Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

-

Data from one or two credit bureaus

-

A recent history of your credit use

-

Additional information about building and protecting your credit

AnnualCreditReport.com is authorized by federal law and safe to use as long as you ensure you’re on the correct site.

Double-check the URL when you type it, to be sure you have not made a typo. Some other sites have similar-sounding names, so check that the URL matches and the site looks as expected.

Be aware that your credit reports are free, but credit bureaus also use the AnnualCreditReport.com site to sell credit scores and promote paid services, such as . However, monitoring doesnt keep your identity from being stolen it just alerts you after the fact. For best protection, use a

Just get your free credit report. Dont get suckered by the upsell, says Ed Mierzwinski, consumer program director for the U.S. Public Interest Research Group.

AnnualCreditReport.com

What Is A Credit Report

A credit report is a record of your credit activity and history. It will have records of your current and closed accounts, how timely you have been in paying creditors, and if you defaulted on any financial obligation, and if you have accounts in collections. Additionally, your credit report will have public records such as bankruptcies and foreclosures.

Your credit report may not contain your complete credit history. Accounts that are closed and paid off in good standing will generally remain on your credit report for ten years. Negative information can only remain in your credit report for a set time. Most negative items get removed after seven years.

The information in your credit report is used by creditors to determine your creditworthiness so they can decide to extend credit to you. The information can also be used by potential employers, government agencies, utility companies, landlords, and other entities within the scope of the Fair Credit Reporting Act.

Its important to note that credit reports are not always accurate. Roughly one in three consumers have found errors in their credit reports.

Experian Vs Equifax: An Overview

Experian and Equifax are the two largest in the U.S. Both companies collect and research credit information of individuals and rate the overall ability to pay back a debt. Credit bureaus like Experian and Equifax provide the information they gather to creditors for a fee. Lenders, in turn, use the information in the reports to measure a prospective credit applicant’s creditworthiness.

Credit bureaus assemble the data from a person’s to create a , which can include any credit products opened or closed as well as transaction history within the last seven years. Credit bureaus take the financial history and using algorithms, create a numerical measurement of a person’s creditworthiness. The numerical value is called a , and it can range from 300 to 850 depending on the model used to create it.

A credit score impacts whether someone will get approved for a credit product, including a loan or . Credit scores are used by lenders to determine the size of the loan they’re willing to make as well as the interest rate to charge a borrower. Credit scores can also come into play when applying for a rental apartment or lease as well as employment.

Although we’ll explore the differences between the information provided by Experian and Equifax, they do collect and share some of the same information, including:

You May Like: Will Disputing Items On Credit Report Lower My Score

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

On Your Equifax Credit Report

Your payment history breakdown is fairly straightforward in Equifax credit files. Therefore, the meaning of the numbers, letters and symbols used in Equifax credit reports are generally pretty easy to understand.

Overall, you want to see a lot of asterisk signs that look like this: *.

Thats because an asterisk symbol on an Equifax credit report means pays or paid as agreed.

The vast majority of other notations indicate negative marks on your Equifax credit file, although there are a few exceptions to this.

For example: if a creditor simply didnt report information about you for some reason in a given month or year, that account history will be classified as Not Reported and you will see a code that says NR.

This NR code is neutral its not positive or negative for your credit file.

But pretty much everything else shows that you have credit blemishes.

Also Check: Does Paypal Credit Report To Credit Bureaus

Read Also: How To Place Fraud Alert On Credit Report

Employment Information And Past History

This section of the credit report will contain your employment history and information. This may include the company name, occupation, income, hire date, and release date if available.

This information along with personal information gets reported on your credit report by an individual inputting the information when you apply for credit.

Review The Credit Bureaus Response

The Fair Credit Reporting Act requires any information considered inaccurate, incomplete or unverifiable to be corrected or deleted from your credit report within 30 days. However, due to the COVID-19 pandemic, as of April 2020, the Consumer Financial Protection Bureau has temporarily extended that deadline to 45 days.

