What Is Corelogic Credco Llc

Credco LLC is the consumer credit information division of CoreLogic Inc. CoreLogic is an information intelligence operation steeped in analytics. At its core is the mining and analysis of data by a team of computer scientists and economists. The company helps its global clients spot opportunities for financial growth. It also uses data to instruct businesses on how to mitigate risk.

CREDCO has become the primary source for merged credit reports in the United States. Previously, lenders had to wade through the individual reports provided by a credit reporting agency such as Experian, Equifax, or TransUnion. CREDCO, over the past few decades, has become a popular middleman and consolidator of consumer information. It combines the three reports into one comprehensive product, often referred to as a three-bureau merged credit report.

Disputing Inaccurate Hard Inquiries

Its recommended that you review your credit reports periodically to make sure youre on track and that no errors are lurking.

There are also , some you dont have to pay for, that will alert you to changes.

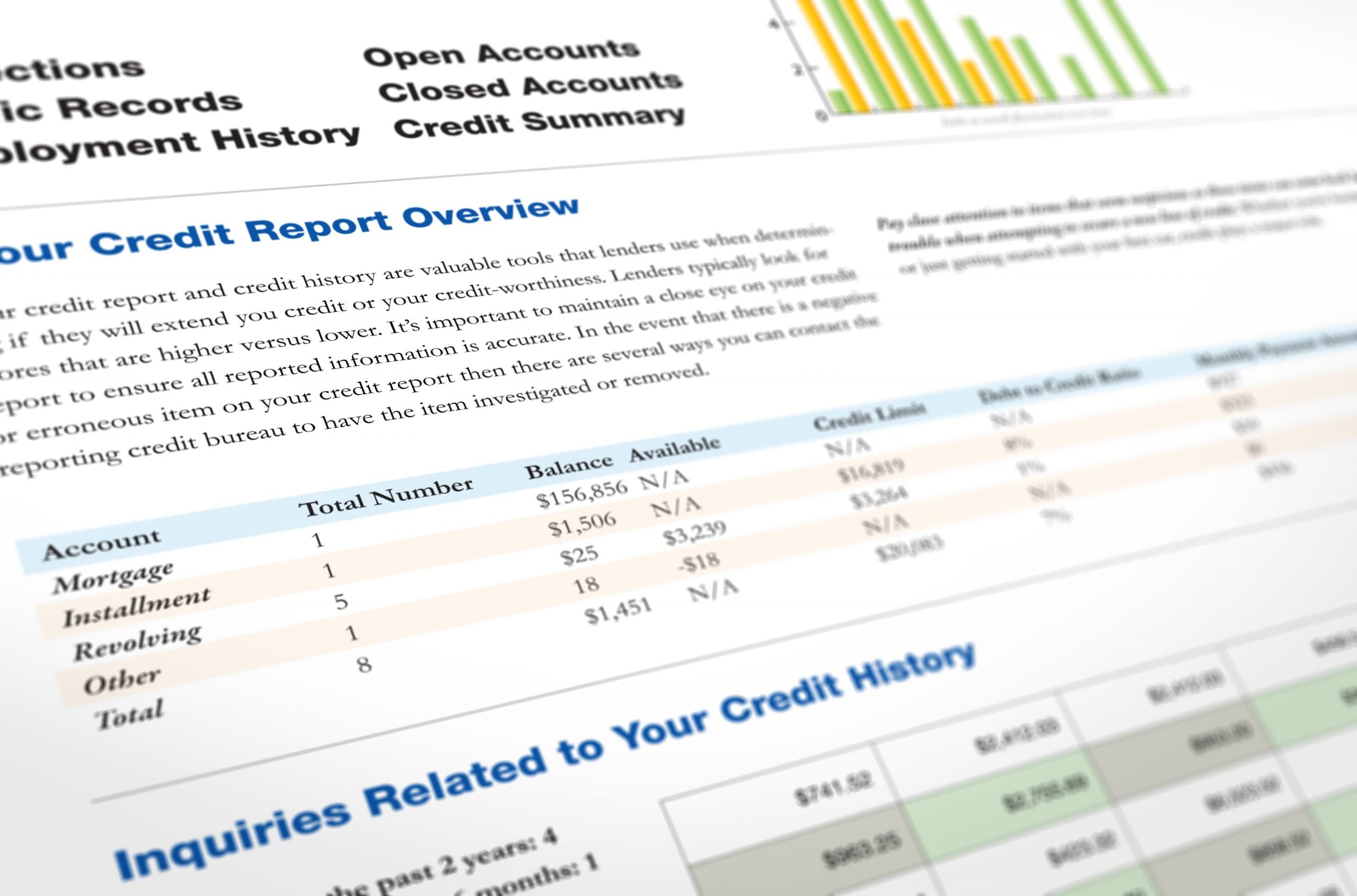

To check for inaccurate hard inquiries on your credit reports from Equifax, Experian, and TransUnion, look for a section that might include:

Credit inquiries

Regular inquiries

Requests viewed by others

You can ask to remove hard inquiries from your credit reports if you didnt apply for a new credit account, you didnt give permission for the inquiry, or the credit bureau added the inquiry by mistake.

