The Bottom Line About Building Credit Fast

When youre working to fix your credit, it takes good behavior over time. However, lowering your utilization rate by paying down existing debt, getting a new credit card or requesting a credit line increase on an existing card can provide the quickest credit score boost.

Any late payments and debts sent to collection should be handled promptly otherwise, theyll just cause more pain once they hit your credit reports. Its also wise to review your credit reports on a regular basis. in order to spot errors that might be dragging down your credit score.

Knowing what actions to take that can help improve your credit score and being a responsible borrower can boost your chances of increasing your credit score by 100 points or even more.

Reasons Why Credit Scores Drop

Credit scores are calculated using lots of information from your credit report about your finances. This includes factors like your payment history, the amount you currently owe, your and how many accounts you have open. So when thereâs a drop in your score, itâs likely that thereâs been a change in one of these or one of the many other factors that go into credit scores.

Read on for some reasons your credit score might drop and what you can do about them.

1. New Credit Applications

A new credit application could have an impact on your credit score. Thatâs because a new credit application creates a âhard inquiry,â which can stay on your credit report for up to two years. And multiple credit applications in a short period of time may raise a red flag to lenders. Those applications could be seen as a sign your financial situation has changed, and it could put a dent in your score.

What you can do: Try to keep new credit applications to a minimum by only applying for the credit you need. And when you do apply for a new credit card, you could first check with the lender to see if they can tell you whether you may be pre-qualified or pre-approved for one of their cards. Pre-qualification and pre-approval use whatâs known as a âsoft inquiryâ to check your credit, which wonât hurt your score.

2. High Credit Utilization

3. Payment History

4. Derogatory Remarks on Your Credit Report

Keep Your Credit Usage Low

Lenders will look not only at your outstanding balances, but at how much credit you have available in its assessment of your risk.

If you have low available credit, prospective lenders may see this as a sign that youre not successfully managing your finances.

Experian says that borrowing more than 90% of the limit on a credit card can knock 50 points off your Experian credit score. Meanwhile, keeping your balance below 30% of the limit will boost it by 90 points. Keeping your credit card balance below £50 can give you a boost of 60 points.

How long will this take to boost my score?

Data from finance providers is usually fed through to CRAs every four to six weeks. So if you can reduce your overall credit usage to around a third of your overall limit across your cards, you can help boost your score fairly quickly.

Recommended Reading: Which Credit Bureau Does Comenity Bank Use

More Than 30 Days Late On A Bill

Late payments are best avoided, we all know that. But sometimes they happen.

If you find yourself in this situation, the best thing to do is to pay the bill and the late fee as soon as possible. Doing so within 30 days will avoid any lasting problems.

However, if your payment is late by 30 days or more, it will be reported and will appear on your credit report. As the table shows, the effect of a late payment will only get worse the longer the bill is left unpaid.

You May Like: What Credit Score Do You Need For Care Credit

You Applied For A Loan Or New Credit Card

When you apply for a loan or credit product, such as a mortgage, auto loan, personal loan or credit card, the lender typically reviews your credit history, which results in a hard inquiry on one or more of your credit reports.

A hard inquiry can ding your score from 5 to 10 points, and stays on your report for two years. So even if youre approved, just the act of applying for credit can hurt your credit score.

Its also worth noting that new credit makes up 10% of your credit score. From a lenders viewpoint, rapidly opening several new credit accounts can signal that you are having financial challenges.

How to fix it:

You May Like: Qvc Collection Agency

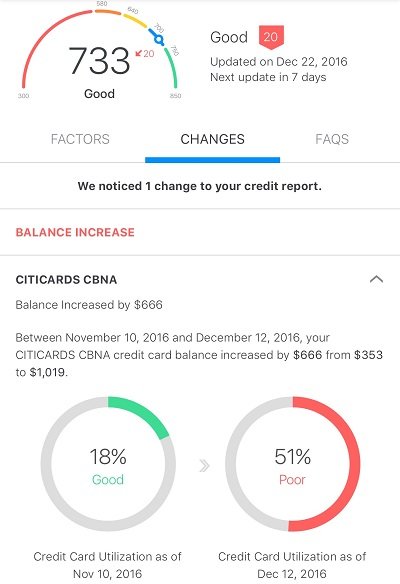

You Had A Big Increase In Your Credit Utilization

Your credit score can drop big time if you carry a large balance on your credit cards. Note also that this is an average of all your revolving credits.

Lets say for instance that you have 3 credit cards with a total credit limit of $10,000. And lets also assume you made a big purchase of $5,500 for whatever reasons and you were unable to pay off the balance, then your credit utilization would jump to 55%. This could result in your credit scores taking a nosedive.

