Affirm Reviews And Complaints

Affirm has a mixed online reputation as of November 2020. It scores slightly over 1 out of 5 stars on the Better Business Bureau, based on over 160 customer reviews. Several customers cited unprofessional staff and trouble closing an account as the main source of complaint.

It does better on Trustpilot, scoring 4.6 out of 5 stars based on more than 3,375 reviews, with some shoppers complaining about customer service while others complimented the service for an efficient overall process.

Affirm Makes It Easy To Go Into Debt

Lets talk a little about how Affirm works.

You have to download the app or go to Affirms website to create an account. Account holders have to be at least 18 and be a permanent resident or citizen of the U.S. You hand over your personal infolike your cell number, email address and the last four digits of your Social Security number. And you have to agree to receive texts from Affirm. Oh, and dont forget, you need a decent credit score too.

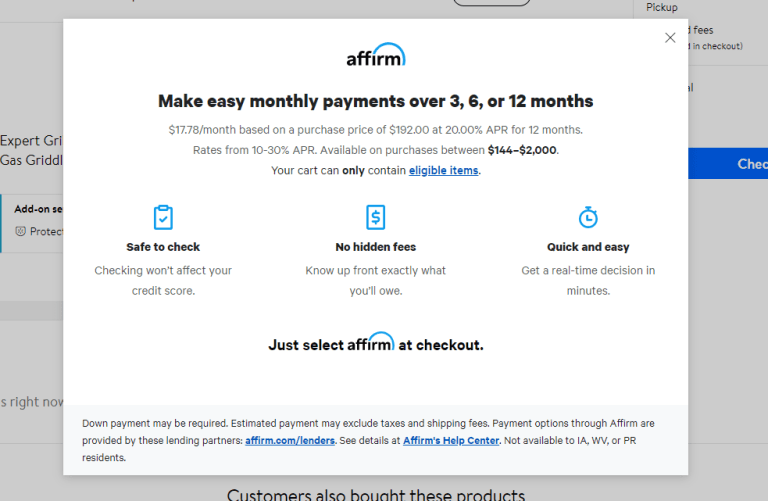

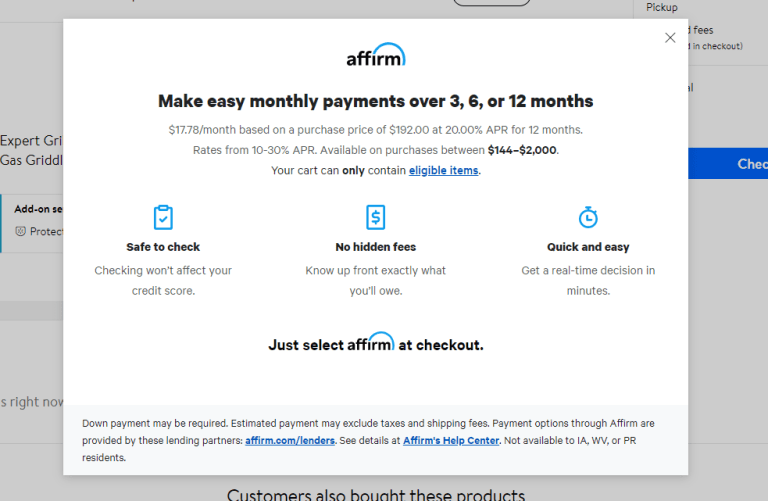

Affirm works with thousands of sites and stores. In fact, as of August 2021, even some Amazon customers can go this route. As youre checking out, you just select Affirm as your payment method.

Then you pick if you want to pay for the item for three, six or 12 months . Once you select the financing option and click to purchase the item, Affirm pays the company, and then you have to pay Affirm the amount of the purchase, plus interest.

And lets talk about that interest. Remember, Affirm is banking on you paying as much interest as possible so they make more money. The idea of paying off an item in lots of little payments may seem so much more manageable to your budget. It feels like a good idea. But the longer you take to pay, the more you pay. Trust us: Thats nota good idea for your budget .

Side note: Affirm checks your credit to make sure youre eligible for the loan. The check itself wont affect your credit score, but late payments can. Well cover that gem more in a moment.

Why You Should Stay Away From Affirm

Lets talk about a few of the reasons why we dislike digital installment plans. To start, interest rates can be high. Like, really high. To give you some perspective, the average credit card interest rate is at 15.91% right now, while Affirms rates can get up to 30%!1,2 Thats almost twice as much!

And dont forget, the longer you take to pay off that loan, the more the interest you pay. And speaking of interest, if you return an item, you wont be refunded the interest you paid Affirm.

