What Credit Card Can I Get With A 635 Credit Score

You might have a hard time getting approved for a credit card with poor credit scores.

The good news is, Credit Karma can help. You can log in to your account to see your personalized Approval Odds for a number of different credit cards. While your Credit Karma Approval Odds arent a guarantee that youll be approved for a particular card, they can help you find a credit card that matches your current credit profile.

Here are some common options you may come across.

How To Read Your Credit Report

Your credit report contains both personal information and financial information. Your credit report illustrates who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. Your credit report is the report card of your financial life and understanding how to read it can help you take control of your finances and be prepared for any of your future credit needs.

Can I Get A Car / Auto Loan W/ A 635 Credit Score

Trying to qualify for an auto loan with a 635 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 635 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

Read Also: Carmax Loans For Bad Credit

How Can I Find Out My Credit Score

Plenty of credit card companies offer free FICO scores to customers nowadays. Some even offer a free credit score to non-customers. You can also purchase your FICO score at FICOs website, MyFICO. Your VantageScore can be purchased from VantageScores website.

Keep in mind that some credit cards and banks provide . However, these credit scores may not be your FICO or VantageScore. Be sure to verify what kind of credit score you are getting before you pay for it.

The only other way to get your credit score is to apply for a credit card or loan. In your acceptance letter, you will generally receive your credit score and how it factored into the decision to approve or deny your credit.

This is the least recommended way to get your credit score, as there is no way for you to improve your credit score before you are denied credit if there are problems.

Capital One Venture Card

If youre an avid traveler, the Capital One Venture can help you to save on your next adventure. A credit card for people with at least a 700 credit score, the Venture card allows clients to use Venture miles for any charge that has to do with travel. That means miles can be used for more than just airfare. They can be used for things like hotel or cruise reservations, train tickets, travel agent fees and more. Theres an annual fee of $95, but users can rack up savings quickly with 2 miles earned for every $1 spent. Theres typically an initial bonus when you sign up, too. At the time of this writing, new users can earn up to 100,000 bonus miles by spending $20,000 on purchases in the first 12 months.

Don’t Miss: Sync Ppc Credit Card

Annual Percentage Rate Apr

Do you know how credit cards typically advertise wide interest rate spreads, like 14.99% to 24.99%? With a credit score between 600 and 649, youre much more likely to pay 24.99%.

This is a primary reason why we recommend throughout this guide that you keep your credit card balance to an absolute minimum. Its possible to use a credit card to increase your credit score and to do so at a very low cost. But if you carry a balance, the interest cost will be substantial.

What Is A 630 Fico Score

Understanding your 630 credit score means knowing how credit scores are calculated and how they affect your life.

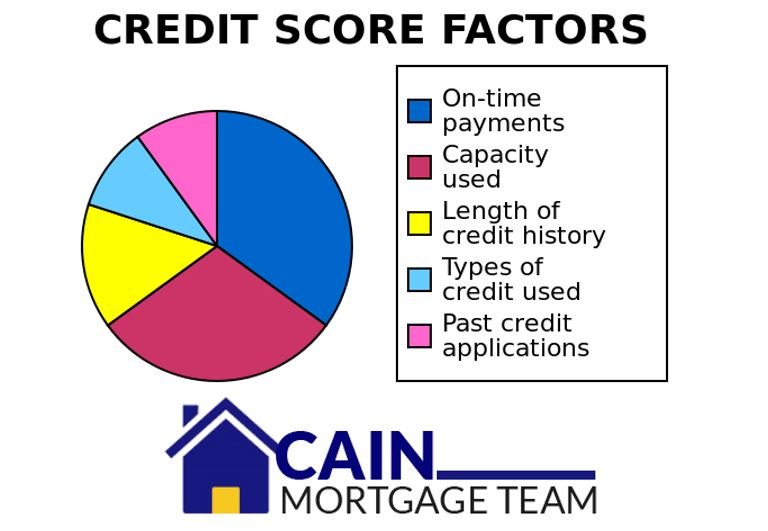

Credit scores are calculated by the FICO corporation based on everything in one of your three credit reports. This means your entire credit history from the time you started using loans and credit cards.

From this information, FICO calculates your score on a scale from 350 to 850 though its rare for anyone to have a score outside of the 450 to 800 FICO range. A 630 credit score isnt exactly in the middle but its pretty close.

That doesnt mean a 630 FICO is a good credit score though.

Recommended Reading: What Is Cbcinnovis On My Credit Report

Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 635 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Is 635 Credit Score Good Or Bad

Short Answer: If you have a 635 Credit Score, then 635 is a Poor Credit Score! Most of the applications that have 635 Credit Score are usually rejected by lenders and insurers. If your credit score is 635, it will undoubtedly be very difficult for you to obtain credit even though you try without a co-signer or large down payment. Luckily if your loan got approved with this score, it will most definitely be a high interest/ credit line.

This grand score is on account of several late or pending payments, numerous defaults on products from different lenders. This score can also be due to bankruptcy which is a scar that will remain on your record for a whole decade. Getting a new credit is near to a miracle for such individuals. It would be advisable for them to look up a professional finical advisor that will aid them in repairing their credit.

Don’t Miss: Carmax For Bad Credit

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

What Is A Fair Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

On commonly used credit score scales, fair credit starts around 630. Most FICO scores use a 300-850 point range, as does FICOs competitor, VantageScore.

While its tempting to hope a particular number will tell you if you’ll qualify for a loan or credit card, the reality is that lenders and card issuers set their own standards for scores required for approval.

