that status continues to appear as part of the account’s history.

Recommended Reading: Credit Score Without Ssn

Determine The Accounts Legitimacy

Is the collection account legitimate a past-due debt that you actually owe? If it is, youre going to have a tough time getting it removed from your credit reports. However, if the account is actually incorrect, or should have been removed from your reports by now, then you may be able to get it removed through the dispute process.

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Also Check: Square Capital Eligibility

My Account Is In Collections But Its Not Showing Up On My Credit Report Now What

If the charge in question doesnt appear on the credit report it is possible that the charge in question has not been reported to either of the credit reporting companies. This actually is good news, because you dont have to work to get it removed. If you feel the charge is valid, pay the charge. Sometimes collection agencies will settle for less than the stated amount if never hurts to ask. Make sure to keep copies of all correspondence. If the charge isnt on your credit report and you believe it to be false, dont ignore it. It might still make it on your report if you do nothing. Instead, write to the collection agency and dispute the charge. Offer as much documentation as you have to strengthen your case. Send your correspondence via certified mail so that you have proof the agency received your letter.

Just because a collection agency says you owe them money doesnt necessarily mean their claim is valid. However, how you deal with their claim will likely affect your ability to get credit at the best rates in the future. It pays to be proactive.

Rating of 3/5 based on 19 votes.

How Is Debt Collected

First and foremost, what does debt collecting entail? Collecting debt is the process of collecting payments owed by individuals or businesses. The organization that collects these debts is a collection agency or a debt collector. These agencies collect debts for a certain fee or a percentage of the individuals debt amount. In certain situations, these agencies are only middlemen and collect delinquent debts to remit them back to the creditors. In this case, the collectors receive a percentage from the creditors, which in most cases is from 25% to 50% of the total amount. But dont worry, there are multiple ways on how to dispute a collection debt.

When a consumer falls behind on payments, their lender i.e. the creditors will try to internally collect the debt. This means that the debtor will start receiving calls and messages from the lender regarding the debt payment. If this does not work, the creditors have the option to write off the debts and give them over to a debt collector. The debt collecting agency then takes on the responsibility of collecting the debt and contacting the debtor.

The debtor has to receive a debt validation letter stating the amount he/she owes. This letter will also include information on the creditor. This is how you can recognize that this is not a scam. After respectfully contacting the debtor several times to no avail, the collection agency has the legal right to transfer the debtors case to court.

Also Check: Does Paypal Credit Build Your Credit

What Types Of Debts Are Covered

Collection agencies collect all types of debts, such as credit card debt, medical debt, personal and student loans, auto loans, etc.

Medical bills

Medical debt is debt related to uncovered health care expenses. This type of debt differs from other types of debt because it does not have to stay on your report for seven years. You can remove medical collections the instant you pay off your medical debt.

Personal and student loans

A personal loan is a type of loan taken by a consumer that aims to cover any type of personal expense such as making renovations, planning a wedding, etc. As for student loans, these are loans meant to cover expenses related to higher education, tuition, living expenses, etc. These types of loans are issued by the federal government, banks, or financial institutions. These student loan debts are collected by collection agencies, and you have to wait seven years to remove collections such as these ones.

Auto loans

Auto loans are a type of secured loan that is borrowed when buying a car, where the car itself serves as collateral. Auto loan lenders have the option to collect the debt internally, by subcontracting to collection agencies or combining both options together.

| DID YOU KNOW: In 2020, the average US student loan debt rounded up to over $37,500, with more than half of the American student population going into student loan debt. |

How Resolve Can Help

If youre dealing with debt and not sure what to do, were here to help. Become a Resolve member and well contact your creditors to get you the best offers for your financial situation. Our debt experts will answer your questions and guide you along the way. And our platform offers powerful budgeting tools, credit score insights and more.Join today.

Also Check: How To Unlock My Credit Report

How Do Collections Affect Credit

Some lenders use older versions of both credit scoring systems that still count paid collection accounts, however, and there’s no way to know ahead of time which credit scoring method a lender will use when deciding to approve a loan application. So while paid collections on your credit report may still hurt your chances of approval, paying off the account gives an opportunity to do the least possible damage.

