What Is Derogatory Credit

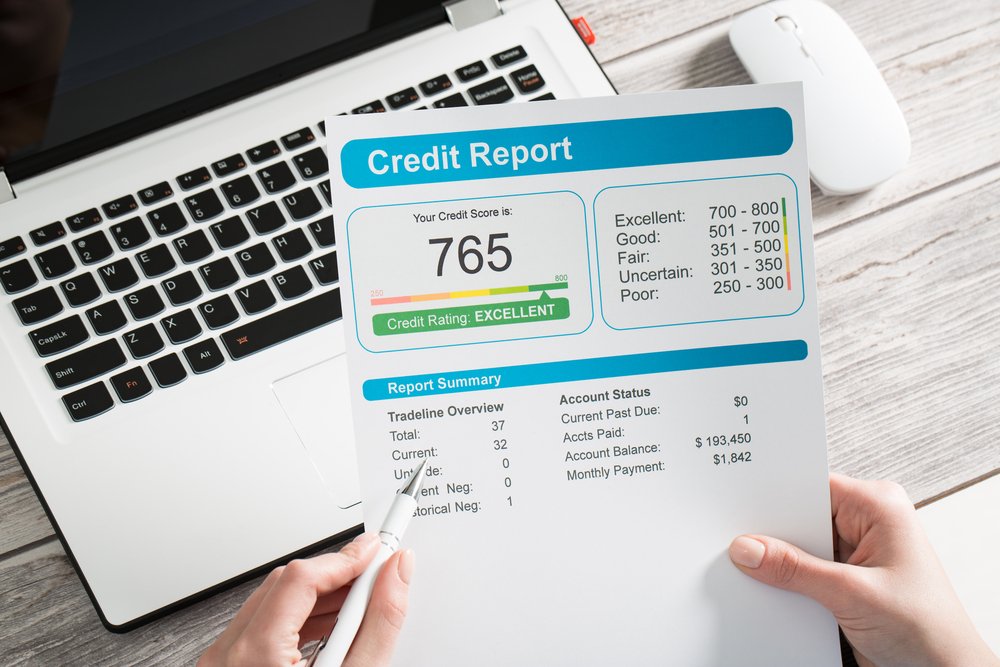

A credit report is a history of your behavior as a borrower the good and the bad. When negative information shows up on your credit report, its called a derogatory mark.

These derogatory credit marks act as red flags to lenders using your credit report to evaluate you. Derogatory marks are meant to reflect mistakes or events that show you have an imperfect payment history. If lenders see too many, they might offer you a more expensive product or reject your application altogether.

Each derogatory mark will lower your credit score and make you less creditworthy, but some are more serious than others. Additionally, some derogatory marks will affect your credit less as they age. A late payment from this year, for instance, will look worse than one from five years ago.

How Long Will Derogatory Credit Last

Derogatory credit can follow you around for a long time. Some types of derogatory informationlike a bankruptcycan remain on your credit report for up to 10 years.

Most other derogatory informationlate payments and debt collection accountswill only remain on your credit report for seven years. Typically, these items will automatically fall off your credit report once theyre past the credit reporting time limit.

Only accurate, timely, and complete information can be included on your credit report. You can dispute an error or outdated derogatory item with the credit bureaus to have it removed from your credit report.

In some cases, having negative information removed can increase your credit score, but it depends on the rest of the information on your credit report.

On Your Experian Credit Report

Now lets take a look at the codes and abbreviations found on another credit report: the credit file about you that is maintained by Experian.

In your Experian credit reports, the most positive code you can see is the notation: OK.

The OK reference is just like it sounds. When you see OK next to an account shown in your Experian credit file, it means that there are no problems with your payment history, that you are current and have met the terms of your agreement.

There are two neutral codes in an Experian report. The first is: CLS, which means closed. The second is: ND, which means there is no data reported for the time period.

Other than the codes just mentioned, all the rest of the number codes and letters youll find on an Experian report are reflective of credit payment problems.

Recommended Reading: Expedia Credit Bureau

Free Annual Credit Report

To support you during the uncertainty caused by COVID-19, we offer a free credit report weekly at annualcreditreport.com through April 20, 2022.

Get your free weekly report online through April 20, 2022 at annualcreditreport.com. You can always get a free report every 12 months.

