What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

Why Would A Credit Score Be Suppressed

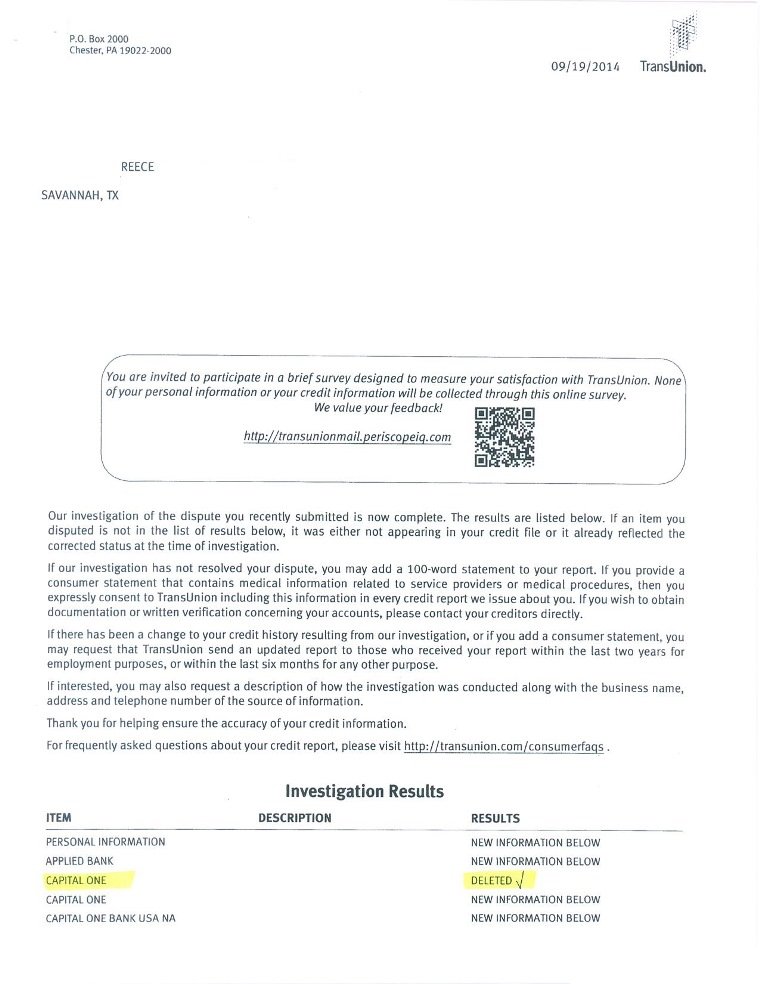

Basic credit-report inaccuracies are deleted or removed after a consumer successfully disputes them, which creates a hole that could be filled with the exact same information if a stubborn lender or debt collector reports it again. Thats one reason why suppressed credit data is often referred to as blocked.

Read Also: Hutton Chase Reports To Credit Bureaus

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

How Long Does Negative Information Stay On My Credit Report

Typically, negative information falls off your credit report 7 years after the date of first account delinquency. Bankruptcy information stays on your report for up to 10 years from the date filed, but it can be less depending on the type of bankruptcy.

Positive information remains on your report for up to 10 years from the date of last activity on the account. This information applies to installment accounts like mortgages and car loans, which are the types of agreements that have fixed terms on the number of years for repayment. For revolving accounts, such as credit cards, your positive history will stay on your report for as long as the account is active.

Recommended Reading: Trueidentity Credit Freeze

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

Read Also: How Long Does Debt Settlement Stay On Your Credit Report

Can You Dispute Your Credit Score With Transunion

As the information in your credit report changes, your score changes. For that reason, we are unable to accept a dispute regarding your credit score. We can, however, investigate the information on your TransUnion Credit Report if you believe it is inaccurate or incomplete. For more information on credit scores, check out our blog.

You May Like: Old Address On Credit Report

What Information Do You Need To Confirm My Address

Any two of the following documents are acceptable proof of your current mailing address:

- Drivers license

- Bank or credit union statement

- Cancelled check

- Signed letter from homeless shelter

- Stamped post office box receipt

- Utility bills

Mail a copy of your documents along with your request to confirm/update your address to:

TransUnion LLC

P.O. Box 1000

Chester, PA 19016

When providing proof of your current mailing address, please ensure that any bank statements, utility bills, cancelled checks, and letters from a homeless shelter are not older than two months. All state issued license and identification cards must be current and unexpired. P.O. Box receipts may not exceed more than one year in age. Please note that any electronic statements printed from a website cannot be accepted as proof of address.

