How Do Those Free Credit Report Sites Work

Chances are that you have seen a commercial on TV or a clever ad on the Internet directing you to check your free credit report by visiting a specific website usually something with the words “free” and “credit” in the URL.

Technically, your credit report is free, but you often have to provide your credit card before accessing your credit report. This is because your “free” credit report is a “reward” for signing up for some sort of credit monitoring service or some other credit-related product.

In many cases, your sign up is treated as a “free trial.” You provide your credit card number and agree to a 7-day or 14-day free trial. At the end of that time period, if you haven’t canceled, then your card is charged the regular fee for the product. The company hopes that you will forget about canceling your trial, and that you will allow your card to be charged.

Another variation of this type of product is that receiving your free credit report is contingent upon signing up for credit services that alert you to negative items on your credit report and then automatically dispute them. These programs charge your credit card only when a dispute is lodged with the credit reporting agency. However, any negative item is often disputed. Unfortunately, if the negative item is accurate, it won’t be removed from your report. So you might end up paying for a useless dispute.

What To Do With Your Credit Report

This would be a good time to get a copy of at least one of your credit reports. When you do you want to check it over carefully. Don’t just look for your credit report score. Other factors are important as well.

You are not just interested in whether you appear trustworthy, you also want to make sure the report is totally accurate. Determine that all entries are correctly yours.

Identity theft is a great threat to us all and checking the details in your credit report is one way to intercept it.

While you are at it, check out annualcreditreport.com’s FAQ page where you can learn a lot more about credit reports and credit report scores.

Top Sites For Free Credit Scores

If youre interested in seeing your actual FICO score, you might want to check with your bank or credit card company. A growing number of credit card issuers now offer truly free credit scores as a way to entice new customers. They include:

- American Express

- Discover

- Wells Fargo

Anyone else may have to pay if they want their actual FICO score by visiting myFICO.com. The site offers single-time and monthly packages. The recurring ones are $19.95 , $29.95 , or $39.95 per month, with the advanced and premier plans including identity theft monitoring.

The two single-time packages are $19.95 for a report from just one credit bureau and $59.85 for a report from all three. Of course, the more you pay, the more features you receive.

As noted above, if you just want to read your credit report without seeing your score, you can do that once a year, completely free, at AnnualCreditReport.com. The nice thing about this government-sanctioned site is that you can request reports from all three bureaus. Because some banks use only one or two of the reports to make lending decisions, its always a good idea to make sure that all three contain accurate information about your borrowing history.

Read Also: Speedy Cash Loan Extension

How To Get Your Credit Report For Free

You can get a free copy of your credit report. Absolutely free. You dont need to consult the advertisers on TV who promise a free report but then require $10-15 dollars a month to provide their handholding to do it, either.

This good news is thanks to a little known law that requires credit companies to make your credit report available at no charge when properly requested. You do not need any help, just a little know how.

Here is all you need to know in order to get your free report from each of the three primary credit reporting organizations. There are only two rules. The first is that you get it from the designated web site. The second is that you can only ask for a free report from each company once each year. Not too difficult is it!

Just go to AnnualCreditReport.com to make your request. You will have a choice to get your reports all at once or order them individually at different times. In the first case you will be able to compare results. In the second you will be able to pick up problems quicker if you get one every four months and repeat the pattern each year.

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Also Check: Does Paypal Credit Report To Credit Bureaus

Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

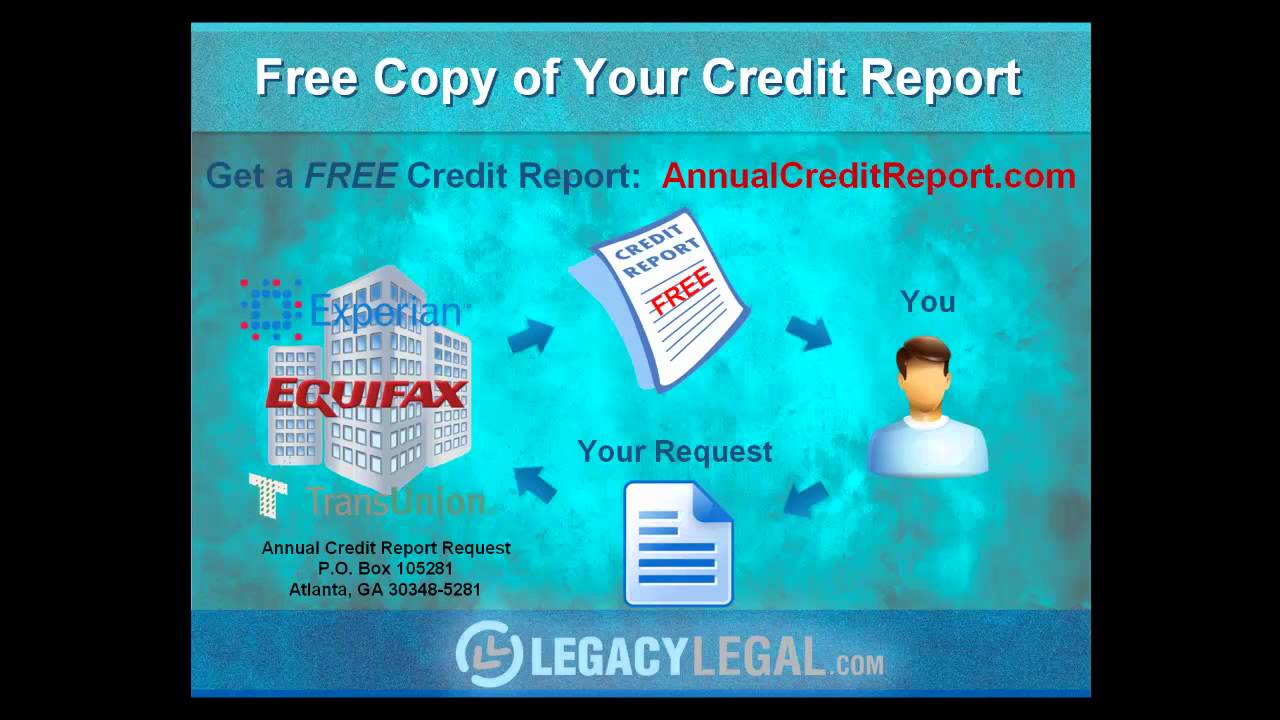

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Don’t Miss: Does Paypal Credit Affect My Credit Score

Best For Single Bureau Access: Credit Sesame

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your information often gives you an idea of where your credit stands and whether you need to improve your score. Credit Sesame analyzes your credit information to make recommendations for credit cards, loans, and other financial products, but you dont have to apply if youre not on the market for a new loan.

Beware Of Free Credit Scams

As you’re looking for free credit resources, make sure to watch out for scams. If a service requires you to enter your credit card number, there’s a good chance you’re enrolling in a trial subscription. Once the subscription ends, your credit card will be charged for the monthly or annual subscription price.

It’s also important to be cautious about emails, phone calls, or text messages asking for personal information to view your credit report. Clicking a link or providing personal or financial information could put you at risk of fraud or identity theft. Report scams to the Federal Trade Commission and your state attorney general.

You May Like: Les Schwab Credit Score Requirement

How To Safeguard Your Identity

If you find accounts listed on your credit reports that you did not open or if you are worried about identity theft, you might consider filing a free fraud alert on your credit file that remains active for one year through the Experian fraud center. The fraud alert notifies lenders pulling your credit report to take extra steps to verify your identity.

You can also freeze your credit reports, another free measure that prevents lenders from issuing new credit in your name altogether. Or try Experian CreditLock, a benefit of your Experian membership, which allows you to lock and unlock your report in real time, with no waiting period.

Understanding Your Credit Report And Correcting Mistakes

Once you receive a copy of your credit report, it will contain explanations to help you understand the details of your credit report. It should also let you know how to correct mistakes or dispute information that you think is incorrect. The Government of Canada has also published a guide called Understanding Your Credit Report and Credit Score to help Canadians understand how the credit reporting system works in Canada. It contains all sorts of helpful info including how long information stays on your credit report.

You May Like: Speedy Cash Change Due Date

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

Free Credit Score Report

By | Submitted On March 28, 2009

Back when I was young adult if I wanted check credit score I had to actually pay to view it. These companies make a lot of money just from a simple service like this, but thanks to the law that was passed a few years back we are now entitled by to one free credit report from the major three companies every year, which are Equifax, Experian, and Trans Union. The problem here is that most people haven’t done enough to diligence to know this simple fact. Instead they respond to an e-mail from an online an online site that promises to give them an accurate credit report for free, but they end up asking you to pay a fee for this report.

