How To Get Something Removed From Your Credit Report

Categories

When it comes to the health of your finances, one of the most important things to have is a clean . After all, its often one of the first things that a bank, credit union, or alternative lender will examine when you apply for a new credit product, such as a personal loan, a line of credit, vehicle financing, or a mortgage.

Unfortunately, negative information on your report can lead to your application being denied, especially if you arent aware of it the information is wrong. To learn more about how credit report errors can affect your credit and how to get inaccurate information removed, keep reading.

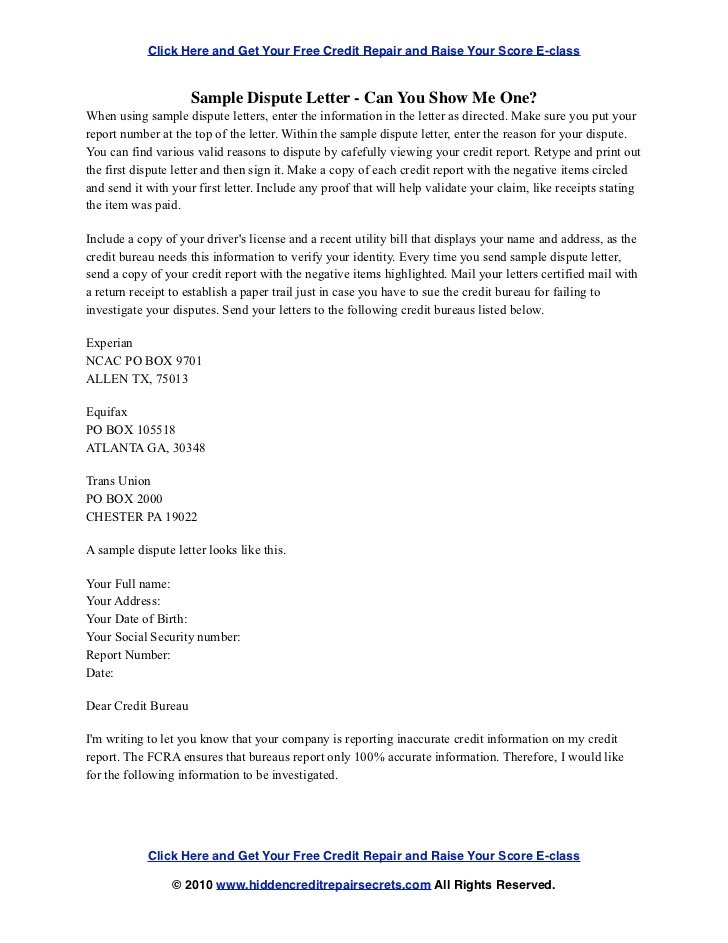

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

Re: Should I Delete My Old Addresses And Phone Numbers From Credit Report

For some reason all of my father’s addresses, previous and current, were showing on my credit reports. ;I have NEVER lived with him beyond the age of 13, nor have I ever had anything mailed there or any other ties to those addresses. ;

When I finallly saw all of them showing on my reports, I immediately had them deleted. ;I also finally understood why my Dad and step-family were always getting collection calls on my behalf. I could never figure it out since I ;had no official ties to them, especially my step-sister, ;But she received calls very frequently, and has for years, 2 different cities, 3 different addresses. ; She is tied to my Dad’s addresses and tthey were all on my reports. ;;It doesn’t matter much now since the collection calls have all but stopped since I’m over SOL on everything but, man, it was emarrassing. I just kept having to lie and sayI had no idea what they could be calling about. ;

I have not been able to get my Dad’s current address removed though. All of the agencies want me to send a copy of my DL before they will remove it. I will do that eventually but I have no idea why they won’t remove it based on the “this is a relative’s address” option on the online dispute forms. ;

Also Check: What Is Cbcinnovis On My Credit Report

Request A Goodwill Deletion If You Have Paid The Debt

The first step, if you have paid the collection account, or have been making regular on-time payments, is to mail the collection agency a goodwill letter that explains your situation.