How Long Does Information Stay On My Credit Report

Positive credit information, like information about paid accounts with no negative history, may remain on your credit report for up to twenty years. By sharing this information with creditors, lenders see the types of credit you managed successfully in the past and recognize your previous good credit history, even when you have limited or no current credit history.

Adverse credit history, collections and defaulted accounts that were not settled through a debt repayment program , are removed automatically from your credit report after six years from the date the account first went delinquent.

Public records such as judgments and bankruptcies may report on your file for 6 to 10 years depending on the province.

In the case of multiple bankruptcies, each bankruptcy will report for 14 years from the date of discharge.

TransUnion may delete credit information reported about you by a data supplier if our relationship with the data supplier comes to an end. The end of a data supplier relationship may impede our ability to maintain a current and accurate credit file and/or carry out our investigation procedures. We delete credit information in these circumstances to ensure that your credit file remains as accurate, complete and up-to-date as possible.

Also Check: Does Stoneberry Report To The Credit Bureaus

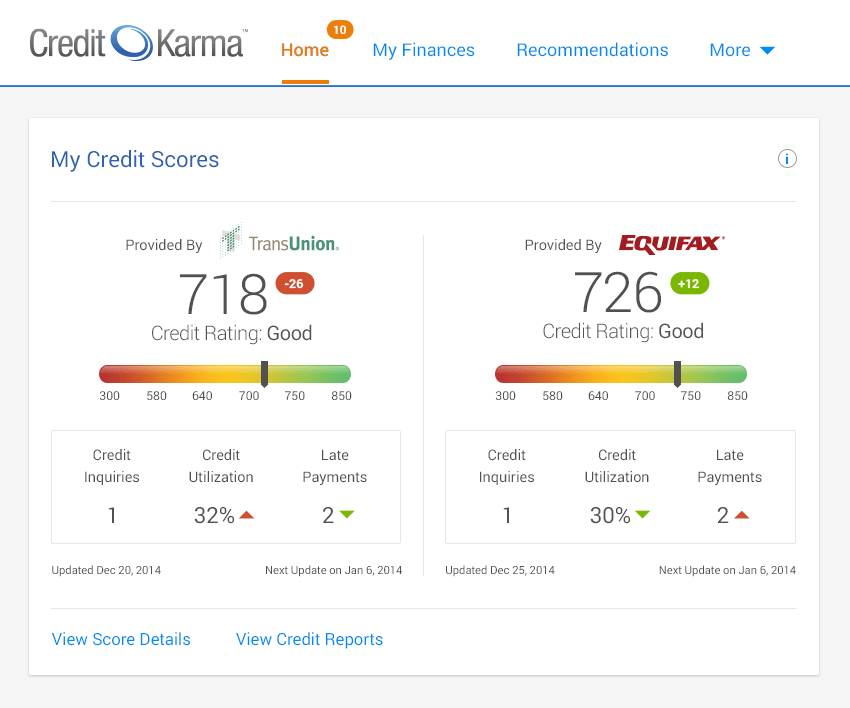

Transunion Vs Equifax: Which Is Most Accurate

No credit score from any one of the credit bureaus is more valuable or more accurate than another. Its possible that a lender may gravitate toward one score over another, but that doesnt necessarily mean that score is better.

And while a lender may prefer credit reports and scores from a specific bureau, keep in mind that each situation and application is different, with multiple variables to take into consideration.

How Can I Improve My Score

- Focus on the factors that were returned with the score to determine the main areas that impacted the score.

- The first two factors had the most effect on the calculation of the score.

- Review your credit report for accuracy.

- Maintain a good credit standing and exhibit responsible credit behavior. The score usually reflects payment history over time with emphasis on recent information. The score can improve as you continue to establish a pattern of paying bills in a timely manner and using credit conservatively.

Read Also: Credit Score For Comenity Bank

Question: How Is My Credit Score Calculated

Answer: A credit score is calculated using the information in your credit report, so a credit score can change as often as the information in your report changes. There are many different types of credit scores, and it’s normal to have more than one. Scores can vary depending on what type of credit you’re applying for or on what day the score is calculated. TransUnion uses the VantageScore® 3.0 credit score. Get more information about VantageScore.

Generally, scoring models use credit report information that falls under six main categories to calculate a credit score:

What Can Transunion Do For Your Credit Score

You should also use a credit monitoring service year-round. TransUnion offers some of the latest and most innovative credit monitoring services, like Credit Lock and Instant Alerts. These services will help you spot inaccuracies, potential fraud and other blemishes that could lead to higher interest rates.