To do so, youd write to the credit reporting agency whose report shows inaccurate information and ask the agency to remove it.

Recommended: Common Credit Report Errors to Know

How Much Do Hard Inquiries Lower My Credit Score

How many points does a thorough investigation affect your creditworthiness? A credit check can lower your credit score by as much as 10 points, but in many cases the damage is probably not that great. As FICO explains: For most people, applying for an additional loan lowers their FICO score by less than five points.

Don’t Miss: How To Remove Repossession From Credit Report

Hard Queries Vs Soft Queries: Whats The Difference

A credit inquiry occurs when a business runs a credit check in order to consider lending you money or offering you a line of credit. An inquiry can take place with your knowledge such as when a car dealership runs your credit to check your rate, or without your knowledge like when a credit card company checks your score to see if youre eligible for a promotional card.

Find: Your Game Plan for Getting the Highest Credit Score Possible

What If I Dont Recognize A Credit Inquiry On My Report

Its never a bad idea to check your credit report, which you can do for free once per year with either credit bureau . Be sure to look the whole document over carefully, as you may end up spotting a suspicious credit inquiry for a product that you dont remember applying for.

Unfortunately, this could be a sign that youve been scammed or had your identity stolen. Not only could this result in hard inquiries that you didnt deserve, it means your finances may be compromised. Heres a list of the preventative measures you should take if you dont recognize a credit inquiry on your report:

Get in Touch With Your Lender

Your credit report should contain information about the lender that made the inquiry. Reach out to them immediately so that they can verify the account or product. If the lender cannot prove its legitimacy, ask them to mail a letter to the credit bureau on your behalf. If the dispute is viable, the bureau will remove the record from your report.

Learn more about why you should monitor your credit.

Send a Letter to The Credit Bureau

If you discover a fraudulent credit inquiry or other kind of suspicious activity on your credit report, you can always send your own letter to Equifax and/or TransUnion. Once the bureau determines that the dispute is legitimate, they will remove the record from your report and you should gradually see your credit improve.

Check out these .

Get a Fraud Alert Added to Your Credit Report

You May Like: How To Get Repossession Off Credit Report

What Are Inquiries On Your Credit Report

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Inquiries are entries that appear on your credit report when your credit information is accessed by a legally authorized person or organization . Most commonly, inquiries are the result of an application for credit, goods or services an account review made by a company that you already do business with or a preapproved offer of credit that has been sent to you.