Recommended Reading: How To See Derogatory Marks On Credit Report

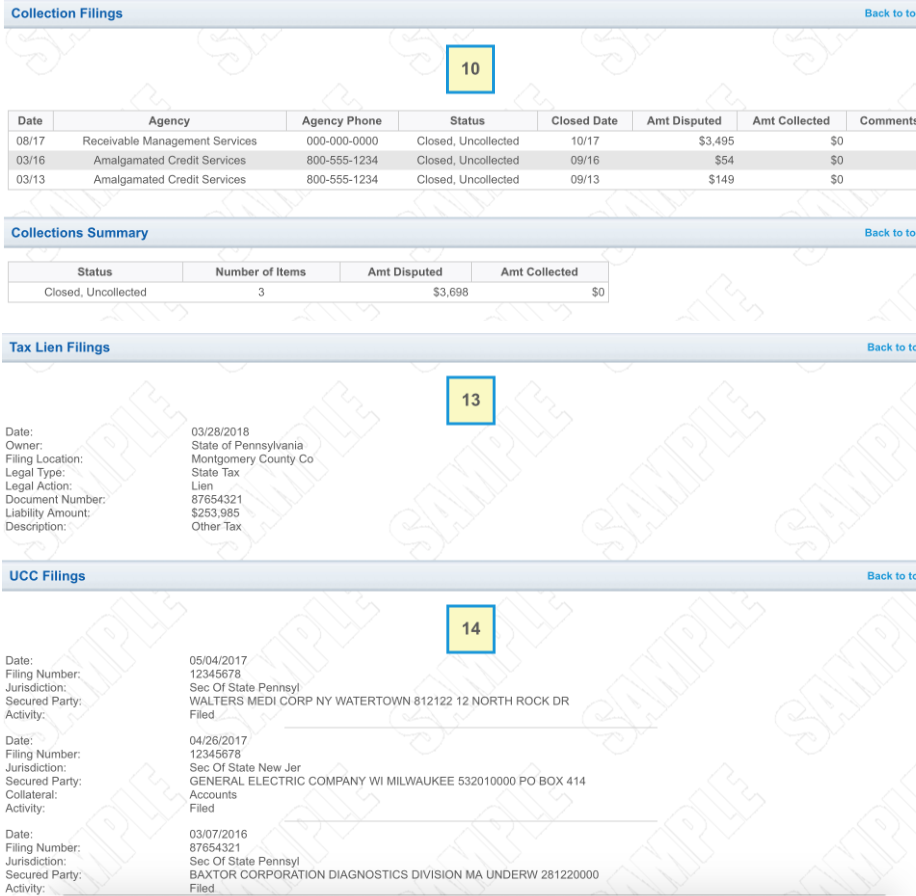

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

How To Check Your Credit Report

It’s easy to check your credit report:

- Request your free credit report from Experian at any time.

- Check your at any time

- Visit annualcreditreport.com to request one free credit report from each of the 3 major credit reporting agencies every 12 months.

Who Can Check My Credit Report?

The Fair Credit Reporting Act limits who can view your credit report and for what reasons. Generally, the following people and organizations can view your credit report:

Recommended Reading: Does Requesting A Credit Increase Hurt Score

Disputes Related To Accounts Or Public Records

- The information you disputed has been updated.

- The information you disputed might have been verified as accurate by the data furnisher, but other information on your account unrelated to your dispute has been updated.

How To Get A Copy Of Your Credit Report From All Three Major Credit Bureaus

You can order one free copy annually of your credit report from Equifax, Experian and TransUnion by requesting it online with each bureau. Or get your hands on all three reports at once by ordering them at AnnualCreditReport.com.

Youre also entitled to a free copy of your credit report from a credit bureau that provided a report to a creditor that declined your credit application.

Recommended Reading: How To Access Credit Report

Trendy Online Shoe Stores

Welcome to Bleacher Reports coverage and recap of AEW All Out 2022. The annual pay-per-view was back in the NOW Arena in the Chicago suburb of Hof 5 Sep 2022 00:30, Sports News. 15 Match Star Ratings Payment is made with or Debit Card, PayPal or through iTunes, Google Play, Roku, Virgin or Amazon. Your purchase will include the.

