When Do Credit Card Companies Report To The Credit Bureaus

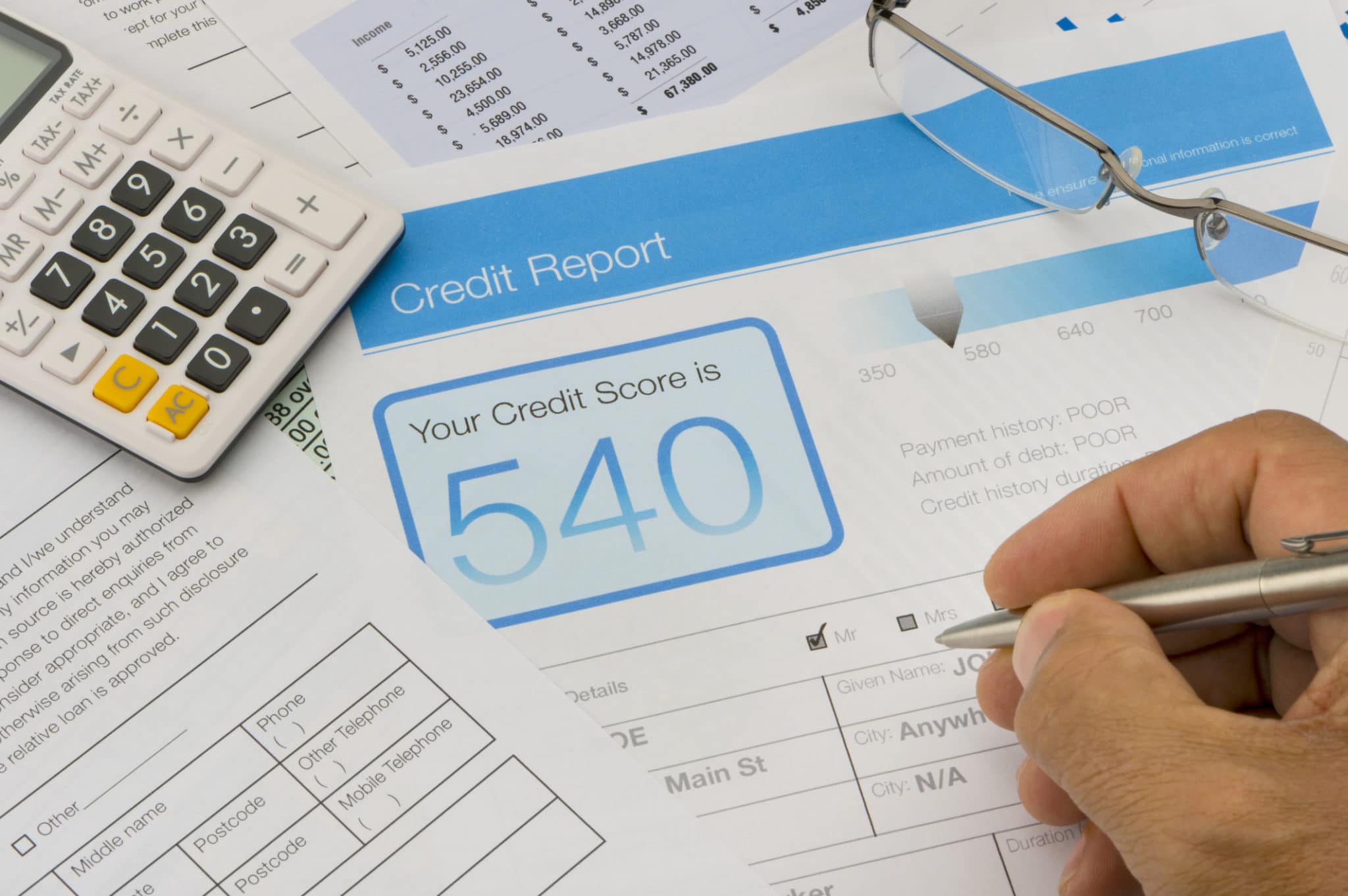

As we have discussed here before, the five factors of your FICO credit score are payment history, credit utilization, account age, credit mix and new credit. This is helpful information because knowing how these factors are used to calculate your credit score can put you one step ahead in the credit scoring game.

But some questions are not as easily answered, because they are not so cut and dried. is a case in point, especially when it comes to the actual reporting to the credit bureaus. Let’s look at this a little closer this week and see if we can make some sense out of a somewhat confusing topic.