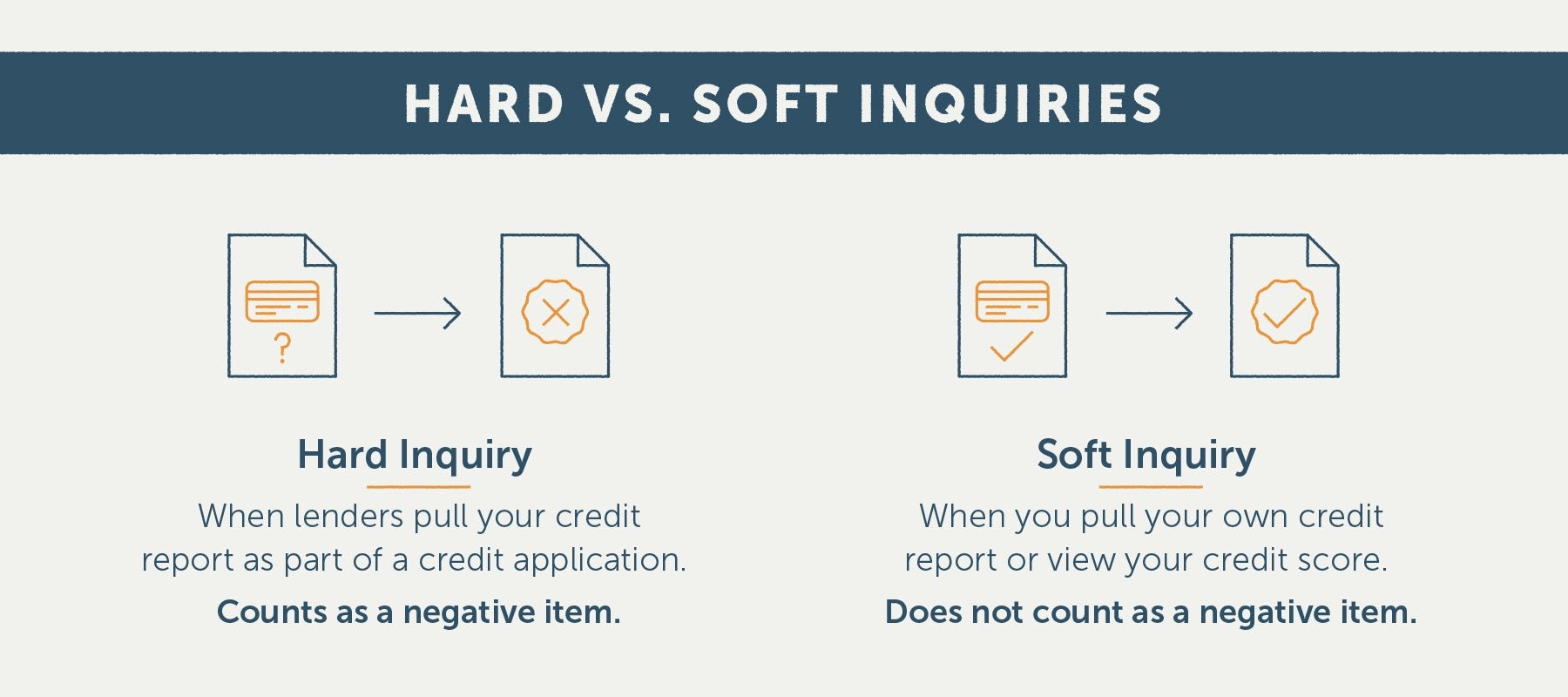

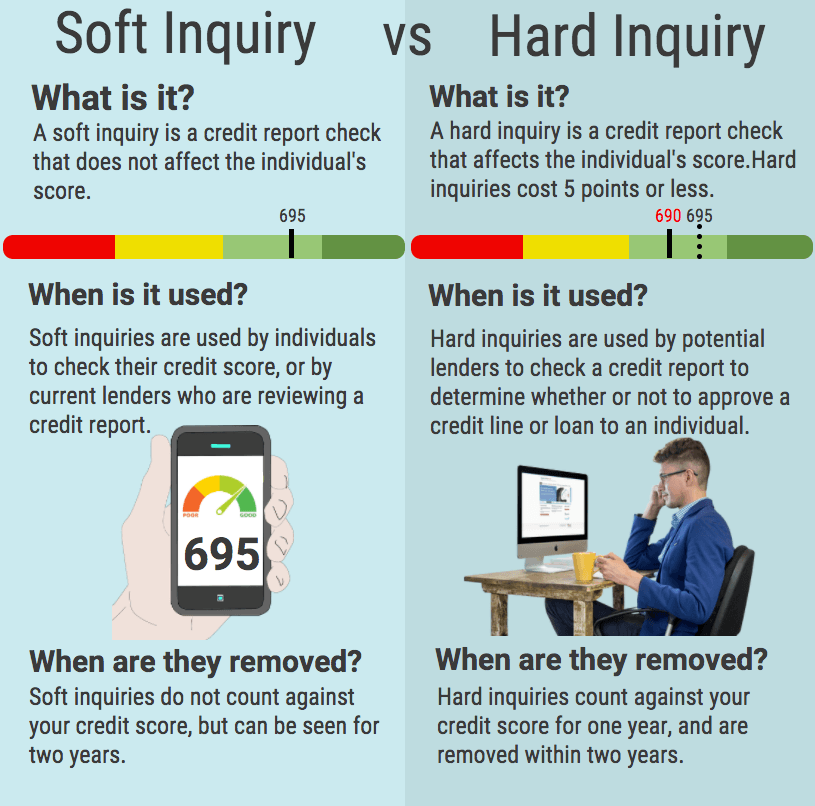

There are two types of credit inquiries: hard inquiries and soft inquiries. Account reviews and preapproved offers fall under the category of soft inquiries, which have no effect on your credit scores. Hard inquiries include applications for credit or certain services, and although their impact is minimal, they can temporarily affect your scores. Here’s what you need to know about inquiries on your credit report and the differences between hard and soft inquiries.

Avoid Excessive Credit Inquiries

The good news about credit inquiries is that they only remain on your credit report for two years. Hard credit inquiries dont impact your score as much as your payment history either. This can work to your advantage if your credit applications are denied. After two years, creditors wont know you applied and were denied credit.

