Renting With A 580 Credit Score

You often need a credit score to rent a house or apartment since many landlords run credit checks on prospective tenants. Theres no universal minimum credit score for tenants, but many landlords look for a score of at least 620650.

If youre looking for a rental and the landlord plans on doing a credit check, its best to be upfront with them about your low score. You may be able to get the landlord to look past it if you can convince them that youll reliably pay your rent on time each month.

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

- Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

- Debt-to-income ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

- Down payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think youre less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment makes your loan less risky for lenders.

- Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least 2 monthsof mortgage payments.

- Employment history: Lenders vary, but they usually like to see that youve worked at the same job, or in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

Fair Credit Score: 580 To 669

Borrowers with credit scores ranging from 580 to 669 are thought to be in the fair category. They may have some dings on their credit history, but there are no major delinquencies. They are still likely to be extended credit by lenders but not at very competitive rates. Even if their options are limited, borrows in need of financing can still find solid options for personal loans.

Recommended Reading: What Credit Score Do You Need To Finance A Car

What Does A Credit Score Of 580 Mean Is A Credit Score Of 580 Good Or Bad

A credit score of 580 is considered Poor. In fact, any credit score below 619 can really take a toll on a persons life and not in a good way. The effects can be worse than one might think.

In this post, well share what having a credit score of 580 means for home loans, car loans and credit cards. Plus, well share how to improve a 580 credit score.

Can I Get A Car Loan With Fair Credit

Automobile loans are considered secured loans because, much like a mortgage, the item being purchased acts as the collateral for the loanin this case, the car.

Buying a car can be confusing because auto lenders dont use the same categories or ranges that the credit rating agencies do. While credit rating agencies consider a score of 580 to 669 to be in the Fair category, you are considered to be in the subprime category of car loans once your credit score dips below 600.

This re-categorization of scores and the use of the car as collateral allows auto lenders to offer financing to people who wouldnt otherwise be able to obtain unsecured loans based on their FICO score. However, it also allows auto lenders to charge higher interest rates based on the subprime ranking.

Borrowers with scores of 600 or lower often turn to credit unions for auto loans. Credit unions generally have slightly lower interest rates than banks, and as a result can have more favorable credit terms. Unlike banks, they are not-for-profit institutions. They are also typically smaller than banks and can evaluate your credit situation on a more personal level.

