Apply For The Credit Builder Loan

After youve determined the loan amount that best suits your financial situation, its time to complete the application.

Selfs bank partner will place the funds in a certificate of deposit , which behaves a bit like a savings account. That means the money remains where it is until the loans fully paid off, just as a standard CD remains under lock and key until its maturity date.

Insider tip

Unlike many loans, theres no hard inquiry involved when you apply for a Self Credit Builder Account, so you shouldnt have to worry too much about what your current credit situation looks like.

Because its in a CD, your loan will garner interest over time at a rate of 0.1%. Unfortunately, the interest on the CD itself isnt nearly as high as the rate youll be paying for the loan. It might be enough for a small coffee.

File A Dispute With The Credit Reporting Agency

Once you have your report, make sure to look through each account and see if there are creditors you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, its time to initiate a dispute directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status, for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus, detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Help Other Entrepreneurs Avoid Deadbeats

The more data credit reporting agencies collect, the better they can help other businesses manage and predict risk. More data = better decisions. Other business owners can check business credit and offer credit to businesses with a track record of paying on time, as well as avoid doing business with companies that are overextended or falling behind on their bills. Found out how to open a business credit file here.

Its worth noting that commercial credit reports dont include information about the names of creditors that share information. Instead, it is categorized by the type of lender or vendor.

Intrigued? Here are two ways to get started reporting your business partners account histories to business credit reporting agencies.

Recommended Reading: Does An Overdraft Affect Credit Score

Does Paying Off A Title Loan Build Credit

Does paying off a title loan build your credit? In short, no: The lender doesnt report your payments to the credit bureaus, so paying the loan does not build credit. If you dont pay, the lender likely wont send you to collections, hurting your credit it can simply repossess your car to satisfy the debt.

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

Also Check: When Do Late Payments Fall Off Credit Report

Warning: Alternative Data Isnt Always Helpful

But be careful. Adding more information to your credit profile can help. But it can also work against you.

For example, a credit score that takes into account alternative data, such as your bank account information, could potentially rate you more negatively if you have limited funds in your account or have recently had a lot of big expenses.

Similarly, just as a missed payment on your credit card can hurt you, so can a late electricity payment or a lapsed phone bill.

Before you share more information about yourself and your financial history, think carefully about whether you really want to show that much information to lenders.

If you prefer to have more control over your information, you can also choose to only work with self-reporting services, such as Experian Boost or a rent reporting service, that let you choose exactly what gets reported.

How Does Positive Payment History Impact Your Credit

Payment history is the biggest factor in credit scores, so paying your bills on time, every time is the most important thing you can do to build a strong credit history.

If you are just starting to establish your credit, it can take time to build a solid history of positive payments. Here some tips to help you begin building your credit history:

Also Check: Comenity Bank Shopping Cart Trick Stores

How Do You Know If Your Creditor Or Lender Reports To A Credit Bureau

The best way to find out is to ask.

Since reporting to the credit bureaus isnt required by law, not all creditors or lenders choose to do so. Oftentimes, smaller lenders may report to only 1 or 2 of the bureaus, or not at all.

Its best to work with lenders that report to all three business credit bureaus to ensure that your positive payment history is updated across the board. This can prevent discrepancies while ensuring that future creditors are getting the most accurate information about your business no matter which credit bureau they pull reports from.

Why Do Creditors Or Lenders Report To Credit Bureaus

Businesses have to pay to report information to any of the three major credit bureaus. They also need to meet credit bureau reporting requirements and go through an application process to verify their credentials so they can become a data furnisher.

So, what do creditors or lenders gain from reporting to credit bureaus?

The reporting system creates a symbiotic relationship between data furnishers. When a lender reports to the credit bureaus, its providing valuable information to help its fellow business owners or creditors make informed decisions when extending credits and making promotional offers.

When the lender needs to evaluate a potential borrower, it can in turn leverage the information from these credit bureaus to help evaluate the applicant. This can save everyone from selling to customers who are less likely to make payments.

The more businesses participate in the reporting system, the more accurate the data is and the more everyone can benefit. Also, because lenders need to go through a vetting process, being a data furnisher can help demonstrate their credibility and attract more loan seekers.