With this credit report youll get:

- Fast, free access to your credit report online

- Control of your credit data, with free reports available from all three credit reporting agencies in one place

- The option to buy a one-time VantageScore® 3.0 credit score

A Derogatory Mark May Plague Your Credit Reports For The Better Part Of A Decade But There Are Still Ways You Can Work To Improve Your Credit

Derogatory marks are negative, long-lasting indications on your credit reports that generally mean you didnt pay back a loan as agreed. For example, a late payment or bankruptcy appears on your reports as a derogatory mark. These derogatory marks generally stay on your credit reports for up to 7 or 10 years and damage your scores.

If you have a lower score coupled with a derogatory mark, you may have a hard time getting approved for credit or may get less-than-ideal credit terms. But the good news is that the impact to your credit of all derogatory marks decreases over time.

A derogatory mark can land on your credit reports in two ways. A creditor or lender may report negative information to the credit bureaus, which is then translated into a derogatory mark. Or the credit bureaus can add public records to your credit reports. These may include bankruptcies, civil judgments and tax liens.

However, thanks to stronger public-record data standards that the credit bureaus have recently agreed to, consumers nationwide will see fewer tax liens and civil judgments on their credit reports.

Recommended Reading: Whats A Good Dun And Bradstreet Score

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Removal Of Delinquent Remarks From Credit Report After Payment

First time posting in a long time, so here it goes: A few years ago I lost my job and missed a bunch of payments on a credit union issued credit card, to the tune of around $6000. They sent it to collection, where a default judgment was entered and after fees, interest, poundage the total now comes to almost $11,000, with interest still compounded daily .

I have the money to pay it all off if I take out a loan against my 401k . However, I would like to be able to purchase my first home and a vehicle in the near future, and I’m real concerned about how this is going to look on my credit report after dropping all that money to the wolves.

Does anybody have any experience or knowledge with a situation like this? I have thought about contacting the credit union directly but I’m not confident in their reaction. In fact they might even contact the collection agency and/or the Sheriff’s department to cause me even further mental anguish. I want the item to not even appear on my credit report after paying it off, if at all possible. If not, I guess the next best thing is for it to show as PAID IN FULL ? Although I’m told this is the same status as pretty much as CHARGED OFF.

Thanks in advance for your helpful advice and tips.

619 TU, 616 EQ619 TU, 616 EQ750

Recommended Reading: How To Remove Inquiries Off Credit Report

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

On Your Equifax Credit Report

Your payment history breakdown is fairly straightforward in Equifax credit files. Therefore, the meaning of the numbers, letters and symbols used in Equifax credit reports are generally pretty easy to understand.

Overall, you want to see a lot of asterisk signs that look like this: *.

Thats because an asterisk symbol on an Equifax credit report means pays or paid as agreed.

The vast majority of other notations indicate negative marks on your Equifax credit file, although there are a few exceptions to this.

For example: if a creditor simply didnt report information about you for some reason in a given month or year, that account history will be classified as Not Reported and you will see a code that says NR.

This NR code is neutral its not positive or negative for your credit file.

But pretty much everything else shows that you have credit blemishes.

You May Like: Credit Report With Itin

Open Disputes Arent Always Removed Automatically

Even after a dispute is resolved, the comments saying the account is being disputed do not always automatically get removed. These dispute comments can stay on your report for years in some cases.

Removing disputes from your report is actually a very simple process that will take you about 20 minutes to complete. All three Credit Bureaus will have the dispute comments removed within 24-72 hours.

How To Improve Your Credit Score

No matter what your history looks like, its always possible to start improving your credit score. By paying your bills on time, paying off debt, and working to get your balances low relative to your overall credit limit, you can increase your score and establish a positive credit history.

Some of those negative marks may stick around for a while, but their impact decreases over time. And in the meantime, those positive habits will help you build a more stable financial foundation.

You May Like: Zzounds Credit Check

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, you’ll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didn’t initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

If The Credit Bureaus Do Not Remove The Dispute Comment

So youve written to the bureaus and called them and theyve flat out refused to remove the late payments?

Heres whats worked for my clients. Call the creditor and specifically ask for their credit bureau department. If they dont have one then ask for a manager. Let them know you are no longer disputing the item and you want them to make a notation of that and they should remove the dispute comment from the credit bureaus.

Something to consider here, if the account is an unpaid negative account like a collection or charge-off, then you want to weigh your options about calling the creditor.

What you need to know is, legally creditors have a certain amount of time to collect, also known as the statute of limitations.

Therefore, unless youre in a position to pay off the debt, then before calling a creditor, make sure to check the statute of limitation for debts in your state and confirmed it has expired.

