You Closed An Old Credit Card Account

Since the length of your credit history also factors into your overall credit score, closing a card youve had for a while can cause a score to drop. This is true even if the bank closes your card for you, which can happen if you dont use the card for a while.

And a dip you see in your score could be the result of a card that was closed some time ago.

When you close a credit card account, your history will eventually fall off your report, says Beverly Harzog, a credit expert and consumer finance analyst with U.S. News and World Report. But that could take up to 10 years, so you wont see a negative impact related to your length of credit history right away.

The positive news here is that, as long as youre not canceling all of your longest-held cards, your score will recover over time as the length of your credit history increases.

Hard Inquires: Mortgage Applications Auto Loans Credit Approvals Etc

Hard inquiries generated by lenders and credit issuers can remain on your credit report for a year or longer. If you have a lot of these entries, it could appear as if financial trouble is requiring you to apply for more credit even if thats not the case. And it can be a big red flag for lenders and may even lower your overall credit score. Most score models, including FICO, make allowances for rate shopping by ignoring related inquiries made within a 30-day period.

You Applied For Another Car Loan

As we mentioned earlier, applying for a car loan will cause a temporary dip in your score. By applying for a loan, you are agreeing to a hard inquiry, and most inquiries will have a negative impact on your score, even if they are soft credit checks. Soft credit pulls may not last as long as the effects of hard credit pull, but they still cause your score to drop even if only by a few points.

Recommended Reading: Can You Remove Hard Inquiries From Your Credit Report

Use Free Services To Understand Whats Helping Or Hurting Your Score

The second thing you can do is use services that provide what are called educational scores. These scores are not calculated using the FICO formula, but by using a variety of other credit scoring formulas. These services do an excellent job of educating you about your credit score. You can see whats hurting your score and whats helping your credit score, so you can figure out what you need to improve.

Two services I can recommend are and Experian. Theyre both free. You dont need a credit card. Ive used them all and theyre very easy to use.

What Other Experts Said

I consulted with three credit scoring experts: Trey Loughran, an executive at CreditCards.coms parent company, Red Ventures, who spent more than a decade at Equifax John Ulzheimer, a veteran of both FICO and Equifax and Sally Taylor, vice president of scores at FICO. They all believe my 41-point drop can be traced back to a series of small tweaks.

Ulzheimer explained, Normally a modest decrease followed by a quick recovery is caused by actionable and subtle changes, either in isolation or a combination of things such as a new inquiry, a lower average age of trade or an increase in utilization. The increase suggests that the score impacts were actionable, unlike things like which dont just go away the next month.

In other words, a few little things added up, but not for long, so I shouldnt worry. That makes sense. He and Loughran both noted that adding a fourth credit card to my portfolio was one of these little things, since number of accounts with balances factors into the algorithm.

Taylor added, The age of your newest account can factor into the FICO score as well. Empirical analysis of millions of credit files has found that all else held equal those with recently opened accounts represent elevated risk of default down the line. But as you observed, the score can bounce back relatively quickly, provided that you do not have any additional new credit accounts post to your file.

Recommended Reading: Check My Credit Score With Itin Number

Why Does Your Credit Score Go Down When Checked

People often wonder why their credit score goes down after they or a lender checks the information on their report.

The equations that output these scores work like black boxes, and the rules and consequences around hard versus soft inquiries are complex. Therefore, it is easy to be confused.

Be clear on one key point. Running your credit score will never hurt your qualification! The bureaus log a soft inquiry that only you can see.

However, the picture muddies once you begin the process of applying for a new borrowing account. Then, some pulls will impact your score more than others.

