What To Do If You Suspect Identity Theft

If you suspect that the TU Interactive mark on your credit report indicates that someones stolen your identity, then there are a few steps you need to take:

You only need to contact one of the three bureaus and have a fraud alert placed on your credit report. The bureau you contact will coordinate with the other two, and your fraud alert will be acknowledged by all three.

Carefully monitor your credit reports in order to catch identity theft as early as possible. The sooner you report it, the less damage will be done.

Negative Codes On An Experian Credit File

For example, here are a variety of negative credit scenarios, and the Experian codes used to describe them:

-

30 Days Past Due: 30

-

60 Days Past Due: 60

-

90 Days Past Due: 90

-

120 Days Past Due: 120

-

150 Days Past Due: 150

-

180 Days Past Due: 180

-

Claim filed with government: G

-

Insurance claim: IC

-

Voluntarily surrendered: VS

Again, none of these is a flat-out credit deathblow in and of themselves.

But if your credit reports show a repeated pattern of late payments and an inability or unwillingness to pay your obligations, then banks, credit unions and other financial institutions definitely wont be beating down your door to offer you credit.

What Should I Do If I Think Tu Interactive Hurt My Credit Score

If you think TU Interactive damaged your credit despite being soft inquiry, contact TransUnion Interactive to make sure they didnt accidentally conduct the credit check as a hard pull. Its more likely that theres some other explanation for the drop in your credit scoreits common for scores to fluctuate slightly on a week-to-week or even day-to-day basisbut theres no harm in checking.

Recommended Reading: Is 850 A Good Credit Score

Bottom Line: Understanding Tu Interactive On Your Credit Report

As we discussed earlier, you can remove TU Interactive from your credit report by either filing a dispute with TransUnion or by hiring a credit repair company.

But remember, a hard inquiry has minimal impact on your credit score, so you really have nothing to worry about.

Kim Pinnelli is a Senior Writer, Editor, & Product Analyst with a Bachelors Degree in Finance from the University of Illinois at Chicago. She has been a professional financial writer for over 15 years, and has appeared in a myriad of industry leading financial media outlets. Leveraging her personal experience, Kim is committed to helping people take charge of their personal finances and make simple financial decisions.

What Will Show Up In My Bank Statement When Transunion Charge Me

| RECURRING CHECK CARD PURCHASE TU *TRANSUNION 800-493-3292 CA | TU *TRANSUNION 800-493-3292 CA 93401 USA | Payment to TU *TRANSUNION|800-493-3292|CA |

| TRANSUNION 800-493-3292 CA |

|

Becoming their member could be a sound choice as they are the leading companies in the industry. If you decide they are not the right fit for you either, then once again, DoNotPay will cancel those subscriptions for you as well. When you subscribe, dont forget to do it with our virtual credit card to avoid being billed after the trial is complete.

Also Check: What Is An Excellent Credit Rating

What Should You Not Say To Debt Collectors

3 Things You Should NEVER Say To A Debt Collector

- Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions.

- Never Admit That The Debt Is Yours. Even if the debt is yours, dont admit that to the debt collector.

- Never Provide Bank Account Information.

Will collections go away after paying?

How Long Does it Take for a Paid Collection to Come Off Your Credit Report? Collection accounts remain on your credit report for around seven years after the date you first became delinquent with the lender. The same is true of all late payments. However, not all late payments are equal.

Is it better to pay off collections or wait?

If the debt is still listed on your credit report, its a good idea to pay it off so you can improve your credit card or loan approval odds. 8 On the other hand, if the debt is going to drop off your credit report in a few months, it may be better to just wait and let it fall off.

How Can I Cancel Transunion On My Own

The only way to cancel your TransUnion membership at this time is via phone. Here is what you should do:

TransUnion offers both free and paid memberships. Note that when you cancel a paid subscription, they will automatically start you on a free one. If you want to close your account with TransUnion permanently, you would also have to cancel that subscription separately.

Another detail to keep in mind is that after you cancel, you will lose access to your data, including any credit scores and analyses purchased during the subscription period.

| Can you cancel TransUnion with | Yes / No |

| No |

Don’t Miss: What Factor Has The Biggest Impact On A Credit Score

What Happens After 7 Years Of Not Paying Debt

Unpaid credit card debt will drop off an individuals credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the persons credit score. After that, a creditor can still sue, but the case will be thrown out if you indicate that the debt is time-barred.