Reasons For A Drop In Credit Score After Paying Off A Collection Account

It is not uncommon for credit scores to drop after paying off a collection account. There are several factors as to why your credit score dropped. The first is to look at the age of the debt. The older the date of the debt, the less impact it has on your credit score. In the past, if you paid it off, it would renew the date as recent activity and create a negative impact on your credit rating.

There are many types of credit score models. With the new scoring system by Fair Isaac and Company, paying off old debt does not hurt your credit score. It distinguishes between new payments and new delinquencies versus old collection accounts.

Recommended Reading: Navy Federal Mortgage Approval Odds

Youve Had A Bankruptcy Or Foreclosure

A bankruptcy or foreclosure can severely damage your credit score and since you likely missed payments leading up to the event, your score will reflect that, too.

A Chapter 7 bankruptcy will stay on your credit reports for 10 years, while a Chapter 13 bankruptcy will stay for seven. A foreclosure will stay on your reports for seven years from the date of your first missed mortgage payment that led to the lender foreclosing on your property.

How to fix it: After a bankruptcy or foreclosure, you may be able to rebuild credit with a secured credit card. To get one, you must submit a security deposit in the amount of your desired credit limit, protecting the issuer in case you default on what you charge to the card. However, be aware that as with any credit card application, approval for a secured card isnt guaranteed.

Another tool for rebuilding your credit is a credit builder loan. With a credit builder loan, you dont get money up front. Instead, you pay money to a financial institution that will put it into a savings account or certificate of deposit for you. At the end of your loan period, the money from the savings account or CD will be disbursed to you. As long as the lender reports to the credit bureaus, youll build positive payment history by paying on a credit builder loan.

You may be able to get a credit builder loan from a smaller bank, a credit union or an online lender such as Self.

Remove Recent Late Payments

A single late payment can drop your credit score by 60 to 110 points. Yikes!

- A 680 credit score a 30-day late payment can drop your score by 60 to 80 points. On the other hand, a 90-day late payment can drop your score 70 to 90.

- A 780 credit score a 30-day late payment can drop your score by 90 to 110 points. In contrast, it can drop 105 to 135 points if you have a 90-day late payment.

The difference between a person with a 780 score and a 680 score is that the 780 score has no late payments, while a person with the 680 may have a 30 day late payment within the last year or a 90 day late payment 2 years ago.

Removing a late payment will take persistence. There are a couple of ways to request removal. The most common and effective way is to call the original creditor and ask for a goodwill adjustment. If they resist, you can even negotiate the removal of the late payment by agreeing to sign up for automatic payments. For other late payments, you can file a dispute against the late payment for inaccuracy.

Read Also: Does A Repossession Stay On Your Credit

Can My Credit Score Drop For No Reason

Since your credit score is based on information found in your credit reports, it only changes as new information is reported. For example, if youve been using more of your available credit or your credit limit has decreased, this can cause your score to drop. If you cant think of any action youve taken to lower your score, review your credit reports for errors and signs of identity theft.

Your Balances Got Too High

If youve recently been charging more than usual onto your credit card or you used it for a big purchase, that can raise your credit utilization. Credit utilization is 30% of your FICO® Score, and your card issuers report your balances every month, so its a factor that can change your credit score quickly.

Your credit utilization is simply your combined credit card balances compared to your combined credit limit. Lets say you have $1,000 in available credit and $700 in balances. That would put your utilization at 70%, which is considered too high and would damage your credit.

How to fix it Reduce your credit utilization to 30% or less and youll quickly raise your credit score. Here are three ways to do this:

- Pay down your balances.

Recommended Reading:

Don’t Miss: Does Paypal Credit Report To Credit Agencies

Your Issuer Reduces Your Credit Limit Or Closes A Credit Card

Though it may come as a shock if it happens to you, your credit card issuer is allowed to reduce your credit limit or even close your card at any time. This is more likely to happen during tough economic times when lenders want to reduce their exposure to possible defaults or when the card is inactive for an extended period.

If your credit limit is lowered or your card is closed, and youre carrying a balance, your utilization will suffer. For example, if youre carrying a $300 balance on a card with a $1,000 credit limit and your credit limit is slashed to $500, your credit utilization jumps from 30% to 60%. Similarly, a closed card account will remove that credit line from your overall credit utilization, which will hurt your credit score if youre carrying high balances on other credit cards.

How to fix it:

You Were The Victim Of Identity Theft

Finally, lets address what might be the most frightening reason for a drop in credit scores: Someone could have stolen your identity and applied for credit accounts in your name.

If you discover that an impostor is using your identity, dont panic. There are actions you can take to help reverse the damage it may have caused to your credit scores.