Also Check: What Is Gs Bank Usa On Credit Report

Fixing A Derogatory Credit On Your Report

A derogatory credit item is a result of having negative information on your credit report. Negative items like previous delinquency, high balances, or other items show youre a potential risk if you borrow more money. This negative information is added to your credit report by the creditors you have accounts with or through public records you have on file with the local or state court.

Because your credit score is calculated based on the information in your credit report, derogatory credit items can hurt your credit score. Many credit score providers, like myFICO and , will give you personalized information about the items that are affecting your credit score.

Learn about derogatory credit and how to turn it around.

Contacting The Credit Bureaus For Dispute Comments Deletion

The most effective way is to always call the bureaus for removing dispute comments. I always recommend my clients to do so. You may spend some time on hold during the process, but it often solves the problem. The list below contains the number that I have personally used to speak with a representative from different bureaus:

EXPERIAN: 855-414-6148

Press the following options after being asked for your SSN number and birth date: 2, 1, 2, 1. Problems may be encountered while trying to reach a live representative. Visit annualcreditreport.com to obtain a free report. Additionally, you can also check out freecreditreport.com to gain access to your Experian report. You will be provided with a special phone number and a report I.D. number on the report. You can use this information to get in touch with customer service much easier. Raise your concern about removing dispute comments for a specific account in the credit report. Dont forget to mention that you no longer want to dispute the specific accounts.

Inquire about how much time it will take to remove the comments, expressing the need to expedite services quicker.

EQUIFAX: 800-846-5279

Equifax usually accommodates their customers through a live representative. However, hold times can be long. Speak to your live agent and request for a dispute comment removal. Tell the agent that you want to apply for new credit. It is also preferable to speak with the manager directly.

TRANSUNION: 800-916-8800

If a Phone Number doesnt work:

Also Check: Opensky Billing Cycle

What Types Of Derogatory Marks Are There

When youre checking your credit report for negative information, it helps to know what to look for.

Here are some types of derogatory marks that can end up on your credit report, in order from the least to most severe:

- Late payments: A late payment can be reported when its overdue by more than 30 days, and it will experience an uptick in severity every 30 days.

- Loan and credit defaults: For installment loans such as mortgages, auto loans or student debt, your loan might be listed as in default. When your loan defaults depends on your account agreement, but its typically after 120 to 180 days of nonpayment.

- Debts sent to collections: Once an account is overdue by a certain number of days, it might be sold to a collection agency, which can put a new derogatory mark on your credit.

- Foreclosures or repossessions: If a mortgage lender foreclosed on a home you owned or you had a vehicle repossessed, those situations usually are listed as derogatory marks.

- Bankruptcies: If you in the past seven to 10 years, this event will be listed on your credit reports.

How Long Can A Derogatory Mark Impact My Credit Scores

Derogatory marks can remain on your credit for up to seven to 10 years or more, depending on what type it is. However, your scores can start improving before that if you take steps to make your credit healthy over time. That can include making at least the minimum payment on time and keeping your balances low.

You May Like: Does Klarna Raise Credit Score

How Do I Dispute A Derogatory Mark On My Credit Report

If you find any negative information on your credit report that you believe is inaccurate, you should dispute it directly with the credit bureau that has it on the report. You can submit disputes by mail or over the phone, and the credit bureaus generally have 3045 days days to respond. Be sure to submit any necessary proof to support why you think the derogatory mark is inaccurate.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Read Also: What Credit Bureau Does Comenity Bank Use

What Is A Remark Removed From Account

Here is why. This dispute comment takes the account out of being factored into the credit score, so if an account with a negative history gets its dispute comment removed, then the credit score may go down. On the other hand, the score may go up if the dispute comment is removed from a positive account.

Look For Negative Information In Your Credit History

You may not even know if you have a derogatory account in your credit history. So you should start by getting your free credit report.

You can get your from many different services. But by law, each of the three major reporting bureaus has to give you a free credit report each year. And during the coronavirus pandemic, consumers are entitled to free weekly reports through April 2021, via AnnualCreditReport.com, the official U.S. government website.

When you open your credit report, you can find a list of all derogatory accounts. These include any account with a late or missed payment.

Below is a sample screenshot showing a credit card account that has a 30-day late payment from July 2011. You can see that its a derogatory item from the color some reports show yellow and red boxes and we know that it is a 30-day late payment because the box says 30 in it.

Image: Eric Rosenberg

Look through your credit report and make a list of all negative information. Then compare to your records to make sure everything there is accurate.

If its not accurate, getting it removed is imperative. And if it is accurate, its harder to remove, but still possible.

You May Like: Syncb Ntwk Card