Dont go into too many details, but let the debt collector know if youre trying to buy a house but cant because of the negative information on your credit report.

Then kindly ask the debt collector to remove collections from your credit report out of goodwill.

With some newer scoring models of FICO and VantageScore, they ignore a collection marked as paid, though many lenders still utilize older formulas that will still weigh a paid collection account against you.

If this sounds overwhelming, you might want to reach out to a credit expert.It costs some money but is less expensive than you might thinkconsidering you are getting your own lawyer to fight on your behalf.

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Read Also: Paypal Credit Soft Pull

Which Credit Report Errors Should You Dispute

The most concerning errors are those that could hurt your scores or suggest identity theft. Those include:

-

Wrong account status .

-

Negative information that’s too old to be reported; most derogatory marks on your credit must be removed after seven years.

-

An ex-spouse incorrectly listed on a loan or credit card.

-

Wrong account numbers or accounts that arent yours.

-

Inaccurate credit limits or loan balances.

-

Accounts you don’t recognize.

If you suspect your identity has been stolen, follow the steps to report identity theft.

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Read Also: Cbcinnovis Inquiry

Check All Three Credit Reports For Errors

Through April 2022, youre entitled to free weekly credit reports from the three major credit reporting bureaus: Experian, Equifax and TransUnion. Request them by;using AnnualCreditReport.com.

There may be small differences among your reports, because some creditors dont report your account activity to all three bureaus. But if negative information has popped up on one report, its wise to see whether its also on the other two.

There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

How To Check With The Data Furnisher

When you file a dispute, the Federal Trade Commission suggests also informing the company that provided the data to the credit bureaus, such as a bank, lender or card issuer, in writing. These sources of information are known as furnishers. Notifying the data furnisher may cause them to proactively stop reporting the inaccurate information to the credit bureau, although that’s not guaranteed.

Send the letter to the company using the address it listed on your credit report. If there is no address listed, ask the company for one.

The FTC notes on its website: “If the provider continues to report the item you disputed to a credit reporting company, it must let the credit reporting company know about your dispute. And if you are correct that is, if the information you dispute is found to be inaccurate or incomplete the information provider must tell the credit reporting company to update or delete the item.”

You May Like: Does Barclaycard Report To Credit Bureaus

Get All Three Of Your Credit Reports

Your three credit reports from consumer reporting agencies Equifax, Experian and TransUnion are not identical.

The old debt in question might be listed in some credit reports but not others. To find out, get a copy of all three of your reports. Federal law entitles you to request a free copy of each report once every 12 months. You can download them for free at AnnualCreditReport.com.

Once you find out which bureaus are listing the debt, contact them. Your credit report will include contact information and dispute instructions. Equifax, Experian and TransUnion will give consumers free weekly credit reports until April 20, 2022.

Why this is important: If youre only looking at the copy of your credit report from one credit bureau, you may be missing inaccurate information that is on another report.

Who this affects most: Mistakes with credit reports can happen to anyone with old debt on any of your credit reports.

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How Long Can A Debt Collector Pursue An Old Debt

Each state has a statute of limitations about how long a debt collector can pursue old debt. For most states, this ranges between four and six years. These statutes govern the amount of time that a debt collector can sue you, but there is no limit to how long a collector has to try and collect on a debt. If you are being contacted about a debt that you believe is not yours or is outside the statute of limitations, do not claim the debt; instead, ask the company to validate that the debt is yours.

When Can Inaccurate Information Indicate Identity Theft

Finding information you believe to be inaccurate on your credit report is not proof positive of identity theft. In some cases, however, unfamiliar information on your credit report can be a sign of fraudulent activity.

