File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

How Long Do Collections Stay On Your Credit Report

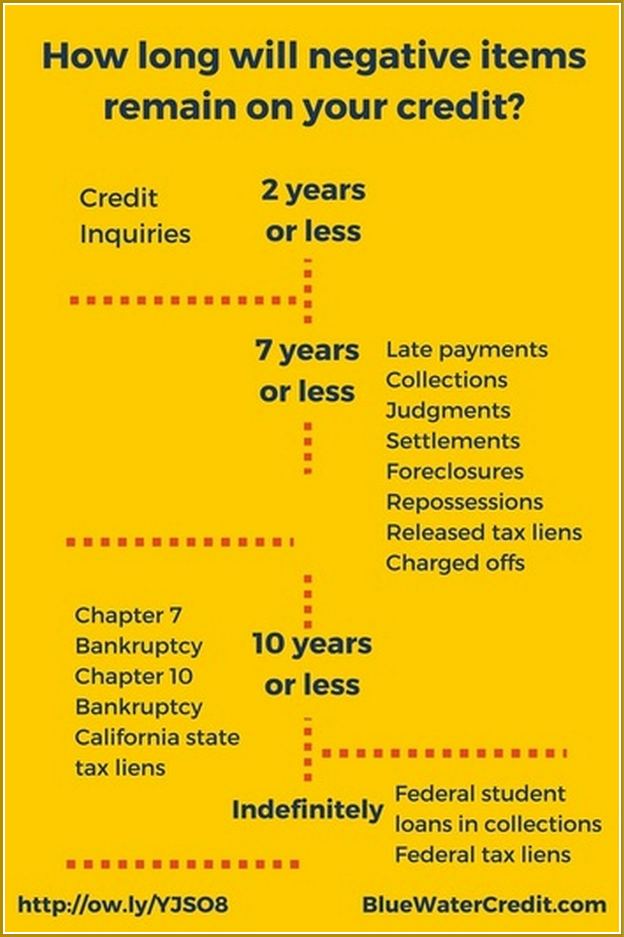

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.

How Long Do Late Payments Stay On A Credit Report

3. Request Pay-For-Delete. If your late payments have been sent to a collections agency, you can also try sending your creditor a pay-for-delete letter. This is a letter requesting that the charges be deleted from your credit report in exchange for you paying the account in full.

The effect of late payments on your credit score is perhaps one of the biggest consequences of late rent payments. If your property management company reports late rent payments to the credit bureaus, your credit score will take a hit.

A late student loan payment could result in your servicer reporting the delinquency to the three major credit bureaus. After 30 days Some federal student loan servicers may charge a fee as soon as you miss a monthly payment, while policies for private lenders vary widely, so check with them if you think youll be late.

Heres what you need to know: The Fair Credit Reporting Acts Section 611 allows for consumers to challenge questionable items on their credit reports. This includes late payments charge-offs, collections, tax liens, bankruptcies, judgments, foreclosures, or any personal identification information.

Upon completing its investigation, the credit reporting agency must send you a letter with the conclusion and a free copy of your credit report. 6. Add a statement of dispute to your credit report.

Recommended Reading: Is 611 A Good Credit Score

Bankruptcy Affects High Credit Scores More Than Low Credit Scores

The higher your FICO score is before a bankruptcy filing, the more it will affect your credit rating:

| Score | |

| Note: Scores do not go lower than 300 | 130-150 points |

You will likely drop to a poor credit score no matter what score you started with. Your credit history already shows you filed for bankruptcy, but credit bureaus want to ensure you take steps to improve your bad credit before you take on more debt and new credit.

The sliding scale system will generally knock your credit points however much it takes to show you have poor credit. Your score may barely change if you already have bad credit . It is not common to see credit scores lower than 500 even after a bankruptcy filing.

What To Do If You Are Behind On Credit Card Payments

The best solution is to get your account current as soon as possible, which means paying the past-due amount. If you cant pay the full amount all at once, talk to your creditor and establish a payment plan over a few months. This can be helpful in getting back on track, even if your account wont be reported as current until the full past-due amount is paid.

Also Check: Does Carmax Accept Bad Credit

Hard Inquiry: Two Years

A hard inquiry, also known as a hard pull, is not necessarily negative information. However, a request that includes your full credit report does deduct a few points from your . Too many hard inquiries can add up. Fortunately, they only remain on your credit report for two years following the inquiry date.