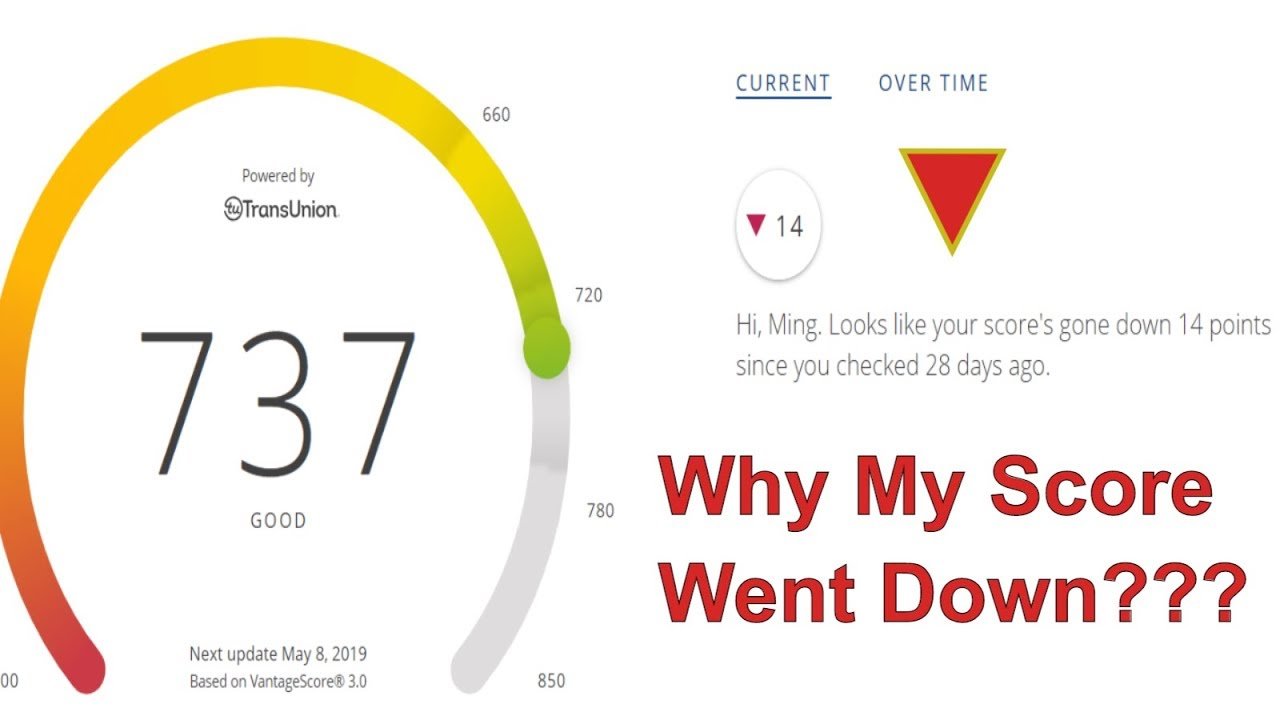

Why Did My Credit Score Drop 9 Possible Reasons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When your credit score takes an unexpected turn downward, you may feel angry or frustrated. Credit scores do fluctuate, and a couple of points up or down is not a big deal but a downward trend or a big drop is.

Heres a list of things that might be behind your credit score drop, and tips for fixing them:

Recommended Reading: How To Get Credit Report Without Social Security Number

What Could Drop A Credit Score 20 To 100 Points

Missed Payment One of the biggest reasons for a credit score drop is a missed or late payment. If you have perfect credit and hit a financial roadblock, a 30-day late payment can drop your credit score by up to 100 points overnight. Typically, creditors wont report a late payment until its at least 30 days late.

Why Did My Credit Score Drop

Home \ \ Why Did My Credit Score Drop?

Join millions of Canadians who have already trusted Loans Canada

In todays financial world, your credit score is a versatile tool that can help you in various situations, such as securing loans and other credit products. In fact, your score is one of the main elements used by lenders to determine your creditworthiness, as well as the interest rate youll be paying for their products once youre approved. Thats why its extremely important to keep your credit score in good shape whenever and however you can. It truly does make all the difference for the health of your finances, both presently and in the near future. Unfortunately, a decent income and employment history arent always enough to secure the credit products you want. However, those elements, coupled with a good credit score usually are.