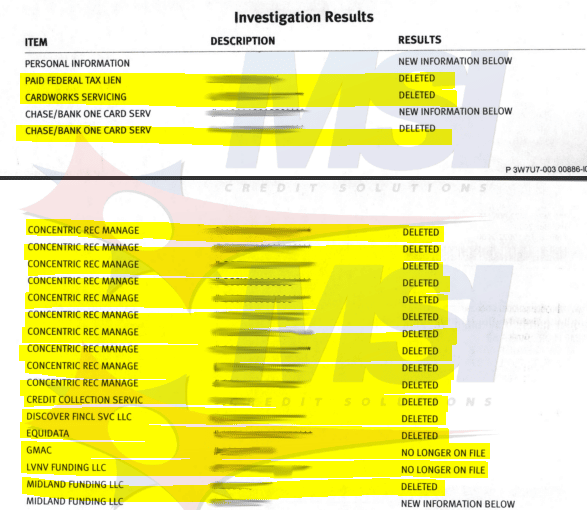

Can Disputing Hurt Your Credit

Filing a dispute has no impact on your score, however, if information on your credit report changes after your dispute is processed, your credit scores could change. If you corrected this type of information, it will not affect your credit scores.

What is the 609 loophole?

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And if youre willing, you can spend big bucks on templates for these magical dispute letters.

How do I remove negative items from my credit report?

1 To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Read Also: What Credit Report Does Rooms To Go Pull

On Your Equifax Credit Report

Your payment history breakdown is fairly straightforward in Equifax credit files. Therefore, the meaning of the numbers, letters and symbols used in Equifax credit reports are generally pretty easy to understand.

Overall, you want to see a lot of asterisk signs that look like this: *.

Thats because an asterisk symbol on an Equifax credit report means pays or paid as agreed.

The vast majority of other notations indicate negative marks on your Equifax credit file, although there are a few exceptions to this.

For example: if a creditor simply didnt report information about you for some reason in a given month or year, that account history will be classified as Not Reported and you will see a code that says NR.

This NR code is neutral its not positive or negative for your credit file.

But pretty much everything else shows that you have credit blemishes.

Is It True That Its Possible To Have A High Credit Score Even If You Dont Earn Much Income

No matter how big or small your paycheck, you can build great credit because income does not affect your credit score and is not included on your credit reports. However, it is a factor when you apply for a loan or credit card as that is how lenders determine whether you have the ability to repay what you borrow.

Also Check: Is 786 A Good Credit Score

Will Lenders See Tu Interactive If They Check My Credit

No, lenders cant see TU Interactive if they run your credit. Not only do soft inquiries like this not affect your credit score, they dont show up when anyone else looks at your credit report. Only you can see them.

The upshot is that, assuming its not a sign of identity theft, TU Interactive appearing on your credit report isnt anything to worry about. It wont affect your finances or your life, and it wont stay on your report for very long.

Takeaway: TU Interactive probably isn’t hurting your credit score

- TransUnion Interactive and its affiliates provide credit monitoring and credit check services. If TU Interactive is showing up on your credit report, you’re probably subscribed to one of them.

- The other possibility is that you’ve been the victim of identity theft. If you’re sure the TU Interactive mark shouldn’t be there, contact the company for more information and file an identity theft report.

- Because TransUnion Interactive conducts soft inquiries, not hard inquiries, even if their mark appears on your credit report, it can’t affect your credit score.

- Lenders won’t be able to see TU Interactive on your credit report when they conduct credit checks on you.

Other Common Inquiries

Donotpay Protects Your Privacy And Finances

Sharing your credit card details online comes with certain risks, and its getting more difficult to tell good and bad websites apart. With DoNotPays virtual credit card generator, you will be able to protect your identity and bank account from cyber scammers.

Whenever you run into a suspicious email or website, generate a virtual credit card and proceed without worries. Our virtual cards also work like a charm if you want to avoid automatic payments after free trials.

Read Also: Will A 2 Day Late Payment Affect Credit Score

What Is Tu Interactive

Do you know who TransUnion is? Sure, you do.

TransUnion is one of the three major credit reporting bureaus. TU Interactive is another name for TransUnion.

While TransUnion traditionally helps lenders and financial institutions verify creditworthiness, they also operate an extensive consumer business.

TransUnion offers consumers a robust solution for a low fee .

So, if you recently applied for a credit card or purchased a credit monitoring solution, then this is the reason why TU Interactive appears on your credit report.

Remember, hundreds of lenders and financial institutions employ TransUnion to pull your credit. This is known as a hard inquiry. But how does this affect my credit score?

How Does A Tu Interactive Hard Inquiry Affect My Credit Score

Fortunately, hard inquiries only remain on your credit report for about 2-years and have minimal impact on your credit score. If you recently applied for a loan or a credit card, then you have nothing to worry about.

However, if you did not, then this could be a mistake on TransUnions end or an early sign of fraudulent activity and potential identity theft.