Read Also: How To Remove Serious Delinquency On Credit Report

How To Remove Negative Items From Your Credit Report

First, it’s important to know your rights when it comes to the information in your credit history.

Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the information disputed is found to be incomplete or erroneous, the bureaus are obligated to remove it from your record.

Some common credit report errors include payments wrongly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number, or identifying information.

Bear in mind that correct information cannot be removed from your credit report. So, if your score is being dragged down by accurate negative information, youll need to repair your credit over time by ensuring you make payments on time and decrease your overall amount of debt.

Here are some tips to help you repair your credit history:

Re: Self Lender Two Months Not Reported Yet

well how about i had self lender since december and it only showed up on experian .so i emailed self lender and they asured me. that it was reported and for me contact the credit bureaus and ask them to do a soft pull. and it will show they reported it. i did and they have not yet to report it the other eqifax or transunion.. and i emailed them again to let them what the credit bureaus said. a week ago and no reply.

Read Also: Letter To Remove Repossession From Credit Report

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history, help you create a budget and even a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

- Local consumer protection agencies

- The United States Trustee program

Why Is Titlemax Going Out Of Business

On Monday, the Department of Business Oversight said TitleMax agreed to stop making loans in California altogether at the end of this month. The DBO moved in December 2018 to revoke TitleMaxs finance license in California based on allegations that the lender routinely charged excessive interest rates and fees.

Also Check: What Is Serious Delinquency On Credit Report

Re: Anyone Tried Self Lender And Did It Raise Score

Hi there,

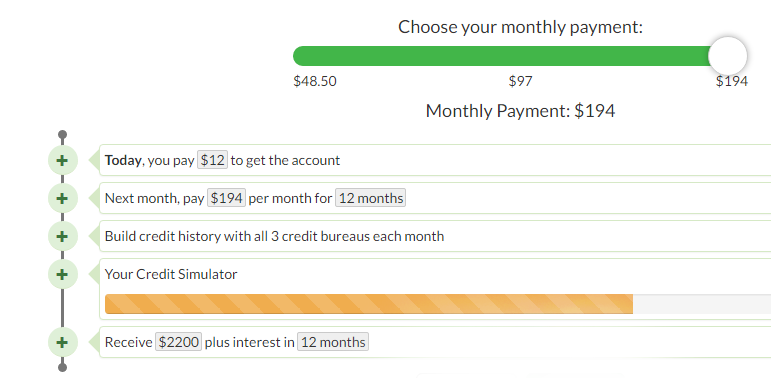

Some of the drawbacks of self lender are: 1) if you don’t repay your account, then you will damage your credit and 2) you have to spend $594 over 12 months for your CD to unlock with $550 . So, it’s not free.

My suggestion: if you can afford to do both a secured credit card and self lender, you may want to consider doing both.

Is It Right For You

The Self Visa credit card certainly lowers some of the traditional barriers to credit card approval, especially given the lack of a credit check. And initially, it can be cost-effective, too. The finance charges you’ll pay on a Credit Builder Account loan range from about $46 to $115, depending on the amount borrowed. If you add the $25 annual fee for the Self Visa, its initially less than you would pay for a traditional security deposit on some secured credit cards. That could be ideal if your budget, and your credit, would benefit from stretching your deposit over several payments.

But over the long term, the loan and card combined would end up costing more than an upfront security deposit. Many secured cards don’t charge annual fees.

Plus, unlike those traditional secured cards, you don’t get access to your funds or your card immediately. And while you could pay off your Credit Builder Account loan early and get your funds sooner, it may affect how much payment history you’re able to establish with the credit bureaus.

Make sure you’re willing to make those trade-offs first.

You May Like: What Credit Score For Amazon Credit Card

What Are The Three Consumer Credit Bureaus

In general, there are two main types of credit bureaus : consumer and business. As you might guess, consumer credit bureaus collect credit data on individual consumers. Business credit bureaus collect credit data on small businesses.

In the consumer world, the three major credit bureaus are:

- Equifax

- Experian

- TransUnion

Details Of The Self Visa Credit Card

Once you’ve met the above criteria and are eligible to order the Self Visa credit card, here’s what you can expect from it:

Annual fee: $25. The annual fee will reduce the amount of credit initially available to you.

