What To Look For In A Credit Report

When you examine your credit report, it’s a good idea to to do the following:

- Be certain you recognize all the accounts listed on your report. If not, get in touch with the lender listed for that account to find out what is happening and to check for the possibility of identity theft.

- Make sure the account status information is correct for your accounts. If it is not, start by calling the lender to ask about the discrepancy, then initiate a dispute.

- Check the on each revolving credit account. To do this, divide the reported balance for each by its credit limit, then multiply by 100 to get a percentage. You also can calculate an overall utilization ratio by dividing the sum of all your balances by the sum of all their credit limits. Remember to keep your utilization ratio below 30% on individual accounts and overall.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Also Check: What Is Syncb Ntwk On Credit Report

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

You May Like: 877-392-2016

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Don’t Miss: What Is Syncb Ntwk On Credit Report

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

What Are The Top Ways To Rebuild Your Credit Score Quickly

A low score is a result of poor credit management, or life events such as divorce or serious illness. Your credit history reflects that you are missing or have missed payments and/or you have too much debt. These two occurrences will make it very hard to earn a high score because they drive about 65% of the points in your credit scores.

The only way to rebuild your credit scores is to address why they are low in the first place. Sounds obvious but youd be surprised how many people take a shot in the dark approach at rebuilding their credit scores. Or, they are guided by misinformation and/or unscrupulous individuals that promise a better credit score in exchange for a fee. Formulating a plan to rebuild your credit scores is not difficult. Heres how to do it:

You May Like: What Credit Score Needed For Amazon Card

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Can I Run A Credit Check On My Spouse

A: No, you cant check your spouses personal credit reports. In order to request a consumer report on someone else, you must have whats called a permissible purpose under federal law, and marriage or divorce is not one of them. Its illegal, and it sounds like your divorce is messy enough as it is.

Don’t Miss: How Long Until Closed Accounts Fall Off Credit Report

Full Lowdown On What Mse Credit Club Offers:

- Our Credit Hit Rate. This shows your chances of success, as a percentage, of grabbing our top cards and loans.

- Eligibility tool. It reveals the likelihood of you getting top credit cards or loans .

- Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Or alternatively…

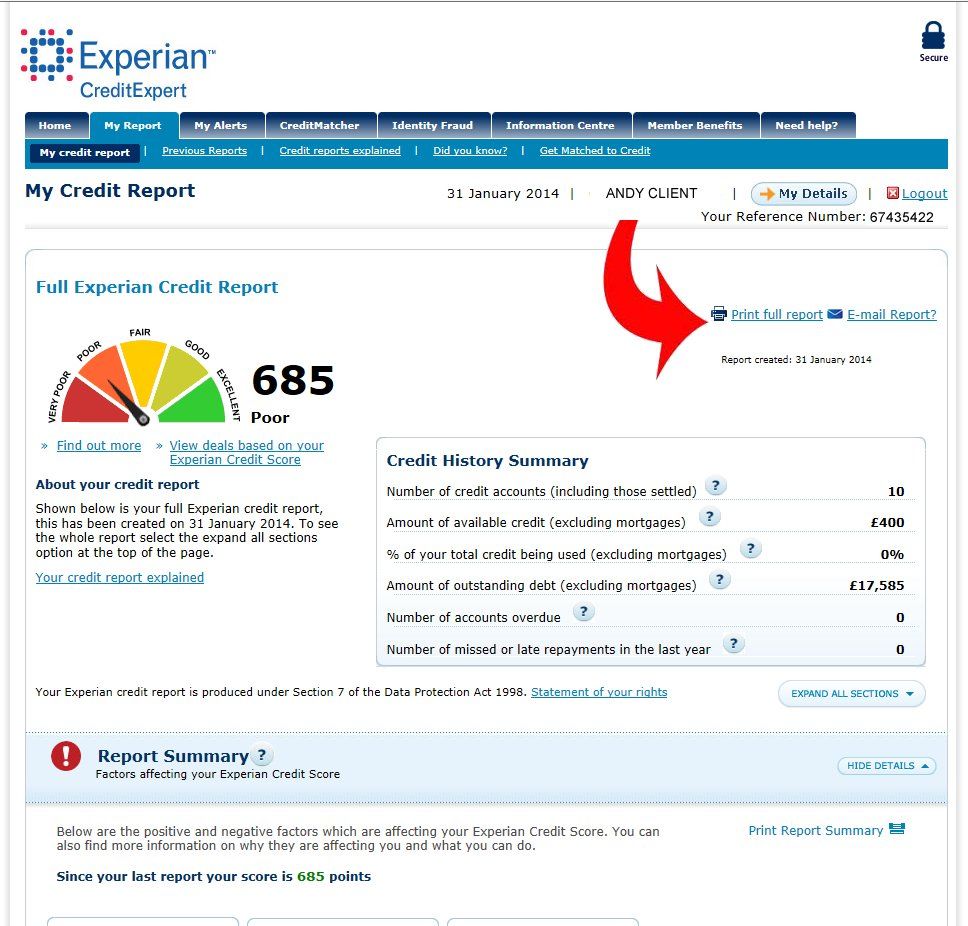

Experian’s CreditExpert free 30-day trial*. CreditExpert offers new customers a “free 30-day trial, then £14.99 a month” service. It’s different from MSE’s Credit Club in that it gives you real-time access to your credit report . It also offers an eligibility checker. You can only do the free-trial once. To cancel your subscription, log into your account and go to ‘My Subscriptions’.