That said, knowing what you are in can give you a good idea of what credit products youre likely to qualify for, and better credit will get you better terms.

Also Check: Capital One Authorized User Credit Report

The Most Important Features Of Credit Cards If Your Fico Score Is Between 600 And 649

If your FICO Score is between 600 and 649, shopping for a credit card is different than it would be if your score was say, over 700. Youll be less concerned with factors like cash rewards, travel benefits, and 0% introductory APRs. Your needs will be more basic, and will focus on a combination of the cost and usability of the card.

The main purpose of getting a credit card in this credit score range is to use it as a tool to improve or rebuild your credit score. Only then will you be eligible for the more generous credit card offers.

Here are the factors that are most important:

What Is The Possibility Of Getting A Personal Loan With A 635 Credit Score

The possibility of getting a personal loan with a credit score of 635 is quite high. A 635 credit score is considered to be fair according to the FICO scoring model. This means there are probably a number of different loans you would qualify for. That being said, it isnt considered a good or excellent score so you may not be offered the lowest interest rates.

The world of credit and credit scores can seem daunting at times. Keeping track of your credit report, your credit score, and the types of loans and financial products you qualify for can be confusing and time-consuming. But starting to gain an understanding of credit scores and how they work will help you to better manage your finances in the future.

Your is a three-digit number that tells lenders how creditworthy you are. Creditworthiness is a term thats used to describe how trustworthy you are when you borrow money or use credit products. Having a high credit score and a good borrowing history will tell lenders that you are creditworthy. This will lead to more loan approvals and better interest rates.

On the flip side of that coin, having a low credit score will show lenders that they may not be able to trust you with a loan or credit card. You may not be able to get approved for the loans you need, and if you are approved you probably wont get the best interest rate.

Heres how the credit scores are broken down into categories by FICO, one of the top credit bureaus that tracks your financial behavior:

You May Like: Why Is There Aargon Agency On My Credit Report

How To Improve Your 675 Credit Score

A FICO® Score of 675 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 675 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

35% of consumers have FICO® Scores lower than 675.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Lower Your Credit Utilization Rate

A high ratio of debt to credit can negatively affect your credit score. You can either pay off this debt or apply for a credit increase to reduce your utilization rate. Another way to do this is by paying your credit cards off early each month so that your posted balance is lower than your spending for the month.

Also Check: Does Paypal Credit Report To The Credit Bureaus 2019

Is 635 Good For A Credit Score

What is a credit score?

A credit rating summarizes your complete credit report information into one number. This number is calculated with a mathematical equation that evaluates various kinds of information from the credit profile at this particular credit-reporting agency. By comparing these records towards the patterns in a huge number of past credit history, scoring identifies your level of credit risk. Your score tells a lender how likely that you are to settle financing, or make credit payments on time. The bigger your score is, the greater chance you’ve of having the finance are applying for.

How can I get my credit report?

To get the free credit history that you’ll be eligible for under federal law, you should head over to www.annualcreditreport.com. There, you can obtain your credit report from all three credit rating agencies – Experian, Equifax and TransUnion – once every calendar year. For daily monitoring of your respective credit history from each of the three credit rating agencies, use FastOnlineCreditScores Monitoring. A reverse phone lookup makes your own credit profile available on the web 24-7. You have relief from understanding that your credit records are monitored daily. If any irregular account activity is detected, we’ll email you promptly.

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 635 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Also Check: What Credit Score Does Carmax Use

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

Read Also: Aargon Agency Inc Phone Number

How We Came Up With This List

We started by isolating the cards known to be available to those in the 600 to 649 credit score range. From there, we considered the features that would make it most valuable to people in that credit score range, based on different credit factors.

Those factors include:

- The issuer reports to all three major credit bureaus TransUnion, Experian and Equifax giving you an opportunity raise your credit score with all three

- Secured or unsecured credit cards secured may be necessary for those at the lower end of the fair credit score range

- Low or no annual fee

- Offering the ability to increase your credit line as your payment history warrants.

- Card features, like rewards and other benefits, if offered

Dont Apply For Too Many New Credit Cards At The Same Time

A hard inquiry typically occurs when you apply for a new credit card. This just means that the card issuer has requested to check your credit as part of the approval process.

A hard inquiry can have a small negative impact on your credit, but just one hard inquiry is usually not a big deal. But multiple hard inquiries in a short period of time might lead lenders to assume that youre a potentially risky borrower. Whether thats true or not, it isnt something you want weighing down your credit!

Don’t Miss: What Credit Score Does Carmax Use

How To Build Your Credit To Good And Beyond

One quick way to build your credit is to examine your credit report and dispute any errors you find.

Depending on the type of error, your score could rebound dramatically. A report of a late payment when you actually paid on time, or a mixup with a file of someone with poor credit habits could cost you points.

You are entitled to at least one free copy of your credit report every 12 months from each of the three major credit bureaus, Equifax, Experian and TransUnion.

A second strategy is to use only a small portion of your credit limit for every credit card you use. Using over 30% is considered a problem less is better.

Its also important to make sure you dont let your score slide further. Here are five habits that, over time, will help.

-

Pay on time, every time.

-

Pay credit card bills in full each month if you are able.

-

Automate credit card payments, or at least minimum payments, to avoid being late.

-

Set up alerts to let you know when you are approaching an amount or percentage of available credit that you choose.

-

Keep credit accounts open unless you have a compelling reason like an annual fee to close them. The average age of your accounts affects your credit score.

If youve had serious missteps in the past, know that time is the best cure but you can diminish their impact by having recent, positive information.

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more