Lets talk about what happens if you miss a payment. Well, as we said, Affirm wont charge you late fees. But customer reviews on Better Business Bureau say the late payment still damages your credit scorewhich can be a worse slap in the face than a fee. And though were anti-credit score, were also anti being sneaky about how your processes work. Also, customers say getting a refund from Affirm after they return an item is often a nightmare.

Bottom line: Affirm is in the debt business. And debt preys on your desire for the good life. Right now. And listen, were all about the good lifebut you should get there the right way . And guess what? This right way is worth it. Cut out this middleman and pay for the good life with actual money!

This have it now, pay for it slowly and painfully mindset has got to end.

Read Also: Opensky Billing Cycle

How To Use Affirm In Stores

If you’d like to use Affirm in-store, you can do so with an Affirm virtual card. When you’re approved for buy now, pay later with Affirm, you can choose to have the amount loaded onto a virtual Visa card that works just like a credit or debit card for making purchases. To use your card in-store, you can access it from the Affirm app or link it to .

Will The Irs Call Me

Technically yes, but rarely. The Tax and Customs Administration can call you. But most people never get a call from the IRS. There are several reasons for this: The IRS mainly sends messages because it doesn’t have the staff to call taxpayers. The IRS wants to fight a lot of scams masquerading as the IRS.

Also Check: Credit Score Of 672

What Happens If You Miss A Payment On Affirm Loan

In an effort to reduce costs, Affirm has removed all standard costs from customers when they do not make a payment. The outstanding balance can still be credited to the customer with the interest paid. Getting another confirmation loan is harder if you don’t pay regularly. It can also affect your credit score. No penalty for early repayment.

Affirm Is Straightforward About What You Will Pay

Affirm promises you wont be hit with any hidden fees or prepayment penalties. For instance, if you come into an unexpected windfall and decide to use it to pay off your Affirm loan, Affirm is cool with that. They wont charge you a fee for denying them the additional interest.

Affirm wont even hit you with a late fee if youre late with a payment. They will, however, probably not opt to give you another loan in the future. They also do not offer extensions on your loans, so be sure you pick a term long enough so your monthly payments arent a burden.

Affirm is also an alternative to personal loans that offer fixed repayment terms and, in some cases, better interest rates than credit cards for borrowers with excellent credit. Affirm is attractive because it may offer you financing at the point-of-sale, whereas a personal loan takes between 24 hours and a week to get approved.

Read Also: Usaa Credit Repair

Is Affirm Part Of Amazon

The agreement will make Affirm deals available to Amazon’s customers at checkout to split any purchases worth $50 or more into monthly payments. Amazon is just the latest in a string of big partnership deals for Affirm. It also recently announced an exclusive deal with Shopify to run Shop Pay Installments.

How Peloton Financing Works

Affirm, which is Pelotons financing partner, will do a soft pull on your credit when you apply for financing. The lenders review of your loan eligibility wont affect your credit scores.

If youre approved for a loan, you may be able to get 0% APR financing with no money down. But not everyone can qualify. Affirm says on its website that a down payment may be required and that interest rates range between 0% and 30%, depending on the strength of your credit.

Loan terms are flexible. You can spread your payments over 12, 24, 39 or 43 months.

Unfortunately, loans apply only to Peloton equipment, so you wont be able to finance the $39 monthly all-access Peloton membership fee that lets you access classes.

