What Information Do I Need To Provide When Submitting A Dispute

Types of information you should be prepared with:

- Your full name, including middle initial and suffix, such as Jr., Sr., II, III

- Social Security Number

- Current address

- All addresses where you have lived during the past two years

Depending on how you submit your dispute , you may also be asked to provide the following additional information:

- Email address

- A copy of a government issued identification card, such as a driver’s license or state ID card

- A copy of a utility bill, bank or insurance statement

You should list each item on your credit report that you believe is inaccurate, including the creditor name, the account number and the specific reason you feel the information is incorrect.

You may also submit documents to support your dispute. Depending on the type of information disputed, the following documents may be helpful in resolving your dispute:

- Police reports or an FTC Identity Theft Report, showing that an account was the result of identity theft

- Bankruptcy schedules showing that an account was included in or discharged in bankruptcy

- Letters from creditors showing how an account should be corrected

- Student loan disability letters showing that a student loan has been discharged due to disability

- Cancelled checks showing that a collection account has been paid

- Court documents regarding public records

What Happens With Credit Reporting During A Conversion Or When My Mortgage Loan Is Sold

Your credit report will show two accounts. One will reference an outstanding balance of $0.00 and the status of “transferred to another servicer”. The other account will show the amount of the outstanding balance plus the name of the new loan service provider. Due to the Real Estate Settlement Procedures Act , the new servicer will not report mortgage, home equity or mobile home loan information to the credit bureaus until 60 days after the conversion.

If There Is Any Error Contact The Business That Reported It

If there is an error on your credit report, get in touch with the party or business that reported it. The reporting party could be your landlord, car or land lender, or a credit card company. The reporting might just be an issue of misunderstanding hence contacting them could solve the issue.

Even though the error might seem insignificant or minor, you should send a formal dispute letter that has reported the error to the credit bureaus. Send along a copy of the credit report and mention the error that was there. You can add additional documentation, which is in your favor.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Mistake #: Falsifying Documents

Offering false and misleading statements or written communication isnât just illegal for creditors and credit agencies. If you lie, chances are you will be prosecuted. Any documentation you provide as part of a dispute or question about an issue of credit must be accurate. You need not elaborate, but what you say must be true.

What Is The Difference Between Incorrect Information On My Credit Report And Incorrect Information On My Credit Card Statement

|

If you have a dispute, then you must |

Follow the guidelines regarding Your Billing Rights outlined in your credit card agreement for submitting disputes. For example, if you have a problem with the quality of the property or services purchased, you may be required to first try to resolve the problem with the merchant prior to submitting a dispute. |

Send a completed written statement and copies of supporting documentation to your credit card issuer, who must then investigate your dispute within 30 days. |

|

Remember |

Information on your credit card statement like late fees or fraudulent purchases may also appear on your credit report and have a negative impact on your credit score. This is why it is very important that you always review your credit card statement and report incorrect information or fraudulent activity immediately to your credit card issuer. |

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Dispute A Debt On Your Credit Report With The Credit Bureaus

According to the Fair Credit Reporting Act , consumers have the right to dispute information they believe to be incorrect or incomplete. Credit bureaus will investigate to determine the validity of your collection dispute.

The investigation usually runs for 30 days. If the consumer reporting agencies prove that your claim is valid, they will correct or remove the information in question. Otherwise, the negative mark will remain on your credit report for up to 7 years.

You can dispute a debt on your credit report by mail or online.

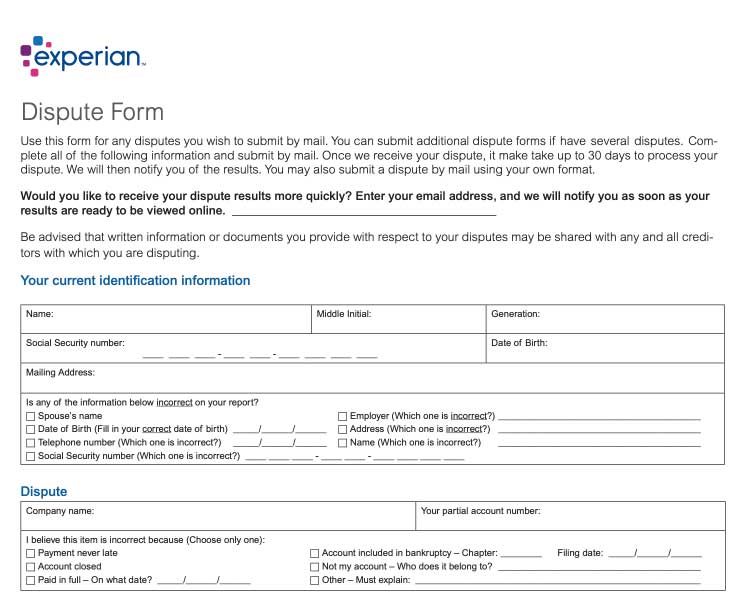

File A Dispute Via Mail:

How To Get Something Removed From Your Credit Report

Categories

When it comes to the health of your finances, one of the most important things to have is a clean . After all, its often one of the first things that a bank, credit union, or alternative lender will examine when you apply for a new credit product, such as a personal loan, a line of credit, vehicle financing, or a mortgage.

Unfortunately, negative information on your report can lead to your application being denied, especially if you arent aware of it the information is wrong. To learn more about how credit report errors can affect your credit and how to get inaccurate information removed, keep reading.

You May Like: Does Speedy Cash Report To Credit Bureaus

Ways To Dispute Information On Your Credit Report

TransUnion and Equifax have their own processes for disputing credit reports, but Experian provides three methods for submitting disputes:

- Online: Get access to your Experian credit report and initiate a dispute at the Experian Dispute Center . There is no cost to you for using this service.

- : To initiate a dispute by phone, you’ll call the number displayed on your Experian credit report. If you’d like to have a copy of your credit report delivered to you by mail, call 866-200-6020.

- : You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. .

What Can Be Disputed On A Credit Report

Essentially anything in the bankruptcy public records and accounts sections of your credit report can be disputed. For example, if you have a bankruptcy, a third-party collection account or an account with a lender on your credit report you feel is incorrect in any way, you can file a dispute with the credit reporting agency on whose report the information appears.

You can also dispute inaccurate PII, such as a name misspelling or an address with which you are unfamiliar.

If, after submitting a dispute, the data furnisher discovers that they are reporting incorrect information to the credit reporting agencies, they must correct it with all three of them. While the lender should update the information automatically, if changes are made, it can be a good idea to check the other credit bureaus just to be sure.

It is often beneficial to file a dispute directly with the company reporting the information, also known as the data furnisher, prior to contacting the credit reporting agencies. This is sometimes referred to as a “direct” dispute because you are filing your dispute directly with the lender or other business that reports the information to the credit bureaus. Notifying the lender that you believe an account is being reported inaccurately can help you get the information corrected more quickly.

