What Is An Updated Tradeline

An updated tradeline is simply a tradeline that has had some sort of change occur, which caused it to update with one or more of the .

There are a number of things that would be considered a tradeline update, such as:

- If you get a

- If the balance of the account changes

- When the account goes from open to closed

- When you are added or removed as an AU

- If you dispute inaccuracies that are then deleted or removed from the tradeline, such as incorrectly reported late payments

How Is Tradeline Information Collected

To stay updated on the information on your credit accounts, you can order your free credit reports. The federal law states that you are entitled to one free credit report per year from each of the major credit bureaus. To order it online, go to the Annual Credit Report website.

Once youve received your credit reports, check them thoroughly for errors. Common errors include:

- Misspelled name

- An address you never lived in

- An account you never opened

- Hard inquiry for a tradeline you didnt apply for

If there are any, report to the credit bureau to get them removed.

Keep in mind that tradelines you dont recognize appearing on your credit reports is a sign of identity theft. They should be disputed with the credit bureau ASAP.

Keep Your Credit Utilization Low

If you have high utilization on your tradelinesmeaning, that you are using a high proportion of the total credit available to youthe harder it is to pay back those debts and that will ultimately hurt your credit score. It is recommended that consumers keep their total debt below 30% of their total credit.

Opening a new credit card can actually help your credit score because your utilization rate will decrease, due to the higher total credit limit from the new card. Just dont spend on the new card and pay off balances on time for any others that you have!

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Can You Buy New Tradelines

Adding new tradelines to your credit report is one way to improve your credit score, allowing you to build a positive payment history. If you have no credit or bad credit, secured credit cards, store credit cards, and credit builder loans are the best options for getting new accounts.

If youve had trouble getting approved or youre looking for a shortcut, you may be tempted to purchase tradelines. There are companies that sell access to tradelines, charging hundreds of dollars to add your name to someones existing tradeline, preferably one thats been open for several years and has no delinquencies.

Once youre added to the purchased tradeline, usually as an on someones credit card, the account appears on your credit report long enough to boost your credit score. With an improved score, you can then apply for credit on your own.

How To Report A Credit Card Company

Category: Credit 1. Disputing Credit Card Charges | FTC Consumer Information Complaints. The Federal Trade Commission enforces the FCBA for most creditors except banks. If you think a creditor has violated the FCBA, file a The Investigation · Complaints About the Quality of Goods and Services Were the Consumer Financial

Recommended Reading: Does Zzounds Report To Credit Bureau

Does Buying Tradelines Work

Many credit card issuers disclose the nature of your relationship to the primary account owner to credit bureaus. You see how this could affect your credit possibilities since lenders will probably factor in that information while reviewing your credit application.

Purchasing tradelines isnt guaranteed to work. Credit reporting agencies and lenders view this as a form of deception and may not look favorably upon your application. Also, they have devised a new scoring model that greatly limits the impact of bought tradelines on your credit scores.

If you consider purchasing tradelines as your last straw at a decent credit score, we recommend doing your due diligence. Some companies that sell tradelines may try to scam, and even if you manage to buy them successfully, their benefits are short-lived and unreliable. Instead of spending several hundred dollars on a tradeline, you can ask a friend or relative to make you an authorized user of their credit account. This still works to boost your credit score, and it doesnt have to cost you a dime.

Having bad credit or zero credit can be resolved with the right knowledge and help from a trustworthy company. At CoastTradelines, we offer an array of such services visit our website to learn more about tradelines and other information.

Check Out Business Boost

Get your full business credit reports & scores, PLUS Nav reports your account payments to the business bureaus as a tradeline.

Have at it! We’d love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Don’t Miss: Cbcinnovis Inquiry

Buying Tradelines: How Does It Work

When you buy or rent a tradeline, you pay money for a stranger to add you onto a credit card as an .

Heres how the tradeline rental process works behind the scenes.

Warning: Its sometimes possible to connect with a credit cardholder on your own to arrange a piggybacking agreement. Craigslist and similar websites are the types of places you might find such offers. But removing the middle man could make tradeline renting even more dangerous.

Be Cautious About Buying Tradelines Or Shelf Companies

If youre looking for a shortcut to build your business credit, youll quickly find there are companies that will sell you tradelines. Often these are seasoned tradelines, meaning theyve been established for some time.

Generally, the seller will make your business an authorized user on the tradeline. Or, it may try to sell you a shelf companya company thats formed on paper and then sits on a shelf until its sold.