Experian’s Credit Score free subscription to your score. If you don’t want to pay a subscription to see your credit report, you can sign up for free to see your Experian Credit Score. You won’t have to pay anything, but the information is limited to seeing your credit score, as opposed to credit report. The score updates every 30 days.

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.

If the information is wrong, you can try to fix it. If the information is right but not so good you can try to improve your credit history.

Recommended Reading: How To Remove Repossession From Credit Report

Look Over Your Inquiries

If you have ever applied for a loan or credit card there will be a record of that inquiry on your credit report. This is a great way to take a look at how often you are applying for cards or loans. Applying for too many cards or loans can negatively affect your credit score so having an idea of how often you do these things is important in changing behavior and increasing your score.

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

Don’t Miss: Aargon Agency Scam

Where Do Mortgage Lenders Get Tri

Tri-merge credit reports can come from a couple of different sources.

In many cases, mortgage lenders like Freddie Mac or Fannie Mae, purchase applicants credit reports directly from the three major credit bureaus.

There are also numerous mortgage credit reporting companies whose operations are dedicated to compiling tri-merge credit reports for mortgage lenders.

In either case, these reports simplify things for mortgage companies by presenting them with a comprehensive report, one that is easy to read and tailored to mortgage-related risk factors.

How Lenders Use Credit Reports

Be aware that different lenders look for different things when reviewing your credit report and deciding whether to lend to you. They can also take other factors into account.

For example, you might have been furloughed and taken a payment holiday during the coronavirus pandemic. While this won’t directly affect your credit score, it may affect your ability to borrow in the future.

You May Like: Open Sky Unsecured

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

Where Can You Find The Information In Your Tri

While you might not be able to get your hands on your actual tri-merge credit report, you can access the information found in the report on your own.

Using free or paid credit monitoring services, you can regularly check your credit scores from the major bureaus.

Many of these services only monitor one or two of your credit scores, though, so note that youll probably pay more for a service that reports all three scores.

You can also access your scores from Experian, Equifax, and TransUnion once a year without doing any damage to your credit score or paying a fee.

Thanks to the Fair Credit Report Act, you can see all three scores once every twelve months at annualcreditreport.com.

If you need to access your full report more than once a year, youll have to pay to access the information.

Recommended Reading: How To Report A Death To Credit Bureaus

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

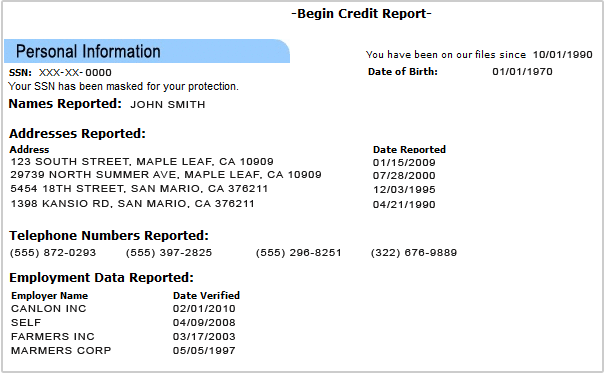

Reviewing Your Credit Report

Once you getyour credit reports, youll want to review them carefully. You can use the listbelow to check for common errors and make sure your credit reports are accurateand up-to-date. Each of the credit reporting companies may have differentinformation in your credit report thats why you should request your reportfrom each of them.

Personal information

- Errors in your identity data, such as wrong name, phone number, or address

- Accounts belonging to another person with the same or similar name to you

Also Check: Synchrony Bank Ntwk

What Makes Up Your Vantage Score

VantageScore uses the following breakdown:

- Payment history: 41%

- Balance: 6%

- Available credit: 2%

While the formula appears largely similar, with payment history and credit utilization holding the greatest importance, there is a critical distinction in the way the two scores create these metrics.

Whereas FICOs numbers generally represent snapshots, VantageScore uses something called trended credit data. This is just a fancy way of saying they consider the trajectory of a borrowers behavior, rather than scoring based only on the current balance or utilization. The reasoning behind this is twofold: consumers should be rewarded for a history of low credit utilization and healthy account balances, and account holders are more likely to make appropriate payments if they have done so in the past.

A further difference between the two is that a FICO score needs more time to develop, at least initially . A VantageScore, on the other hand, is available to people with a more limited credit history.