Get A Copy Of Your Credit Report

Once you have your credit report write down the accounts that you need to remove disputes from. You will now need to call each Credit Bureau that lists dispute comments on your report. Tell them you need to remove dispute comments from all of the accounts on your report.

Below are working phone numbers to connect you to a live person with all three Credit Bureaus.

Recommended Reading: Does Zebit Do A Credit Check

How Many Points Can My Credit Score Increase If A Collection Is Deleted

Late payments, skipped payments, and collection accounts are all factored into your credit score. Accounts that get to the collection stage are considered seriously delinquent. They will have a significant, negative impact on your credit score.

There is no fixed number of points that a credit score can increase if a paid collection is removed from your credit report. Each individuals credit score will be differently affected.

However, if the collection has lowered your score by 100 points, getting it removed from your credit report can increase your score by 100 points.

How Long Do Late Payments Stay On Your Credit Report

Late payments remain on your credit report for seven years. However, contrary to popular belief, you do NOT have to wait up to seven years before being able to get a mortgage, car loan, or any other type of credit again.

Your credit score will steadily rise as time goes on. Even better is that there are several ways to get the late payment permanently deleted.

Keep reading to find out how you can get a late payment removed from your credit reports.

You May Like: Which Banks Report Authorized Users To Credit Bureaus

When Negative Information Comes Off Your Credit Reports

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

Learn More About Credit Scores

If its not clear from everything above your credit score in the U.S. will be an essential part of living in America on a visa. That said, there are lots of other important topics around credit scores that it would be worth it to familiarize yourself with:

Its crucial that you understand these things if you want to make the most of your financial freedom in the U.S.!

Don’t Miss: Unlock Credit Experian

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Disputing The Collection Account