Don’t Miss: Does Having More Than One Credit Card Affect Credit Rating

Does Transunion Offer Free Trials

Yes, TransUnion offers free trials as a way of attracting new customers. The terms of the free trials are specific to the products that are provided by it. You will need to provide your debit or credit card details before you are allowed to use your free trial. You wont be charged for anything you have access to until the trial expires. Note that you may be offered a payable upgrade to your trial while it lasts. If you accept, you will be charged for the upgrade, your trial will be terminated, and you will be on a paid subscription to TransUnion.

How To Cancel Transunion Hassle

TransUnion is a global credit-reporting agency that acts as an intermediary between businesses and consumers. It collects information on over a billion consumers in more than 30 countries around the world, monitors credits, makes credit reports, and offers a variety of fraud protection products to its customers.

Recommended Reading: Where To Get My Free Credit Report

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

Is It Illegal To Pay For Delete

Whether your attempts to pay for delete are successful can depend on whether youre dealing with the original creditor or a debt collection agency. As to the debt collector, you can ask them to pay for delete, says McClelland. This is completely legal under the FCRA.

Can a hacker fix credit?

No, you cant pay a cyber spy to delete your negative credit information. If you consider that a credit hack, then no, you cant hack credit. Yes, you can pay to be added as an authorized user for the purpose of increasing your credit scores. If you consider that credit hacking, then yes, you can hack credit.

How do you check if u are blacklisted?

How to check if you have been blacklisted?

Recommended Reading: Why Did My Credit Score Drop 20 Points

How Can Donotpay Cancel My Transunion Membership

If you would like to avoid the hassle of waiting on hold and remember if youve canceled all your subscriptions, let DoNotPay handle the whole process for you. It wont take you more than 30 seconds because all you have to do is:

Negative Codes On A Transunion Credit File

However, other codes in your TransUnion credit file do show harm or damage to your credit health. These include:

-

30 Days Late: 30

-

Repossession: RPO

-

Voluntary Surrender: VS

When you examine your TransUnion credit report, its also possible that you might see various remarks noted.

According to TransUnion officials, these remarks occur when creditors make certain comments about your account. Any remark that contains brackets like these > < indicates that the remark is considered adverse.

A few examples of negative remarks might be comments related to a bankruptcy, a case where a judgment was obtained, a lease was broken, or an account was settled for less than the original amount due.

Now that you have a clear understanding of what all those codes and abbreviations in your credit report mean, you should work hard to improve your credit standing and also dispute any erroneous information you might find in your credit files.

Facebook Comments

You May Like: When Does Chapter 13 Get Removed From Credit Report

What Is Tu Interactive And Why Would They Do An Inq

Sitting here this morning and started getting alerts. New inq on TU. It’s listed as TU Interactive. The strange thing is, my wife also got an alert for the same thing. I say strange because, my wife and I have totally separate financial profiles. Separate bank accounts and to my knowledge have never applied for a joint credit account at any point, let alone today or within the past few days. The only thing I can think of that we share would be that I’m an AU on her Wells Fargo Visa. Of course, we also have the common tax return each year.

@AP1964 wrote:

Sitting here this morning and started getting alerts. New inq on TU. It’s listed as TU Interactive. The strange thing is, my wife also got an alert for the same thing. I say strange because, my wife and I have totally separate financial profiles. Separate bank accounts and to my knowledge have never applied for a joint credit account at any point, let alone today or within the past few days. The only thing I can think of that we share would be that I’m an AU on her Wells Fargo Visa. Of course, we also have the common tax return each year.

Do you subsribe to TU monitoring. I do and they did this to me today too! It updates every day so this better not be daily HP!

I called in and they said they are “working on it.”

I do and wondered if it was that. My wife does not though. Only thing she’s subscribed to is Credit Ssmae.

Legal And Regulatory Issues

In 2003, Judy Thomas of Klamath Falls, Oregon, was awarded $5.3 million in a successful lawsuit against TransUnion. The award was made on the grounds that it took her six years to get TransUnion to remove incorrect information in her credit report.

In 2006, after spending two years trying to correct erroneous credit information that resulted from being a victim of identity theft, a fraud victim named Sloan filed suit against all three of the US’s largest credit agencies. TransUnion and Experian settled out of court for an undisclosed amount. In Sloan v. Equifax, a jury awarded Sloan $351,000. “She wrote letters. She called them. They saw the problem. They just didn’t fix it,” said her attorney, A. Hugo Blankingship III.

TransUnion has also been criticized for concealing charges. Many users complained of not being aware of a $17.95/month charge for holding a TransUnion account.

In March 2015, following a settlement with the New York Attorney-General, TransUnion, along with other credit reporting companies, Experian and Equifax, agreed to help consumers with errors and red flags on credit reports. Under the new settlement, credit-reporting firms are required to use trained employees to respond when a consumer flags a mistake on their file. These employees are responsible for communicating with the lender and resolving the dispute.

You May Like: How To Get Paid Collections Off Credit Report