Limit the damage: Bunch up hard inquiries, such as mortgage and car loan applications, in a two-week period so they count as one inquiry.

Late Payments And Your Credit Score

When you set up an account with a company, youâll usually agree to make monthly payments. Itâs important to meet these payments on time and in full. Otherwise, you may negatively affect your relationship with the company, and reduce your chances of getting credit with other companies in the future.

However, things donât always go according to plan. Perhaps youâve had a hectic month and the bills slipped your mind. Or maybe the car needed repairs and you donât have enough money left over. Whatever the reason, if youâve missed a payment or think youâre going to, there may be steps you can take to reduce the damage.

Also Check: Cbcinnovis Hard Inquiry

Getting A Copy Of Your Report

To get a copy of your credit report, youll need to contact the credit reporting bodies:

Your credit report changes over time and the CRBs will have the most up-to-date information. Youre entitled to one free copy from each CRB every year.

The Bank can only provide you a copy of the credit report we obtained at the time of your most recent application. This may not show changes in your credit report since you last applied for credit with us.

View a Sample Credit Report from CreditSmart

How Long Do Late Payments Stay On Your Credit Report

Late payments remain on your credit reports for seven years from the original date of the delinquency. Even if you repay overdue bills, the late payment wont fall off your credit report until after seven years. And no matter how late your payment is, say 30 days versus 60 days, it will still take seven years to drop off.

Since payment history is the most important factor of your credit score, one late payment can make a big impact on your credit. However, the impact of a late payment lessens over time, especially if it’s only a one-time mistake and you counteract it with on-time payments. You have a 30-day window to repay a late bill before it appears on your credit report. Anything more than 30 days will likely cause a dip in your that can be as much as 180 points.

Here are more details on what to expect based on how late your payment is:

Late payments appear on your credit report under the account that you haven’t paid. So if you’re behind on a credit card, there will be a note in that section of your report saying you’re 30, 60, or 90 days late .

Read Also: How Long Does Something Stay On Chexsystems

How Long Do Late Payments Stay On The Credit Report

It is important for a person to be prompt in paying back whatever amount is due each month, because a late payment stays for seven years on a credit report- and that is a LONG time. Consider this late payment factor as a major stain on your credit report .

These seven years mean that for a long time lenders will consider you as someone who is irresponsible in paying back what they owe. So for seven whole years you will have the hardest time finding loans, or even if you do, they will be on a very high interest rate.

File A Dispute With The Credit Reporting Agency

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

Read Also: Does Paypal Credit Report To Credit Bureaus

File A Complaint With The Cfpb

The CFPB, Consumer Financial Protection Bureau, accepts credit reporting complaints as of September 22nd, 2012. Now consumers have the chance to file complaints against bands and lenders about inaccurate credit reporting on a Federal level.

You can file a complaint against the creditor directly or against the credit bureaus here.

Communicate With The Credit Issuer

Its tempting to ignore past due bills, especially from credit card companies that cant turn off your utilities or repossess your car. But try to avoid this temptation.

A lot of credit accounts offer payment flexibility you should take advantage of if youre struggling to make on-time payments.

Some companies will let you skip a payment so you can get your personal finances back on track.

But you wont know about these possibilities if you dont get in touch with your creditor.

So dont ignore their phone calls or emails, especially when youre still not 30 days late.

You May Like: Credit Score Without Social Security Number

How To Quickly Remove Mortgage Lates From Your Credit Report

According to Equifax, closed accounts with derogatory marks such as late or missed payments, collections and charge-offs will stay on your credit report for around seven years. Closed accounts with a “paid as agreed” status, on the other hand, can stay on your credit report for up to 10 years from the date the lender reported it as closed.

Pay-for-delete also wont remove an account completely from the credit report. It may remove the account in collection, but the negative item from the original creditor , will still appear. 4. Send a request for goodwill deletion.

D&B reports are like personal credit reports for businesses and are issued by the credit reporting agency Dun & Bradstreet. Companies typically check a D&B report when negotiating payment terms and lenders will also sometimes check when assessing a business borrower. Dun & Bradstreet business credit reports are generated in one of two ways: 1.