Aug 30, 2022 · As of April 2022, the average Americans FICO scorewhich ranges from 300 to 850 was 716, the same score that was recorded in October 2021 and again in April 2021, according to a. Poor: 580-669. Fair: 601-660. Good: 670-739. Very good: 740-799. Exceptional: 800-850. Most Americans fall into the Good and Very Good categories. Over 46% of. Sep 07, 2022 · Looking at VantageScore 3.0 scores from TransUnion for tens of millions of members who had a mortgage tradeline open on their report in the past two years, we also studied the average VantageScore 3.0 score among homebuyers state by state. Our findings: Averagescores ranged from 683 to 739 . In a typical scoring model, your score generally ranges from a low of 300 to a high of 850. The higher the , the better a borrower looks to potential lenders. How would your taxes change? The Wake Up for Tuesday, Sept. 6, 2022. Published: Sep. 06, 2022, 6:03 a.m..

british electronic bands 2010s

The current average car loan interest rate for new cars is 4.07% and 8.67% for used cars according to Experian. In 2022, new car loan rates range from 2.40% to 14.76% while used.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Don’t Miss: Does A Mortgage Show On Your Credit Report

Ways To Dispute Information On Your Credit Report

TransUnion and Equifax have their own processes for disputing credit reports, but Experian provides three methods for submitting disputes:

- Online: Get access to your Experian credit report and initiate a dispute at the Experian Dispute Center . There is no cost to you for using this service.

- : To initiate a dispute by phone, you’ll call the number displayed on your Experian credit report. If you’d like to have a copy of your credit report delivered to you by mail, call .

- : You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. .

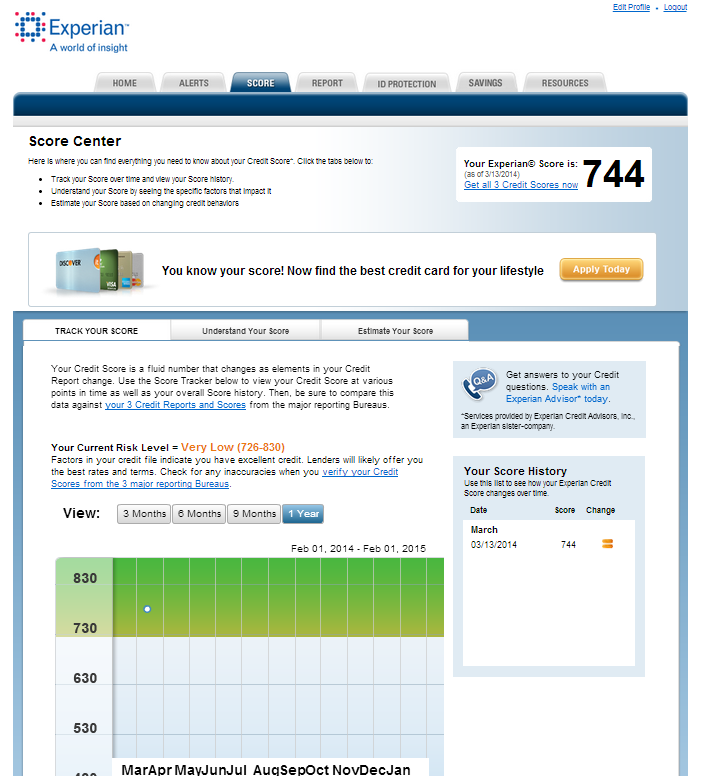

What Is Experian Boost

On-time payment history is the most important factor in your credit score accounting for 35% of your total credit score, followed by credit utilization which makes up 30% of your credit score. This product allows consumers to add additional on-time payments to their Experian credit report by linking their bank account. Additional on-time payment history can help increase your credit score.

Using Experian Boost to boost your credit scores isnt complicated. The first thing youll need to do is connect the account that you use to pay your qualifying utility, cell phone and video streaming service payments. After connecting the bank account, users can choose which positive payment histories from these services to add to their Experian credit report. If applicable, you may see the results of Experian Boost instantly.