If you find an address you don’t recognize on your credit report, take the time to read through the entire report for any additional signs of trouble. In particular, be on the lookout for unfamiliar information:

- Accounts you didn’t open

You May Like: What Is Cbcinnovis On My Credit Report

Review The Results Of The Investigation

The credit bureau involved must provide you with results of the investigation in writing and also a free copy of your credit report if the dispute results in a change to that report. The credit bureau must also provide you with the name, address and phone number of the furnisher that reported the incorrect information.

If a furnisher continues to report a disputed item, it is required to notify the credit bureau involved about your dispute. If the disputed information is found to be inaccurate, the furnisher must tell the credit bureau to update or delete the item. The furnisher must also notify all the credit bureaus to which it sent the incorrect information so that the bureaus can correct their records.

Even if the furnisher insists that the disputed information is accurate, you can still request that the credit bureau include a statement in your credit file explaining the dispute.

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

You May Like: How To Remove Car Repossession From Credit Report

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

Does Address Information Affect Your Credit Score

In addition to information credit scoring models use to calculate your credit score, your credit report includes personal identifying information such as your name, aliases and addresses that are used to help verify your identity and match you to your credit history. Experian uses this identifying information to differentiate your credit history from the other 220 million consumers with credit files, some of whom may have the same name as you.

Personal information like this isn’t used to calculate your score. Credit scoring models only look at debt-related information, including payment history, amount of debt, length of credit history, types of accounts and recent applications for credit to determine your credit score. As long as personal information including your current and past addresses is accurate, you shouldn’t worry about it.

The addresses that appear on your credit report have been reported to the credit bureaus by current or past creditors you’ve done business with. Past addresses you’ve used to receive bills in the past are likely to show up on your credit report. Old addresses don’t need to be removed or disputed just because they’re outdated; they’re actually left there on purpose and may be used for identity verification purposes.

Read Also: Credit Score 524

Pull Your Tax Records

If youve kept your past tax returns ,;you can check them for past addresses. If you havent kept records, you can contact the IRS to request copies of your tax returns for the past six years. It will cost you $50 per copy.

You may also request free tax transcripts from the IRS, but the free version may not be very helpful. The IRS redacts transcripts to increase taxpayer privacy. That means youll only see the first six characters of your former street addresses. If youre great at puzzles, those hints may be all you need to recall your previous addresses. Otherwise, it may be a worthwhile investment to pay the $50.

Write A Goodwill Letter

A goodwill letter is a formal request to a creditor asking for a negative item to be removed.;

Although creditors are not required to remove negative items upon request, they may be willing to do so if you have a long history with them or if there were special hardships that led to the negative item.;

However, goodwill letters are generally useful only for late or missed payments rather than collections, repossessions or other more significant negative items.

In addition to goodwill letters, you can also request that an account is removed using a pay for delete letter. These letters can lead to an agreement with a collection agency to remove an account in exchange for a set payment. That said, the collection agency may decide not to remove the account, and the original account that went to collections may remain on your report.;

Also Check: Syncb/ppc Closed Account

Re: Removing Old Addresses And Names

Yes, those names were not on any collections or open accounts

492

wrote:

Good afternoon all, I am writing this message to inform of an option for rebuilding if it applies to you. I called experian to find out my;DOFD’s,my credit tracker is not showing them.; I spoke with an account representative in the dispute department who gave me the info i needed .;Then i spoke with her;regarding all the different name variations and addresses which were incorrect or outdated. ;She removed the names and addresses which were not linked to any accounts, I only mentioned ones I knew were not on any collections anymore because they are more than ten years old . then there was an address which was right ;linked to a wrong social ,which was off by a number which linked to;6 collections , she asked if i wanted to dispute those. but i told her i would wait and verify them. She placed me on a hold and came back and said she could remove the items with the;wrong social security number. and that now i will only have two collections on my credit report . ;I will try this with eq and TU hopefully with some luck. Good luck to you all if this applies to you and your situation give it ;a shot .;

Well done!