But regardless of which score used, the general path to credit success is the same: make regular, on-time and appropriately-sized payments, and keep accounts open for a long time. The formulas for FICO and VantageScore may seem complicated, but earning a good credit score doesnt have to be.

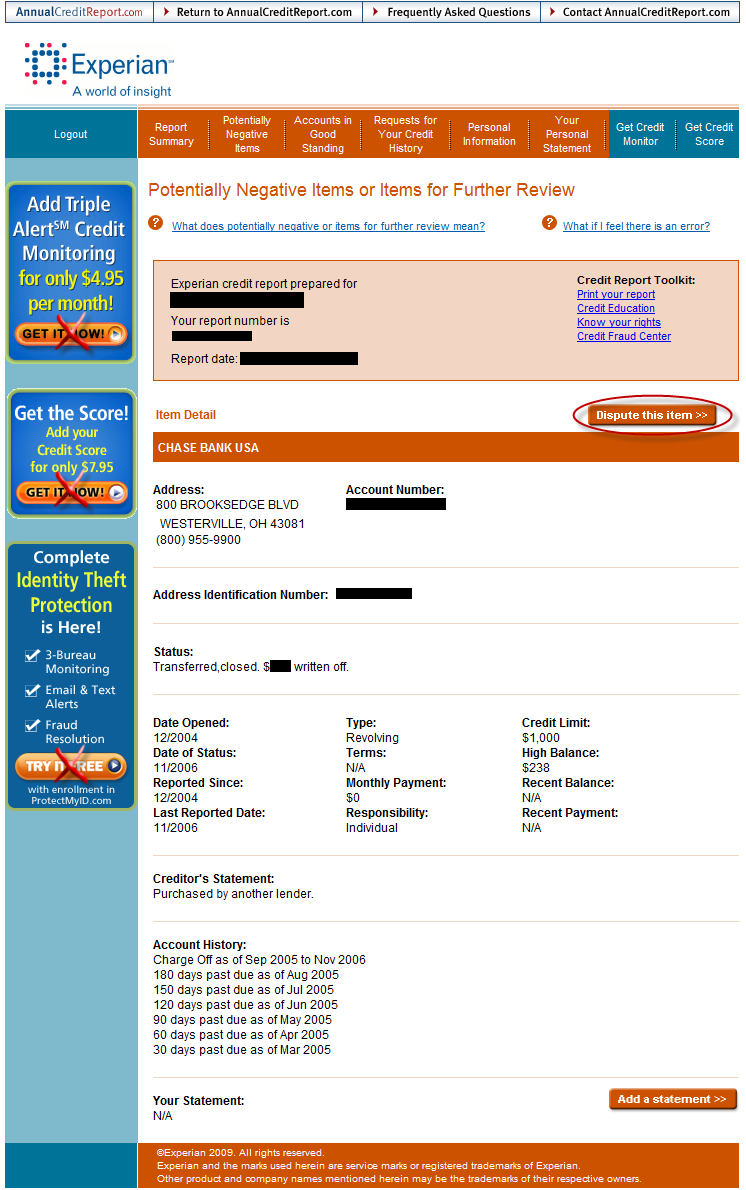

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Don’t Miss: How To Report A Tenant To The Credit Bureau

Where Can I Find My Credit Score

If you got a free credit report, dont be surprised when it doesnt include your . To see that, youll have to use a free web service or pay for it through MyFico.com or a credit bureau.

But keep in mind, when it all comes down to it, a credit score is really just an I love debt score. Thats right, a good score simply shows how well youve played the debt game. It doesnt reflect your actual net worth or the amount of money you have in the bank. In other words, its nothing to be proud of. The only way to keep your stellar credit score is to live in debt and stay there. No thanks!

It is possible to live life without a credit score, which is exactly what Dave recommends. But that doesnt mean you should trash your credit to lower it! Just start paying off your debt, close your credit accounts once theyre paid off, and dont take on any new debt. If youre following the Baby Steps, you should reach that indeterminable score within a few months to a few years. Remember: No credit is not the same as having a low credit score.

How Long Does Negative Information Stay On Your Credit Reports Ive Heard Seven Years

Positive or neutral information can stay on your credit reports indefinitely, though in practice some credit reporting agencies will remove accounts that are older. Experian, for example, no longer reports accounts that are more than ten years old if the account is closed and there is no activity on it.

Accounts such as credit cards and mortgages can stay on a credit report for many years if they are open and active.

With negative information, however, federal law limits how long that information may be reported:

So how can you be sure that these items will be removed when the time has come?

Each of the credit bureaus hard codes their credit reporting systems to look for the purge from dates. As these dates hit their 7 or 10 year anniversary they will no longer be reported. Unless you believe that an account is being reported past those time limits, there is no need to remind the credit bureaus that an item is to be removed. It is done automatically. Still, its a good idea to check your free credit report each year to make sure that is the case.

Don’t Miss: What Credit Report Does Comenity Bank Pull