These so-called free credit reports scam companies are also all over the Internet and mix in really well with the truly free credit score report agencies. The key here is to look at the fine print. The scam companies put in fine print that they will charge your credit card for their credit monitoring services after 30 days. Just remember to read the fine print before clicking or giving permission to access your credit report from any online company. While filling out any credit report application if they ask for any more than the basic info from you and they are probably a scam company.

Now that you’re on with the knowledge and have gotten your free credit report hopefully you will start to work on raising your credit score and become a dependable borrower again.

Recommended Reading: Does Opensky Report To Credit Bureaus

Money Minute Day : How To Get A Truly Free Credit Report

Checking your credit report is one of the first and most important steps to take to get your finances in order. In todays Money Minute, learn how to get a truly free credit report, up to three times a year.

Love this Money Minute? Sign up for The Good Stuff newsletter, and follow along for more Money Minutes in January.

Transcript:

Hi Im Jeanette Pavini, Savings Expert for Coupons.com, here with your Money Minute. Today, spend a little time with us and well show you the only way to get a truly free credit report.

Each of the nationwide credit reporting companies must provide you with a free credit report once every 12 months. That means you are entitled to a total of three free reports per year one each from Equifax, Experian and Transunion.

The trick is theyre only required to provide it if you request it.

Go to annualcreditreport.com to order a truly free credit report

If this is your first time requesting a credit report, or its been awhile, you may want to get all three at once so you can compare reports.

If youre up-to-date on your credit standing, then spread it out. That way, you can check your score about every four months to track new information and immediately dispute any errors.

You will usually get your report immediately when you order it online.

Thats your Money Minute. See you next time!

How To Get A Truly Free Credit Report

This post contains references to products from our advertisers. We may receive compensation when you click on links to those products. The content is not provided by the advertiser and any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any bank, card issuer, airline or hotel chain. Please visit our Advertiser Disclosure to view our partners, and for additional details.

Disclaimer: This site contains affiliate links from which we receive a compensation . But they do not affect the opinions and recommendations of the authors.

Wise Bread is an independent, award-winning consumer publication established in 2006. Our finance columns have been reprinted on MSN, Yahoo Finance, US News, Business Insider, Money Magazine, and Time Magazine.

Like many news outlets our publication is supported by ad revenue from companies whose products appear on our site. This revenue may affect the location and order in which products appear. But revenue considerations do not impact the objectivity of our content. While our team has dedicated thousands of hours to research, we aren’t able to cover every product in the marketplace.

For example, Wise Bread has partnerships with brands including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi, Discover, and Amazon.

You May Like: How Accurate Is Creditwise Credit Score

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Important Facts About Your Credit Score

- Check your score annually. The only truly free place to check your credit report is at www.annualcreditreport.com. Do yourself a favor, protect your credit and identity by reviewing your report from each of the three bureaus every year.

- Check your credit report. Your score is different each month and with each lender, so focusing on your credit report is a better use of your time. Make sure your report is accurate, as well as a good reflection of your long-term financial goals. Think of it as your financial reference.

- Pay your bills on time. Of the few key elements that make up your FICO credit score the single most important is paying all bills on time. This component is responsible for more than 30% of your score.

- Available credit is key. Another 30% of your credit score is based on how much of your credit you use compared to how much you have available. The more you have available, and the less you use, the better it is for your score.

Also Check: Does Qvc Report To Credit Bureaus

What Doesn’t Impact Your Credit Score

There are many common misconceptions about what does affect your credit score. “Consumers sometimes focus on things that simply don’t matter to their scores. The most common is information about your wealth,” says Ulzheimer.

“Income, balances in retirement accounts, equity in your home, net worth … anything that defines how much money you have or how much you’re worth are not considered by your credit scores.”

Other factors that don’t affect your credit score include race, religion, nationality, gender, marital status, age, political affiliation, education, occupation, job title, employer, employment history, where you live or your total assets.

Learn more: Can employers see your credit score? How to prepare for what they actually see when they run a credit check