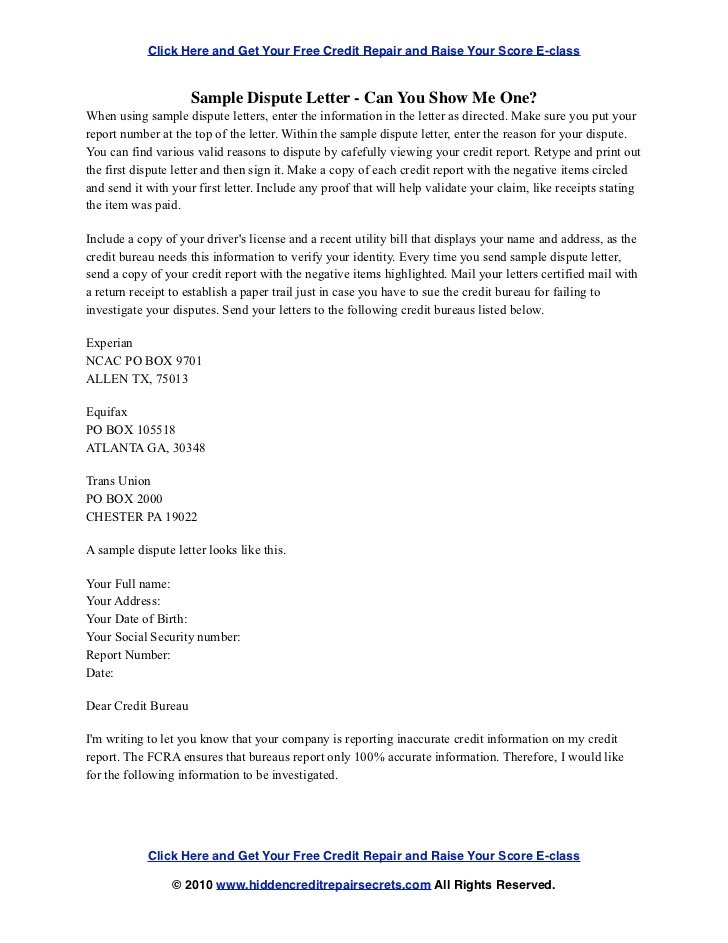

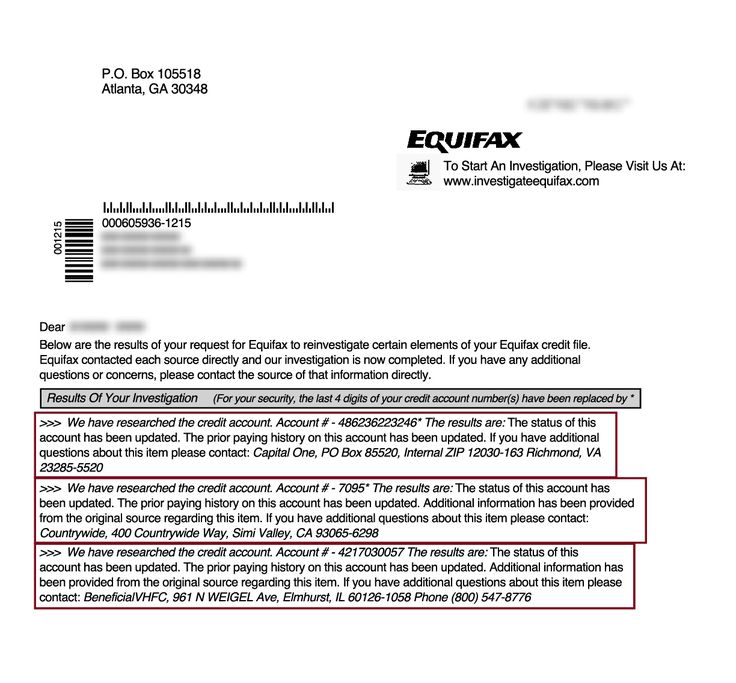

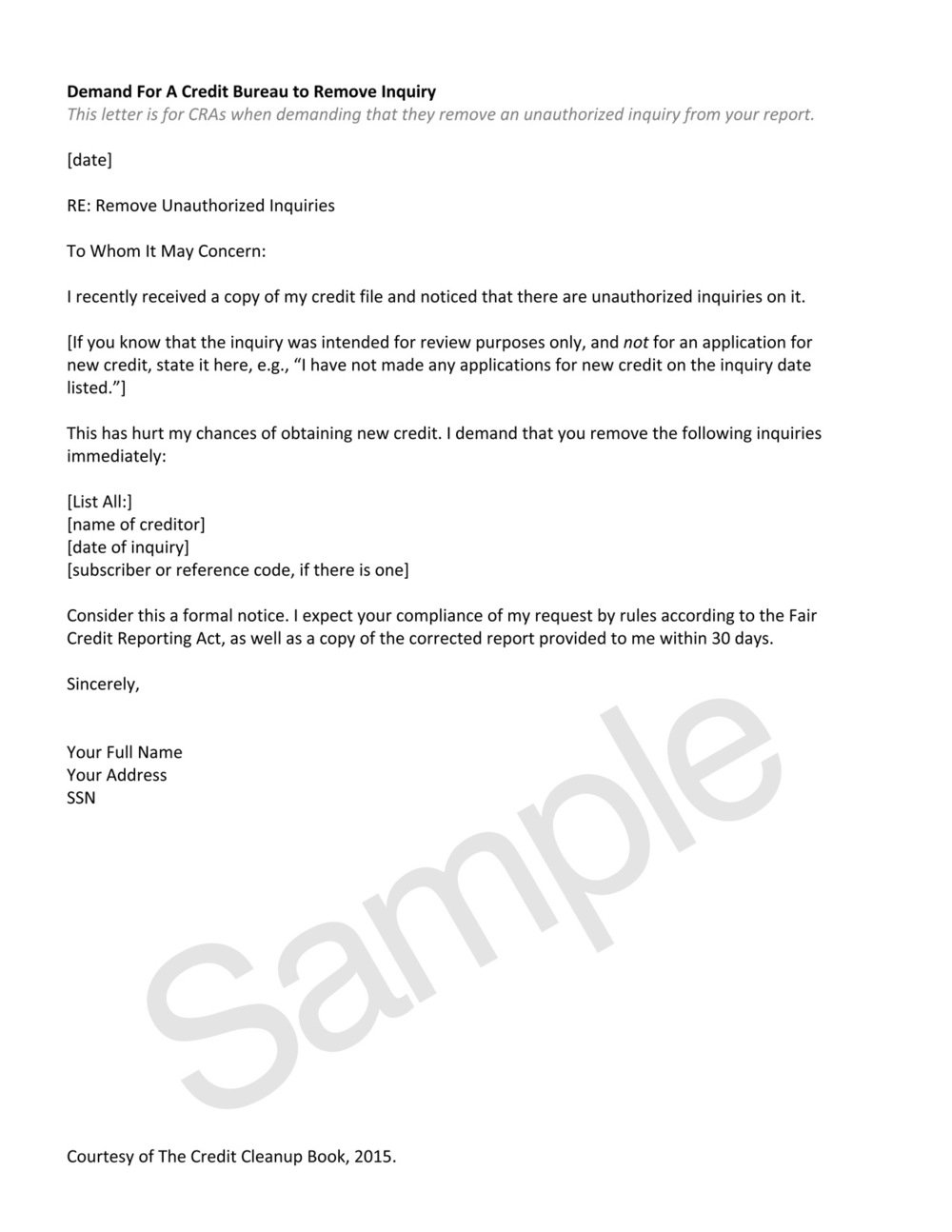

You have the right to dispute any information on your credit report with the credit bureau who has provided that report. Under the Fair Debt Collection Practices Act, debt collectors can face penalties for reporting false information, and credit bureaus are required to report truthful, accurate information. Despite these regulations, credit reports often contain errors for a variety of reasons, including miscommunication from creditors and identity theft. If you find that a collection agency account does not belong on your credit report, you can write a letter to each credit bureau or file disputes online. Experian, TransUnion, and Equifax each offer the option to file a dispute online, but if you choose to mail in your dispute, be sure to send the letter via certified mail and to attach a return receipt request. The credit bureau must investigate the disputed matter, and generally must respond within 30 days.

Don’t Miss: How To Report A Tenant To The Credit Bureau

How To Dispute Or Remove A Charge

It can be tough to earn great credit scores when there are negative items on your credit reports. One such item is the so-called charged-off account or, informally, a charge-off.

If you have a charge-off on your credit reports, its only natural to wonder if theres a legitimate way to have it removed. In many cases, youll need to be patient when it comes to charge-offs. The Fair Credit Reporting Act allows legitimate charge-offs to remain on your credit reports for up to seven years.

But, if a charge-off is incorrect or contains questionable information, it may be possible to get it removed from your report much sooner.

What You Can Do If Your Dispute Is Unsuccessful

Just because you dispute a charge-off with the credit reporting agencies doesnt automatically mean it will be removed from your credit reports. However, if the charge-off is verified and remains on your report, you may have a few other options to consider.

- Send follow-up disputes. In the event you strongly believe that the charge-off is incorrect, outdated, or otherwise unverifiable, you may opt to send follow-up disputes to the credit bureaus. If you have additional proof that the information on your credit report is false, be sure to include this information with your new disputes. Be aware, however, that if you start filing frivolous disputes, the credit bureaus have the right under the FCRA to ignore them.

- Notify the Consumer Financial Protection Bureau. When disputes fail to resolve credit errors, you have the option to submit a complaint to the CFPB. The CFPB will forward your complaint to the company in question and work to get you a response. Still, this doesnt guarantee a deletion.

- Add a Consumer Statement. If your charge-off is accurate and it remains, you may consider adding a consumer statement to your credit reports. This statement, which is normally no longer than 100 words, can be used to explain your side of the situation. These are free to add.

These additional actions can help remove charge-offs from your credit report if your first dispute is unsuccessful.

Read Also: Speedy Cash Collections