Recommended Reading: Does Perpay Report To Credit Bureaus

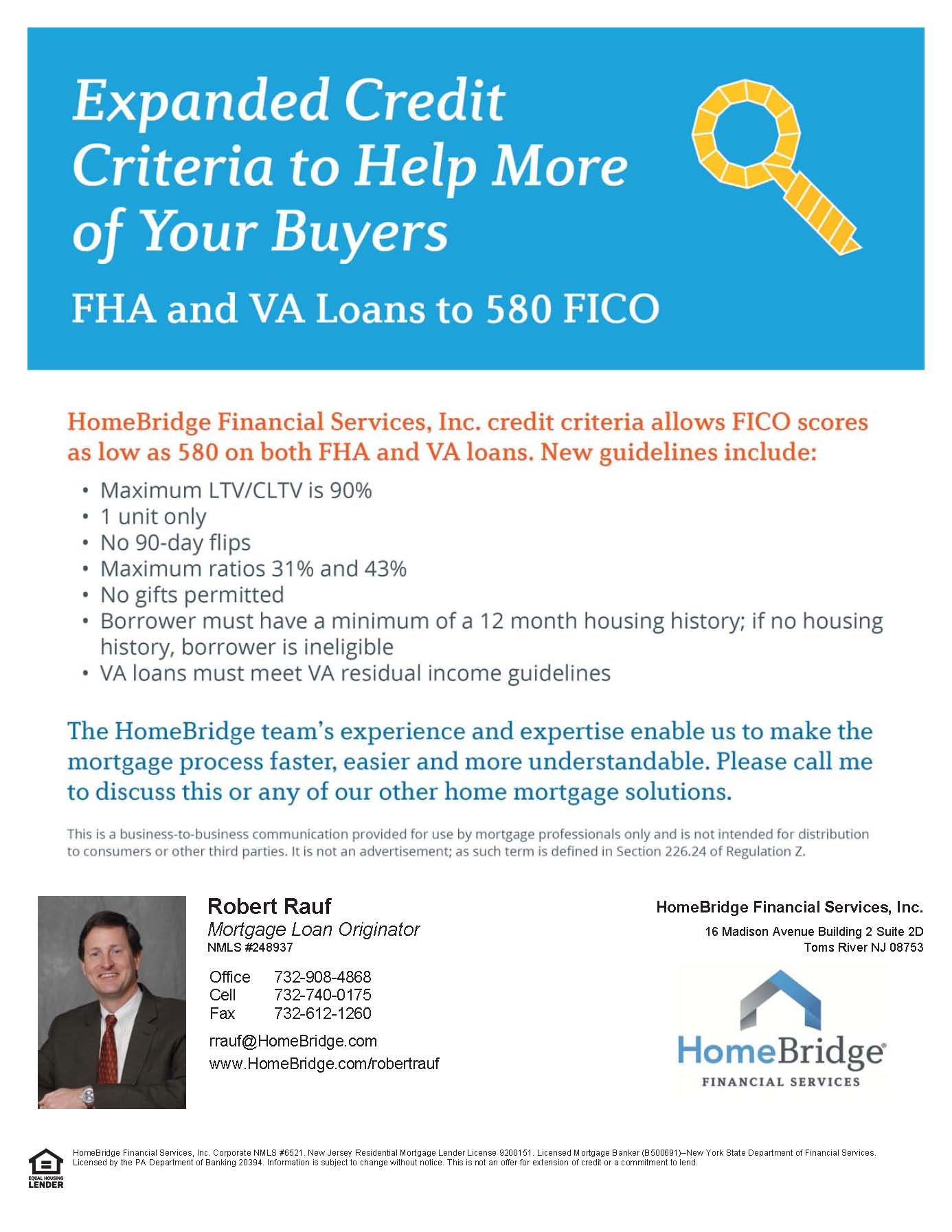

Shop Around: Fha Lender Guidelines Vary

While mortgage lenders are allowed to approved loans for 580 credit scores, they arent required to.

Because lenders can set higher minimum credit scores for FHA loans, if yours is on the low side, you may have to contact more lenders.

It makes sense to check with several FHA lenders and compare rates, anyway. Just because your FICO is 580 doesnt mean you shouldnt get the best deal available to you.

Is 580 A Good Or Bad Credit Score

Mini Saha

With a credit score of 580, you may be wondering what it means. It can be challenging to visualize what credit scores actually mean and which are good or bad. Dont worry because weve got you covered. Read this blog to learn everything you should know if your and ways to boost your credit.

You May Like: How Often Does Ally Financial Report To Credit Bureaus

How Long Does It Take To Get A 580 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

What Is A Bad Credit Score

Credit score ranges vary based on the credit scoring model used and the credit bureau that pulls the score. Below, you can check which credit score range you fall into, using estimates from Experian. Take note that the lenders use varies, though 90% pull your FICO score.

FICO Score

- Excellent: 781 to 850

Recommended Reading: How Often Does Your Credit Score Go Up

Personal Loans With A 580 Credit Score

You might find it challenging to get approved for a personal loan with poor credit scores.

Given your current scores, you might not have the luxury of shopping for the best personal loans with the lowest interest rates. Instead, you may have to settle for a personal loan with a high interest rate not to mention other fees, such as an origination fee.

This could make a personal loan seem very unappealing to you, especially if your intention with the loan is to consolidate high-interest credit card debt. The APR on your personal loan could be just as high, if not higher, than the interest rate youre currently paying on your credit cards.

On the other hand, if your goal with a personal loan is to finance a major purchase, you should ask yourself whether its something you need right now. If it can wait until after you spend some time building credit, you may qualify for a personal loan with a lower APR and better terms later down the line.

If youre really in a pinch for cash and youre having a difficult time finding a personal loan you qualify for, you might be considering a payday loan. While everyones situation is unique, you should generally be wary of these short-term loans that come saddled with high fees and interest rates. They can quickly snowball into a cycle of debt thats even harder to climb out from.

Mortgages For A 580 Credit Score: Available With A Catch

If you have a 580 credit score, buying a house can be a challenge.

And it may be frustrating, too, because while the FHA program guidelines allow a 580 credit score, the average FICO score of an approved FHA purchase mortgage is 686, according to analysts at Ellie Mae.

But certain programs today allow you to become a homeowner despite lower credit.

Don’t Miss: How To Add Positive Credit To Your Credit Report

What Is Credit Score

A credit score is a number that ranges from 300 to 850 and determines if you are worthy of a loan or not. Potential lenders judge your credit score by your credit history. They use your credit scores to check out the likelihood of repaying a loan on time.

When you apply for a car loan, your interest rate is determined by several criteria, including your credit score. A value between 300 and 850 determines your score. Credit scores between 580 to 669 are considered fair. They may have a few blemishes on their credit report but no severe defaults.

- Excellent: 800 to 850

Also Check Joint Auto Loan Explained!