Don’t Miss: Ginny’s Catalog Request

Does Transunion Offer Free Trials

Yes, TransUnion offers free trials as a way of attracting new customers. The terms of the free trials are specific to the products that are provided by it. You will need to provide your debit or credit card details before you are allowed to use your free trial. You wont be charged for anything you have access to until the trial expires. Note that you may be offered a payable upgrade to your trial while it lasts. If you accept, you will be charged for the upgrade, your trial will be terminated, and you will be on a paid subscription to TransUnion.

Ecoa: Equal Credit Opportunity Act

ECOA stands for Equal Credit Opportunity Act. The law requires that businesses report accounts shared by spouses to the credit bureaus when spouses’ names are on the contract or when the business has received a written request from one of the spouses.

ECOA will appear as a column header and will be followed by codes indicating who is responsible for repaying each account.

| Code |

|---|

| X |

For shared accounts, the abbreviation or numeral in the WHOSE column shows who an account belongs to.

Don’t Miss: Affirm Approval Odds

Why Credit Scores Differ

Suppose you apply for a loan, line of credit, or credit card from a lender. That lender almost certainly performs a , requesting that a report on you be run from at least one of the three major credit bureaus. However, it does not have to use all three. The lender might have a preferred relationship or value one credit scoring or reporting system over the other two. All are noted on your credit report, but they only show up for the bureaus whose reports are pulled. For example, if a credit inquiry is only sent to Experian, then Equifax and TransUnion do not know about it.

Similarly, not all lenders report credit activity to each credit bureau, so a credit report from one company can differ from another. Lenders that do report to all three agencies may see their data appear on credit reports at different times simply because each bureau compiles data at different times of the month.

Delinquency generally doesnt affect your credit score until at least 45 days have passed.

Most lenders examine just one report from a single credit bureau to determine an applicants creditworthiness. The major exception is a mortgage company. A mortgage lender examines reports from all three credit bureaus because such large amounts of money per consumer are involved. It often bases the approval or denial on the middle score.

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

You May Like: Credit Report Serious Delinquency

Why Check Your Reports

One important reason to regularly check your reports is to verify the information in them is accurate. If you find something you think is inaccurate, it may be a good idea to contact your lender directly to get more details, since they report the account to the credit reporting agencies. You can also start a dispute with TransUnion, and well investigate. Knowing what is on your credit reports also may help you make good decisions to maintain your credit health.

Credit monitoring products can make it easier for you to stay on top of your reports and credit health. For example, with TransUnion Credit Monitoring you can:

- Refresh your TransUnion score & report daily

- Get alerts whenever there are critical changes to your TransUnion, Experian or Equifax reports

- Learn how you can improve your credit health with hands-on, interactive tools

- Protect your credit health & identity with Credit Lock Plus and $1MM ID Theft Insurance

What Is A Consumer Reporting Agency Or Credit Bureau And What Does It Do

Consumer reporting agencies, like TransUnion, serve consumers and businesses by providing credit information and risk management tools to help businesses make credit-granting decisions.

Lenders and other institutions provide credit bureaus with factual information about how their customers pay their bills and other debts. Credit reporting agencies compile payment histories, along with public record information, into a “file” for each consumer. Credit grantors and authorized institutions obtain credit reports about individual consumers. Consumers benefit through faster credit decisions.

TransUnion generates millions of credit reports each year to make buying on credit fast, easy and safe for qualified applicants.

Read Also: Removing Hard Inquiries Increase Credit Score

Dont Settle For An Incomplete Picture

- See all there is to see with data from all four CRAs

- Get support and online dispute resolution from UK based Credit Analysts

Free 30-day trial, then just £14.99 a month cancel anytime. Checkmyfile is a trading name of Credit Reporting Agency Ltd. TransUnion receives a fee from Checkmyfile if you sign up.

The Cost Of A Transunion Credit Report Error

An error on your credit report can not only lower your credit score, but it can also result in the following:

- Higher interest rates for your home mortgage, credit card, and private student loans

- Higher insurance premiums for your home and car

- Loss of a job opportunity

- Denial of loan and credit applications

In extreme cases, an error on your credit report could even affect your U.S. government clearance. In fact, TransUnion lost a class action lawsuit in 2017 after consumers were flagged as terrorists on their credit report.