Interest rate: 23.99% variable APR .

Low fees: There’s no penalty APR, and Self doesn’t charge a late fee on your first late payment. Subsequent late payment fees are as high as $15, which is significantly lower than fees charged by other credit cards.

Read Also: Which Credit Bureau Does Wells Fargo Use

Transunion Credit Information Bureau Limited Or Cibil

CIBIL is a comprehensive credit bureau which was established in 2000 with a license to operate in 2010. CIBIL covers the analysis for individuals as well as organisations. It gives a credit score rating that varies between 300 to 850 where 720 and above is an excellent score. For companies and other entities it gives a score called PERFORM score.

Common Credit Report Errors To Look Out For

According to the Consumer Financial Protection Bureau, these are the most common errors consumers find on their credit history:

Mistaken identity

- Wrong name, address or phone number

- Accounts from someone with a similar name

- New credit accounts opened by someone who stole your identity

Incorrect account status

- Accounts wrongfully labeled as open, past due or delinquent

- Accounts that wrongfully listed you as the owner instead of authorized user

- Wrong date for the last payment received, date the account was opened or delinquency status

- Same debt listed multiple times

Data management

- Information that is not removed, despite already being disputed and corrected

- Accounts that are listed multiple times, with different creditors

Balance

- Incorrect credit limit

Recommended Reading: How To Check Credit Score On Usaa

What Is Self Reporting

Describing it as self reporting is a bit deceiving, because an individual cannot actually contact the credit bureaus directly to report credit information or payments.

Self reporting refers to giving the credit bureaus permission to view your accounts and payment history for things that are not automatically reported. This process still involves the use of some third-party service as individuals themselves cannot report directly.

Before considering self reporting, its important to remember what information is already reported to the bureaus. Loan payments are reported automatically: student loans, auto loans, personal loans, mortgages, and most credit cards.

Who Reports To Credit Bureaus

- Banks, credit card issuers, lenders, collection agencies and peer-to-peer lending sites can furnish positive and negative payment information to credit bureaus.

- Utility companies, telecommunication providers and landlords or rental property managers can report negative information. However, they may not be able to report positive information, depending on state law and other regulations.

Note that Individuals such as friends, family members, business partners, etc., cant report any payment information.

You May Like: What Card Is Syncb/ppc

Self Lender Two Months Not Reported Yet

Hoping the CEO of Self Lender sees this as he was very active on another thread and even responded to me by name… It’s been two months now and Self Lender has not showed up on any of my three reports! I know it’s a wait game as my 2 credit cards I got to rebuild my credit took about a month to show up but this seems a little long…. starting to tick away at the three month mark and nothing…. I read a formum response the CEO chimed in on and said as last november they would be reporting weekly….. Im guessing this hadn’t happend….. I was really hoping this would of showed up after a month…. months seem a little long to start reporting… isn’t it as simple as providing the statement balanace or they pooling to meet reporting req before they report causing the wait? or they going through a third person reporting?… Im not sure I would recomend this to anyone rebudling as there are much faster things to report and build with then waiting months for this then it start helping montly… I was going to sign up my brother and girlfriend but have since stalled on the idea…

Anyone else know how long it took for there’s to show up? Kinda sad about it.. I check everyday hoping and always nothing….

How Can Utility Bills Help My Credit

Utility bills aren’t typically used to determine your credit score. But if you’re making those monthly payments on time, you may feel like you should get credit for it.

You now have the opportunity to get that credit with Experian Boost. Through this tool, you allow Experian to access your bank account information to identify various utility and telecom payments, including your cell phone bill.

You’ll then have a chance to verify the information and confirm that you want to add it to your credit report. The entire process takes roughly five minutes and, if you qualify for a boost to your credit score, it will happen immediately.

Experian Boost only considers on-time payments, so you don’t have to worry about late payments having a negative impact on your credit score.

Based on data from Experian, 75% of people with a FICO® Score below 680 saw an improvement in their score after adding utility payment information to their report.

Don’t Miss: What Credit Bureau Does Paypal Use