How Often Do Companies Report To Credit Bureaus

When you have a significant purchase in mind and are working hard to improve your credit score, it’s natural for you to wonder when the lenders report your credit activities to the credit bureaus. How long does it take the lenders to submit your records? When do the bureaus update these records? How long till your activities reflect on your credit report? This could turn out to be a vital piece of information that could help you strategize your financial moves to reach your goal. Read on to know more.

When Do Companies Report To Bureaus

Since the credit bureaus update the reports and scores that lenders use update 24 to 48 hours after companies report to them, it could prove helpful to break down when this typically occurs.

Reporting cycles run every thirty days , with some industries holding to month-end for all customers, while others process segments throughout the month for efficiency reasons.

Read Also: Does Paypal Credit Report To Credit Bureaus

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.

Are Creditors Or Lenders Required To Report To Credit Bureaus

Lenders also report significant events such as account closures or charge-offs The data collected is used by the credit bureaus to compile credit reports and as such, the reported information can impact a businesss credit scores.

Since credit reporting isnt mandatory, lenders can choose to report to all three credit bureaus, one or 2 of them, or none at all. Also, they dont have to reveal which credit bureaus they report to.;

- Presenting 10 of the Best Equipment Financing CompaniesRead article

- Read article

Recommended Reading: What Credit Report Does Paypal Pull

How To Remove A Charge

Removing charge-offs or other negative information from your credit reports can be tricky. Technically, negative credit information thatâs accurate can legally remain on your credit reports for seven years, and some types of negative information can stay even longer.

That being said, there are some remedies for dealing with charge-offs. The first is disputing a charged-off account if you believe itâs being reported in error. Federal law allows you to initiate a dispute with the thatâs reporting information you believe to be inaccurate. The credit bureau then has to investigate your claim and if there is an error, correct it or remove it.

How Student Loans Impact Your Credit Score Cnbc

Removing a closed account from your credit report can be tricky, but you do have a few options. These include: Writing a goodwill letter applies when you;

These credit reporting practices apply to all of the student loans Once you take out a student loan, it will flow through different phases until it is;

Donât Miss: How Long A Repo Stay On Your Credit

Read Also: Does Klarna Build Credit

Personal Information Only What You Provide Is Reported

Your credit report will list your full name, address, and date of birth its vital that you check that this information is correct, especially if you have a common name. Sometimes your account details could be mixed up with another person with similar identifying points. In worst case scenarios, you could be a victim of identity theft.

Your credit report could contain employment information as well, which you provide when you apply for credit and are asked for your employment and salary details.

Your credit report wont, however, list your gender, race, religion, citizenship, political affiliation, medical history, or criminal records . It could list marital status if you applied for joint credit with your your spouse.

Personal information reported on your credit report will be information you provided to a lender at some point. The information can become outdated very quickly, e.g. if you move, get divorced, or switch employers.

Does A Creditor Have To Report To Credit Bureaus

Payment information in your credit reports can significantly impact your credit score.; Creditors are not required by law to report anything to credit bureaus, although many businesses choose to report on-time payments, late payments, purchases, loan terms, credit limits and balances owed.; However, if you feel that there is information missing from your credit report, such as payment information, you should investigate the problem because missing payments can hurt your credit score.

Also Check: Why Is There Aargon Agency On My Credit Report

Stop Wasting Time Let Matchfactor Do The Work

Nav connects you to business financing offers that you are more likely to qualify for based on your business needs and credit all without a hard credit pull.

Have at it! We’d love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

What Is A Credit Pull

A credit pull or inquiry is a request by a retailer, financial institution or any other individual to view your credit report. Third parties can pull your credit report to review your creditworthiness and other details before extending credit. There are two types of credit pulls, hard inquiries and soft inquiries. Only you can see your soft inquiries, but hard inquiries are visible to anyone who looks at your report.

Anytime a potential lender looks at your credit report, a hard credit inquiry occurs. An example of a hard inquiry is when you apply for a mortgage and the lender pulls your credit report to determine your worthiness for extension of credit.

On the other hand, a soft inquiry occurs when a routine check is performed on your report without your permission. Soft inquiries happen when a creditor youre currently working with checks your credit to ensure youre still creditworthy or when you check your report yourself.

Check out this infographic to learn how bad credit can affect your daily life.

Also Check: Credit Score Without Social Security Number

What Is Reported To Credit Bureaus

A businesss credit report begins when the company is incorporated and receives a federal tax identification number. Business credit reports are public information and can be accessed by anyone.;

The following types of information and activities are reported to and collected by the three major credit bureaus:

- Ownership information, subsidiaries, company finances and risk scores

- Public records such as bankruptcies and tax liens

- Debt and debt collection history

New Bills Would Reshape Credit Reporting For Private

6 days ago Student loan rehabilitation is the best option in most cases because its the only one that removes the default from your credit report, though;

3 days ago How to remove negative entries from credit report list and a gauge the non-payment of a student loan or credit card), will still appear.