Don’t Miss: Realpage Inc On My Credit Report

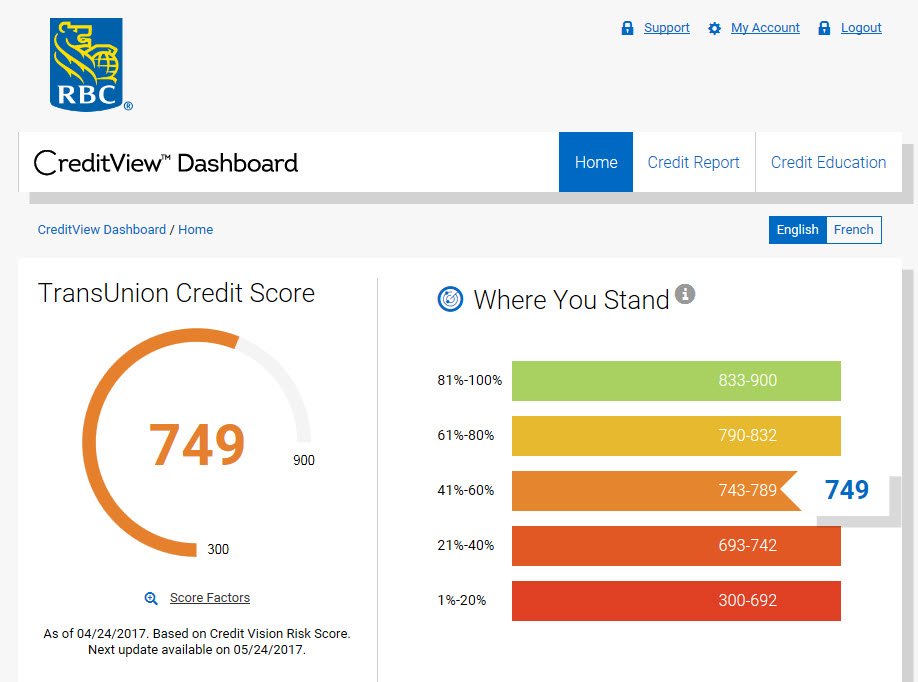

Where Can You Get Your Credit Report

You can obtain a copy of your credit report from the credit bureaus in Canada or from third-party providers.

A copy of your credit report can be ordered from Equifax Canada or TransUnion Canada by mail, fax, telephone, or online for free. If you choose to obtain your report online, you may need to pay a fee to see it right away.

Third-Party Providers

Some companies are available that provide credit scores for free, while others may require a sign-up process for a paid service for you to see your credit score. These companies include Credit Karma, Borrowell, and Credit Verify, to name a few.

Question: What Impacts My Credit Score The Most

Answer: Payment history is the most important factor in calculating your credit scores because it shows how you’ve managed your finances, including whether you’ve made any late payments. Your credit history is also very important as it demonstrates how long you’ve been managing your accounts, when your last payments were made and any recent charges.

Don’t Miss: Usaa Credit Card Credit Score

Accessing Your Credit Report

To get your free credit report from each credit reporting agency, visit AnnualCreditReport.com. To access your reports, you will need to provide certain information, including your name, Social Security number and address. You will then be asked to select which of the credit reporting agencies you want to get your report from:

- TransUnion

- Equifax

Accounts With Adverse Information

If you fail to make timely payments or an account falls into collection, it will show up in this section.

What To Look For:

Look at the names of the accounts listed in this section to be sure you recognize them. If youve been the victim of identity theft, a fraudster may have opened an account in your name.

While you cant dispute negative information in your credit report just because its negative, you can dispute accounts that are inaccurate or the result of fraud.

How This Impacts Your Credit Score:

Missed payments are a major credit score factor. Adverse information will typically remain on your credit report for up to 7 years.

Account Name

Don’t Miss: Account Closed Repossession

How To Use Your 3 Credit Reports

Once you get a copy of your reports, you’ll be able to see what lenders and other permitted parties see about your credit activity and history. The reports list the following types of information:

- Your name and address

- Your current open accounts, including balances and payment history

- Your closed accounts, unless they are over 7 years old

- Records of inquiries by all parties that received a credit report from that particular credit reporting agency

- Public records from the last 10 years

You can also follow the instructions provided on AnnualCreditReport.com to report any inaccuracies. You will not receive a credit score with your free annual credit reports. However, there are many places where you can request a credit score, including other websites, some banks where you may have an account, and directly from the three credit reporting agencies. A TransUnion Credit Monitoring membership includes unlimited access to your score with updates available daily.

Who Uses Transunion Credit Reports

A business, lender, or landlord will use a TransUnion credit report, to determine a consumers creditworthiness and risk in lending. TransUnion credit reports and background checks may be requested when applying for jobs, housing, credit, and more. TransUnion is one the the three largest credit reporting bureaus. It is likely that you have had a TransUnion credit report requested at some point in your life. Accuracy of information in your TransUnion report is critical.

Unfortunately, . Credit report errors and can be harmful and expensive.

Also Check: How To Get A Repo Off Your Credit