The idea is that you can buy a company that has a long time in business and established credit. You can then use its history to qualify for contracts and higher funding limits.

Purchasing tradelines and shelf corporations arent technically illegal, but lenders dont like the practice. If a lender finds out that you used these tactics, it could get you in trouble.

Buying tradelines or a shelf company with the intent of misrepresenting your credit history and applying for a loan or credit account could be considered fraud.

Read Also: Paypal Credit Credit Report

Check Your Credit Report Regularly

The tradelines on your credit report provide a wealth of information to both you and lenders. To make sure all the information contained in your tradelines is accurate and legitimate, check your credit report regularly.

You’re entitled to one free credit report from each of the major credit reporting agencies every 12 months. You can also get free credit monitoring and access to an updated every 30 days when you sign in. As you review your tradelines frequently, you’ll have a better chance of spotting fraud and inaccuracies before they damage your credit scores significantly.

How Credit Boosting Works

Boosting an individuals credit score can be achieved by adding them as a authorized user on a credit card account with a perfect payment history, and low utilization. When the credit card reports to the credit bureaus each month, the positive credit history is copied to the authorized users credit report and the result is an increase in credit score.

Tradelines Club pays card holders, just like you, fees for adding our customers as authorized users to your credit card/s. . They are paying strictly for the benefit of your credit cards payment history appearing on their credit report. They dont know who you are, where you live or anything about you.

You may have heard of parents adding their children to their credit card account as authorized users so that they can get a low interest first car loan this process is credit boosting, sometimes called credit piggybacking, and it works!

Also Check: How To Report To A Credit Bureau Landlord

Why You Should Check For Errors

Once youve obtained your credit report, review it thoroughly to ensure all the information reported about you is accurate. If you spot errors on your credit report, like tradelines that are outdated or arent completely accurate, you can have them removed by writing to the credit bureau.

Tradelines you dont recognize could be a sign of identity theft. These fraudulent tradelines can be disputed with the credit bureaus.

How Being An Authorized User Affects Your Credit

Some self-proclaimed financial gurus claim that authorized user accounts do not have an impact on your credit score, but this is a myth, says John.

In reality, virtually all credit scoring models that are commercially available, from both FICO and VantageScore, do consider authorized user accounts when your credit score is calculated.

Therefore, if the credit card account has been managed properly, it certainly has the potential to bump up your credit score as soon as the account shows up on your .

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

What Will A Tradeline Help You Achieve

A tradeline helps you improve your credit score so it will reap all the benefits a good credit score enables you to achieve. Without a good credit score, you will have limited access and services of your credit card, loan plan, and a higher rate of mortgages. In short, you will have to end up paying more money than usual.

But good tradelines on your account will help you achieve a credit score of 750 or higher in no time. When you buy an authorized tradeline from someone like Personal Tradelines, you are added as an AU to one of their credit card accounts, and it takes only 25-30 days to get your credit up to a good score.

Why Are Tradelines Important

Business tradelines can be important because they can help other businesses and organizations determine your companys creditworthiness.

Your business credit reports may have overviews of your companys history of paying its bills and trade credit accounts.

They also often have details about the business, such as how old it is, the industry, whether there are outstanding liens or judgments, and information about the owners.

Someone may review your businesss credit reports when you apply for a loan, line of credit, lease, insurance, or trade credit. Or, when you try to get a contract with a major corporation or government agency.

Many business credit reports also come with business credit scores or creditworthiness ratings, and your tradelines can directly impact these.

For example, the D& B Paydex Score ranges from 1 to 100. You need to make on-time payments on your trade accounts to get a score of 80. If you want a higher score, you need to pay earlier than your trade credit accounts require.

Don’t Miss: Does Zzounds Report To Credit Bureau

How Tradelines Affect Your Credit

The number of tradelines you have open at a time can affect your credit score. Having too many can make you look overextended, and having too few shows you lack experience with credit.

Unfortunately, credit scoring companies havent disclosed the specific number of tradelines you need to achieve excellent credit. To build the best credit score, you should ideally open and close accounts only as you need, keep your existing accounts in good standing, and keep your debt balances low.

While good credit comes with a number of benefits, it doesnt guarantee your applications will be approved. For example, you can have a credit card application denied if youve recently applied for multiple different lines of credit.

What Information Is In A Credit Report

Learn about positive and negative information on your credit report, and how creditors may use this information. 2:21

A credit report is a summary of your credit history. Potential creditors and lenders use credit reports as part of their decision-making process to choose whether to extend you credit and at what interest rate. It’s important to check your credit report regularly because creditors and lenders use the information in it, such as your payment history and the number of active credit accounts, also known as tradelines, to evaluate your creditworthiness.