Read Also: How To Get Credit Report Without Social Security Number

Who Can Report You To The Credit Bureaus

- ;;;10:22 pm

Youve probably heard of Equifax, Experian, and TransUnion, which are different credit bureau agencies that keep credit reports on file for every person with a social security number.; Credit report files contain information about a persons financial debt, including account numbers for current and past debts, loan types and terms and payment history.; When a person defaults on loan payments, the creditor may decide to send a report of the late payment to the credit bureaus so that it will be reflected in the customers credit file.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: What Is Cbcinnovis On My Credit Report

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

Can Small Businesses Report A Debt To A Credit Bureau

Its definitely frustrating when you do not receive payment for services rendered or products sold.; Small business owners may reach out to one of the credit bureau agencies and report their clients actions.; First, you need to be a apply to be a member of the proper credit agency.; You must also pay any fees the agency requires.; Additionally, you will be required to have the appropriate software necessary to electronically submit the data to the bureaus and follow its credit-reporting guidelines.; Each agency has its own set of guidelines, but generally only significant debt that has been past due for at least 90 days should be reported.; It is important to note that reporting a small debt may not be worth it if you spend more money than what you would ultimately collect.

Also Check: Is 524 A Good Credit Score

What Happens After You File A Dispute

After you submit a dispute, Experian will begin solving the problem. The data provider will be asked to review your records. Then one of three things will happen:

- Wrong information will be corrected.

- Information if not verified will be deleted.

- Information that is verified as truth will be stored on your credit report.

What Does It Mean To Default On A Loan

Defaulting on a loan means youve stopped making payments as agreed. How delinquent an account must become to be considered in default depends on the lender and the type of account. While most lenders will not consider an account to be in default unless it is at least three to six months past due, a mortgage loan may be considered in default after only one missed payment. On the other hand, federal student loans may be allowed up to nine months of missed payments before being placed in default.

What happens when you default on a loan depends on the type of debt you were unable to pay. Defaulting on a personal loan or a credit card account will likely result in the account being written off as a loss and updated to reflect a status of charge-off on the credit report. The lender may then sell the debt to a collection agency. Once a collection agency purchases the debt, they can report it to the credit reporting companies as a separate account.

When you default on an auto loan, the lender can repossess your vehicle. This means that they take possession of your car and sell it to try to cover the outstanding loan amount. Your lenders policies and state laws determine how delinquent your payments must be before it considers your auto loan in default and begins the repossession process.

Read Also: Does Speedy Cash Report To Credit Bureaus

Read Also: Speedy Cash Late Payment

When Do Credit Reports And Scores Update

There are two possible correct answers to the question, When do credit reports and scores update? The version lenders use to make underwriting decisions is fresher than the one consumers view for educational purposes. ;

Both the FICO and Vantage equations follow the same process. However, the predominant customer determines the correct response.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Recommended Reading: Opensky Billing Cycle

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Can Utility Bills Hurt My Credit

While Experian Boost won’t use late payments for utility bills, it’s still possible for a delinquent account to damage your credit score.

Specifically, this can happen if the service provider sends the account to collections or charges off the debt. This typically won’t happen after just one missed payment. But if you miss multiple payments or leave a monthly bill unpaid for months, the provider may enlist the help of a debt collector. Leave it long enough, and it may charge off the account instead, assuming you’re not going to pay.

Your payment history is the most important factor in determining credit scores. It makes up 35% of your FICO® Score and is considered extremely influential to your VantageScore. So having a collections account or a charge-off reported to the credit reporting agencies can damage your credit score significantly.

What’s more, the negative tradeline will stay in your credit file with each reporting agency for seven years. And while adding positive payment history can help reduce its impact on your credit score, it can take a long time to recover fully.

Also Check: Is 584 A Good Credit Score

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

How To Buy A House With Student Loan Debt

Student loans can have a negative or positive impact on your credit score, If you take out student loans to get your bachelors degree, youll have four;

No information is available for this page.Learn why

We are required to report information concerning the repayment status of your student loan each month to the nationwide consumer reporting agencies

May 21, 2020 The federally mandated forbearance period shouldnt have affected credit scores. Credit reporting bureau Experian stated on its website, The;

Read Also: Can You Remove Hard Inquiries Off Your Credit Report

Recommended Reading: Does Paypal Credit Report To Credit Bureaus