Monitoring your credit inquiries makes sure you dont apply too often or too soon. Its widely expected to have one or two inquiries on your report. Banks become more cautious when you have at least three inquiries at once on your report.

Don’t Miss: Do Affirm Report To Credit Bureaus

How To Apply For A Paypal Credit Card

Category: Credit 1. Explore our credit cards, debit cards, prepaid cards PayPal Explore PayPal debit cards, credit card and other credit products and offerings that fit your financial needs. Learn more and apply online today.PayPal Extras Mastercard · PayPal Cashback Mastercard Just fill out a quick application, and

What To Know About Rate Shopping

Research has indicated that FICO Scores are more predictive when they treat loans that commonly involve rate-shopping, such as mortgage, auto and student loans, in a different way. For these types of loans, FICO Scores ignore inquiries made in the 30 days prior to scoring. So, if you find a loan within 30 days, the inquiries won’t affect your scores while you’re rate shopping.

In addition, FICO Scores look on your credit report for rate-shopping inquiries older than 30 days. If your FICO Scores find some, your scores will consider inquiries that fall in a typical shopping period as just one inquiry. For FICO Scores calculated from older versions of the scoring formula, this shopping period is any 14-day span. For FICO Scores calculated from the newest versions of the scoring formula, this shopping period is any 45-day span. Each lender chooses which version of the FICO scoring formula it wants the credit reporting agency to use to calculate your FICO Scores.

Recommended Reading: What Credit Report Does Capital One Use

How Many Points Will A Hard Inquiry Cost You

According to FICO, one new inquiry will generally lower a credit score by less than five points. As that inquiry grows older, the impact on your score should be less until it no longer counts at all. Of course, the real credit scoring process is a bit more complicated when you break it down.

Hard credit inquiries dont count toward your credit score calculation nearly as much as other factors. With FICO scoring models, for example, credit inquiries influence 10% of your credit score. By comparison, your payment history is worth 35% of your FICO Score. Hard inquiries matter even less under VantageScore credit scoring models. VantageScore calculates just 5% of your score based on hard inquiries.

Individual credit inquiries dont have a specific point value across the board. For example, you cant say that a new hard inquiry will lower your credit score five points. Thats not how credit scoring works.

Instead, a credit scoring model considers the total number of inquiries that appear on your credit report along with the age of those inquiries. The rest of your credit information matters too. A new hard inquiry might have a bigger score impact for people with little credit history versus those with older, more established credit reports.

Dispute The Inquiry With Equifax And Other Bureaus

Whenever you find a reporting issue, you need to dispute it promptly.

Inaccurate entries could be the result of a reporting error, or they might mean someone is using your identity fraudulently to get approved for credit.

Thanks to the Fair Credit Reporting Act, the bureaus have to look into cases of suspected fraud if you send them a dispute.

When you call, write, or submit a dispute online, the bureaus have 30 days to investigate your case.

If its evident that you didnt consent to a credit check or submit a mortgage application, it should get removed from your report quickly.

You should also contact EMS directly to get to the bottom of the inquiry and find out what prompted it.

If you suspect that identity theft is involved, you should also:

These two steps will alert the bureaus to whats going on and prevent further damage from being done to your credit.

Another important step that everyone should take is signing up for . You can do this using a free platform like .

The app is intuitive and user-friendly, and it breaks down your credit factors in a way that is easy to understand.

You get tailor-made advice for improving your credit, with offers that youre either pre-approved or likely to be approved for.

Most importantly, youll get regular updates on your score and any additions to your report, allowing you to catch issues as soon as they arise.

Recommended Reading: Syncb Ppc

Hard Pulls Vs Soft Pulls

Along with hard pulls, soft credit inquiries also exist that do not appear on your credit report and have no effect on your credit score. Checking your credit report yourself or applying for a pre-approved credit card are considered soft pulls. Other cases, like a periodic review of your credit by a company already lending to you or the Internal Revenue Service verifying your identity, can also result in soft pulls.

Importantly, checking your credit report yourself has no effect on your credit report or credit score.

What Type Of Public Records Show Up On My Credit Report

A public record comes from government documents and includes bankruptcies, foreclosures lawsuits and unpaid tax liens. A public record with negative information could indicate that a borrower is having difficulty paying their bills. Depending on the public record, they will stay on your credit report for seven to 10 years.

Also Check: How Accurate Is Creditwise Credit Score

Example Of A Credit Inquiry

Lets assume John is looking to purchase a new vehicle. After deciding on the make and model, he decides to look into financing terms. The dealership has an on-site financing arm and pulls Johns credit report. John has had a steady job for four years and doesnt have any outstanding debts. He has also paid his bills on time throughout the years. Based on the credit inquiry, the dealership offers him their lowest percentage rate of 4% to purchase the vehicle.