Don’t Miss: When Does An Eviction Show On Your Credit Report

File A Dispute With The Credit Reporting Agency

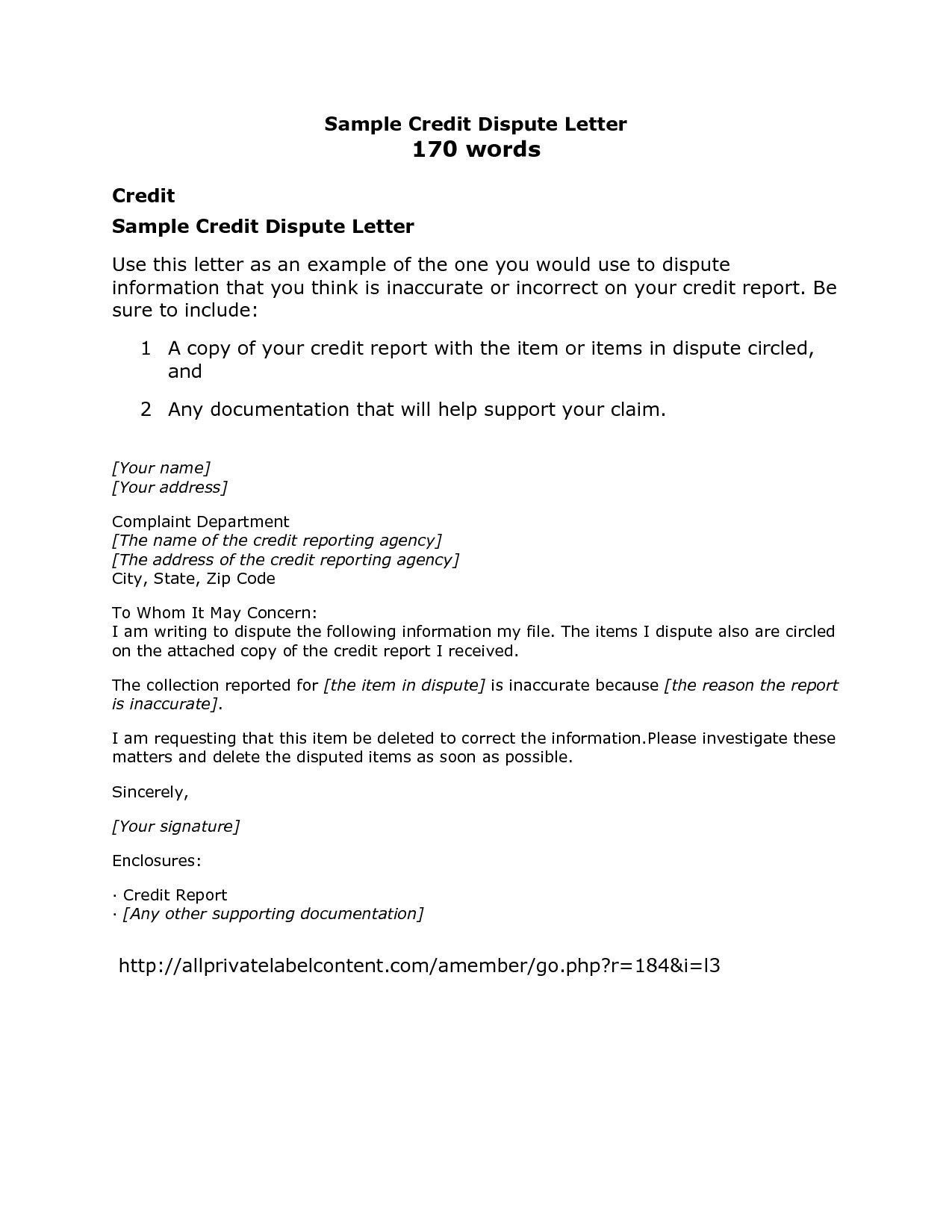

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

What Steps Can I Take If I Do Not Agree With The Dispute Investigation Results

If you still believe that the information on your credit report is not accurate following your review of the investigation results from the credit reporting company, you have several options:

- You may contact the creditor that reported the information to the credit reporting company and dispute it directly with them. If you wish to obtain documentation or written verification concerning your accounts, please contact your creditors directly.

- You may provide additional information or documents to the credit reporting company relating to your dispute.

- You may request a brief statement be added to your report. Your statement should be specific to your dispute of credit information.

- You may file a complaint about the credit reporting company, or the business reporting the item, with the Consumer Financial Protection Bureau or your State’s Attorney General’s office.

Recommended Reading: Credit Score Needed For Les Schwab Account

Can You Dispute Student Loans After 7 Years

If thereâs an error on your credit report about a student loan that is over seven years old, you can dispute the error following the above steps. If your taxes are being garnished because of your student debt, you can request a review with the Department of Treasury to dispute the amount. If you received a notice your wages are being garnished for a student loan, you can take steps to reduce or dispute the amount being garnished for your student loan.

Can You Really Remove Hard Inquiries From Your Credit Report

If you believe that the number of hard inquiries showing up in your credit report is hurting your credit score, you might be wondering whether it is possible to remove these from your credit report.

A hard inquiry or also referred to as a hard pull takes place when a lender pulls your credit report when youre applying for new credit. A hard pull will provide the lender with necessary information about your borrowing history which will help them determine if you are a good risk.

Can you remove hard inquiries from your credit report if you willingly applied for new credit and authorized the lender to do a hard pull? The answer is NO. If you actually applied for a loan or a mortgage and gave your authorization for the creditor to pull your credit report, then you cannot have this removed from your credit report.

However, there are special circumstances when it is possible to get a hard inquiry removed.

Also Check: Does Klarna Report To Credit

How Do I Submit My Dispute

To submit a dispute to a credit reporting company, contact the credit reporting company who has the inaccurate information on your credit report. You may submit a dispute with each of the credit reporting companies over the internet or by mail.

Online:

- P.O. Box 2000

- Chester, PA 19016

You may also submit documents in support of your dispute. Documents may be uploaded for online disputes or submitted by mail. When mailing documents, please only submit copies of documents and not originals. Documents will not be returned to you following the investigation.

To submit a dispute with a business:

- Contact the business directly. The contact information for that business should be included on your credit report or monthly billing statement.

The Federal Trade Commission’s website has more information on correcting your credit report, and the Consumer Financial Protection Bureau’s website also provides additional information on disputing information on your credit report as well.