But how do you spot identity theft in the first place? One step to consider is . Keeping a close eye on your credit scores and credit reports may help you catch suspicious activity faster than if youre not regularly monitoring your accounts. Youre entitled to one free credit report periodically from each of the three major consumer credit bureaus at annualcreditreport.com.

If youve been a victim of identity theft, youll likely want to make a recovery plan. Placing a fraud alert on your credit file could be a good place to begin. You only need to place the alert with one of the national credit bureaus. The other two bureaus will be automatically notified.

After youve added your fraud alert to your credit profile, you may want to fill out an identity theft report with the FTC. Then you can begin the process of disputing inquiries on your report if necessary.

Read Also: How Many Authorized Users Can Be On A Capital One Credit Card

Why Did My Score Drop After Paying A Collection Account

Why did my score drop after paying a collection account?

I paid all of my debts in collections . BAD NEWS – My score dropped after paying off a debt I owed to Sprint. I thought paying off the bills that were in collections would help my score, not hurt it. What did I turn wrong? Now, my score isn’t high enough to apply for any “new credit.”

Congratulations on paying off your collection accounts. While it is frustrating that your credit score dropped, over time, as you make timely payments, you will see an improvement in your credit score.

The good news is that your credit score should improve over time due to paying off the collection account.

You Charged A Large Purchase Onto Your Credit Card

Credit cards are convenient for making large purchases because you don’t need to pay all the money upfront, but leaving a high balance on your card will report a higher to the credit bureaus.

Your utilization rate, or your debt-to-credit ratio, measures how much credit you use compared to much you have available. You want to aim for a low utilization rate because using too much of your available credit limit shows that you pose a financial risk to issuers. Experts recommend keeping your credit utilization below 30%, with some even suggesting below 10% to get the best credit score.

Before you charge a hefty expense onto your credit card, make sure you can pay it off in full before the billing cycle ends. Carrying a high balance on your credit card is not only bad for your credit utilization rate, but it will also incur a whole lot of interest.

You May Like: Does Hsn Report To Credit Bureaus

In Credit Scoring The Bigger They Are The Harder They Fall

How much you owe counts for 30 percent of your FICO score . Length of credit history is worth 15 percent, credit mix is 10 percent and new credit is 10 percent. Ive paid all of my bills on time in the past seven years , so there werent any late payments to blame for my recent 41-point drop.

My credit utilization remained constant during the August-to-November timeframe. My overall utilization ratio is below 10 percent and the same is true on all four of my credit cards. Anything below 30 percent is good and anything below 10 percent is really good, so I dont think this factored into the 41-point plunge either.

The bigger they are, the harder they fall applies to credit scores in that a negative item will hurt someone with a score in the 800s much more than that same negative item would hurt someone in the 600s. But Im still surprised that my new credit card application if that was, in fact, the reason caused my score to drop 41 points in less than two months. The good news is that I regained 33 of those points a few weeks after that.

See related: Should I get a new card to help boost my credit score?

Change To Average Age Of Credit

Your average age of credit shows how much experience you have in managing credit responsibly. Different scoring models calculate this in a variety of ways:

- Finding the average age of your open accounts

- Using the age of the oldest account

- Taking into account closed accounts if theyre still featured on your credit report

If you have closed one of your older accounts, this will have lowered the average age of your credit. This may even have happened several years in the past, depending on which model your lender uses. Furthermore, under some models, opening a new line of credit could also lower the average age, with the same effect.

Recommended Reading: How Long Do Repo Stay On Your Credit

Something Was Recorded On Your Credit Report

Think back on your payment history have you missed a credit card payment in the last few months? Were there any bills that you may have missed in previous months?

Missed payments are typically not reported to the credit bureaus until theyre at least 30 days late, so your score wont be impacted until after that time. Your score will be hurt by a payment thats more than 30 days late, but a delinquency, referring to a payment that is over 30 days late, can devastate your score.

Derogatory marks such as tax liens, charge-offs, collections, foreclosures or bankruptcies have drastic impacts on your credit too, and it may take weeks or months for them to show up on your report. If youve experienced any of these, it may take time for your score to change.

Reasons For Your Credit Score Drop

by Lyle Daly | Updated July 17, 2021 – First published on March 18, 2019

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

If your credit score took a dive, we’re going to show you how to bring it back up.

So you’ve just had the unpleasant experience of seeing that your credit score dropped.

Since no one likes to go backwards, a dip in your credit score is both frustrating and stressful. It can have a serious impact on your life, as you may have a harder time qualifying for the top credit cards or obtaining the best personal loan rates.

That’s why it’s crucial that you figure out what happened to your credit and how to correct the issue. Here are all the possible problems that could have caused your credit score drop, plus how you can fix each one.

Also Check: Opensky Billing Cycle