The only problem is, your credit score fluctuates with every credit-related transaction you make, whether youre paying your credit card bill or simply applying for a new credit product. There are a number of reasons why your credit score rises and falls. Some things, such as timely payments, make your score climb, while others, like missed payments, will ultimately cause it to drop. Then, once your score drops, it can be difficult and time-consuming to get it back up, which is another reason why you should monitor it regularly and keep it as healthy as you can.

Don’t Miss: How To Delete Inquiries

Things That May Hurt Your Credit Scores

Reading time: 4 minutes

- Even one late payment can cause credit scores to drop

- Carrying high balances may also impact credit scores

- Closing a credit card account may impact your debt to credit utilization ratio

If youve tried to make a large purchase such as a home or a vehicle, or even open a credit card account, you likely know the important role your credit scores play in lending decisions. When you apply for credit, your credit scores and the information in your credit reports, along with other criteria, are used by lenders and creditors as part of their decision-making process when evaluating your application.

It might be easier than you think to negatively impact your credit scores. Here are five ways that could happen:

1. Making a late payment

Your payment history on loan and credit accounts can play a prominent role in calculating credit scores depending on the scoring model used, even one late payment on a credit card account or loan can result in a decrease. In addition, late payments remain on your Equifax credit report for seven years. Its always best to pay your bills on time, every time.

2. Having a high debt to credit utilization ratio

3. Applying for a lot of credit at once

4. Closing a credit card account

5. Stopping your credit-related activities for an extended period

Youve Had A Bankruptcy Or Foreclosure

A bankruptcy or foreclosure can severely damage your credit score and since you likely missed payments leading up to the event, your score will reflect that, too.

A Chapter 7 bankruptcy will stay on your credit reports for 10 years, while a Chapter 13 bankruptcy will stay for seven. A foreclosure will stay on your reports for seven years from the date of your first missed mortgage payment that led to the lender foreclosing on your property.

How to fix it: After a bankruptcy or foreclosure, you may be able to rebuild credit with a secured credit card. To get one, you must submit a security deposit in the amount of your desired credit limit, protecting the issuer in case you default on what you charge to the card. However, be aware that as with any credit card application, approval for a secured card isnt guaranteed.

Another tool for rebuilding your credit is a credit builder loan. With a credit builder loan, you dont get money up front. Instead, you pay money to a financial institution that will put it into a savings account or certificate of deposit for you. At the end of your loan period, the money from the savings account or CD will be disbursed to you. As long as the lender reports to the credit bureaus, youll build positive payment history by paying on a credit builder loan.

You may be able to get a credit builder loan from a smaller bank, a credit union or an online lender such as Self.

Read Also: What Credit Bureau Does Usaa Use

Why Has My Credit Score Dropped With No Changes

Why did your credit score go down when nothing changed? If you didnt change the amount you owe, perhaps your credit card company has increased or decreased your total credit limit. If your spending habits remain the same, a decrease in your credit limit would increase your credit utilization ratio and harm your score.

You Had An Account Reported To Collections

A collections account can wreak havoc on your credit. The original creditor will report that you didn’t pay, and then the collections agency that buys the debt will also report it to the credit bureaus.

If you had an excellent credit score to begin with, a collections account could easily drop it by 100 points or more.

How to fix it — First, verify that it’s a legitimate debt. If not, you can dispute it with the creditor and whichever credit bureaus have the debt listed on your credit report.

Collections accounts can damage your credit for years, but you may be able to negotiate what’s known as a “pay for delete” with the collection agency. Simply put, you let the agency know that you’ll pay off the account only if they agree to take it off your credit file.

Not every collection agency will agree to this and the credit bureaus frown on it, but it’s worth a shot.