Ems On My Credit Report

The credit reporting code EMS stands for Equifax Mortgage Services.

Equifax is one of the three main credit bureaus, but it serves as more than a bureau.

This branch of Equifax is employed by mortgage lenders to obtain their applicants credit reports.

Prospective lenders use the info contained in your credit report to determine if you are the type of lender theyre looking for.

Whenever you apply for a loan or credit card, you are consenting to a hard inquiry.

Well talk about what that entails below.

If you are overwhelmed by dealing with negative entries on your credit report,we suggest you ask a professional credit repair company for help.

Also Check: How To Remove Repossession From Credit Report

What Bank Is Alaska Airlines Credit Card

Category: Credit 1. Alaska Airlines Visa® Credit Card Bank of America An Alaska Airlines credit card comes with great perks like its Famous Companion Fare, free checked bag on Alaska flights, and many more. If youve updated or changed your name with your card issuer, please contact Alaska Airlines

What Are The Different Types Of Inquiries On My Credit Report And Do They Affect My Score

An inquiry is posted to a consumers credit report every time an individual or a business reviews or obtains a copy of the credit report.Inquiry types of AR and PRM appear only on credit reports received directly by the consumer. These types of inquiries do not appear on credit reports sold to a commercial user .Account Review inquires result from the purchase of a credit report by a company reviewing the credit report of its accountholders.

Promotional inquiries result from the purchase of a credit report by a company that reviews the consumers credit file in order to make firm offers of credit or insurance. In such a case, the company does not view the credit report. Rather, it receives the name and address of the consumer only if such consumer meets the companys predefined criteria, which has been conveyed from the company to the credit bureau.

For futher information regarding your credit score, please refer to the Frequently Asked Questions sections of the three main credit bureaus: Equifax , Experian , and Trans Union .

Don’t Miss: How To Check Your Credit Score With Itin

Summary Of How To Check Credit Inquiries

If you check credit inquiries on a regular basis, you have a better way of maintaining a high credit score. Even if you dont apply for new credit often, you should still check the number of credit inquiries on your credit report at least once a year.

The comments on this page are not provided, reviewed, or otherwise approved by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Editorial Note: The editorial content on this page is not provided by any bank, credit card issuer, airlines or hotel chain, and has not been reviewed, approved or otherwise endorsed by any of these entities.

Errors To Watch Out For On Your Credit Report

Once you get your report, check for:

- mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- errors in credit card and loan accounts, such as a payment you made on time that is shown as late

- negative information about your accounts that is still listed after the maximum number of years it’s allowed to stay on your report

- accounts listed that you never opened, which could be a sign of identity theft

A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account won’t remove the negative history.

Negative information such as late payments or defaults only stays on your credit report for a certain period of time.

Read Also: Fingerhut Late Payment Removed

Examine Your Credit Reports For Any Errors

Regularly checking your credit reports from Equifax, Experian, and TransUnion should become a habit. Unless you alert the credit bureaus, they may be unaware of inaccurate information.

You may verify your credit reports for erroneous hard inquiries by looking for an area called

- Others have seen your reports

- Soft Inquires

There should be a distinct area for soft inquiries, branded something like requests seen exclusively by you. Soft inquiries, as opposed to hard inquiries, have no impact on your credit ratings.

Dont know how to interpret the information on your credit reports? Discover whats on your credit reports and how to interpret them.

How To Escalate Matters

File An Identity Theft Complaint With The FTC: You can file a formal identity theft complaint with the Federal Trade Commission through its online complaint form. Once you have submitted your complaint, the FTC will generate an Identity Theft Affidavit. It is very important that you save and print this document, as it can only be viewed once through the online system. The FTC Identity Theft Affidavit is a critical supporting document for investigations into suspected identity theft.

File A Report With Your Local Police Department: Bring a copy of your FTC Identity Theft Affidavit to your local police department, along with a government-issued ID, proof of your address and any additional documentation you have concerning the unauthorized inquiry. This will enable you to file an official police report, which, together with your FTC affidavit, will comprise your “Identity Theft Report.” People often are hesitant to report a seemingly minor sign of identity theft to the police, but its important to remember that taking this step which may be as simple as filling out and submitting a form at the station is more of a procedural milestone than the beginning of an active investigation by law enforcement.

Either way, an unauthorized inquiry should raise suspicions about the security of your personal and financial information, so you may want to consider taking additional steps to ensure this case of suspected identity theft does not spread.

You May Like: Does Speedy Cash Check Credit