Repossessed: vehicles can be voluntarily or involuntarily repossessed by financial institutions for several reasons, including late payments, undisclosed past credit issues, or failure to maintain full coverage insurance. Auto auctions are the most common method of disposing of repossessed vehicles.

Ask The Lender To Remove It With A Goodwill Adjustment Letter

This is a straightforward way to get a late payment removed from your credit report. In some cases, creditors are willing to make a if your payment history has been good or if you have a good relationship with them.

The process is easy: simply write a letter to your creditor explaining why you paid late. Ask them to forgive the late payment and assure them it won’t happen again. If they do agree to forgive the late payment, your creditor will adjust your credit report accordingly.

You May Like: How Accurate Is Creditwise

How Long Late Payments Stay On The Credit Report

Late payment may stay on your credit reports for up to 7 years and can affect your credit scores during the whole period it is there.

Late payments tend to have a big effect when they first appear, and you could work to build your credit while waiting for late payments to fall off your credit reports.

How To Remove Late Payments From Your Credit Reports

that reporting of an account which has been included in a chapter 13 bankruptcy as past due or late is a per se violation of the automatic stay, because reporting late payments or past due balances is classic collection activity under § 362 .

Rental Kharma will add up to six months of past rent payments to your credit report. The registration fee is $50 per person and the monthly charge is $8.95 as of March 2020. Your entire rental history can be added for a fee of $30 or $60, depending on how long youve been at your current address.

The Experian Credit Score can give you an idea of how companies see you. Its based on information in your credit report, and is the UKs most trusted score*. If youve been late with payments, check your Experian Credit Score to understand how your ability to get credit may have been affected.

There are late payments, collection accounts, judgments or bankruptcies on your credit history. The name and address on your credit report don’t match the name and address you’ve provided on your mortgage application. There are discrepancies between the employment history you report to the mortgage lender and what’s listed on your credit reports.

Every situation is different, but negative factors like late credit card payments might show up on your credit report for years. And while the exact impact of late payments is hard to predict, payment history is a factor used to determine your credit score.

Don’t Miss: What Credit Score Does Carmax Use

Request A Goodwill Adjustment From The Original Creditor

The idea is simple, and it works surprisingly well.

Many times creditors are happy to grant goodwill adjustments if your previous payment history is relatively good and you have established a good relationship with the creditor.

This is probably the easiest and surest way to get a late payment removed from your credit report.

The process involves writing the creditor a letter explaining your situation and asking that they forgive the late payment and adjust your credit report accordingly.

The easiest way to get started is to use this goodwill/forgiveness letter template that I created. This method might not work if you have multiple late payments.

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

Also Check: Does Klarna Report To Credit

Dispute The Late Payment With The Creditor

Disputing a late payment with the bank or creditor directly is often the most effective. If the late payment is, in fact, an error. You can explain the situation to customer service to investigate. Usually, they will need some time to have a department look into the error and respond.

In most cases, if the error is on the creditors behalf, they will refund the late fee and have the late payment removed from your credit report. However, this is not always the case. If they refuse to remove the late payment, you can move on to the next step.

Negotiate With A Pay For Delete Letter

If you dont have a great history with the lender, or if your debt has already been sent to a collection agency, you can consider sending a .

This letter is a negotiation tool you can use to offer a full payment of the debt in exchange for a removal of the negative mark. You can also offer to sign up for automatic payments to ensure payments are not late in the future.

The letter should explicitly include what youre offering , what you want in return and the date youd like a response.

Read Also: Minimum Credit Score For Carmax

What Is A Charge

A charge-off means a lender has written off your account as a loss, and the account is closed, meaning youâll no longer be able to use it. Your lender will likely first contact you to remind you of your past-due amount before your account is charged-off.

If this happens, your debt is transferred to either the companyâs internal collection agency or a third-party collection agency. Youâre still responsible for paying this overdue balance, however. The agency will aggressively pursue you until your debt is paid, whether itâs a credit card balance, a personal loan, a student loan, or other debt.

A charge-off is a derogatory entry that will stay on your credit report for up to 6 years from the date of your first missed payment on the account. If you pay the charged-off account before the 6-year period is up, it will remain on your credit report but may have a less severe impact on your credit score.