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Also Check: How High Can A Credit Score Go

Why Do Lenders Care About Your Credit Score

The credit reporting and scoring system was established to help lenders measure creditworthiness. Every time you apply for a loan or a credit card, you are authorizing the lender to pull a copy of your credit report. Checking credit scores allows lenders to avoid unnecessary risk or adjust interest rates to compensate for a high-risk borrower.

A lender knowing what they are getting into before entering a loan agreement is necessary for the proper functioning of any financial institution. Lenders care about your FICO credit score because they could lose money if they grant loan approval to the wrong person.

Dispute Credit Report Errors

Its important to review your credit report on a regular basis to make sure all the information contained in it is accurate. Humans work at the credit reporting agencies and can make mistakes just like anyone else. Catching errors and getting them corrected in a timely fashion can help you change a credit score from Fair to Good.

Read Also: Why Do Hard Credit Inquiries Lower Score

Extra Tips For Improving Your Credit Score

Work with a reputable credit counseling or repair service if necessary. If you have bad credit, there’s no shame in seeking help from a professional service. Just be sure to choose a reputable company that will help you improve your score in a legitimate way.

Use a mix of different types of credit. Lenders like to see that you can handle different types of debt, such as installment loans and revolving lines of credit. This shows that you’re a responsible borrower.

Consider signing up for a credit monitoring service so you can keep an eye on your progress and spot any potential issues early on.

Keep old accounts open even if you don’t use them often.

Limit new applications for credit.

Getting A Car Loan With A Credit Score Of 580

If you apply for a car loan with a credit score of 580, you may get the loan. However, youll get something else too. An incredibly high interest rate. Lets compare the interest rates for a 36-month auto loan for two different car buyers. One person has a credit score of 580. The other has a credit score of 680. The buyer with the poor credit score of 580 may get their loan with an interest rate of about 14.8%.The buyer with the score of 680, a good credit score, would likely be able to walk away with a loan with a 6.7% interest rate.

The one hundred point difference in credit scores is quite significant. The person with the credit score of 580 will end up paying more than $3,700 more in interest than the buyer with the higher credit score over the course of the 36 months.

Don’t Miss: How Bad Is A 500 Credit Score

How To Repair A 580 Credit Score

With a credit score of 580, there are several concrete steps you can take to ensure that your credit score sees concrete improvements in the months to come.

First, address immediate credit issues that could be seriously hampering your credit score, and your ability to pay back loans. If you have any loans in default or any due payments to collections agencies, prioritize those repayments.

Adhering to healthy credit repayment habits can help repair your credit. Resolve from this point forward to pay back debts promptly, and to make complete, on-time payments that begin to reflect positively on your payment history.

In addition, youll want to avoid hard inquiries while working to repair your overall credit score. Every time you are considered for a new loan, they perform a hard inquiry: a routine check into your credit past.

Hard inquiries remain on your record for a year, and anything more than one or two hard inquiries serves as a serious red flag to future potential lenders.

If youre serious about repairing your credit score, know that the best professional credit repair companies can expedite the process and make it as painless as possible.

When repairing credit means overcoming collection agency demands, repaying defaulted loans, or even navigating bankruptcy or civil judgments, leaving the future of your credit score in the hands of the professionals is often the best step forward.

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 580 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Also Check: How Bad Is A Judgement On Your Credit Report

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

How A Bad Credit Score Can Hurt You

Denials for credit

A bad credit score can reduce your approval chances for credit cards and loans, making it difficult to accomplish many goals. If you want to get out of debt with a balance transfer card, such as the Discover it® Balance Transfer, you’ll need good or excellent credit. And if you want to earn rewards or receive luxury travel perks, it’ll be near impossible to find a card that accepts bad credit.

Less favorable loan terms

If you’re approved for credit, odds are you’ll receive less favorable terms, such as high interest rates or annual fees, compared to applicants with good credit. For example, one of CNBC Select’s best credit cards for bad credit, the OpenSky® Secured Visa® Credit Card, has a $35 annual fee though there are no annual fee options.

Limited credit card choices

Bad credit limits which credit cards you can qualify for the options you have will be primarily secured cards. While a secured card, such as the Discover it® Secured Credit Card or the Capital One Platinum Secured Credit Card, can help you rebuild credit, you’re required to make a security deposit typically $200 in order to receive an equivalent line of credit.