There are two nationwide credit reporting agencies Equifax and TransUnion both of which maintain consumer credit reports containing information reported to them by lenders and creditors. Your credit report may not be identical with each of the two agencies, as some lenders may report information to both of them, just one, or sometimes none at all.

Also Check: Paypal Credit Credit Bureau

How A Trade Line Works

A trade line is an important record-keeping mechanism that tracks the activity of borrowers on their credit reports. Each credit account has its own trade line. Borrowers will have multiple trade lines on their credit report, representing the individual borrowing accounts for which they have been approved. The basic types of accounts are those paid off in fixed installments, such as a car loan mortgages revolving accounts, such as credit cards and open accounts, for which full payment is made upon the receipt of goods.

Pay Off Your Balances On Time

Everytime you make an on time payment for one of your tradelines, you are adding positive payment history on that tradeline. Payment history is looked at as a percentage of on time payments across all of your payments on all tradelines.

Well break it down a bit further.

If you only have 5 tradelines, each open for 10 months, and you have one late payment total across those accounts, thats 49 on time payments and one late payment which is a 98% positive payment history. On paper that may look great, but it is important to note that anything below 99% is considered bad and your credit score will take a hit.

Don’t Miss: Does Paypal Credit Report To The Credit Bureau

Find Out The Average Monthly Balance On The Card

Credit scoring models penalize you for having too high of a monthly balance on the card relative to the credit limit of the card. This is whats referred to as the revolving utilization ratio or the , and its very important to your credit score.

Too high of a balance on the card could increase your overall credit utilization ratio and thus bring down your credit score, which obviously is counterproductive.

On the other hand, the lower the utilization ratio is, the better it is for your scores, so look for a low monthly balance when considering an authorized user account.

How Positive Tradelines Affect Your Credit

Positive tradelines for accounts that are paid on time can boost the strength of your credit, and most lenders and creditors do report positive tradelines to the major credit reporting agencies Experian, Equifax, and Transunion. There are different types of positive credit, the main ones being revolving credit and installment credit . When you keep these accounts open and pay them on time over a period of years, they can strengthen your credit.

But what happens when the credit reporting agencies do not report a positive tradeline on a consumers credit report? Can the agencies be required to report it?

You May Like: Unlock Experian Account

What Is A Tradeline On A Credit Report

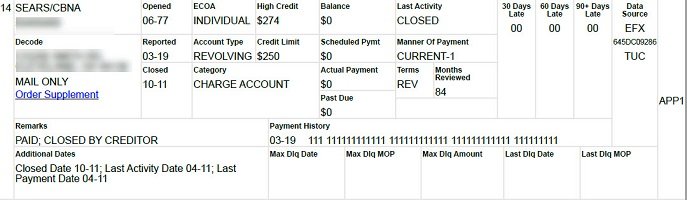

A tradeline on a credit report is a credit account. Credit agencies build credit reports on individuals based on these tradelines. Each tradeline includes information reported by the creditor, including:

- Partial account number

- Amount of the last payment

- Date the account was last updated

- Payment history

- Current account status

There are two kinds of tradelines: revolving and installment. A revolving tradeline is a line of credit or a credit card accountthese accounts let the borrower use credit as needed over an extended time frame. An installment tradeline, such as a student loan, mortgage, or auto loan, is a loan for a set amount that is paid back in installments.

Is It Illegal To Buy Trade Lines

It’s possible to buy trade lines. You pay a for-profit company, which then has you added to someone’s credit account as an authorized user. The primary account holder will have a “seasoned trade line,” meaning an extensive, positive history. This may boost your credit score.

Currently, it’s not illegal to buy a trade line, although the activity does exist in a legal gray area. Selling and buying trade lines may also violate the terms of service laid out by your lender.

Criminals have used trade lines to commit fraud. Scammers use authorized trade lines to build a credit history for fake identities. The primary account is legitimate and has a positive credit history. They then create false identities and tie them to the primary account to build a credit history. Then, the scammers can take money from lenders and never pay it back.

On the other hand, its perfectly legal and often encouraged to be added to a family members trade line. In this case, youre not buying a trade line and you know the person.

This is a legitimate way to build your credit and may be especially helpful for people with a limited credit history, assuming your family member has a good credit history.

Don’t Miss: Remove Repossession From Credit Report