Those most likely to benefit have thin credit histories, meaning they dont have many credit accounts to report on-time payments to their credit report. According to Experians website, average users who received a boost improved their FICO Score based on Experian Data by 13 points. Remember that results may vary, and are dependent on factors like your existing credit profile.

Read More: What Is a Good Credit Score?

Recommended Reading: How To Keep A Good Credit Score

Disputes Related To Your Personal Information Or An Inquiry

- Added: This item was added to your credit report.

- Address Updated: This may appear to you as Deleted, as your address is updated to the current address.

- Deleted: The item was removed from your credit report.

- Processed: The item was either updated or deleted.

- Remains: The company reporting the information has certified to Experian that the information is accurate, so the item has not changed.

How To Get A Credit Report

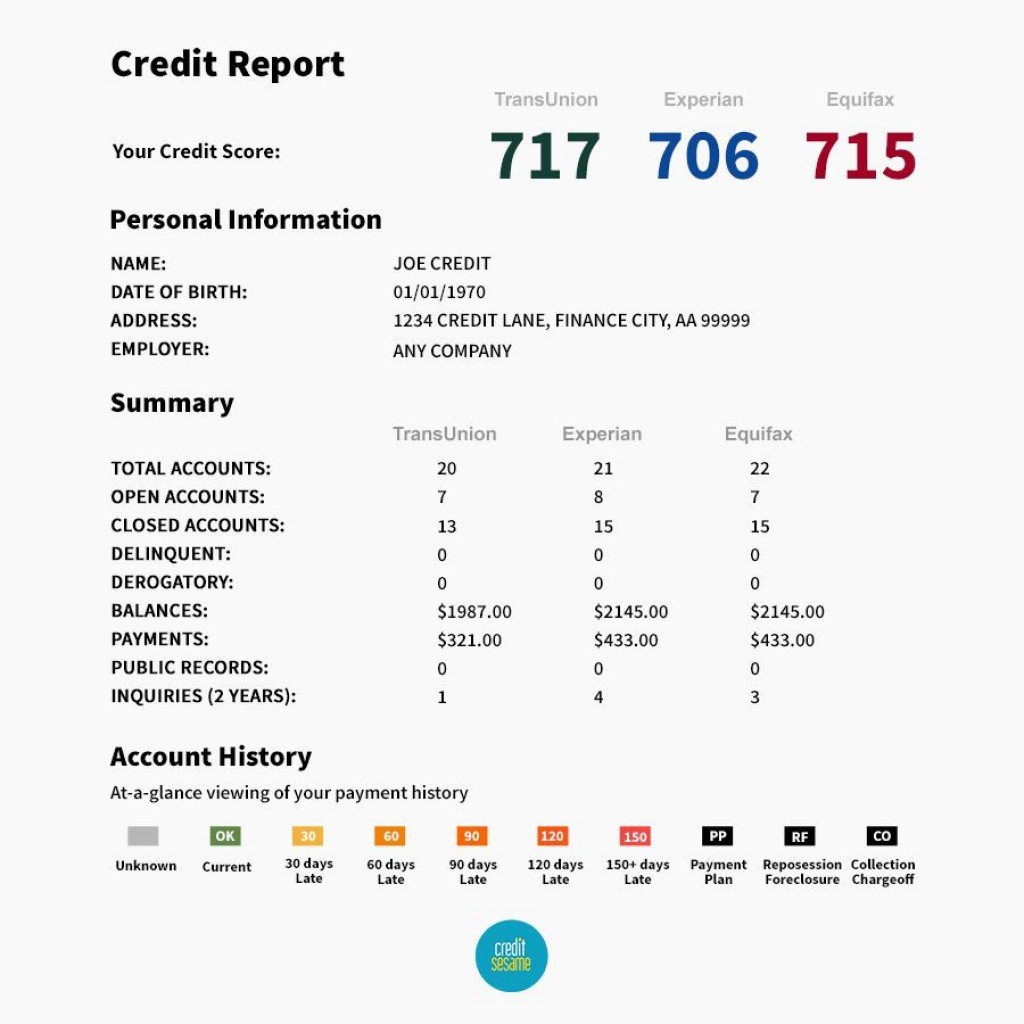

Even though its typically referred to as one document, you actually have three credit reports, one from each of the that maintain a file on your credit history: TransUnion®, Experian® and Equifax®. While the appearance of these credit reports differs slightly, the information they contain tends to be similar.