Take note that even if your credit score falls within the bad range, that is not a guarantee you’ll be approved for a credit card requiring bad credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Also Check: What Credit Score To Buy A House

How A Below Average Credit Score Can Affect Your Finances

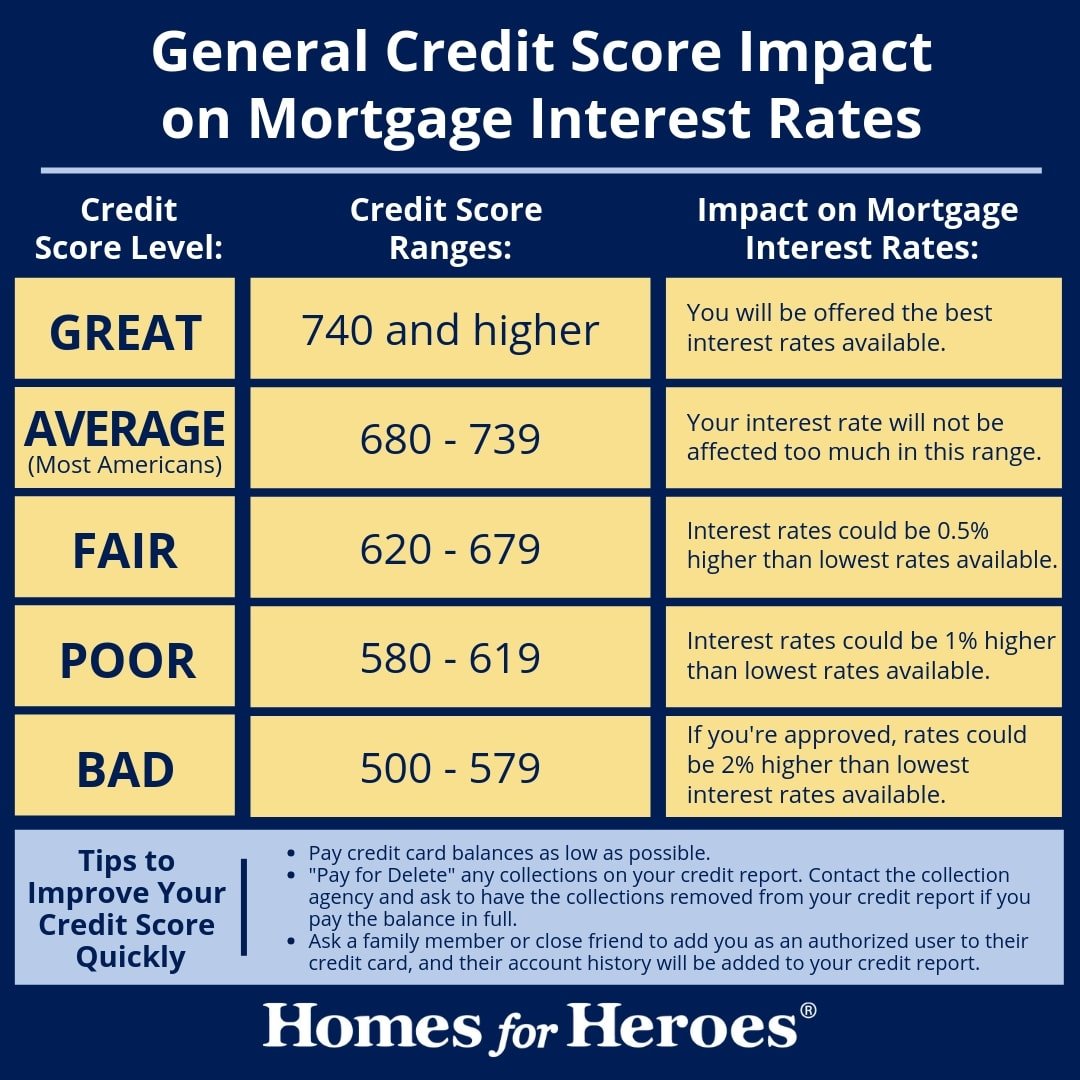

Having a 580 credit score makes it very hard to get approved for a loan or a new line of credit, as shown in the table below. Even if you do qualify, youll end up paying more money for your credit or loan because your lender will charge you a much higher interest rate.

Loans and Credit You Can Get with a 580 Credit Score

| Eligible for FHA-backed mortgages with a 3.5% down payment, VA loans, and some non-qualified mortgages | |

| Car loan | Eligible, but youll have to pay a higher interest rate |

| Private student loan | Usually ineligible without a cosigner |

| Personal loan | Usually ineligible without a cosigner, though you can get high-risk loans, such as subprime loans, payday loans, and car title loans |

| Revolving credit | Eligible, though youll probably pay a high interest rate |

| Secured credit card | |

| Eligible, but you may need to pay a deposit | |

| Utilities | Eligible, but you may need to pay a deposit |

| Charge cards | Usually ineligible |

A bad credit score can also affect your life in other ways. For instance, it can make it hard to find an apartment and can limit your job prospects because many landlords and employers run credit checks. Employers probably wont see your actual numerical score, but they will be able to see the negative items in your credit history that contributed to it.

Having a low credit score also means youll probably end up paying more for services like insurance.