Recommended Reading: How Does A Balance Transfer Affect Your Credit Score

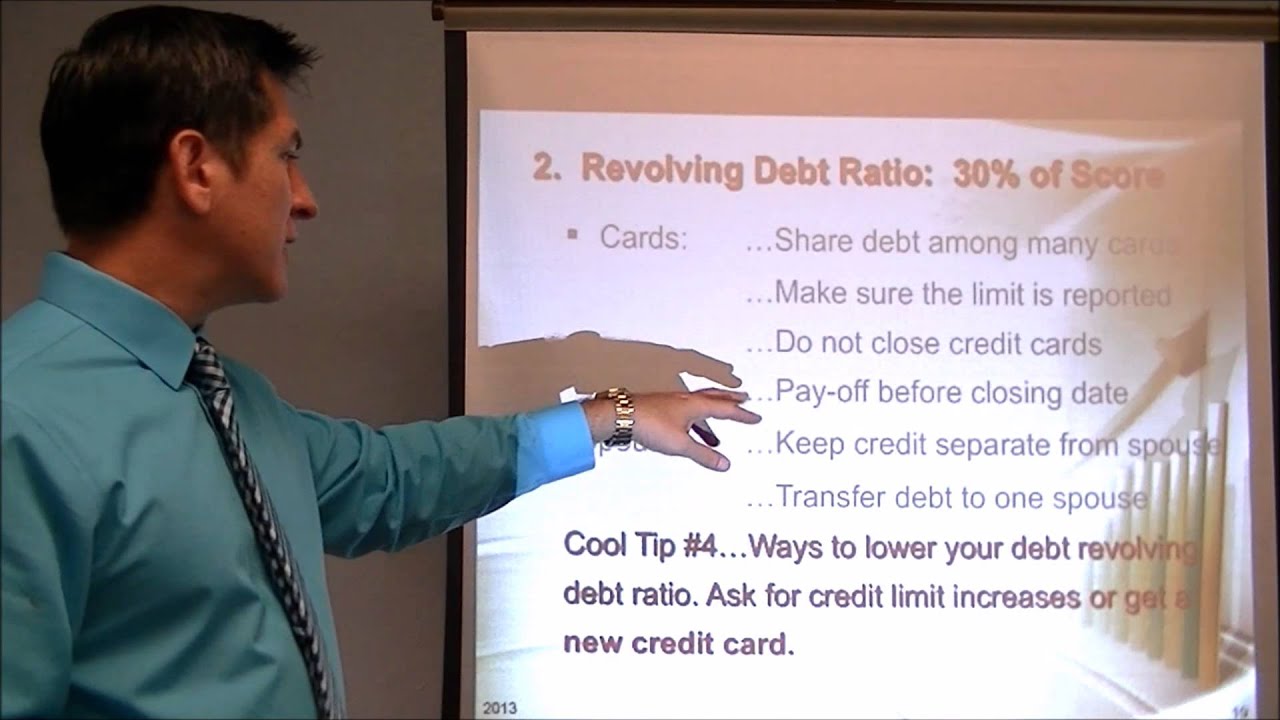

How Can I Increase My Credit Limit

If you’re initially approved for a loan with Affirm but were hoping for a higher credit limit, there are a couple of things you may be able to do to improve it.

First, you can pay off your current Affirm loan on schedule. As mentioned, Affirm looks at how you’re managing existing loans when approving you for new buy now, pay later arrangements.

Next, you can work on boosting your overall. Things like paying bills on time, reducing debt balances, and limiting how often you apply for new credit could work in your favor for getting a higher credit limit with Affirm or any other lender.

What If I See An Interest Rate 0% Apr Available On Walmartcom But The Interest Rate I Later See During Affirms Application Process Is Between 10

0% APR is a promotional financing offer that is specific to certain Walmart.com products for a limited time. For items that do not qualify for 0% APR financing, your APR rate will be between 1030%, depending upon your credit. The exact terms you qualify for will be shown when you check out with Affirm.

Also Check: Does Carmax Report To Credit Bureaus

What Are The Interest Rates On Affirm Savings Accounts

These credit partners offer payment confirmation options: their interest rate is 0-30% per annum depending on the loan and is subject to authorization checks. The options depend on the amount of your purchase and a security deposit may be required. Verified savings accounts are held at Cross River Bank, a member of the FDIC.

Need A Bnpl Loan That Won’t Impact Your Credit Score

Each BNPL loan handles credit checks and reporting to credit bureaus differently.

Although AfterPay does not consider itself a POS provider, AfterPay performs no credit check at all, making it a solid option for people who have poor or bad credit and have a hard time securing a loan otherwise . It doesn’t report loans to the credit bureaus.

Klarna also does not report information to the credit bureaus on its POS loans, according to Klarna. Klarna will perform a soft credit check, which won’t affect your credit score, if you’re taking out a ‘Pay in 4’ loan or a ‘Pay in 30 days’ loan. Additionally, if a consumer applies for a branded open line-of-credit product offered by Klarna’s partner bank, a hard inquiry may be conducted.

Your score won’t be affected if you take out an Affirm loan that charges 0% APR and has four biweekly payments or loans where people were given the option of a three-month payment term with 0% APR. If you take out a longer loan with interest, the loan will be reported to Experian.

Before you take out any BNPL loan make sure you’re clear on the terms and conditions, so you understand the interest rate and repayment schedule.

Don’t Miss: When Does Open Sky Report To Credit Bureau

Is There An Interest Charged By Affirm

Whether or not you are charged interest depends on where you make your purchase. It is up to the retail partner to determine the specific interest rate, which can range between 0% and 29.95% APR . Affirm will always calculate and show you your exact APR and total cost of borrowing before you finalize your transaction.

Some Affirm plans also charge a small monthly processing fee with each payment. Affirm does not charge any other service fees, prepayment fees, or late fees. However, if you miss a payment, you wonât be able to use the service for future payments.

If you stop making your payments, Affirm may âcharge offâ your purchase. This doesnât mean you are off the hook. It means Affirm will close your account and possibly transfer it to a collection agency — not great news for your credit score. Legally, you will still be obligated to pay your debt. So, if youâre going to be late on a payment, reach out to Affirm to let them know as soon as possible.