Everyone is entitled to a free credit report from each bureau at least once a year at AnnualCreditReport.com, which is the easiest way to access your report. After filling in your personal information and verifying your identity, youll be able to download your report immediately.

Recommended Reading: How Long Does Debt Stay On Credit Report

What Is A Credit Report And How Do I Access Mine

Institutions that have issued you credit cards and loans send regular updates about your accounts to , also known as credit reporting agencies. Credit bureaus collect all the data and combine it into a single file, known as your credit report. When you apply for new credit, the financial institution pulls your to determine whether you meet the qualifications.

To quickly figure out the likelihood that youll repay a loan on time, creditors may instead use your , a three-digit numerical summary of your credit report information at a given point in time.

Its important to check your credit report periodically to make sure the information it contains is accurate, complete, and within the allowed reporting time limit. You can access your credit report online from any of the credit bureaus, but there may be a fee. Youre also entitled to a free credit report each year from the major credit bureaus.

You can get one free credit report per week from Equifax, TransUnion, and Experian through December 2023 at AnnualCreditReport.com.

As you read through your credit report, reference this guide to better understand some of the abbreviations you see. Different credit bureaus and credit report providers may use slightly different codes, and some codes may only appear on the reports issued to lenders. Well clarify as much as possible.

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get atAnnualCreditReport.com.

Recommended Reading: Is 618 A Good Credit Score

Who Can See My Credit Report

Most people cant legally use your personal information to access your credit report. However, there are several types of organizations that are allowed to pull your credit: banks, creditors, lenders, insurance companies, potential landlords, collections agencies, potential employers and the government.

The laws about who can access your credit score are different from state to state. If youre worried at all, do some research and find out what the law is where you live.

Recommended Reading: Business Credit Cards That Don T Report To Personal Credit

Reading Reports From Each Bureau

While the essential information should be very similar in each of the three bureaus reports, the presentation may vary. For your convenience, weve provided information on guides for each below.

How to read an Experian credit report

Experians guide breaks down their report into personal information, accounts, collections, public records and credit inquiries.

How to read a TransUnion credit report

TransUnions guide organizes their reporting into personal information, public records, account information, accounts with adverse information, satisfactory accounts, collections, regular inquiries, promotional inquiries, account review inquiries and consumer statements.

How to read an Equifax credit report

Equifaxs guide categorizes their report details broadly into identifying information, credit account information, inquiry information, bankruptcies and collections accounts.

Don’t Miss: What Does Account Settled Mean On Credit Report

How Often Is My Credit Report Updated

Your credit report is updated frequently, as new information is reported by lenders and older information is gradually removed per federal retention requirements.

However, it’s important to also know that most lenders report changes in account status, such as payments you’ve made or whether you’ve fallen behind, on a monthly basis. If you make a payment on one of your accounts, it’s possible that the payment won’t appear on your credit report for up to 30 days.

Are There Any Legitimate Ways To Repair Your Credit And Credit Scores

It depends. According to the Fair Credit Reporting Act you have the right to ask that the information on your credit reports be verified as accurate and not outdated. The credit bureaus have 30 days to complete the verification process or they must remove or change the information to coincide with your dispute. Credit repair companies may assist you in writing and that is something that you can do on your own, for free. It is sort of like cleaning your gutters or changing your oil. You can do it yourself for a fraction of the costthe question is, do you really want to?

From this point forward is where it gets a little fuzzy. Disputing data that you know to be accurate isnt considered a legitimate dispute. And, the credit bureaus are likely to validate it as accurate and leave it on your reports. There are no surefire methods for repairing accurate credit data that you simply dont want on your credit reports.

Beware the company or individual who guarantees that they can remove delinquencies or create a new credit report in your name. These are not legitimate practices and are illegal in most states.

Don’t Miss: Why Is My Credit Score So Low