Dispute Credit Report Errors

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also call, but you may not be able to complete your dispute over the phone. Here’s information for each bureau:

How to dispute Equifax credit report errors

-

Write to Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on how to dispute your TransUnion credit report for details.

Also Check: Cbcinnovis Credit Inquiry

Checking Your Credit Report

Now that youre aware of what can happen if theres than an inaccuracy on your credit report, lets talk about what kinds of common errors you may see on it:

- Inaccurate Personal Details Simple mistakes such as the wrong name, birthdate, or mailing address can spell disaster because you could end up with someone elses credit information .

- Wrong Account Information Its also possible that your lender didnt report your payment or account activity correctly. For instance, if you paid your debt on time but it was accidentally labeled as late or defaulted.

- Falsified or Stolen Accounts Identity theft and fraud are two of the worst things that can happen to your finances and credit report, not to mention complicated and time consuming to deal with afterward.

- Uncorrected Negative Information Missed payments and other negative credit actions stay on your report for several years . If so, a bureau may forget to remove the information after the allotted time period.

How Do I Dispute Information On My Credit Report That Was Reported By Td Bank To The Credit Bureaus

Step One

For Mortgages or Home Equity Loans:

Mail a written statement with copies of your supporting documentation to the appropriate address for the product you are disputing.

If you think theres an error, would like to send a request for information, or have a credit bureau dispute related to your mortgage or home equity loan, please write us as soon as possible.

In your letter, be sure to include:

- Your name, property address, and account number or other identifying information

- Description of error or information you are requesting

- Why you believe there is an error

- Any additional information you think will help us

For Lines of Credit, Credit Cards, Personal Loans, Auto Loans or Deposit Accounts:

In a written statement, please provide the following information:

For your convenience, we’ve created an optional Consumer Report Dispute Form that you may use as your written statement.

Important Note: If we do not receive sufficient information to identify your account, you may experience a delay, or we may be unable to investigate your dispute.

Step Two:

For Mortgages or Home Equity Loans:

Send your letter to:

P.O. Box 218 Lewiston, ME 04243

If you are unsure of which address to mail your letter, please call us at 1-888-751-9000. A delay may be experienced if the letter is not mailed to the specified address.

TD Bank Operations Center P.O. Box 219 Lewiston, ME 04243-0219

For Disputes on a Target Credit Card TD Bank USA, N.A. PO Box 9500 Minneapolis, MN 55440

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

What Is A Credit Inquiry

Every time you apply for a credit product, such as a credit card, a loan or a line of credit, the lender youve applied to will submit a request to review your credit report. This is recorded on your credit report as a hard credit inquiry. While a few inquiries is usually fine, too many hard inquiries on your credit file can suggest to lenders that youre not able to manage credit responsibly and may lead to a declined application.

A soft credit inquiry is when you or a creditor who you already do business with checks your credit report. Another common soft pull of your credit can be when a business or lender checks your credit report to prescreen you to see if youre eligible for a product, such as when your bank sends you an offer to open a line of credit. Soft inquiries have no affect on your credit score or report.

Print Out Your Credit Report And Notate The Errors

In step two you printed out your original credit report. Now, youll want to notate the errors you noticed on your report by circling the items you wish to have changed. Its important that the credit bureau knows exactly what your request is about, so be extra careful here and make sure the information youre citing here matches the description on your credit report dispute form.

Don’t Miss: How To Get Credit Report With Itin Number

What To Do If You Find An Error On Your Credit Report

The Fair Credit Reporting Act protects consumers rights by requiring credit bureaus to furnish correct and complete information to companies requesting credit histories for evaluation. If you find an error on your credit report, there are some steps you can take:

Write to the credit-reporting bureau disputing the item and include any supporting documents. Send copies of the documents, rather than originals, and keep the originals for your records. You can also visit the credit bureaus Web sites and fill out their online forms.

When the credit reporting agency receives your letter disputing the item, they are required to investigate the item in dispute by presenting the information you submit to the creditor. By law, the creditor must review your evidence and report its findings to the credit bureau. The credit bureau must then give you a written report of its investigation and a copy of your report if the report results in a change.

If an item on your report is found to be an error and is corrected, you can request that the credit bureau send corrected copies of your report to any creditor who received your report in the previous six months or any employer who received your report in the previous two years.

Before you try disputing all of the negative information on your report, you should know that this works only for errors. In fact, credit-reporting agencies often flag suspicious disputes. The only way to remove accurate but negative information is to wait.