How To Use Affirm Payments

Affirm is a buy now, pay later service that allows you to make in-store and online purchases without paying the total bill upfront. Its a good choice for any consumer who needs to break down large payments into more manageable installments.

So, how does Affirm work? Well walk you through everything you need to know in this article.

Read Also: Credit Score Credit Limit

What’s The Difference Between Affirm And Soft Credit Pull

Soft loan. Proofs verifies your credit like any other lender when evaluating your application for approval. The main difference is that approved financing will not affect your creditworthiness, whether it is approved or not. This is because the company uses a flexible credit check that will not appear on your credit report.

How Can I Pay With Affirm

You can make or schedule payments in or in the Affirm app. To make payments: log in to your Affirm account. Go to payment. Select the desired purchase. Click on “Pay once”. Choose how much you want to pay and when. Add a payment method or select a payment method. Click Continue. Check the amount, payment method and payment date. Click on “Send Payment”.

Also Check: What Credit Score Do You Need For Amazon Prime Visa

Is There A Credit Limit

Affirm doesn’t have a minimum or maximum , per se. Though there is an upper limit of $17,500 on purchases as mentioned, your individual credit limit is determined by things like:

- Your credit history

- Your payment history with Affirm

- How long you’ve had an account with Affirm

- The interest rate offered by the merchant where you’re applying

What this all means is that it’s possible to be approved for more than one Affirm loan at a time, with more than one merchant. Affirm also mentions that it takes current economic conditions into account so whether or not you’re approved and your credit limit can depend on things beyond your financial history.

Where To Get An Affirm Loan

Affirm loans are available online, through its mobile application, or at over 6,500 merchants, including Walmart, Best Buy, Wayfair, Nordstrom, Peloton, Casper, and Expedia.

If you are still questioning whether an Affirm loan is right for you, you can go through the lenders prequalification process. Prequalifying will give you an estimate of how much Affirm will lend you and at what interest rate.

You May Like: How To Unlock Experian Credit Report

Creating And Using An Affirm Account

Before you can make purchases through Affirm, you will need to have an account with the lender. You can do this easily through their website.

You will need to be at least 18 years old and be a permanent resident or citizen of the U.S. to qualify. You must have a cell phone number and agree to receive texts from the company. It is also ideal to have a credit score of at least 550.

The company has also launched a mobile app that can be downloaded at the Apple store and Google Play Store to create an account.

Affirm Vs Afterpay: Credit Requirements

Affirm performs a soft credit inquiry when you create an account to prequalify you for future purchases. This soft inquiry does not affect your credit score and will not show on your credit report. However, when you do make a purchase, your credit score could be affected if Affirm does a hard credit inquiry. Additionally, your payment history and credit usage may also be reported to the credit bureaus.

Afterpay does not check a customer’s credit to open an account or at the time of purchase. If you are late with a payment, Afterpay also does not report late or missed payments to the credit bureaus. This makes Afterpay an attractive financing option for people with troubled credit or who don’t have enough credit history to get approved by other lenders.

Also Check: Is 517 A Good Credit Score

Does A Loan Modification Negatively Affect Your Credit Score

Depending on how your lender reports it to the credit bureaus, changing your credit could lower your credit rating. At the same time, however, it will have much less negative impact than an â â â â â â â â â or series of late payments, so in this case it can really help with your long-term evaluation.

What Are The Benefits Of Using Affirm

For more information about Affirm and their policies, please refer to their FAQ page.

You May Like: What Credit Score Does Carmax Use

How Do You Make An Online Payment

There are two main methods of paying online: credit card payment and direct debit. Online payments can be made directly from an account, credit or debit card, or through a universal payment process such as PayPal or Worldpay Online Payments. These methods provide your customers with a fast, easy and secure way to pay online.

Do Affirm Loans Help Your Credit

In theory, Affirm loans could help your credit when you make timely payments. That said, one important factor for your credit sore is your credit utilization ratio. What makes your credit score happy is when you have a lot of credit available to you, but you havent used a lot of it. For example, having a couple of credit cards with over $10k in available credit, but a low balance that you regularly pay off each month. That would give you a good credit utilization ratio. On the other hand, if you have a lot of credit extended to you and you have high balances on that credit, that can actually harm your score. On top of that, when you actually pay off your loan with Affirm, you are essentially closing off a line of credit extended to you, which could in theory harm your score.

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

Why Is Affirm Rejecting Me

Why was I denied financing by Affirm? The merchant has no information regarding a customer’s financing denial. Affirm strives to offer all credit-worthy applicants financing with Affirm, but isn’t able to offer credit in every case. Affirm will send you an email with more details about its decision.