Read Also: Does Usaa Report Authorized Users

Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

Reduce Your Credit Card Spending

Your credit utilization has the second biggest impact on your FICO credit score, accounting for 30% of your total. To lower your credit utilization, cut back on your credit card spending and try to pay off all of your balance as you can each month.

Although minimum payments are certainly preferable to missed payments, they wont help improve your credit utilization rate. Bigger payments will reduce your balance faster, help you save on interest, and help you quickly improve your credit score. The lower your credit utilization the better, but try not to exceed 30% of your available credit.

Read Also: What Is Syncb Ntwk On Credit Report

Your Balances Got Too High

If you’ve recently been charging more than usual onto your credit card or you used it for a big purchase, that can raise your credit utilization. Credit utilization is 30% of your FICO® Score, and your card issuers report your balances every month, so it’s a factor that can change your credit score quickly.

Your credit utilization is simply your combined credit card balances compared to your combined credit limit. Let’s say you have $1,000 in available credit and $700 in balances. That would put your utilization at 70%, which is considered too high and would damage your credit.

How to fix it — Reduce your credit utilization to 30% or less and you’ll quickly raise your credit score. Here are three ways to do this:

- Pay down your balances.

- Ask your card issuers to increase your credit limits, as more available credit lowers your credit utilization.

- Open a new credit card. When its credit limit gets added to your credit file, it will increase your available credit.

You Closed A Credit Card Or One Was Cancelled

Closing a credit card can hurt your credit score, especially if the card has a balance or more available credit than your other credit cards. Credit card issuers can also cancel your credit card, which will impact your creditnot necessarily because it was the creditor who closed the account, but because the account was closed at all.

Closing your only credit card or your oldest credit card can also impact your credit score.

Read Also: When Does Care Credit Report To Credit Bureaus

A Derogatory Mark Was Added To Your Report

Your credit report is the source of data that lenders use to approve you for a loan. Itâs also the basis for your credit score. A bad mark on your credit history can cause issues for your score, even if it was a mistake and not something you actually did.

âSolution: In addition to checking your credit score, ask for a free copy of your full credit report from each of the three agencies every year. Look for errors and follow the procedures given at each of the bureauâs websites to dispute and resolve them.

Derogatory Remarks On Your Credit Reports

Since your based on information in your credit reports, negative information can drag your score down. For example, if you have a bankruptcy listed on your reports, it can have a negative effect on your score for a long time. A Chapter 7 bankruptcy remains on your credit report for up to 10 years while a Chapter 13 bankruptcy remains on your report for up to seven years.

Some other examples of derogatory remarks that can lower your credit score include collection accounts and foreclosures. An original debt creditor usually sends your account to collections after failing to collect a debt from you. A foreclosure happens when you default on your mortgage. These negative remarks remain on your credit reports for up to seven years.

Although a derogatory remark can stay on your credit report for up to ten years, its impact lessens over time. Also, practicing good credit habits can help you rebuild your credit faster.

Don’t Miss: When Do Credit Companies Report

Theres A Mistake In Your Credit Report

Your credit score is based on the data in your credit reports. Credit report mistakes like a transposed number, a payment reported to the wrong account or a payment reported late when it wasnt can hurt your score.

The fix:Check your credit reports for mistakes and gather the documentation you need to dispute the errors. You can dispute online or by mail, and you will need to follow the process with each credit bureau individually.

Using a good deal more of your credit card balance than usual even if you pay on time can reduce your score that much until a new, lower balance is reported. A mistake in your credit report can also do it. Closed accounts and lower credit limits can also result in lower scores even if your payment behavior has not changed. Also, if you are certain it is for no reason, check to be sure you are not a victim of identity theft.

It actually wasn’t random. Credit scoring formulas use information in your credit reports to calculate your score. Closing an account, having your credit limit cut, charging more than normal, an error in your credit report or even identity theft can result in a lower score.

No, but it can feel that way. Scores are determined by formulas, and things like paying off a loan, having your credit limit reduced or closing an account can result in a lower score, as can a credit card balance that is higher than normal for you.